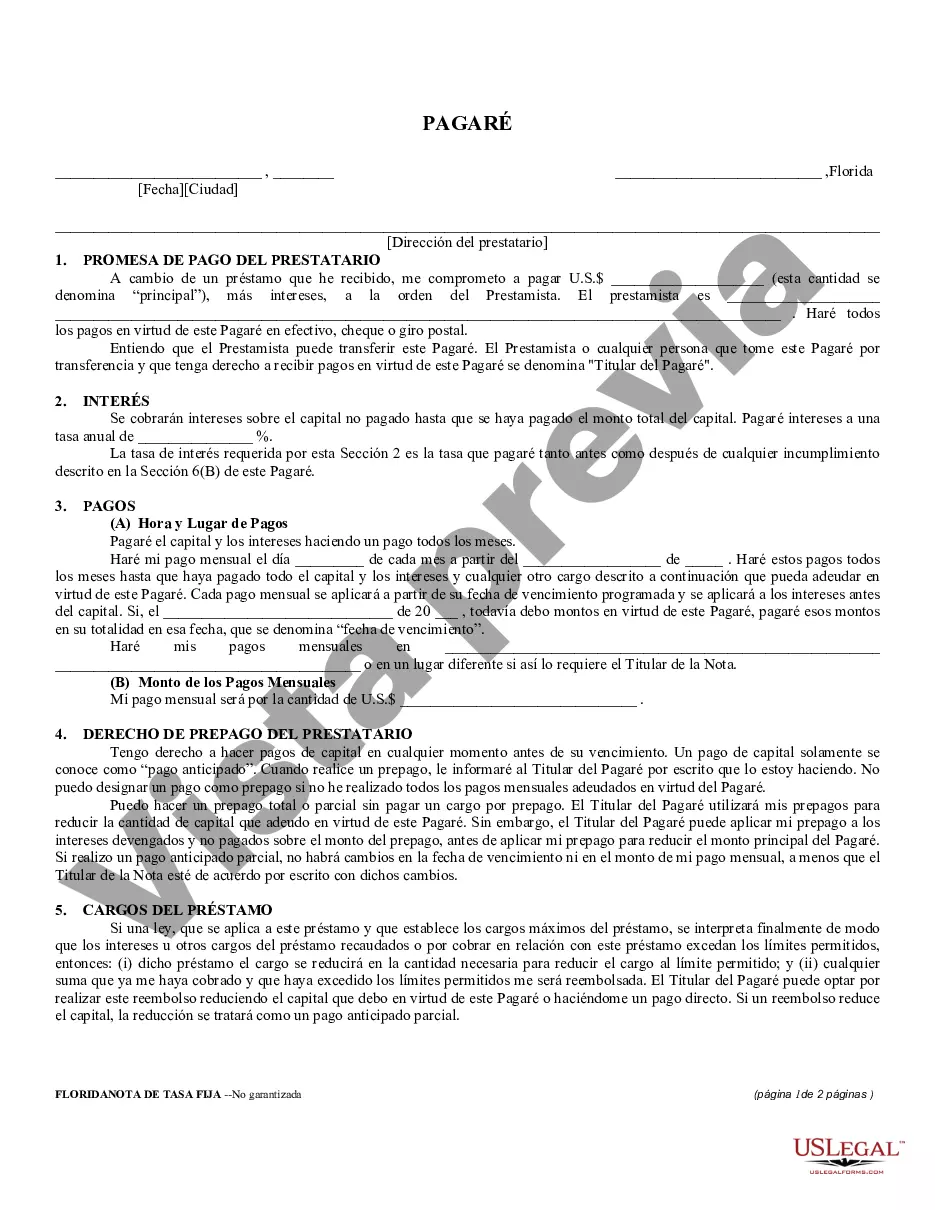

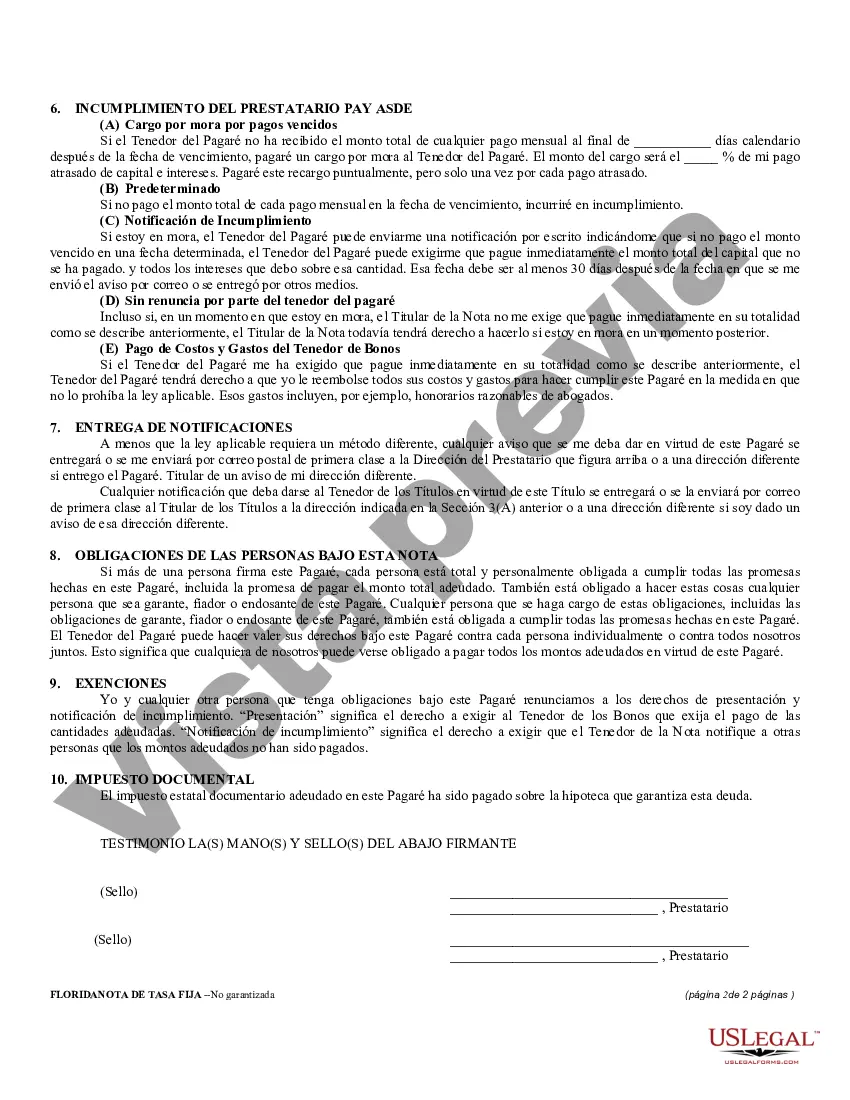

A Palm Bay Florida Unsecured Installment Payment Promissory Note for Fixed Rate is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower. This type of promissory note is specifically designed for individuals or entities residing in Palm Bay, Florida, who wish to borrow money and make repayments in regular installments. The term "unsecured" indicates that the loan is not backed by collateral, meaning the borrower does not need to pledge any assets as security for the loan. Instead, the lender relies solely on the borrower's promise to repay the loan according to the agreed-upon terms. The promissory note specifies that the loan will be repaid over a fixed period through regular installments. The fixed rate refers to the predetermined interest rate that remains constant throughout the loan term. This type of note offers predictability for both the lender and the borrower, as the interest rate remains unchanged, ensuring consistent repayment amounts. It is important to note that there may be different variations or types of Palm Bay Florida Unsecured Installment Payment Promissory Notes for Fixed Rate, which could vary based on specific terms or conditions agreed upon by the parties involved. Some possible variations may include: 1. Personal Unsecured Installment Payment Promissory Note for Fixed Rate: This type of promissory note is utilized when an individual borrower wants to obtain a loan for personal needs, such as debt consolidation, home improvement, or financing a major purchase. 2. Business Unsecured Installment Payment Promissory Note for Fixed Rate: This variation is designed for businesses or entrepreneurs in Palm Bay, Florida, who require financial assistance to support their company's growth, fund working capital, or expand operations. 3. Student Unsecured Installment Payment Promissory Note for Fixed Rate: This type of promissory note targets students in Palm Bay, Florida, who need funds to cover education-related expenses, such as tuition, books, or living costs. It enables students to repay the loan gradually over fixed installments, making it more manageable for them financially. Regardless of the specific type, a Palm Bay Florida Unsecured Installment Payment Promissory Note for Fixed Rate should include essential information such as the loan amount, repayment schedule, interest rate, late payment fees, and any additional terms or conditions agreed upon between the lender and borrower.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Palm Bay Pagaré de pago a plazos no garantizado de Florida para tasa fija - Florida Unsecured Installment Payment Promissory Note for Fixed Rate

Description

How to fill out Palm Bay Pagaré De Pago A Plazos No Garantizado De Florida Para Tasa Fija?

We always strive to minimize or prevent legal damage when dealing with nuanced legal or financial matters. To do so, we sign up for attorney services that, usually, are extremely expensive. Nevertheless, not all legal matters are equally complex. Most of them can be taken care of by ourselves.

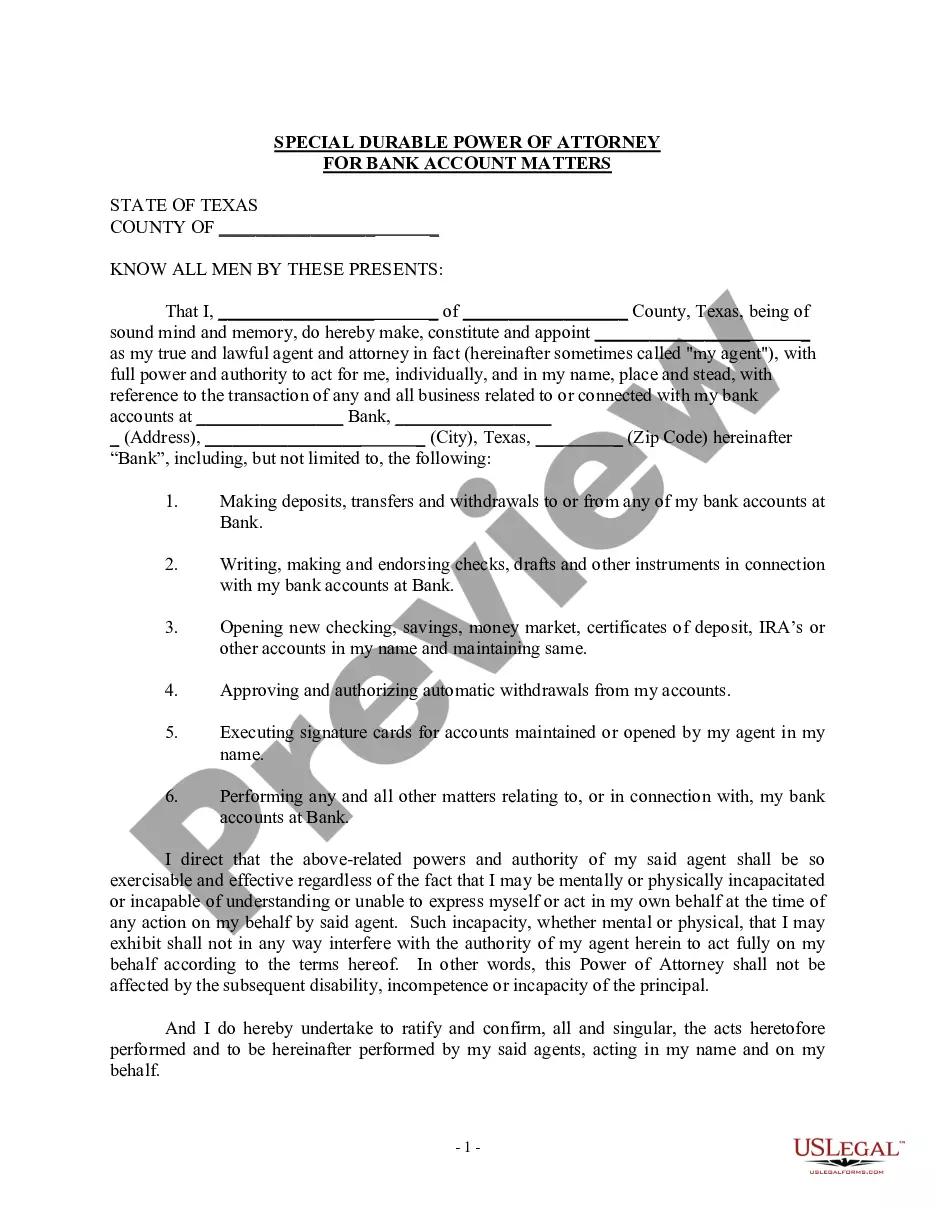

US Legal Forms is a web-based collection of updated DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your matters into your own hands without turning to an attorney. We offer access to legal document templates that aren’t always publicly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the Palm Bay Florida Unsecured Installment Payment Promissory Note for Fixed Rate or any other document easily and safely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always re-download it from within the My Forms tab.

The process is equally effortless if you’re unfamiliar with the platform! You can register your account within minutes.

- Make sure to check if the Palm Bay Florida Unsecured Installment Payment Promissory Note for Fixed Rate complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s description (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve made sure that the Palm Bay Florida Unsecured Installment Payment Promissory Note for Fixed Rate is suitable for your case, you can pick the subscription plan and make a payment.

- Then you can download the form in any suitable format.

For over 24 years of our presence on the market, we’ve helped millions of people by offering ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save efforts and resources!