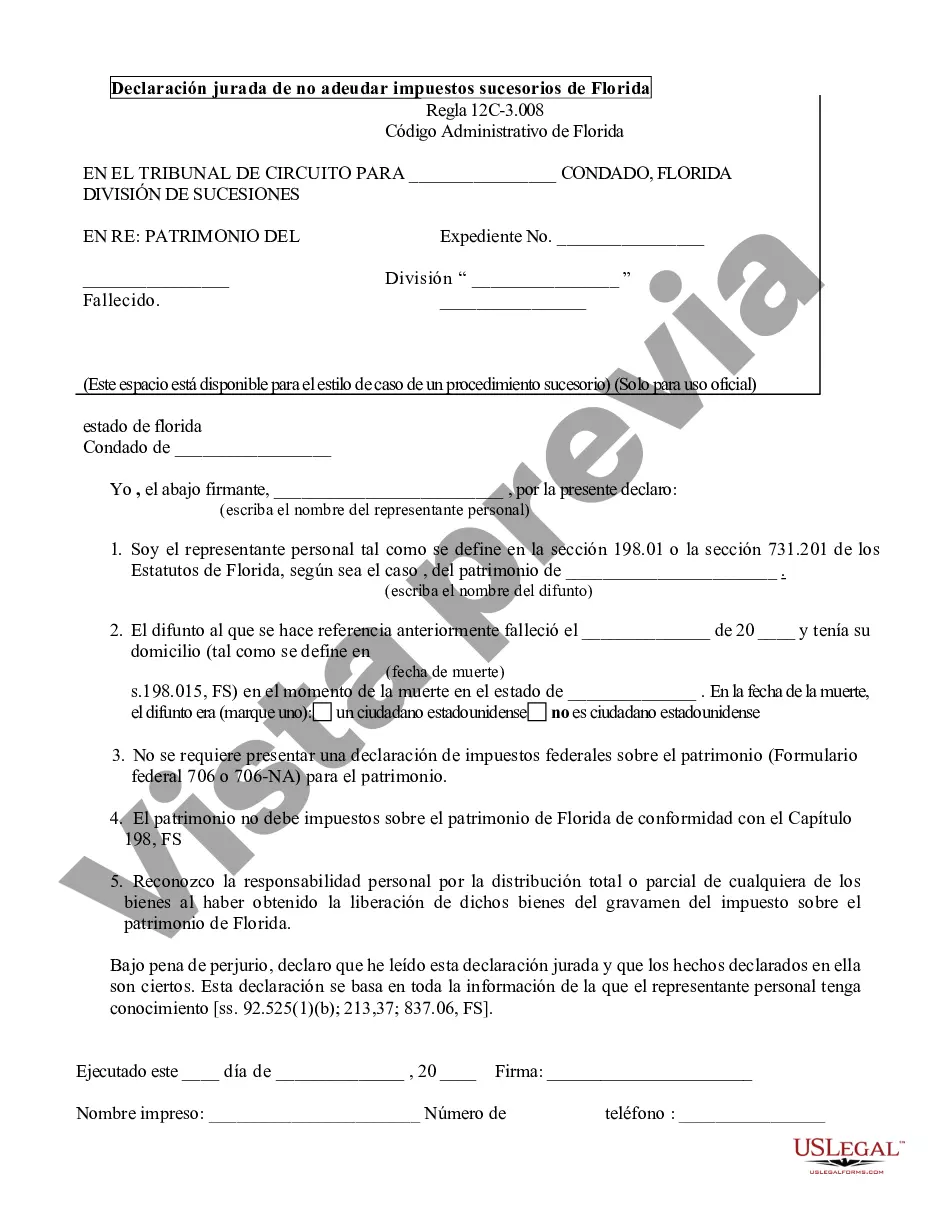

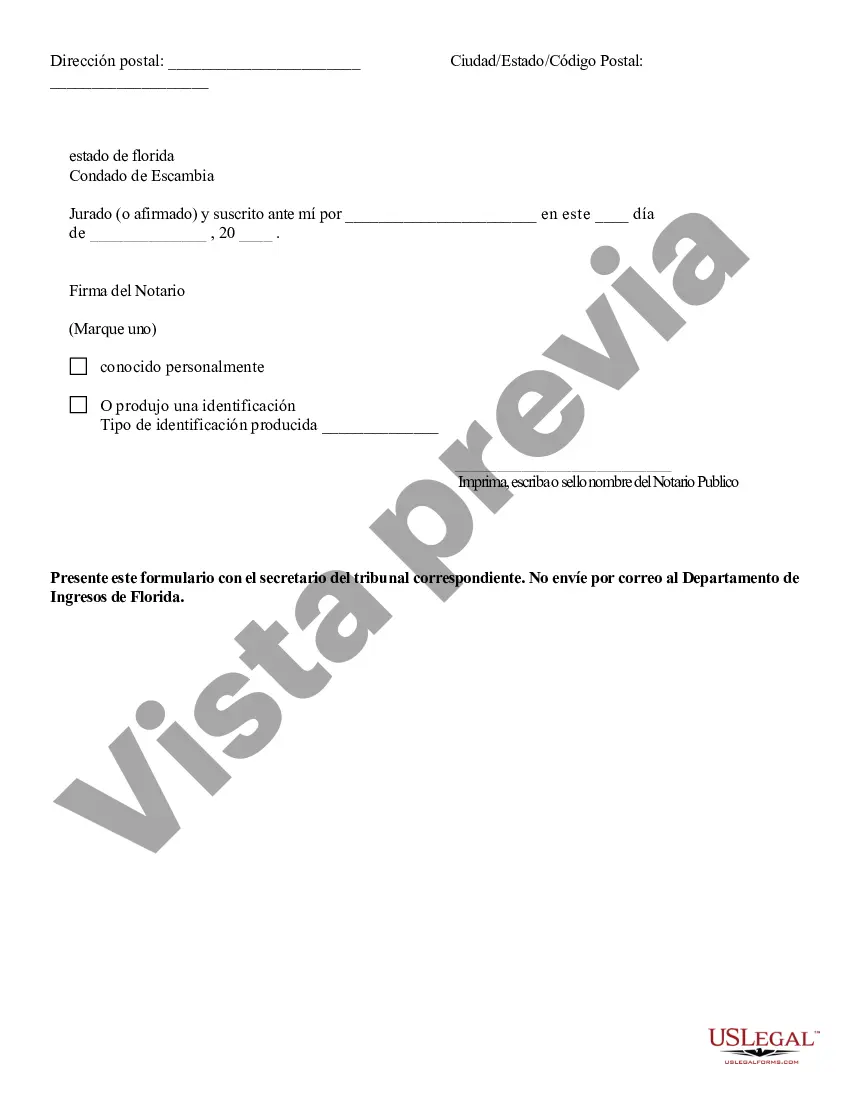

The Jacksonville Affidavit of No Florida Estate Tax Due is a legal document used to declare that an estate is not subject to any Florida estate tax. This affidavit is commonly required during the probate process to provide assurance that no estate tax obligations exist. The affidavit serves as a statement made under oath by the personal representative of the estate, confirming that the decedent's estate does not meet the criteria for Florida estate tax liability. It includes relevant information such as the decedent's name, date of death, and details about the estate's assets and liabilities. The purpose of the affidavit is to inform the Court and taxing authorities that the estate does not exceed the threshold set by the Florida Department of Revenue for estate tax liability. If the estate value does not surpass the established threshold, there is no need to file an estate tax return or pay any estate taxes. It is crucial to note that the Jacksonville Affidavit of No Florida Estate Tax Due may vary in name or requirements depending on the specific jurisdiction within Duval County. Although a standardized form may exist, it is essential to consult with a legal professional to ensure compliance with the particular local requirements. In some cases, additional documentation or supporting evidence may be necessary to complete the affidavit accurately. This can include an inventory of the decedent's assets and liabilities, appraisals, and any other relevant financial records. By filing the Jacksonville Affidavit of No Florida Estate Tax Due, the personal representative is affirming that all necessary due diligence has been conducted to ascertain the estate's tax liability status. It provides a legally binding declaration that no Florida estate tax is owed, thus allowing for the smooth progression of the probate process. In summary, the Jacksonville Affidavit of No Florida Estate Tax Due is a crucial document utilized during the probate process to confirm that an estate does not owe any Florida estate tax. It protects the personal representative while providing assurance to the Court that all potential tax liabilities have been properly addressed.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Jacksonville Declaración jurada de no adeudar impuestos sucesorios de Florida - Affidavit of No Florida Estate Tax Due

Category:

State:

Florida

City:

Jacksonville

Control #:

FL-LR012

Format:

Word

Instant download

Description

This form is used in an estate probate proceeding as a sworn statement that no estate tax is due on a property.

The Jacksonville Affidavit of No Florida Estate Tax Due is a legal document used to declare that an estate is not subject to any Florida estate tax. This affidavit is commonly required during the probate process to provide assurance that no estate tax obligations exist. The affidavit serves as a statement made under oath by the personal representative of the estate, confirming that the decedent's estate does not meet the criteria for Florida estate tax liability. It includes relevant information such as the decedent's name, date of death, and details about the estate's assets and liabilities. The purpose of the affidavit is to inform the Court and taxing authorities that the estate does not exceed the threshold set by the Florida Department of Revenue for estate tax liability. If the estate value does not surpass the established threshold, there is no need to file an estate tax return or pay any estate taxes. It is crucial to note that the Jacksonville Affidavit of No Florida Estate Tax Due may vary in name or requirements depending on the specific jurisdiction within Duval County. Although a standardized form may exist, it is essential to consult with a legal professional to ensure compliance with the particular local requirements. In some cases, additional documentation or supporting evidence may be necessary to complete the affidavit accurately. This can include an inventory of the decedent's assets and liabilities, appraisals, and any other relevant financial records. By filing the Jacksonville Affidavit of No Florida Estate Tax Due, the personal representative is affirming that all necessary due diligence has been conducted to ascertain the estate's tax liability status. It provides a legally binding declaration that no Florida estate tax is owed, thus allowing for the smooth progression of the probate process. In summary, the Jacksonville Affidavit of No Florida Estate Tax Due is a crucial document utilized during the probate process to confirm that an estate does not owe any Florida estate tax. It protects the personal representative while providing assurance to the Court that all potential tax liabilities have been properly addressed.

Free preview

How to fill out Jacksonville Declaración Jurada De No Adeudar Impuestos Sucesorios De Florida?

If you’ve already utilized our service before, log in to your account and download the Jacksonville Affidavit of No Florida Estate Tax Due on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, follow these simple steps to get your document:

- Make certain you’ve found a suitable document. Read the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t fit you, use the Search tab above to find the appropriate one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Obtain your Jacksonville Affidavit of No Florida Estate Tax Due. Select the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to every piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly find and save any template for your individual or professional needs!