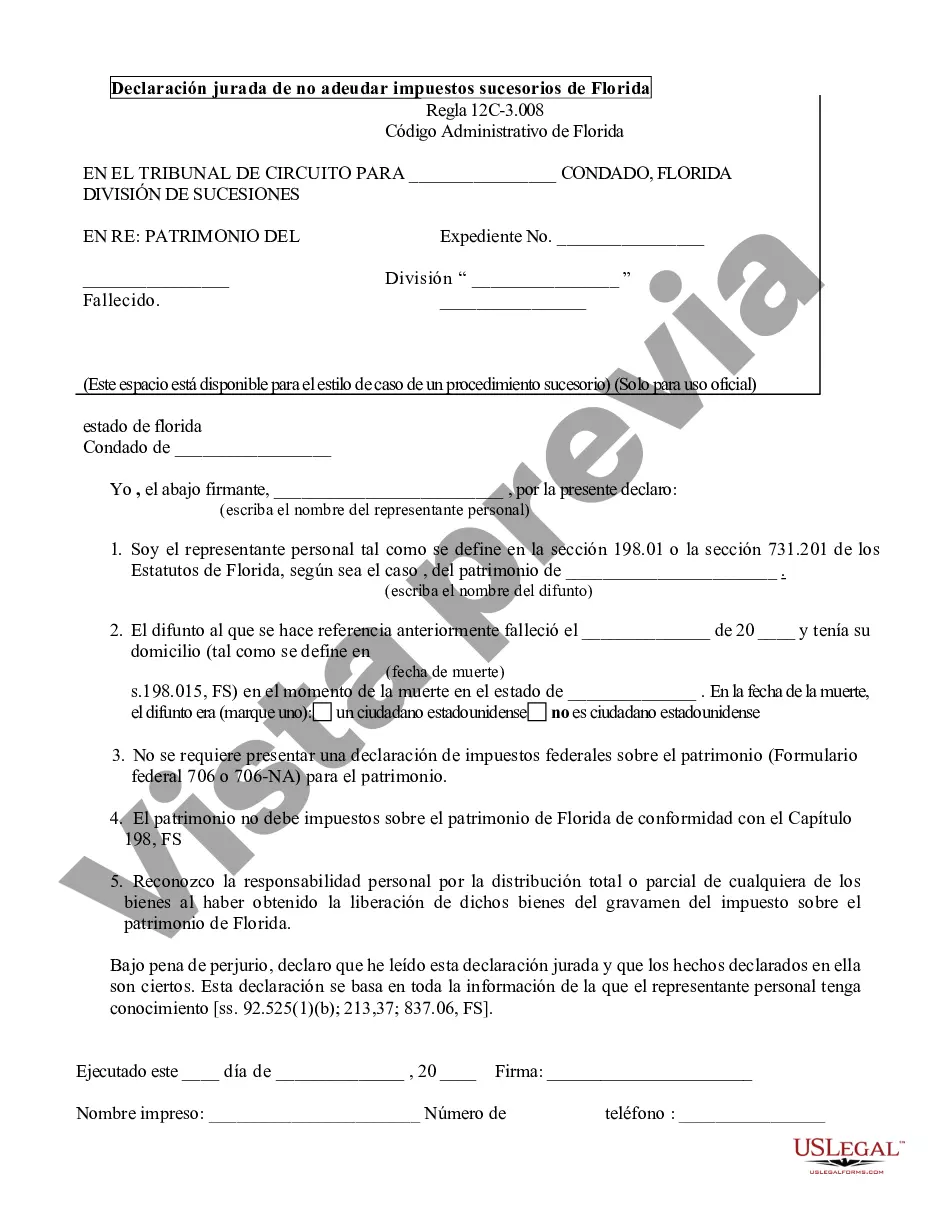

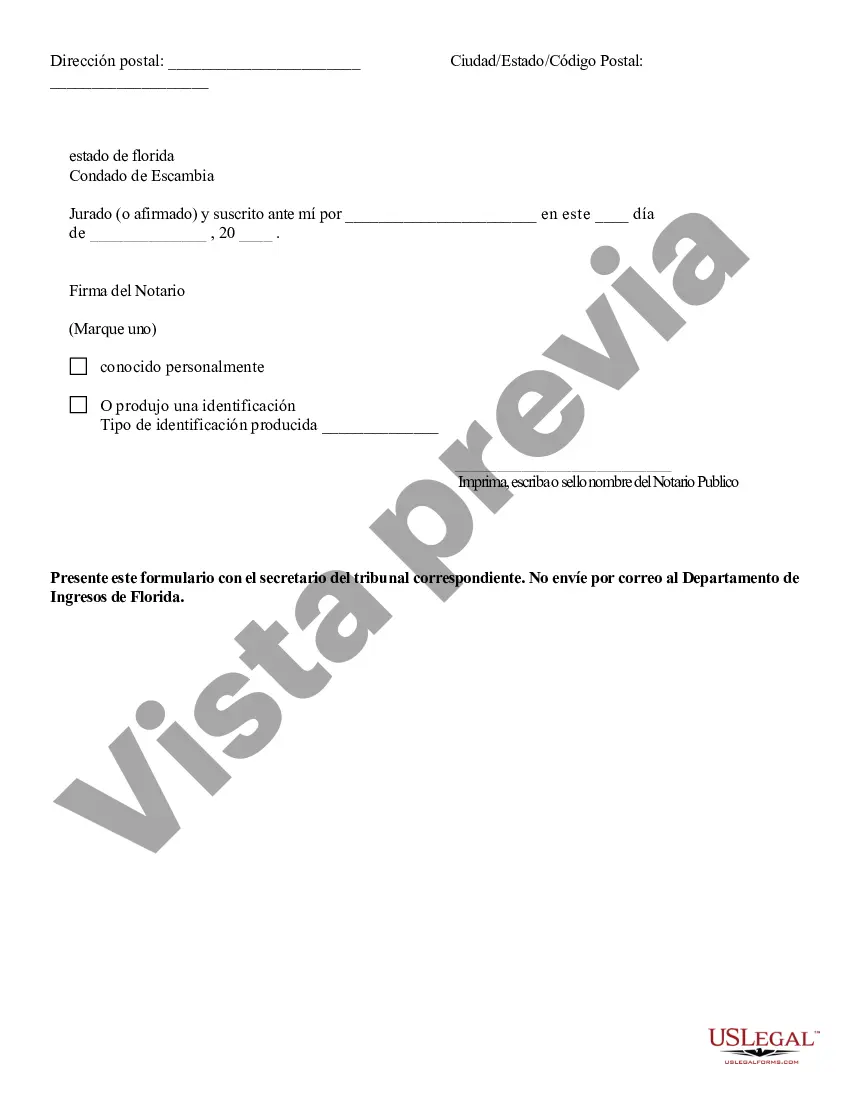

The St. Petersburg Affidavit of No Florida Estate Tax Due is a legal document that is used to declare that no estate tax is owed on a deceased individual's estate in the city of St. Petersburg, Florida. This affidavit is essential for estate executors or administrators who are responsible for settling the affairs of the deceased and ensuring compliance with applicable tax laws. When it comes to the types of St. Petersburg Affidavit of No Florida Estate Tax Due, there are generally two main categories: 1. St. Petersburg Affidavit of No Florida Estate Tax Due for Resident Decedents: This type of affidavit applies to individuals who were considered residents of St. Petersburg, Florida, at the time of their death. It asserts that no Florida estate tax is owed on the estate of the resident decedent. 2. St. Petersburg Affidavit of No Florida Estate Tax Due for Non-Resident Decedents: This affidavit is relevant for individuals who were not residents of St. Petersburg, Florida, at the time of their death but still have assets located within the city. It declares that no Florida estate tax is due on the property. To complete the St. Petersburg Affidavit of No Florida Estate Tax Due, certain key information must be provided, including: — Deceased Individual's Information: Full legal name, date of death, social security number, and last known address. — Executor/Administrator Information: Full name, address, contact details, and relationship to the deceased. — Assets and Liabilities: A comprehensive list of the deceased's assets located within St. Petersburg, such as real estate, personal property, and financial accounts, along with their estimated values. Additionally, any of the deceased's liabilities, such as outstanding debts or mortgages, should be disclosed. — Supporting Documentation: It is essential to attach supporting documents, such as real estate deeds, bank statements, appraisals, and any other relevant paperwork that verifies the existence and value of the assets mentioned. — Signatures and Notarization: The affidavit needs to be signed by the executor/administrator in the presence of a notary public, who will validate the authenticity of the signature. Once the St. Petersburg Affidavit of No Florida Estate Tax Due is completed and notarized, it should be filed with the appropriate tax authorities in St. Petersburg, Florida, within the designated timeframe. This affidavit serves as an official declaration that no Florida estate tax is owed, providing the necessary assurance and documentation to settle the estate properly. It is crucial to consult with a qualified attorney or tax professional to ensure the accurate completion of the St. Petersburg Affidavit of No Florida Estate Tax Due and to navigate any specific legal requirements or nuances that may exist.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.St. Petersburg Declaración jurada de no adeudar impuestos sucesorios de Florida - Affidavit of No Florida Estate Tax Due

Description

How to fill out St. Petersburg Declaración Jurada De No Adeudar Impuestos Sucesorios De Florida?

Make use of the US Legal Forms and obtain immediate access to any form sample you need. Our beneficial platform with a huge number of templates simplifies the way to find and obtain almost any document sample you require. It is possible to save, complete, and sign the St. Petersburg Affidavit of No Florida Estate Tax Due in a matter of minutes instead of browsing the web for many hours searching for an appropriate template.

Utilizing our library is a wonderful way to increase the safety of your document filing. Our experienced attorneys on a regular basis check all the documents to ensure that the templates are appropriate for a particular state and compliant with new laws and polices.

How can you obtain the St. Petersburg Affidavit of No Florida Estate Tax Due? If you have a subscription, just log in to the account. The Download option will be enabled on all the documents you view. Moreover, you can find all the previously saved records in the My Forms menu.

If you haven’t registered an account yet, follow the tips listed below:

- Open the page with the template you need. Ensure that it is the template you were seeking: verify its title and description, and use the Preview function if it is available. Otherwise, make use of the Search field to look for the needed one.

- Launch the downloading process. Click Buy Now and select the pricing plan that suits you best. Then, sign up for an account and pay for your order utilizing a credit card or PayPal.

- Save the file. Pick the format to get the St. Petersburg Affidavit of No Florida Estate Tax Due and edit and complete, or sign it for your needs.

US Legal Forms is probably the most considerable and reliable form libraries on the internet. Our company is always happy to help you in any legal process, even if it is just downloading the St. Petersburg Affidavit of No Florida Estate Tax Due.

Feel free to make the most of our platform and make your document experience as straightforward as possible!