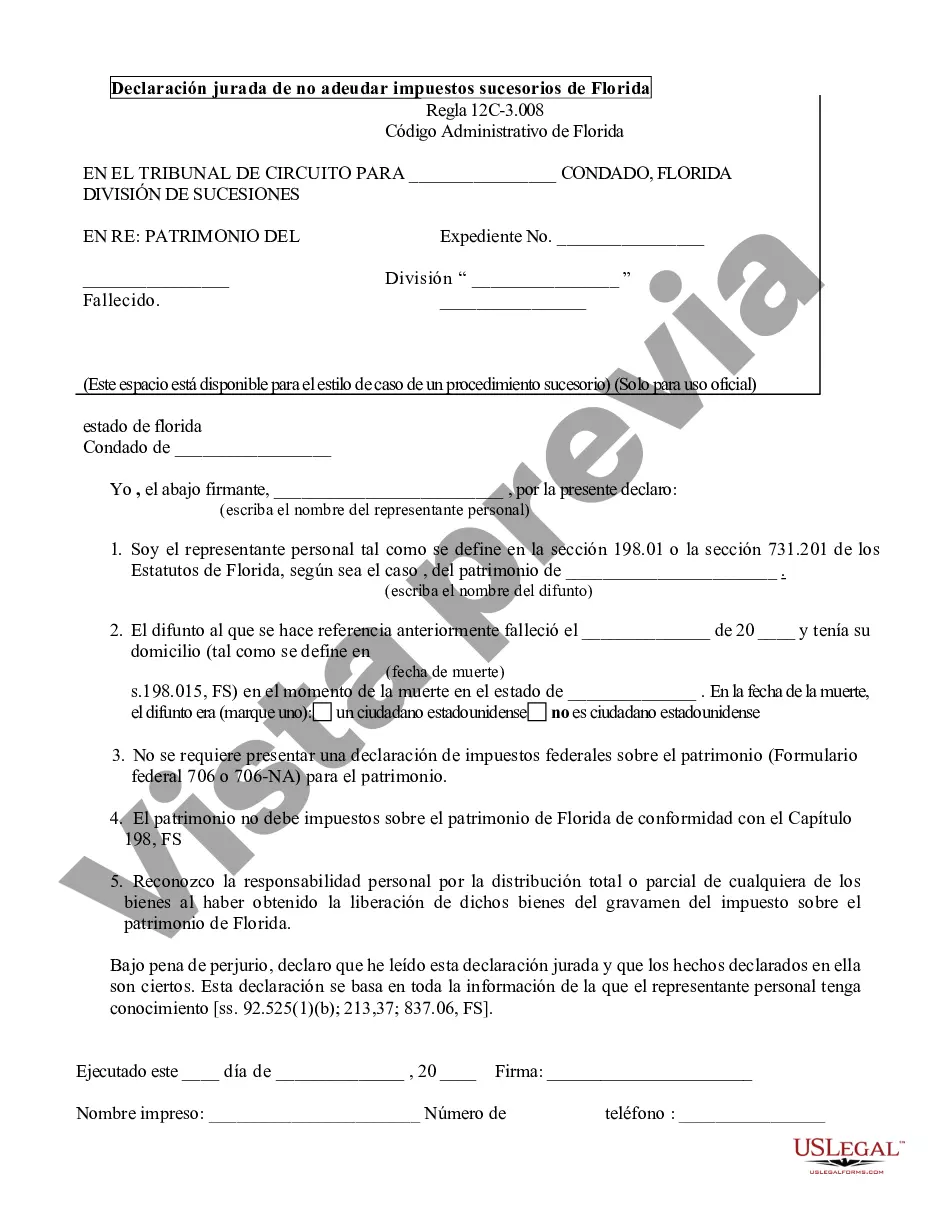

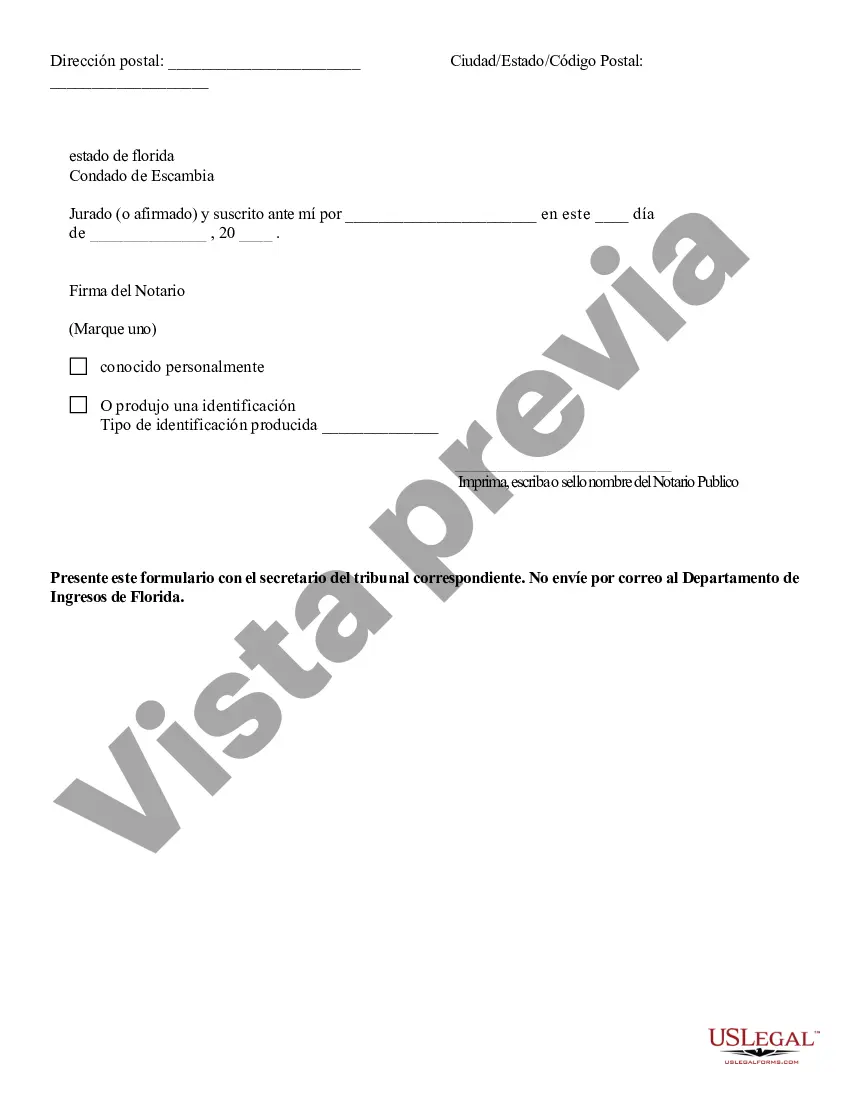

The Palm Bay Affidavit of No Florida Estate Tax Due is a legal document that is required to be filed when an individual passes away, and their estate is subject to the Florida estate tax. This document is specifically used in cases where there is no Florida estate tax due. The purpose of the Palm Bay Affidavit of No Florida Estate Tax Due is to declare that the deceased individual's estate does not owe any Florida estate tax based on its total value. This affidavit is typically filed by the personal representative or executor of the estate with the Palm Bay County Clerk's Office, as part of the probate process. The Palm Bay Affidavit of No Florida Estate Tax Due serves as proof that the estate has been properly evaluated and determined to be exempt from Florida estate tax. It is essential in order to accurately settle the deceased person's estate, distribute assets to beneficiaries, and close out the probate process. It's important to note that there are no different types of Palm Bay Affidavit of No Florida Estate Tax Due. However, there may be variations in the way this affidavit is titled or specific requirements within different counties in Florida. It is essential to check with the Palm Bay County Clerk's Office or consult with a qualified legal professional to ensure compliance with the specific rules and regulations in that jurisdiction. Keywords: Palm Bay, Affidavit of No Florida Estate Tax Due, legal document, deceased, estate, Florida estate tax, personal representative, executor, probate process, Palm Bay County Clerk's Office, exempt, beneficiaries, probate.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Palm Bay Declaración jurada de no adeudar impuestos sucesorios de Florida - Affidavit of No Florida Estate Tax Due

Description

How to fill out Palm Bay Declaración Jurada De No Adeudar Impuestos Sucesorios De Florida?

Benefit from the US Legal Forms and get immediate access to any form sample you need. Our beneficial website with a huge number of documents allows you to find and obtain virtually any document sample you require. You are able to download, fill, and certify the Palm Bay Affidavit of No Florida Estate Tax Due in just a matter of minutes instead of browsing the web for several hours seeking an appropriate template.

Utilizing our catalog is an excellent way to improve the safety of your form filing. Our professional legal professionals on a regular basis review all the records to make certain that the forms are relevant for a particular state and compliant with new acts and regulations.

How can you obtain the Palm Bay Affidavit of No Florida Estate Tax Due? If you have a subscription, just log in to the account. The Download button will be enabled on all the documents you look at. Moreover, you can find all the earlier saved documents in the My Forms menu.

If you don’t have a profile yet, stick to the instruction listed below:

- Find the form you require. Make sure that it is the form you were hoping to find: examine its headline and description, and make use of the Preview feature when it is available. Otherwise, utilize the Search field to find the appropriate one.

- Start the downloading process. Click Buy Now and select the pricing plan that suits you best. Then, create an account and process your order with a credit card or PayPal.

- Export the document. Pick the format to obtain the Palm Bay Affidavit of No Florida Estate Tax Due and modify and fill, or sign it for your needs.

US Legal Forms is one of the most considerable and trustworthy form libraries on the web. Our company is always happy to assist you in any legal process, even if it is just downloading the Palm Bay Affidavit of No Florida Estate Tax Due.

Feel free to make the most of our service and make your document experience as convenient as possible!