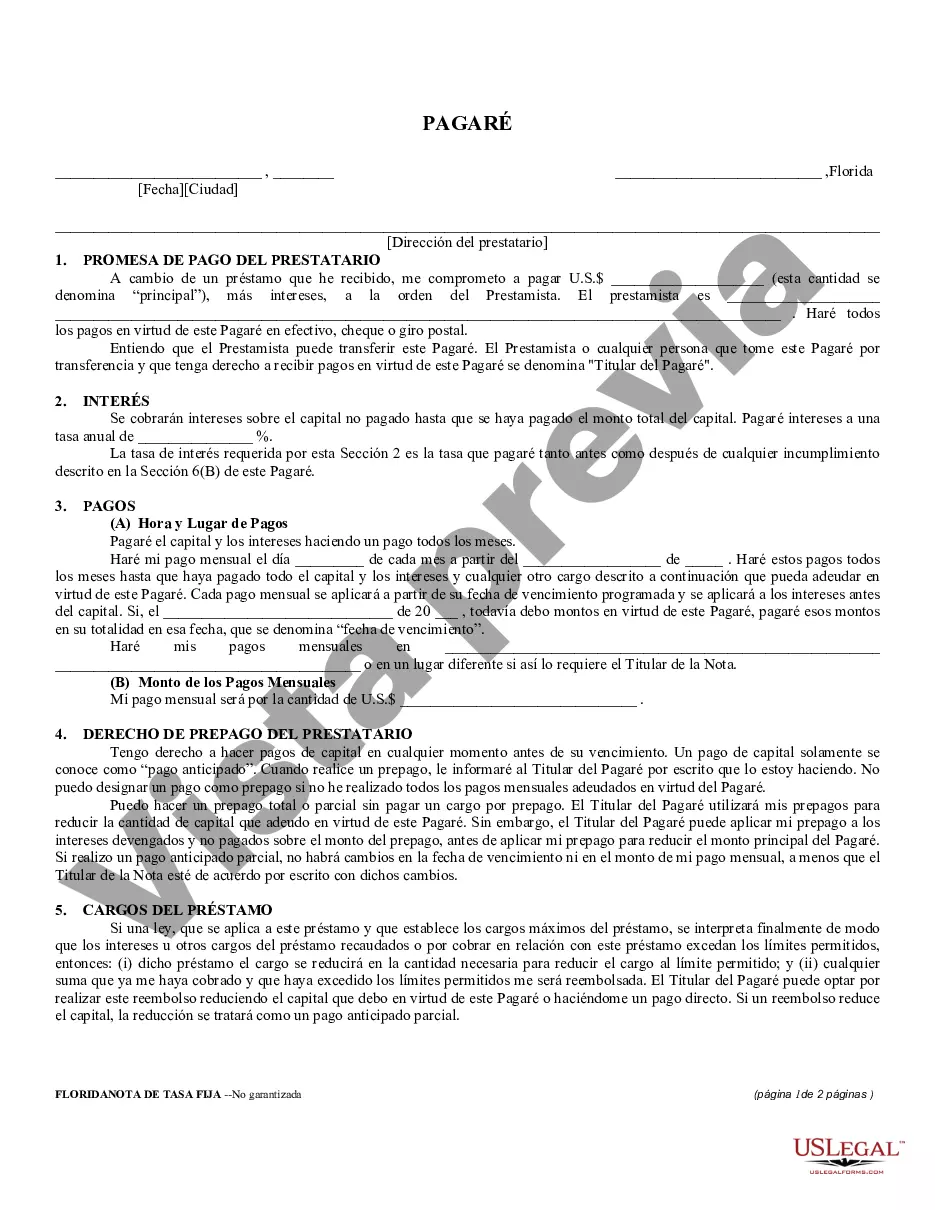

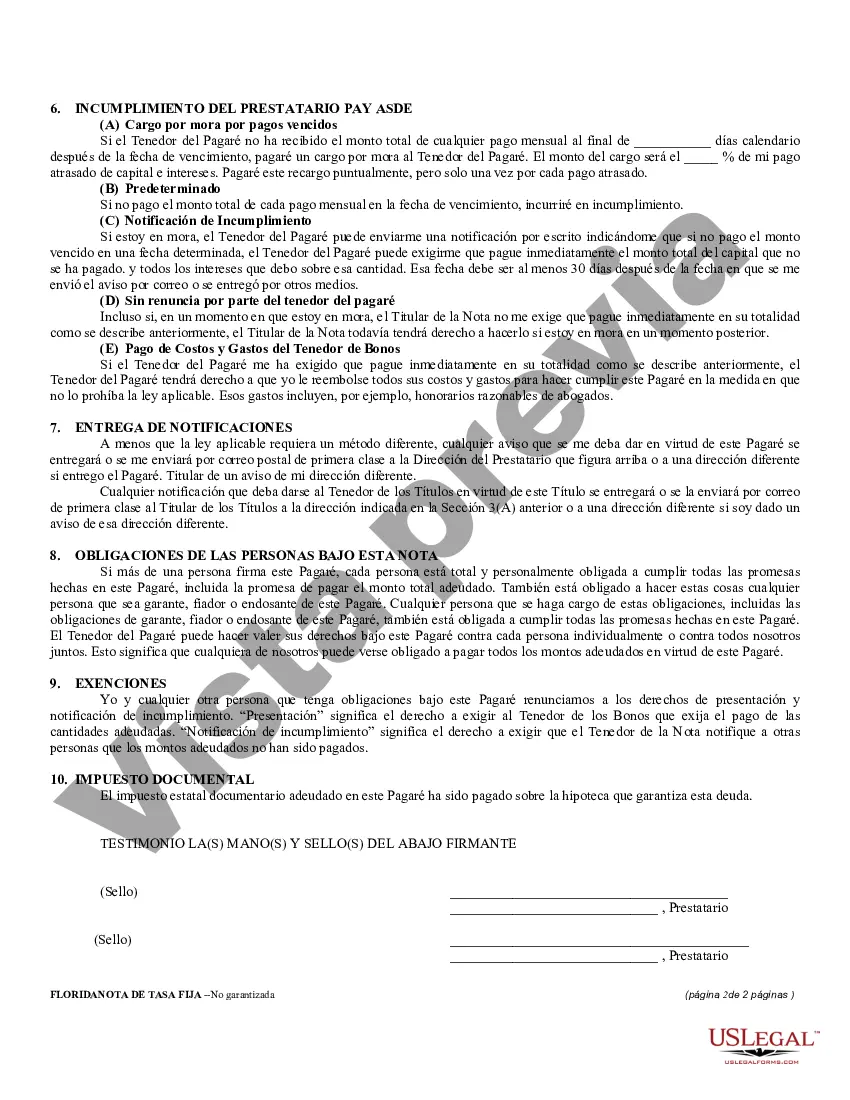

Fort Lauderdale Florida Unsecured Installment Payment Promissory Note for Fixed Rate is a legally binding contract used in Fort Lauderdale, Florida to establish a loan agreement between a lender and borrower. This type of promissory note is specifically designed for unsecured loans, meaning that the borrower does not have to provide any collateral or guarantee. The Fort Lauderdale Florida Unsecured Installment Payment Promissory Note outlines the terms and conditions of the loan, including the principal amount, interest rate, repayment schedule, and any additional provisions or clauses agreed upon between the parties involved. It serves as an essential document for both the lender and borrower to protect their financial interests and establish a clear understanding of the loan obligations. Keywords: Fort Lauderdale, Florida, unsecured, installment payment, promissory note, fixed rate, loan agreement, lender, borrower, collateral, guarantee, terms and conditions, principal amount, interest rate, repayment schedule, provisions, clauses, financial interests. Different types of Fort Lauderdale Florida Unsecured Installment Payment Promissory Note for Fixed Rate can include: 1. Personal Loan Promissory Note: This type of promissory note is used for personal loans between individuals, such as friends or family members, where no collateral is required. 2. Business Loan Promissory Note: This promissory note is utilized for unsecured loans provided by a business to another business, which may involve a fixed repayment schedule over a specific period. 3. Student Loan Promissory Note: Specifically designed for educational purposes, this promissory note outlines the terms of unsecured loans granted to students, enabling them to finance their education without collateral. 4. Medical Loan Promissory Note: This promissory note is utilized for unsecured loans related to medical expenses, helping individuals pay for medical treatments or procedures over a fixed period. 5. Small Business Loan Promissory Note: This type of promissory note is used for unsecured loans granted to small businesses, typically involving a fixed repayment schedule and interest rate. Overall, Fort Lauderdale Florida Unsecured Installment Payment Promissory Note for Fixed Rate is a crucial document that ensures both parties involved in a loan agreement are protected and have a clear understanding of their obligations. It is recommended to seek legal advice or utilize templates provided by reputable sources to draft a comprehensive promissory note.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Fort Lauderdale Pagaré de pago a plazos no garantizado de Florida para tasa fija - Florida Unsecured Installment Payment Promissory Note for Fixed Rate

Description

How to fill out Fort Lauderdale Pagaré De Pago A Plazos No Garantizado De Florida Para Tasa Fija?

Take advantage of the US Legal Forms and have immediate access to any form template you want. Our beneficial website with a huge number of templates makes it easy to find and obtain virtually any document sample you want. You can export, fill, and sign the Fort Lauderdale Florida Unsecured Installment Payment Promissory Note for Fixed Rate in a couple of minutes instead of browsing the web for many hours attempting to find the right template.

Utilizing our collection is a superb way to increase the safety of your form submissions. Our professional lawyers regularly check all the records to make certain that the templates are relevant for a particular state and compliant with new acts and regulations.

How do you obtain the Fort Lauderdale Florida Unsecured Installment Payment Promissory Note for Fixed Rate? If you already have a profile, just log in to the account. The Download option will be enabled on all the documents you look at. In addition, you can get all the previously saved documents in the My Forms menu.

If you don’t have an account yet, stick to the tips below:

- Open the page with the template you require. Make certain that it is the template you were hoping to find: check its title and description, and use the Preview option when it is available. Otherwise, make use of the Search field to find the appropriate one.

- Start the downloading process. Click Buy Now and choose the pricing plan you like. Then, sign up for an account and pay for your order using a credit card or PayPal.

- Export the file. Select the format to obtain the Fort Lauderdale Florida Unsecured Installment Payment Promissory Note for Fixed Rate and revise and fill, or sign it for your needs.

US Legal Forms is among the most extensive and trustworthy template libraries on the internet. We are always ready to help you in any legal case, even if it is just downloading the Fort Lauderdale Florida Unsecured Installment Payment Promissory Note for Fixed Rate.

Feel free to take full advantage of our service and make your document experience as convenient as possible!