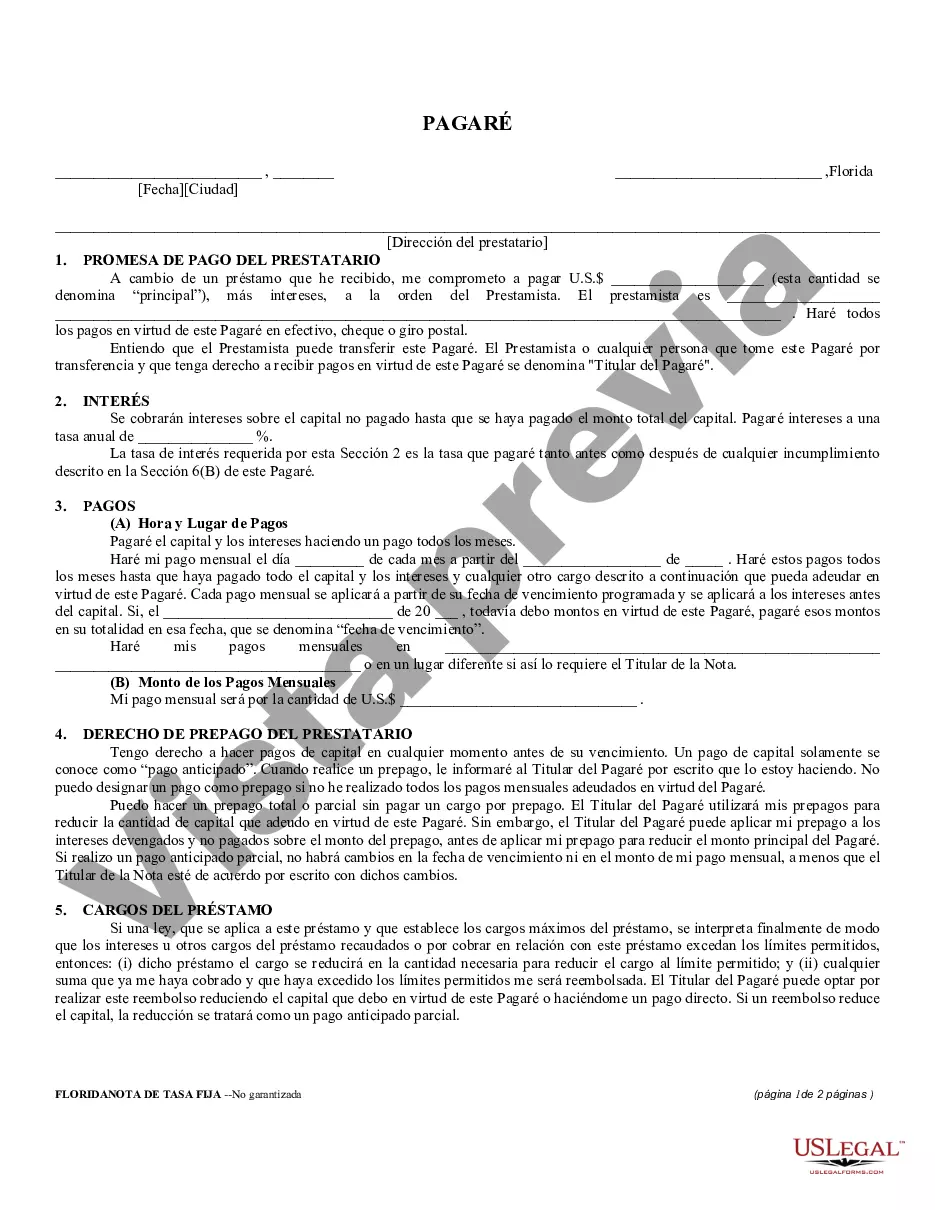

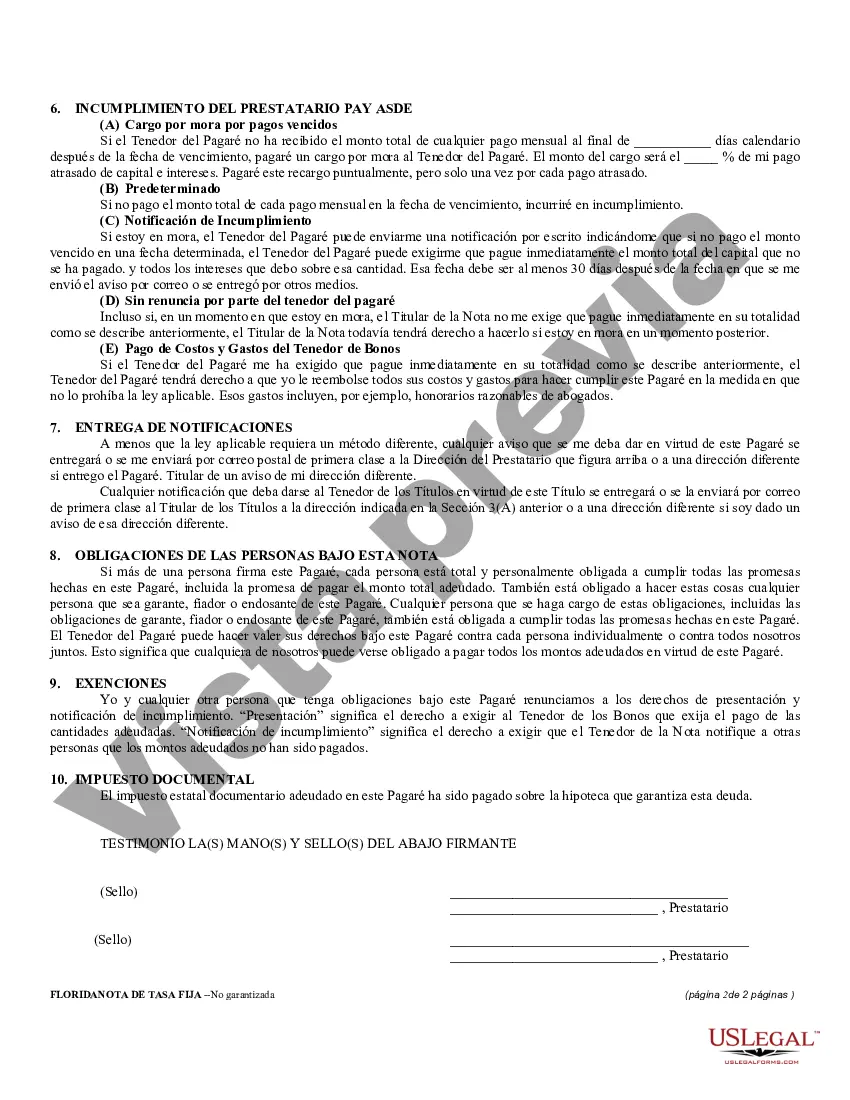

A Cape Coral Florida Unsecured Installment Payment Promissory Note for Fixed Rate is a legally binding document that outlines the terms and conditions of a loan agreement between a borrower and a lender. This promissory note is specific to Cape Coral, Florida, and is designed for unsecured loans with fixed interest rates that are repaid in installments over a set period of time. Keywords: Cape Coral, Florida, unsecured, installment payment, promissory note, fixed rate. The Cape Coral Florida Unsecured Installment Payment Promissory Note for Fixed Rate serves as a contract between the borrower and the lender, ensuring transparency and clarity in the loan agreement. It includes key details such as the names and contact information of both parties involved, the loan amount granted, the fixed interest rate, the repayment terms, and any late payment penalties or prepayment clauses. The promissory note highlights the borrower's obligation to repay the loan according to the agreed-upon terms. By signing this note, the borrower acknowledges the full amount owed, the interest rate, and the repayment schedule. It protects the lender's rights by detailing the consequences of default, including potential legal action. Key variations of Cape Coral Florida Unsecured Installment Payment Promissory Note for Fixed Rate may include: 1. Short-term Unsecured Installment Payment Promissory Note: This note is designed for smaller loan amounts with a shorter repayment term, typically ranging from a few months to a year. It suits borrowers looking for quick financial assistance. 2. Long-term Unsecured Installment Payment Promissory Note: This note is suitable for larger loan amounts that require a more extended repayment period. The term can range from several months to several years, depending on the agreement between the borrower and the lender. 3. Personal Unsecured Installment Payment Promissory Note: This note caters to personal loans made between individuals, such as family or friends. It outlines the repayment terms and serves as a formal agreement to maintain transparency and avoid any misunderstandings. In conclusion, the Cape Coral Florida Unsecured Installment Payment Promissory Note for Fixed Rate is a crucial legal document that protects both the borrower and the lender in a loan agreement. With its defined repayment terms, interest rate, and consequences of default, it ensures a clear understanding and promotes financial responsibility for borrowers in Cape Coral, Florida.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cape Coral Pagaré de pago a plazos no garantizado de Florida para tasa fija - Florida Unsecured Installment Payment Promissory Note for Fixed Rate

State:

Florida

City:

Cape Coral

Control #:

FL-NOTE-2

Format:

Word

Instant download

Description

This is a Promissory Note for your state. The promissory note is unsecured, with a fixed interest rate, and contains a provision for installment payments.

A Cape Coral Florida Unsecured Installment Payment Promissory Note for Fixed Rate is a legally binding document that outlines the terms and conditions of a loan agreement between a borrower and a lender. This promissory note is specific to Cape Coral, Florida, and is designed for unsecured loans with fixed interest rates that are repaid in installments over a set period of time. Keywords: Cape Coral, Florida, unsecured, installment payment, promissory note, fixed rate. The Cape Coral Florida Unsecured Installment Payment Promissory Note for Fixed Rate serves as a contract between the borrower and the lender, ensuring transparency and clarity in the loan agreement. It includes key details such as the names and contact information of both parties involved, the loan amount granted, the fixed interest rate, the repayment terms, and any late payment penalties or prepayment clauses. The promissory note highlights the borrower's obligation to repay the loan according to the agreed-upon terms. By signing this note, the borrower acknowledges the full amount owed, the interest rate, and the repayment schedule. It protects the lender's rights by detailing the consequences of default, including potential legal action. Key variations of Cape Coral Florida Unsecured Installment Payment Promissory Note for Fixed Rate may include: 1. Short-term Unsecured Installment Payment Promissory Note: This note is designed for smaller loan amounts with a shorter repayment term, typically ranging from a few months to a year. It suits borrowers looking for quick financial assistance. 2. Long-term Unsecured Installment Payment Promissory Note: This note is suitable for larger loan amounts that require a more extended repayment period. The term can range from several months to several years, depending on the agreement between the borrower and the lender. 3. Personal Unsecured Installment Payment Promissory Note: This note caters to personal loans made between individuals, such as family or friends. It outlines the repayment terms and serves as a formal agreement to maintain transparency and avoid any misunderstandings. In conclusion, the Cape Coral Florida Unsecured Installment Payment Promissory Note for Fixed Rate is a crucial legal document that protects both the borrower and the lender in a loan agreement. With its defined repayment terms, interest rate, and consequences of default, it ensures a clear understanding and promotes financial responsibility for borrowers in Cape Coral, Florida.

Free preview

How to fill out Cape Coral Pagaré De Pago A Plazos No Garantizado De Florida Para Tasa Fija?

If you’ve already used our service before, log in to your account and save the Cape Coral Florida Unsecured Installment Payment Promissory Note for Fixed Rate on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple actions to obtain your document:

- Make certain you’ve located a suitable document. Look through the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t fit you, utilize the Search tab above to obtain the appropriate one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Obtain your Cape Coral Florida Unsecured Installment Payment Promissory Note for Fixed Rate. Select the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have bought: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly find and save any template for your individual or professional needs!