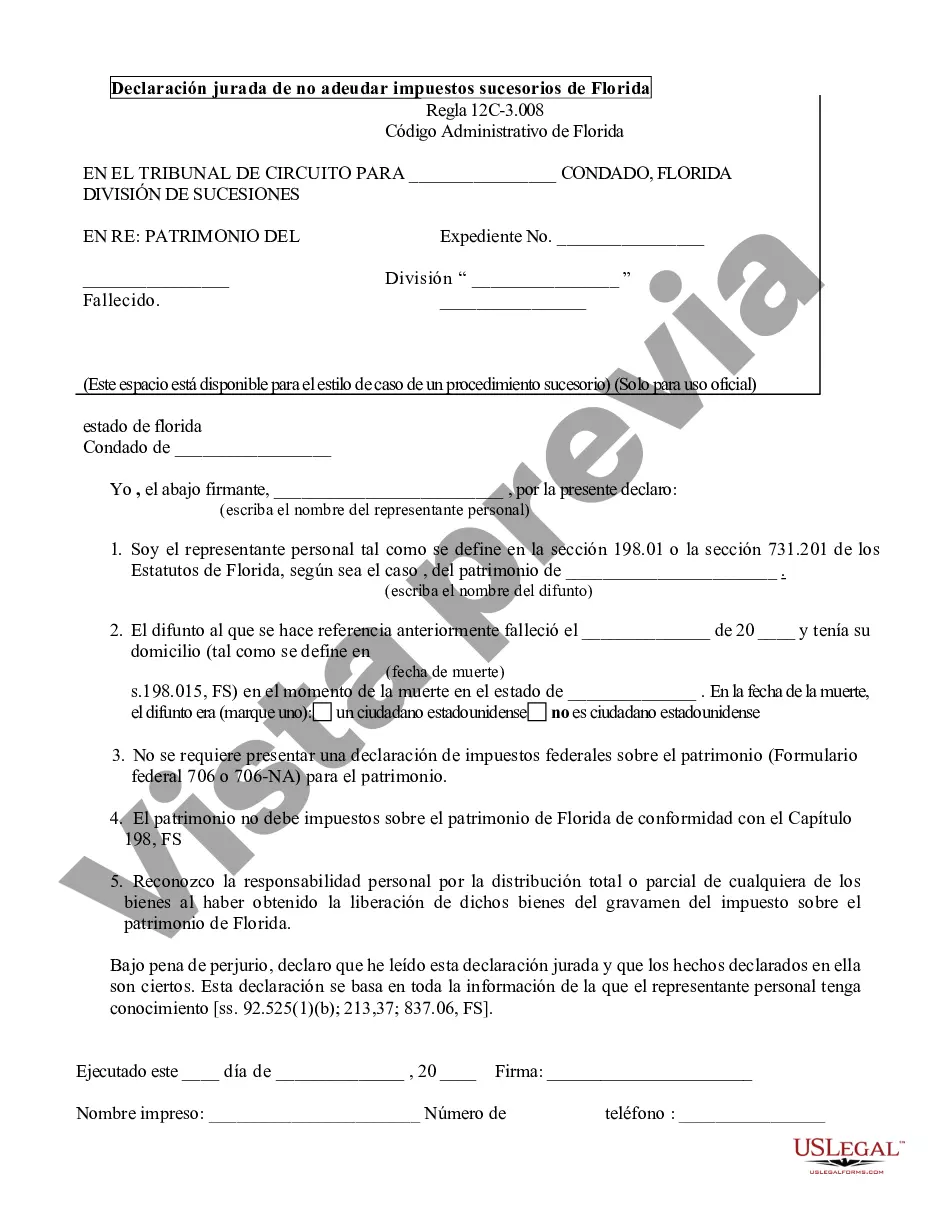

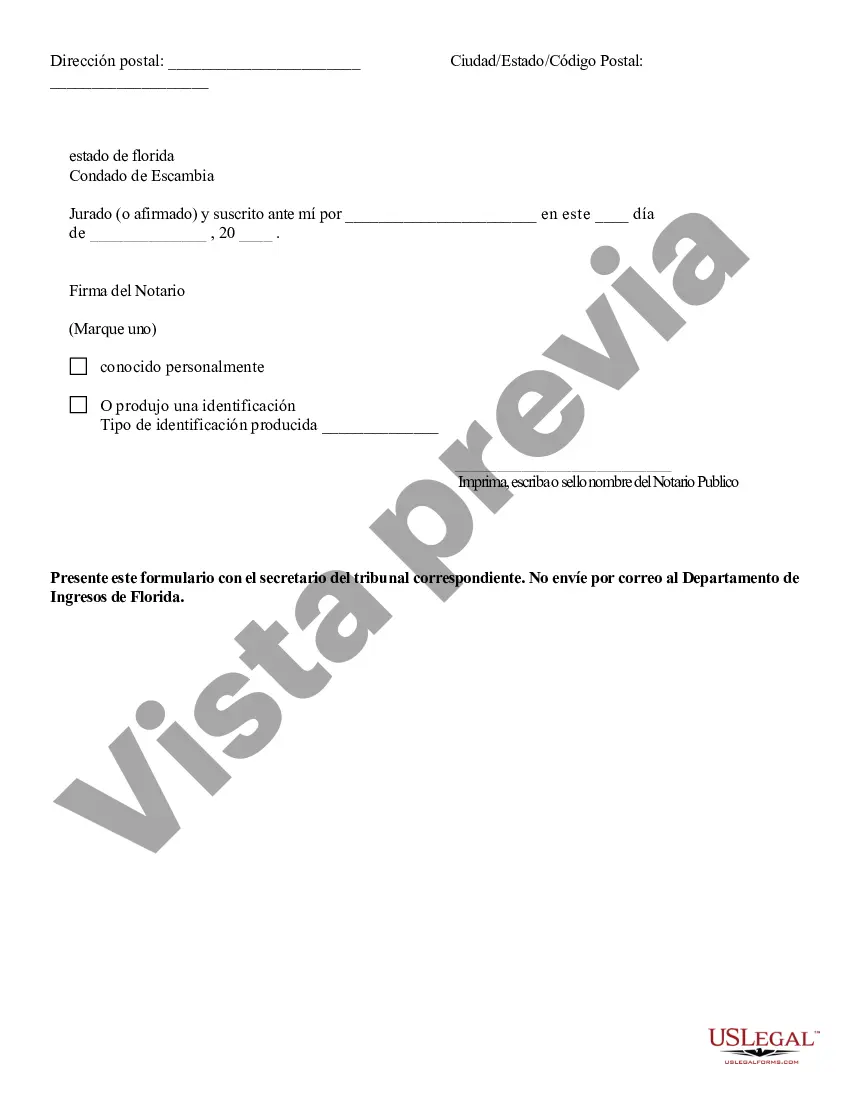

The Orange Affidavit of No Florida Estate Tax Due is a legal document filed in the state of Florida to notify the appropriates authorities that there is no Florida Estate Tax payable for a particular estate. This affidavit is commonly used when a person passes away, and their estate does not meet the specified requirements for estate tax liability in the state of Florida. By completing and filing this form, the executor or personal representative of the estate confirms that no estate tax is due. The Orange Affidavit of No Florida Estate Tax Due serves as proof that the deceased individual's estate is exempt from Florida estate tax. It is a crucial document in the probate process that provides assurance to the courts, financial institutions, and other interested parties that the estate is not liable for any outstanding taxes. This affidavit helps to streamline the settlement of the estate and alleviate any potential tax concerns. Different types or variations of the Orange Affidavit of No Florida Estate Tax Due may consist of specific circumstances or variations in the filing requirements. Some potential variations could include: 1. Orange Affidavit of No Florida Estate Tax Due with Real Estate: This type of affidavit may be required when the estate includes real estate property in Florida. It may involve additional documentation and information regarding the property's valuation and ownership. 2. Orange Affidavit of No Florida Estate Tax Due with Assets Overseas: This specific type of affidavit might be necessary when the deceased individual had assets or investments located outside the United States. It could involve providing additional details regarding foreign assets, valuations, and potential tax treaties. 3. Orange Affidavit of No Florida Estate Tax Due for Small Estates: This particular affidavit could be used for estates that qualify as "small estates" under Florida law. It might involve different filing requirements or a simplified process, acknowledging the estate's minimal value and limited tax liability. 4. Orange Affidavit of No Florida Estate Tax Due for Spouses: This type of affidavit might be required when the deceased individual had a surviving spouse. It could require specific information and declarations related to marital assets, joint ownership, and spousal exemptions from estate taxes. 5. Orange Affidavit of No Florida Estate Tax Due for Trusts: This variation could be applicable when the deceased individual's assets were held within a trust. It may involve additional details about the trust structure, beneficiaries, and potential tax implications. In summary, the Orange Affidavit of No Florida Estate Tax Due is a crucial legal document used in the probate process to declare that no Florida estate tax is payable. Different types or variations of this affidavit may exist, depending on specific circumstances such as the presence of real estate, overseas assets, small estates, surviving spouses, or assets held within a trust.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Orange Declaración jurada de no adeudar impuestos sucesorios de Florida - Affidavit of No Florida Estate Tax Due

Description

How to fill out Orange Declaración Jurada De No Adeudar Impuestos Sucesorios De Florida?

Take advantage of the US Legal Forms and have instant access to any form you want. Our beneficial platform with thousands of templates makes it simple to find and get virtually any document sample you require. It is possible to download, complete, and sign the Orange Affidavit of No Florida Estate Tax Due in just a couple of minutes instead of surfing the Net for several hours searching for a proper template.

Utilizing our collection is a superb strategy to raise the safety of your form filing. Our professional legal professionals regularly check all the documents to make sure that the templates are appropriate for a particular region and compliant with new acts and polices.

How can you get the Orange Affidavit of No Florida Estate Tax Due? If you have a subscription, just log in to the account. The Download option will appear on all the samples you view. Moreover, you can find all the previously saved files in the My Forms menu.

If you don’t have an account yet, stick to the instructions below:

- Find the form you need. Make sure that it is the template you were seeking: check its title and description, and take take advantage of the Preview function when it is available. Otherwise, utilize the Search field to find the needed one.

- Launch the saving procedure. Select Buy Now and choose the pricing plan that suits you best. Then, sign up for an account and process your order utilizing a credit card or PayPal.

- Download the document. Pick the format to obtain the Orange Affidavit of No Florida Estate Tax Due and change and complete, or sign it according to your requirements.

US Legal Forms is one of the most considerable and trustworthy form libraries on the web. Our company is always ready to assist you in virtually any legal case, even if it is just downloading the Orange Affidavit of No Florida Estate Tax Due.

Feel free to take full advantage of our form catalog and make your document experience as efficient as possible!