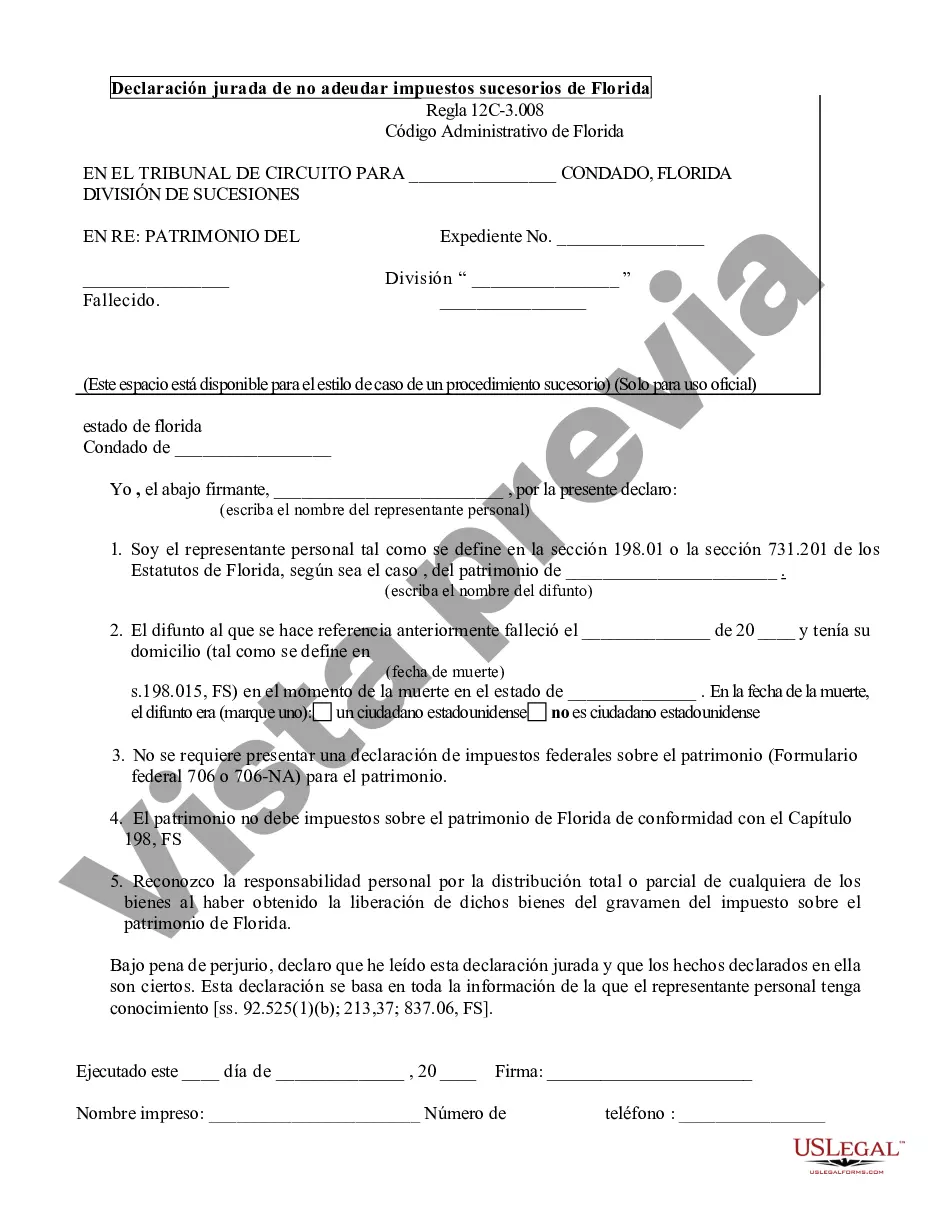

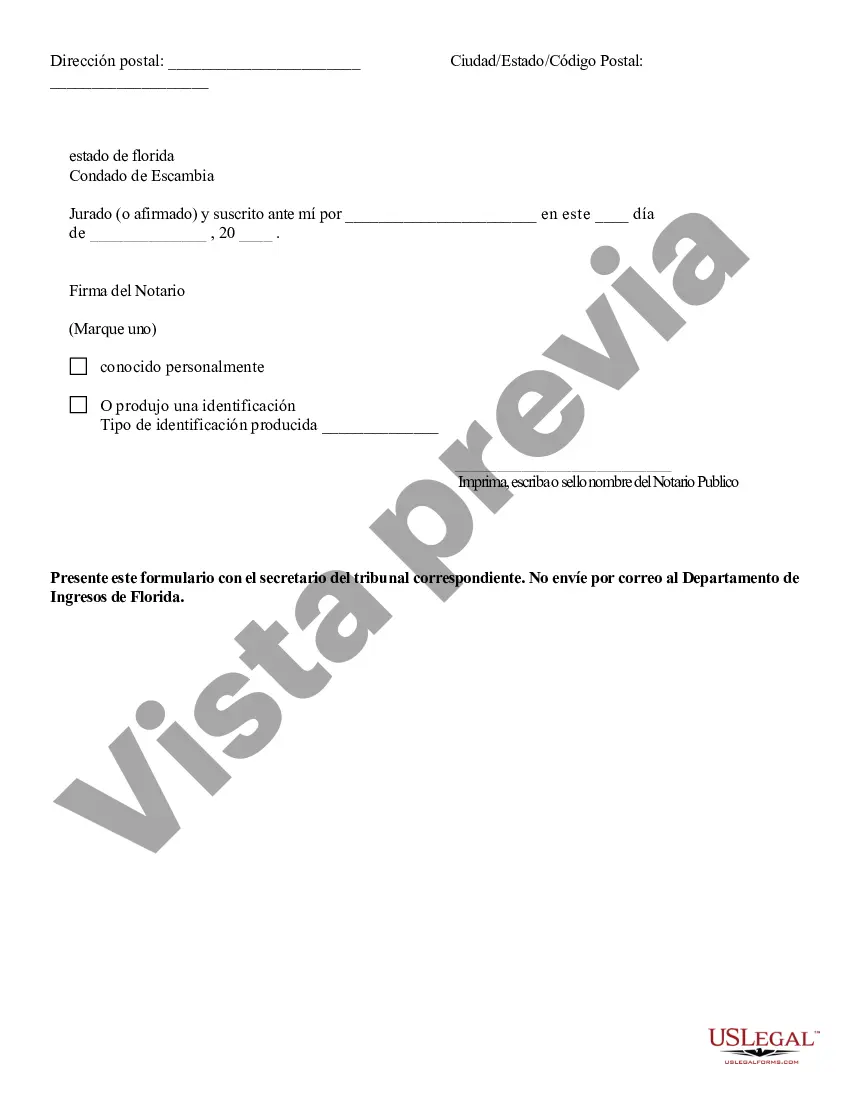

The Palm Beach Affidavit of No Florida Estate Tax Due is an important document used in the state of Florida to confirm that no estate tax is owed upon the death of an individual. This affidavit is particularly relevant for individuals who resided in Palm Beach County, Florida or had any substantial assets located within the county. The purpose of the Palm Beach Affidavit of No Florida Estate Tax Due is to provide proof to the Florida Department of Revenue that the deceased person's estate is not subject to any estate taxes, in accordance with the laws and regulations of the state. By executing this affidavit, the personal representative or executor of the estate asserts that the estate qualifies for this exemption and that no tax is required to be paid. Several key elements should be included in the Palm Beach Affidavit of No Florida Estate Tax Due. These elements may vary depending on the specific circumstances of the estate, but typically include: 1. Identification of the decedent: This section provides the full legal name of the deceased individual, along with their date of birth and date of death. Additionally, their Social Security number or tax identifier is included for identification purposes. 2. Executor or personal representative information: The affidavit must include the name, address, and contact details of the executor or personal representative responsible for managing the estate's affairs. This person acts as the main point of contact for any questions or concerns related to the estate tax exemption. 3. Estate assets and liabilities: It is crucial to provide a detailed overview of the deceased individual's assets and liabilities. This includes a comprehensive list of the property, real estate, financial accounts, and other valuable assets held by the decedent at the time of their passing. Additionally, any outstanding debts or obligations should be disclosed. 4. Beneficiary information: The affidavit should outline the names and contact information of all beneficiaries entitled to receive a portion of the estate. This section confirms that the proper distribution of assets will occur following the filing of the affidavit. 5. Reason for exemption: A clear and concise statement must be included, explaining why no Florida estate tax is due on the decedent's estate. This could be due to the estate's total value falling below the threshold for state estate tax liability or because certain exemptions apply. It's worth noting that there are no specific variations of the Palm Beach Affidavit of No Florida Estate Tax Due based on different types. However, the affidavit may differ in format and requirements across various counties in Florida. Other counties may have their own specific versions of this document, but for Palm Beach County, this particular affidavit is the primary document used for confirming no Florida estate tax is due. In conclusion, the Palm Beach Affidavit of No Florida Estate Tax Due serves as an essential instrument in providing evidence that no estate tax should be levied on a deceased individual's estate in Palm Beach County. By accurately completing and filing this form, executors or personal representatives can ensure the efficient administration of the estate while complying with Florida state tax regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Palm Beach Declaración jurada de no adeudar impuestos sucesorios de Florida - Affidavit of No Florida Estate Tax Due

Description

How to fill out Palm Beach Declaración Jurada De No Adeudar Impuestos Sucesorios De Florida?

Do you need a trustworthy and inexpensive legal forms supplier to buy the Palm Beach Affidavit of No Florida Estate Tax Due? US Legal Forms is your go-to choice.

Whether you require a basic arrangement to set rules for cohabitating with your partner or a set of forms to advance your divorce through the court, we got you covered. Our website offers over 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t generic and framed in accordance with the requirements of separate state and county.

To download the document, you need to log in account, find the needed form, and hit the Download button next to it. Please take into account that you can download your previously purchased document templates at any time in the My Forms tab.

Are you new to our platform? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Find out if the Palm Beach Affidavit of No Florida Estate Tax Due conforms to the laws of your state and local area.

- Go through the form’s details (if available) to find out who and what the document is good for.

- Restart the search in case the form isn’t suitable for your legal scenario.

Now you can register your account. Then select the subscription option and proceed to payment. As soon as the payment is done, download the Palm Beach Affidavit of No Florida Estate Tax Due in any available file format. You can get back to the website when you need and redownload the document without any extra costs.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a try now, and forget about spending your valuable time researching legal papers online once and for all.