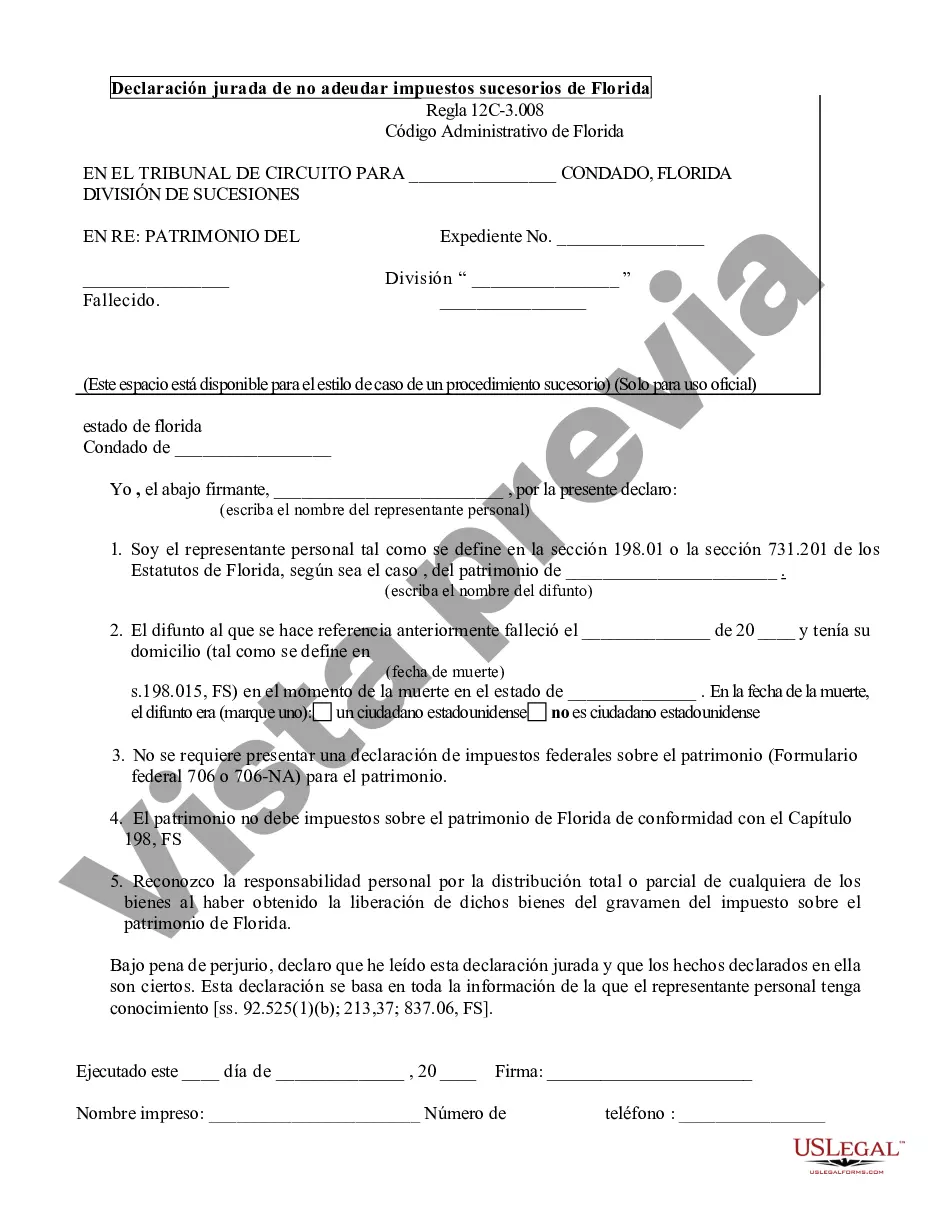

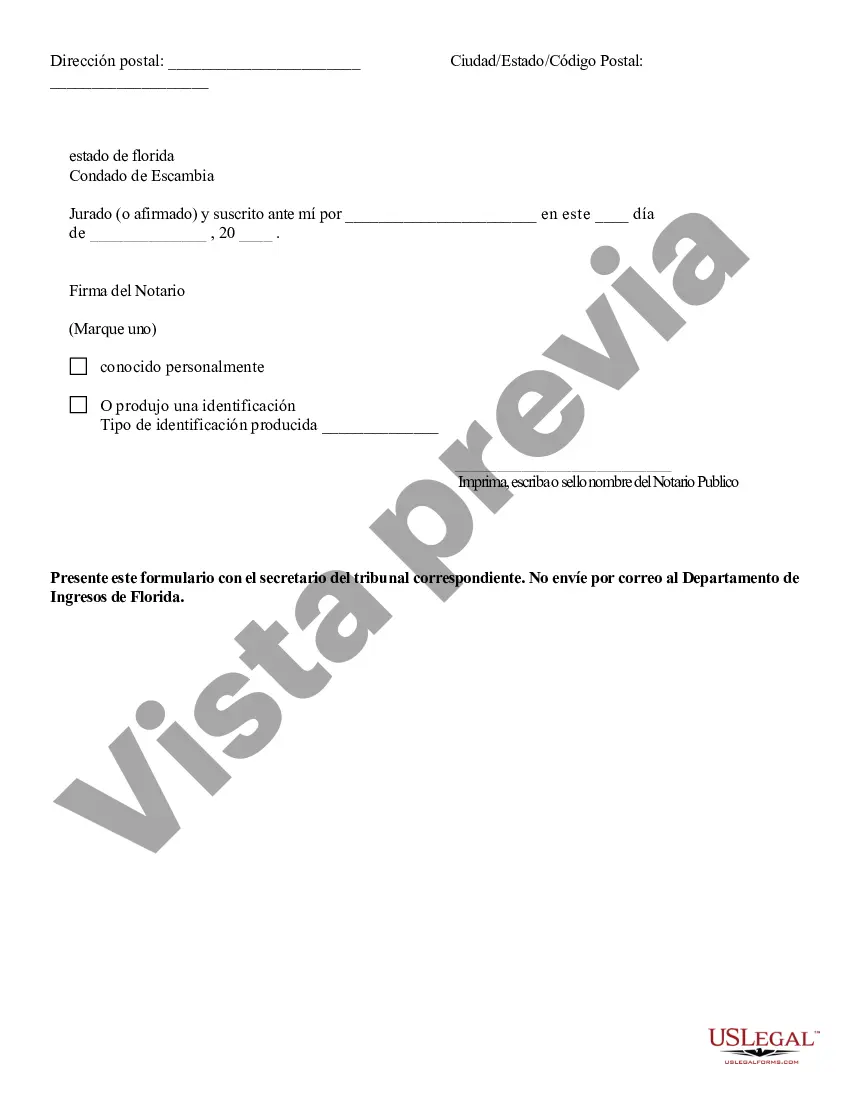

The Port St. Lucie Affidavit of No Florida Estate Tax Due is a legal document used in the state of Florida to declare that no Florida estate tax is due on a deceased person's estate. This affidavit is typically required to be filed with the Florida Department of Revenue when a decedent's estate consists solely of property located in Florida. The affidavit serves as a declaration that the estate does not exceed the taxable threshold set by the state and that no estate tax is owed. It provides assurance to the Department of Revenue that the estate is exempt from paying Florida estate tax. The Port St. Lucie Affidavit of No Florida Estate Tax Due is an essential document for the executor or personal representative of an estate who wishes to efficiently handle the estate administration process. By filing this affidavit, the executor can avoid delays and complications in the probate process by certifying the absence of any estate tax liability. Different types or variations of the Port St. Lucie Affidavit of No Florida Estate Tax Due may include: 1. Simple Affidavit of No Florida Estate Tax Due: This is the standard version of the affidavit, declaring that no estate tax is owed and providing the necessary information about the deceased person's estate. 2. Affidavit of No Florida Estate Tax Due for Small Estates: Designed specifically for small estates, this variation of the affidavit is applicable when the total value of the estate falls below the threshold for the Florida estate tax. 3. Affidavit of No Florida Estate Tax Due for Spousal Transfers: In cases where a deceased individual's estate is being transferred to their surviving spouse, this affidavit may be used to assert that no Florida estate tax is due to the spousal transfer exemption. It's crucial to consult with an experienced estate planning attorney or tax professional to determine the specific requirements and variations of the Port St. Lucie Affidavit of No Florida Estate Tax Due based on your unique circumstances. They can guide you through the preparation and filing process to ensure compliance with state regulations and avoid potential penalties or complications.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Port St. Lucie Declaración jurada de no adeudar impuestos sucesorios de Florida - Affidavit of No Florida Estate Tax Due

Description

How to fill out Port St. Lucie Declaración Jurada De No Adeudar Impuestos Sucesorios De Florida?

We always want to reduce or prevent legal issues when dealing with nuanced law-related or financial affairs. To accomplish this, we sign up for legal services that, usually, are very expensive. Nevertheless, not all legal issues are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is an online catalog of updated DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without turning to legal counsel. We offer access to legal document templates that aren’t always publicly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the Port St. Lucie Affidavit of No Florida Estate Tax Due or any other document easily and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always download it again from within the My Forms tab.

The process is just as easy if you’re unfamiliar with the platform! You can register your account within minutes.

- Make sure to check if the Port St. Lucie Affidavit of No Florida Estate Tax Due complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s outline (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve ensured that the Port St. Lucie Affidavit of No Florida Estate Tax Due would work for your case, you can select the subscription option and proceed to payment.

- Then you can download the document in any suitable format.

For more than 24 years of our presence on the market, we’ve served millions of people by providing ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save time and resources!