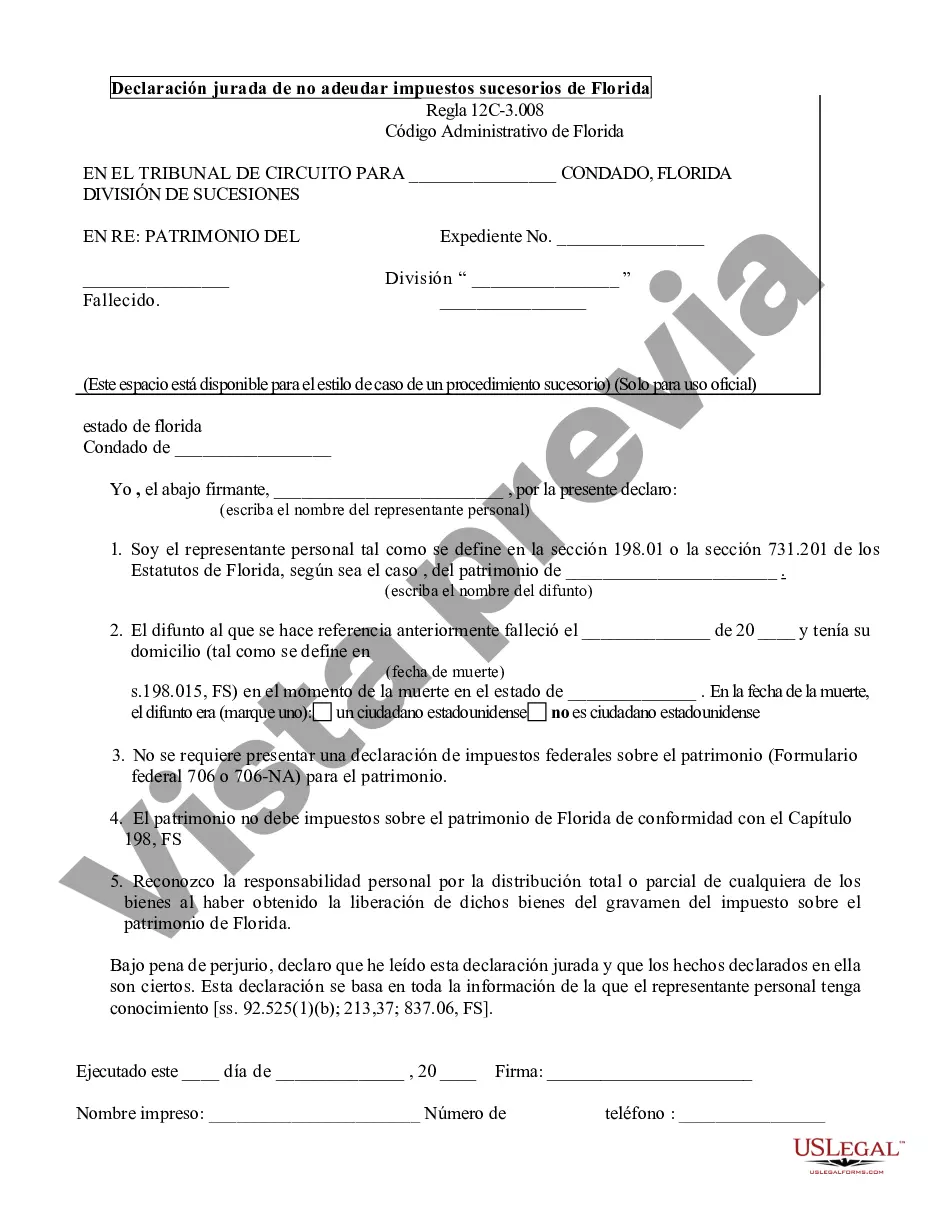

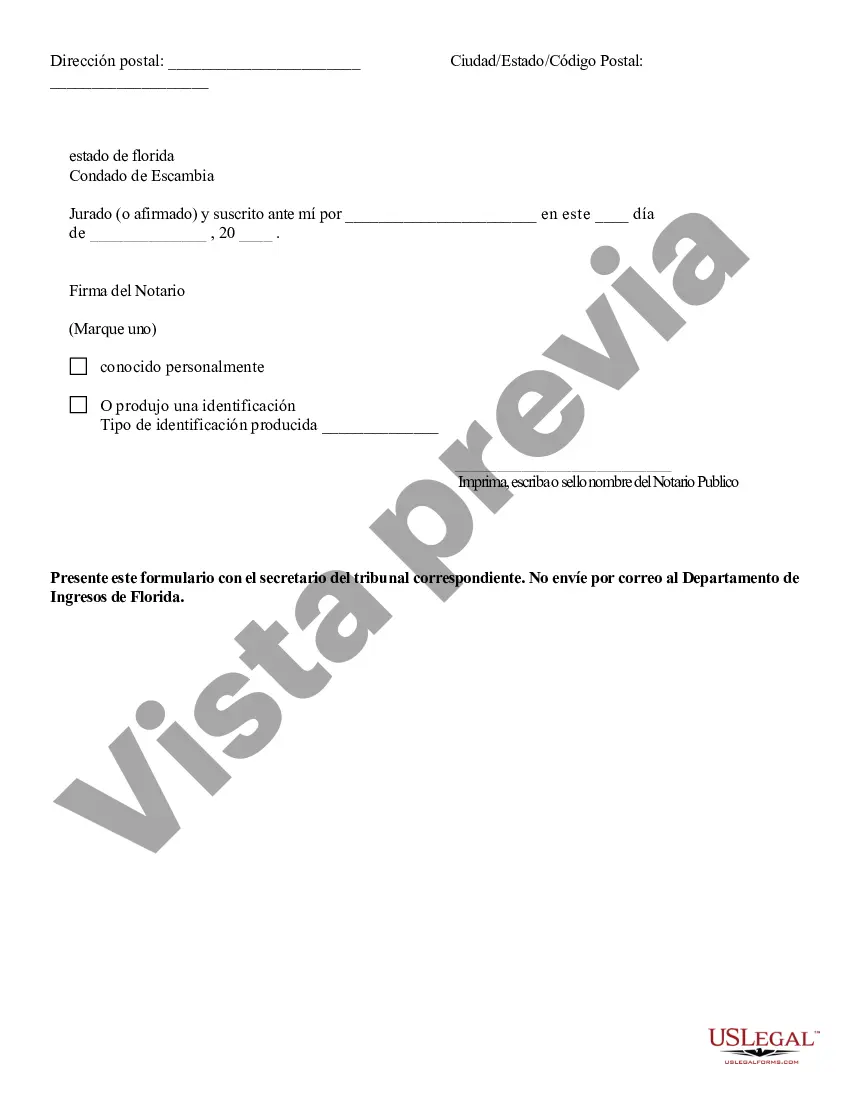

The Pompano Beach Affidavit of No Florida Estate Tax Due is a legal document that serves as proof that an estate is not subject to any state estate tax in Florida. This affidavit is typically required to be filed by the personal representative or executor of a deceased individual's estate in order to settle the estate and distribute the assets to the rightful beneficiaries. The affidavit states that the total value of the estate does not exceed the threshold set by the State of Florida for estate tax liability. As of 2021, the threshold is $5.7 million, meaning that if the estate's value is below this amount, no Florida estate taxes are due. This affidavit is essential for individuals dealing with estates in Pompano Beach, as it helps simplify the probate process by eliminating the need for filing and paying estate taxes if the estate falls below the threshold. It provides peace of mind to the personal representative and beneficiaries by confirming that they are not required to fulfill any tax obligations related to the estate. Different types or variations of the Pompano Beach Affidavit of No Florida Estate Tax Due may include: 1. Affidavit of No Florida Estate Tax Due for Real Estate: This specific affidavit may be required when the estate primarily consists of real estate properties located in Pompano Beach. It certifies that no estate taxes need to be paid concerning the property or properties in question. 2. Simplified Affidavit of No Florida Estate Tax Due: This variation of the affidavit is a simplified version that streamlines the process of confirming no estate tax liability for estates with relatively simple and straightforward assets and beneficiaries. It requires less detailed information and documentation compared to the standard affidavit. 3. Affidavit of No Florida Estate Tax Due for Large Estates: This type of affidavit is often used when dealing with larger estates, exceeding the $5.7 million threshold. It may require additional supporting documentation and more extensive financial information to demonstrate that no estate taxes are due. In conclusion, the Pompano Beach Affidavit of No Florida Estate Tax Due is a crucial legal document that provides evidence that an estate is not obligated to pay any state estate taxes. It simplifies the probate process for individuals settling estates in Pompano Beach and offers peace of mind to personal representatives and beneficiaries alike.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Pompano Beach Declaración jurada de no adeudar impuestos sucesorios de Florida - Affidavit of No Florida Estate Tax Due

Category:

State:

Florida

City:

Pompano Beach

Control #:

FL-LR012

Format:

Word

Instant download

Description

This form is used in an estate probate proceeding as a sworn statement that no estate tax is due on a property.

The Pompano Beach Affidavit of No Florida Estate Tax Due is a legal document that serves as proof that an estate is not subject to any state estate tax in Florida. This affidavit is typically required to be filed by the personal representative or executor of a deceased individual's estate in order to settle the estate and distribute the assets to the rightful beneficiaries. The affidavit states that the total value of the estate does not exceed the threshold set by the State of Florida for estate tax liability. As of 2021, the threshold is $5.7 million, meaning that if the estate's value is below this amount, no Florida estate taxes are due. This affidavit is essential for individuals dealing with estates in Pompano Beach, as it helps simplify the probate process by eliminating the need for filing and paying estate taxes if the estate falls below the threshold. It provides peace of mind to the personal representative and beneficiaries by confirming that they are not required to fulfill any tax obligations related to the estate. Different types or variations of the Pompano Beach Affidavit of No Florida Estate Tax Due may include: 1. Affidavit of No Florida Estate Tax Due for Real Estate: This specific affidavit may be required when the estate primarily consists of real estate properties located in Pompano Beach. It certifies that no estate taxes need to be paid concerning the property or properties in question. 2. Simplified Affidavit of No Florida Estate Tax Due: This variation of the affidavit is a simplified version that streamlines the process of confirming no estate tax liability for estates with relatively simple and straightforward assets and beneficiaries. It requires less detailed information and documentation compared to the standard affidavit. 3. Affidavit of No Florida Estate Tax Due for Large Estates: This type of affidavit is often used when dealing with larger estates, exceeding the $5.7 million threshold. It may require additional supporting documentation and more extensive financial information to demonstrate that no estate taxes are due. In conclusion, the Pompano Beach Affidavit of No Florida Estate Tax Due is a crucial legal document that provides evidence that an estate is not obligated to pay any state estate taxes. It simplifies the probate process for individuals settling estates in Pompano Beach and offers peace of mind to personal representatives and beneficiaries alike.

Free preview

How to fill out Pompano Beach Declaración Jurada De No Adeudar Impuestos Sucesorios De Florida?

If you’ve already utilized our service before, log in to your account and save the Pompano Beach Affidavit of No Florida Estate Tax Due on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple steps to get your file:

- Ensure you’ve located a suitable document. Read the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t suit you, use the Search tab above to find the appropriate one.

- Buy the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Obtain your Pompano Beach Affidavit of No Florida Estate Tax Due. Opt for the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to quickly find and save any template for your individual or professional needs!