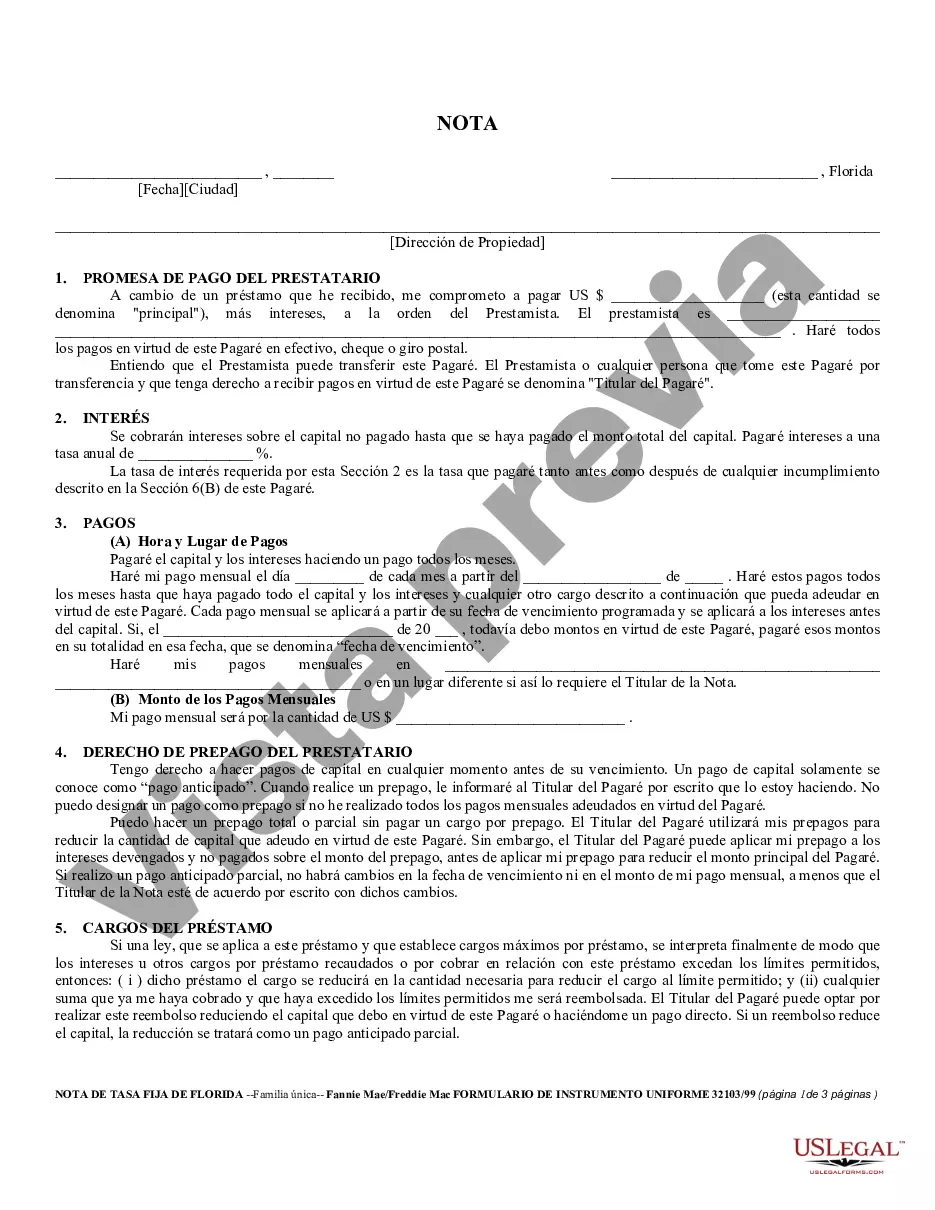

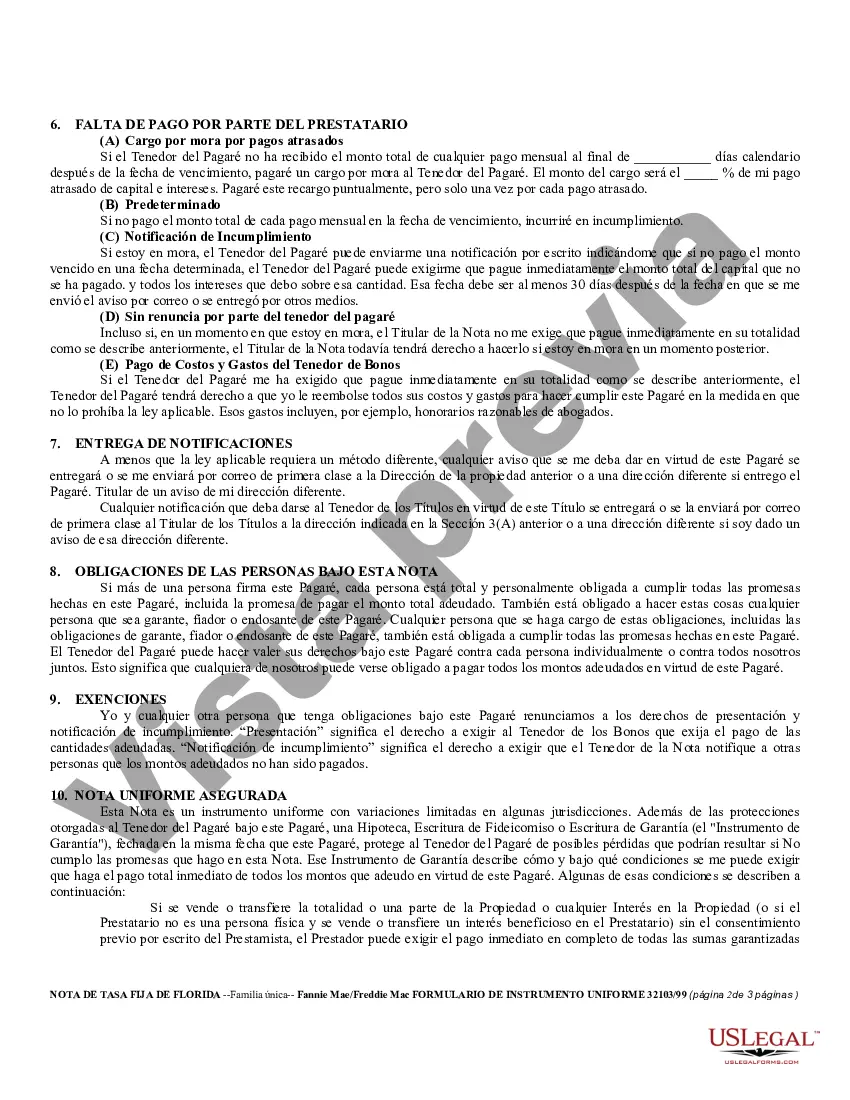

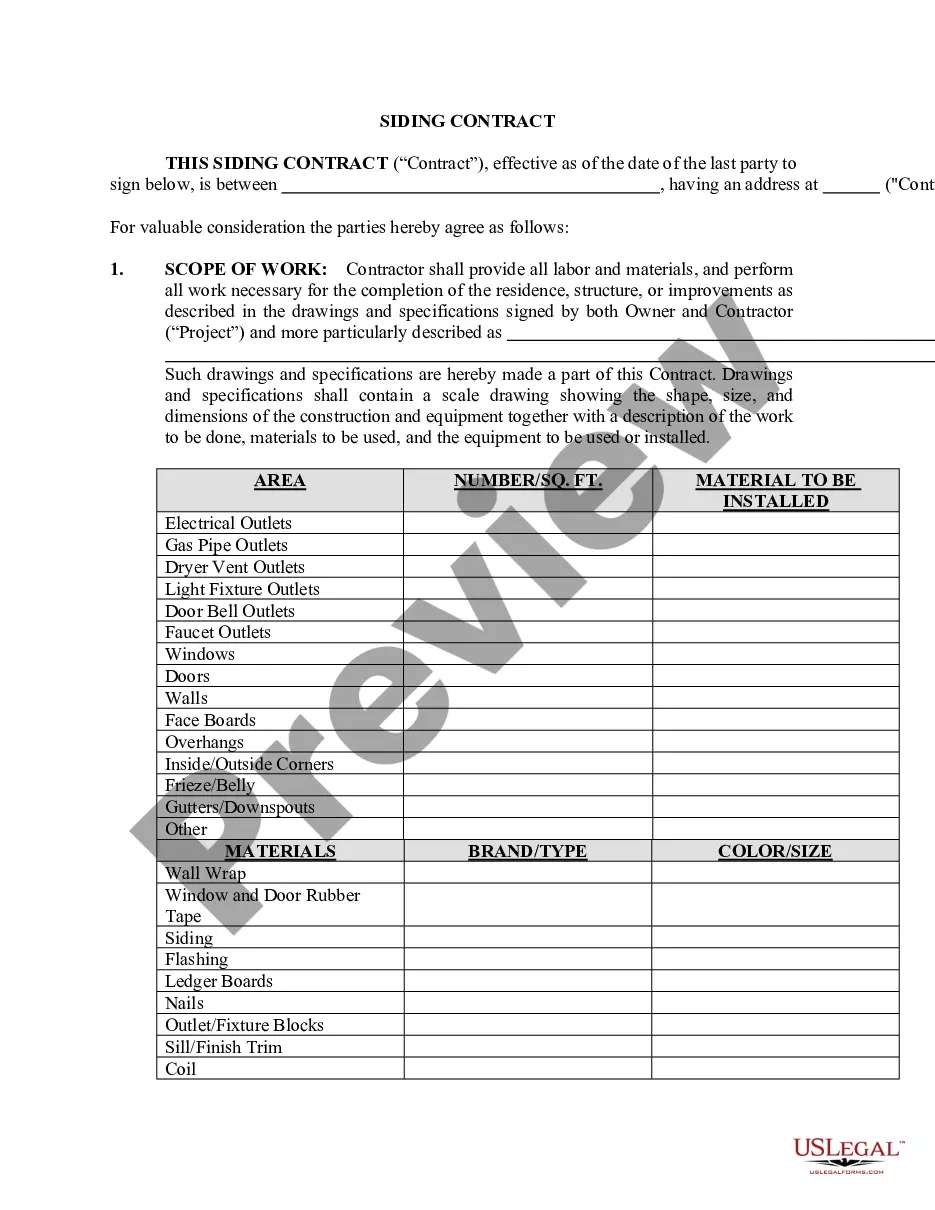

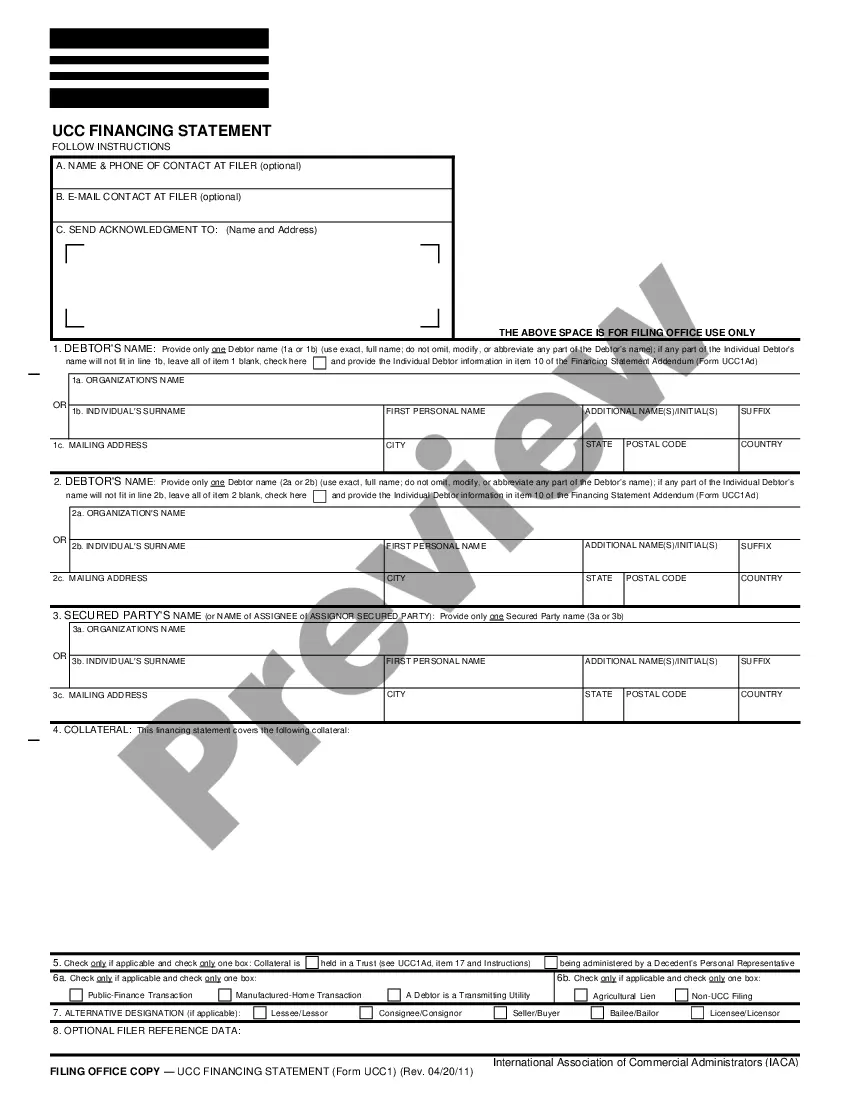

A Fort Lauderdale Florida Secured Promissory Note is a legally binding agreement that establishes the terms and conditions for a loan between a lender and a borrower. This note provides the lender with added security by allowing them to hold a specific asset or property as collateral in the event of default by the borrower. By securing the loan with collateral, the lender can recover their investment if the borrower fails to meet their repayment obligations. The Fort Lauderdale Florida Secured Promissory Note includes several key elements, including the loan amount, interest rate, repayment schedule, and consequences of default. The note also specifies the collateral being used to secure the loan, such as real estate, vehicles, or personal assets. This collateral provides the lender with a legal claim against the borrower's assets if they fail to repay the loan as agreed. There are various types of Fort Lauderdale Florida Secured Promissory Notes, each designed for specific purposes. These include: 1. Real Estate Secured Promissory Note: This type of note is commonly used in Fort Lauderdale for loans related to real estate transactions. It allows the lender to secure repayment by placing a lien on the property being financed. 2. Vehicle Secured Promissory Note: For loans involving the purchase of a vehicle, a vehicle secured promissory note is used. The lender retains a security interest in the vehicle until the loan is fully repaid. 3. Collateralized Personal Loan: In cases where personal assets like jewelry, art, or valuable collectibles are used as collateral, a collateralized personal loan note is utilized. This note outlines the terms of the loan and the consequences of default, providing protection for both the lender and the borrower. 4. Business Secured Promissory Note: When a business borrows money, a business secured promissory note may be employed. This note outlines the terms and conditions of the loan, including the agreed-upon repayment schedule and the assets being used as collateral. In Fort Lauderdale, Florida, a secured promissory note is an essential legal document that protects the interests of both borrowers and lenders. By detailing the loan terms and securing it with collateral, the note provides a level of assurance to lenders while allowing borrowers access to finance they may not otherwise obtain.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Fort Lauderdale Pagaré garantizado de Florida - Florida Secured Promissory Note

Category:

State:

Florida

City:

Fort Lauderdale

Control #:

FL-NOTE-1

Format:

Word

Instant download

Description

Pagaré garantizado para uso en Florida. Venta de casa.

A Fort Lauderdale Florida Secured Promissory Note is a legally binding agreement that establishes the terms and conditions for a loan between a lender and a borrower. This note provides the lender with added security by allowing them to hold a specific asset or property as collateral in the event of default by the borrower. By securing the loan with collateral, the lender can recover their investment if the borrower fails to meet their repayment obligations. The Fort Lauderdale Florida Secured Promissory Note includes several key elements, including the loan amount, interest rate, repayment schedule, and consequences of default. The note also specifies the collateral being used to secure the loan, such as real estate, vehicles, or personal assets. This collateral provides the lender with a legal claim against the borrower's assets if they fail to repay the loan as agreed. There are various types of Fort Lauderdale Florida Secured Promissory Notes, each designed for specific purposes. These include: 1. Real Estate Secured Promissory Note: This type of note is commonly used in Fort Lauderdale for loans related to real estate transactions. It allows the lender to secure repayment by placing a lien on the property being financed. 2. Vehicle Secured Promissory Note: For loans involving the purchase of a vehicle, a vehicle secured promissory note is used. The lender retains a security interest in the vehicle until the loan is fully repaid. 3. Collateralized Personal Loan: In cases where personal assets like jewelry, art, or valuable collectibles are used as collateral, a collateralized personal loan note is utilized. This note outlines the terms of the loan and the consequences of default, providing protection for both the lender and the borrower. 4. Business Secured Promissory Note: When a business borrows money, a business secured promissory note may be employed. This note outlines the terms and conditions of the loan, including the agreed-upon repayment schedule and the assets being used as collateral. In Fort Lauderdale, Florida, a secured promissory note is an essential legal document that protects the interests of both borrowers and lenders. By detailing the loan terms and securing it with collateral, the note provides a level of assurance to lenders while allowing borrowers access to finance they may not otherwise obtain.

Free preview

How to fill out Fort Lauderdale Pagaré Garantizado De Florida?

If you’ve already used our service before, log in to your account and download the Fort Lauderdale Florida Secured Promissory Note on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple actions to get your file:

- Make sure you’ve found an appropriate document. Read the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t suit you, use the Search tab above to find the proper one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Obtain your Fort Lauderdale Florida Secured Promissory Note. Choose the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have purchased: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly find and save any template for your personal or professional needs!