A promissory note is a legal document that outlines the terms and conditions of a loan agreement between a borrower and a lender. In Coral Springs, Florida, a promissory note is an essential instrument utilized in various financial transactions. It serves as evidence of a debt and ensures that both parties involved comprehend and agree upon the loan terms. Here is a detailed description of Coral Springs Florida Promissory Note, including different types: 1. Secured Promissory Note: This type of promissory note requires the borrower to provide collateral, such as real estate or personal property, to secure the loan. If the borrower fails to repay the loan, the lender has the right to seize the collateral to recover their investment. 2. Unsecured Promissory Note: Unlike the secured promissory note, this type does not require any collateral. Instead, the borrower's creditworthiness and financial history are the determining factors for granting the loan. In the case of default, the lender might face challenges in recovering the borrowed amount. 3. Demand Promissory Note: Also known as "payable on demand," this promissory note enables the lender to request repayment of the loan at any time the lender wishes. This type provides flexibility to the lender, giving them the choice to call for full payment or negotiate a revised repayment plan. 4. Installment Promissory Note: This note divides the loan amount into predetermined installments, making it more convenient for the borrower to repay the debt over a set period. Each installment includes both principal and interest portions, allowing clear expectations for both parties involved. 5. Balloon Promissory Note: A balloon payment is incorporated into this type of note, requiring the borrower to make regular payments over a specific period, with a significant final payment at the end. This note is beneficial for borrowers who anticipate a substantial inflow of funds before the payment maturity date. 6. Convertible Promissory Note: This unique type of promissory note allows the debt to be converted into equity in the borrower's company. This note is often used in start-up ventures, providing the lender with a potential ownership stake in the company as an alternative form of repayment. Coral Springs, Florida, recognizes the importance of promissory notes in facilitating financial transactions. These documents serve not only as evidence of a loan agreement but also as protective measures for both the borrower and the lender. Understanding the various types of promissory notes available in Coral Springs ensures that borrowers select the appropriate document that best suits their financial needs and preferences.

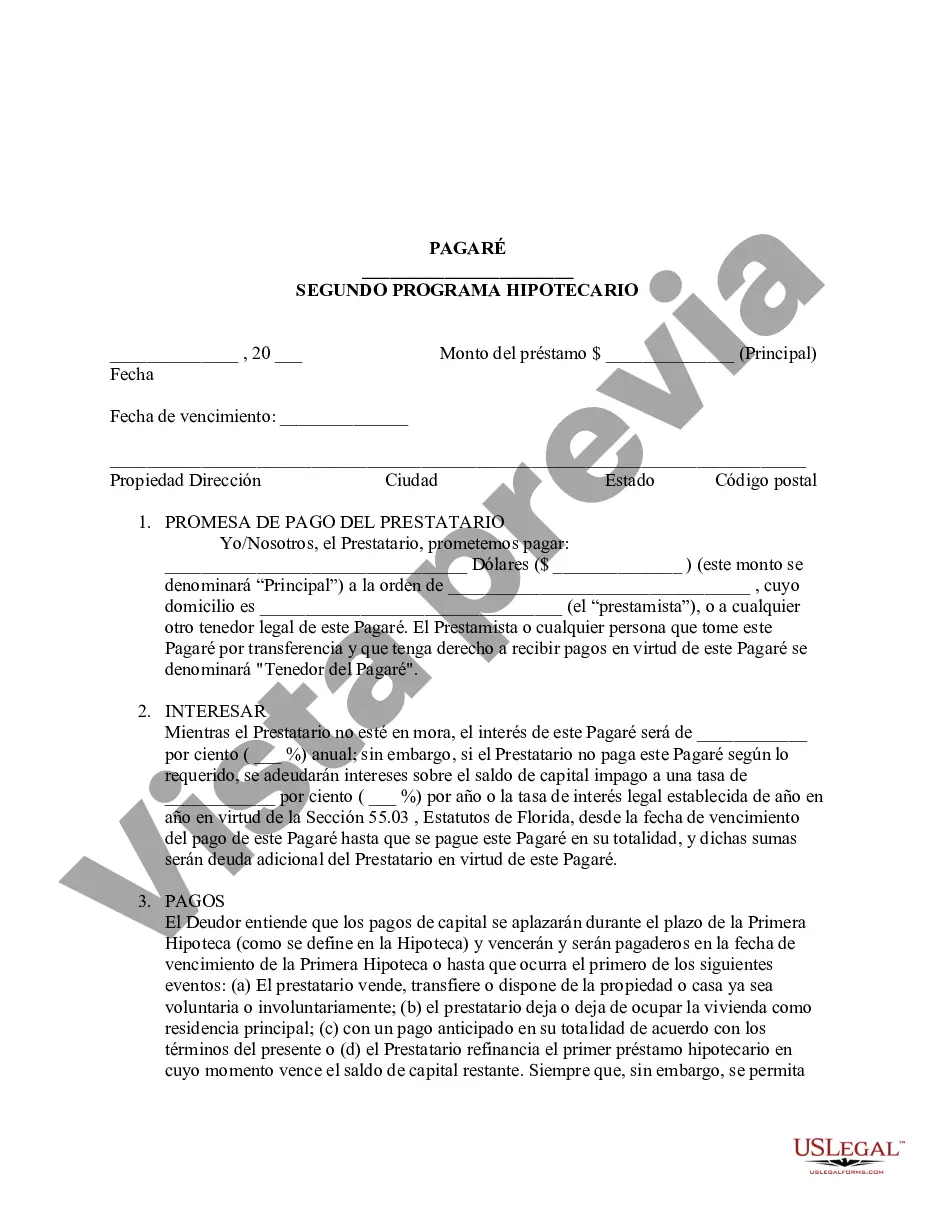

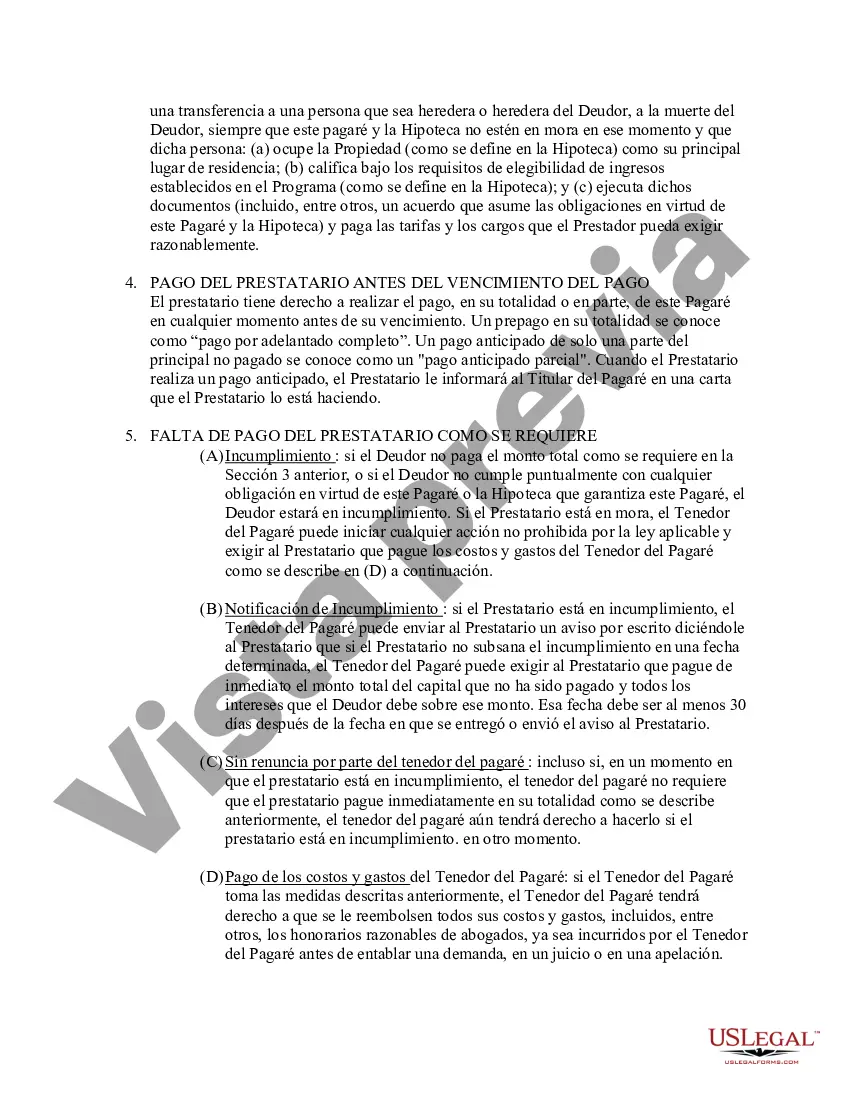

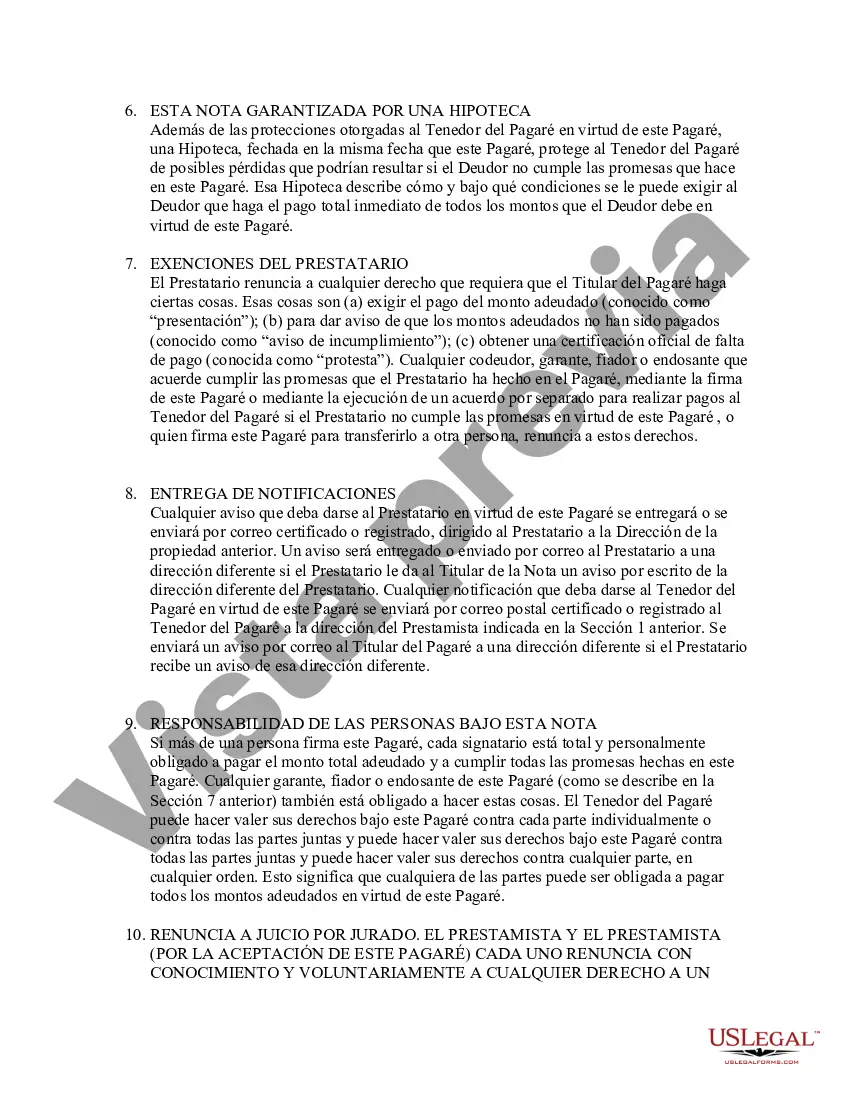

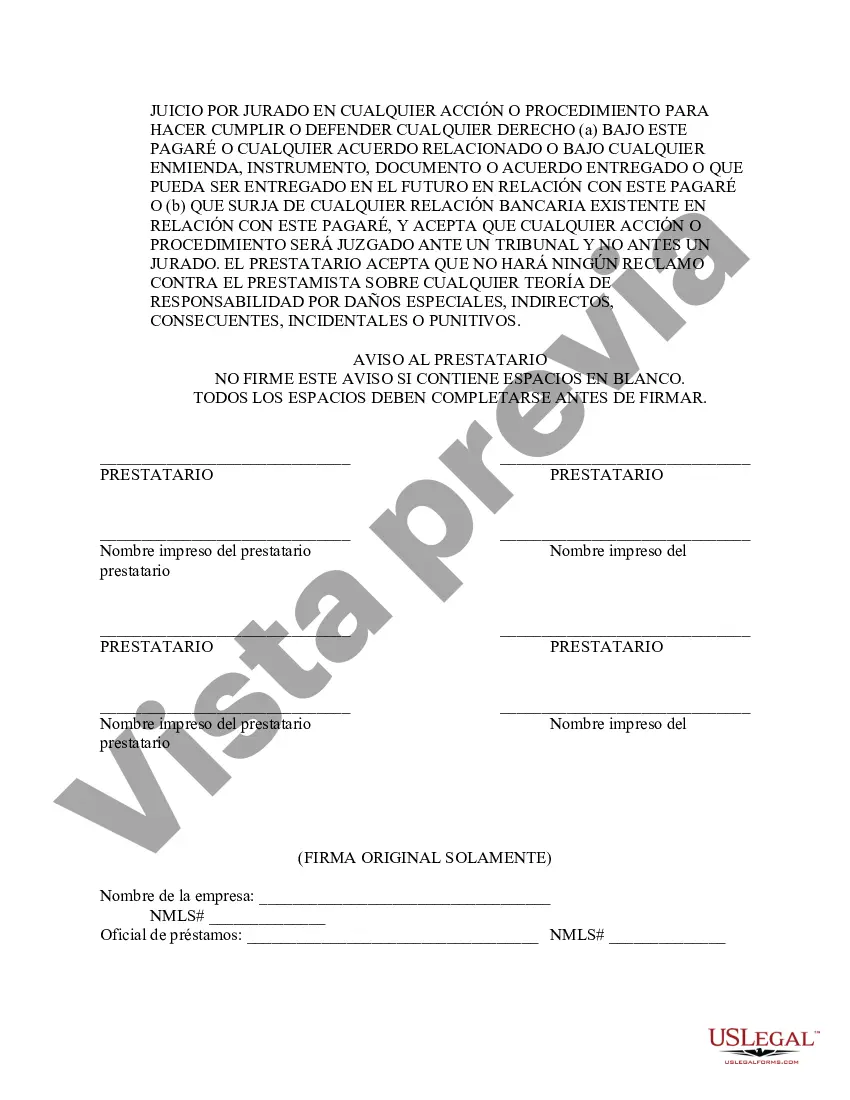

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Coral Springs Florida Pagaré - Florida Promissory Note

Instant download

Description

A promissory note, sometimes referred to as a note payable, is a legal instrument, in which one party promises in writing to pay a determinate sum of money to the other, either at a fixed or determinable future time or on demand of the payee, under specific terms.

A promissory note is a legal document that outlines the terms and conditions of a loan agreement between a borrower and a lender. In Coral Springs, Florida, a promissory note is an essential instrument utilized in various financial transactions. It serves as evidence of a debt and ensures that both parties involved comprehend and agree upon the loan terms. Here is a detailed description of Coral Springs Florida Promissory Note, including different types: 1. Secured Promissory Note: This type of promissory note requires the borrower to provide collateral, such as real estate or personal property, to secure the loan. If the borrower fails to repay the loan, the lender has the right to seize the collateral to recover their investment. 2. Unsecured Promissory Note: Unlike the secured promissory note, this type does not require any collateral. Instead, the borrower's creditworthiness and financial history are the determining factors for granting the loan. In the case of default, the lender might face challenges in recovering the borrowed amount. 3. Demand Promissory Note: Also known as "payable on demand," this promissory note enables the lender to request repayment of the loan at any time the lender wishes. This type provides flexibility to the lender, giving them the choice to call for full payment or negotiate a revised repayment plan. 4. Installment Promissory Note: This note divides the loan amount into predetermined installments, making it more convenient for the borrower to repay the debt over a set period. Each installment includes both principal and interest portions, allowing clear expectations for both parties involved. 5. Balloon Promissory Note: A balloon payment is incorporated into this type of note, requiring the borrower to make regular payments over a specific period, with a significant final payment at the end. This note is beneficial for borrowers who anticipate a substantial inflow of funds before the payment maturity date. 6. Convertible Promissory Note: This unique type of promissory note allows the debt to be converted into equity in the borrower's company. This note is often used in start-up ventures, providing the lender with a potential ownership stake in the company as an alternative form of repayment. Coral Springs, Florida, recognizes the importance of promissory notes in facilitating financial transactions. These documents serve not only as evidence of a loan agreement but also as protective measures for both the borrower and the lender. Understanding the various types of promissory notes available in Coral Springs ensures that borrowers select the appropriate document that best suits their financial needs and preferences.

Free preview

How to fill out Coral Springs Florida Pagaré?

If you’ve already utilized our service before, log in to your account and download the Coral Springs Florida Promissory Note on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple steps to obtain your file:

- Make certain you’ve located the right document. Read the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t suit you, utilize the Search tab above to find the appropriate one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Get your Coral Springs Florida Promissory Note. Select the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have bought: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your personal or professional needs!