A Palm Bay Florida promissory note is a legally-binding document that establishes a written agreement between a lender and a borrower in Palm Bay, Florida. This document outlines the terms and conditions of a loan, including the principal amount borrowed, the interest rate applied, the repayment schedule, and any other relevant terms. A Palm Bay Florida promissory note serves as evidence of the debt owed by the borrower to the lender and acts as a protection for both parties involved. By signing this document, the borrower promises to repay the loan according to the agreed-upon terms, while the lender agrees to provide the funds. There are different types of Palm Bay Florida promissory notes that can cater to various loan scenarios. Some commonly used promissory notes in Palm Bay, Florida include: 1. Simple Promissory Note: This is a straightforward and commonly used type of promissory note that outlines the essential details of the loan agreement. 2. Secured Promissory Note: In this type of promissory note, the borrower pledges collateral (such as a property or a vehicle) to secure the loan, assuring the lender that they will receive repayment even if the borrower defaults. 3. Unsecured Promissory Note: Unlike a secured promissory note, an unsecured promissory note does not require any collateral. This type of note relies solely on the borrower's promise to repay the borrowed funds. 4. Demand Promissory Note: This type of note allows the lender to demand repayment of the loan at any time they see fit, rather than adhering to a predetermined schedule. This can be beneficial for lenders who may require immediate repayment. 5. Installment Promissory Note: This note establishes a specific payment schedule, outlining the amount of each installment, the due dates, and the duration of the loan, allowing for gradual repayment. 6. Balloon Promissory Note: A balloon note requires the borrower to make smaller regular payments throughout the loan term, with a large final payment (the "balloon payment") due at the end of the term. Palm Bay Florida promissory notes are crucial legal documents that ensure clarity and protection for both lenders and borrowers. It is recommended to seek legal advice or use a professionally crafted promissory note template to ensure compliance with Florida laws and to safeguard the interests of all parties involved in the loan agreement.

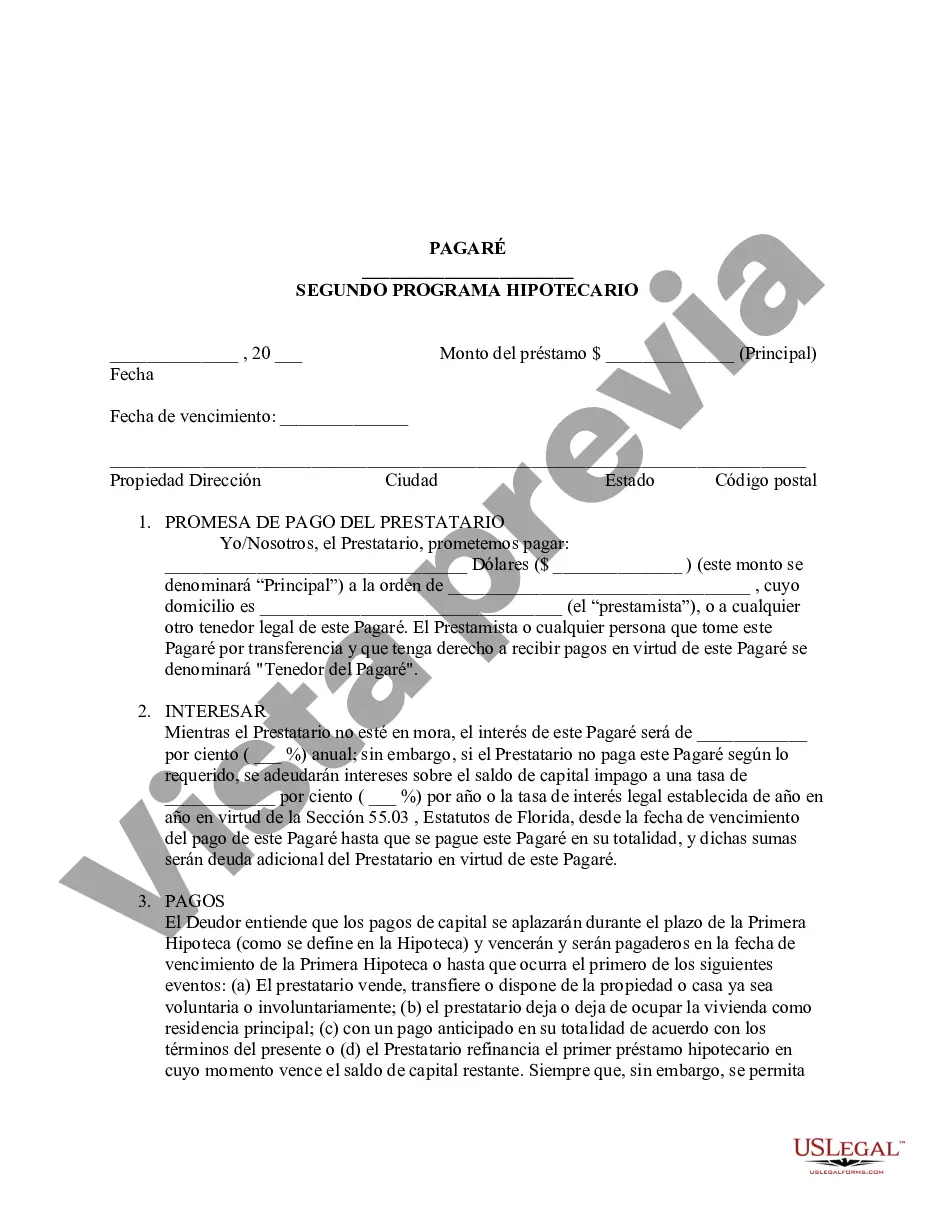

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Palm Bay Florida Pagaré - Florida Promissory Note

Instant download

Description

A promissory note, sometimes referred to as a note payable, is a legal instrument, in which one party promises in writing to pay a determinate sum of money to the other, either at a fixed or determinable future time or on demand of the payee, under specific terms.

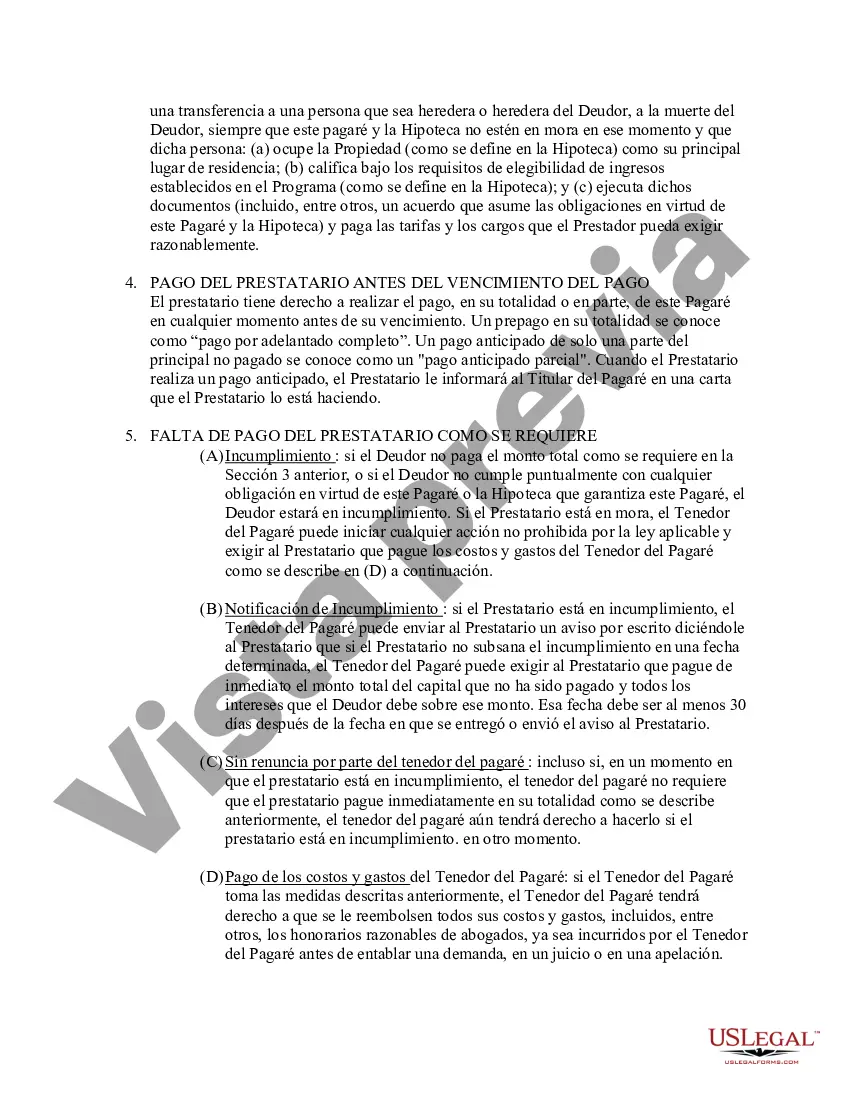

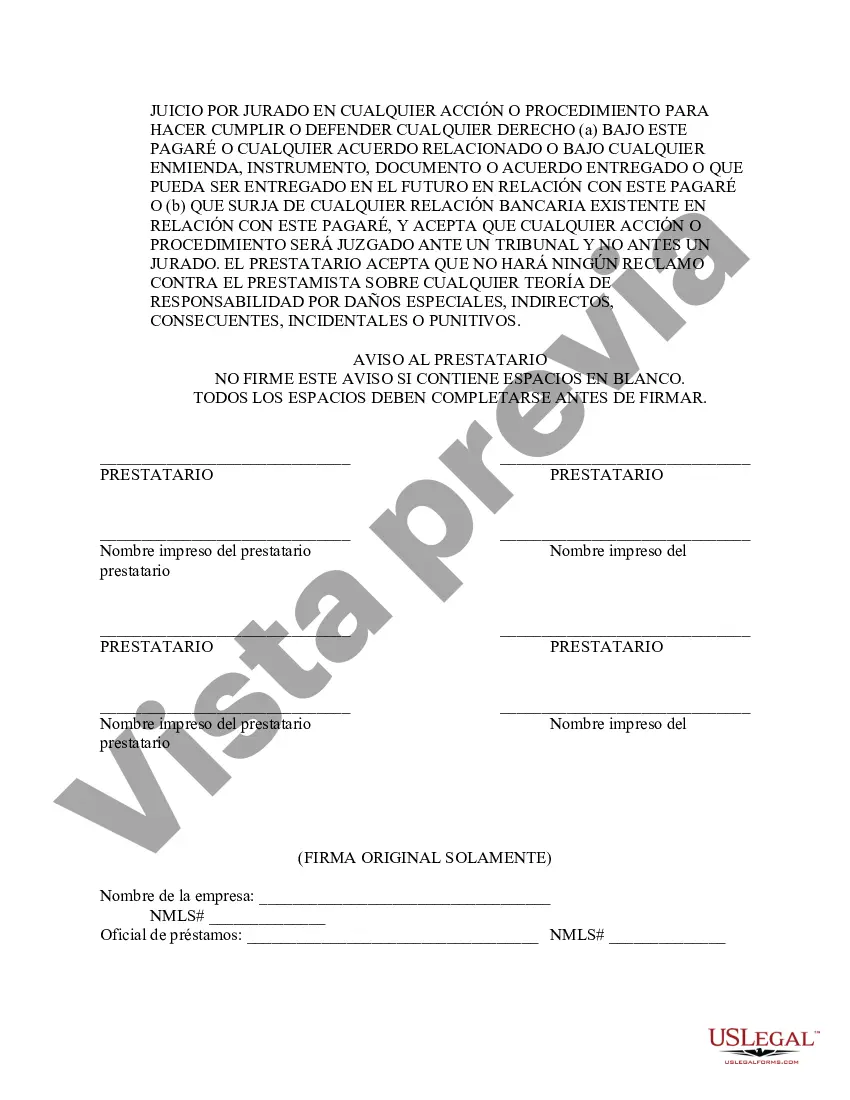

A Palm Bay Florida promissory note is a legally-binding document that establishes a written agreement between a lender and a borrower in Palm Bay, Florida. This document outlines the terms and conditions of a loan, including the principal amount borrowed, the interest rate applied, the repayment schedule, and any other relevant terms. A Palm Bay Florida promissory note serves as evidence of the debt owed by the borrower to the lender and acts as a protection for both parties involved. By signing this document, the borrower promises to repay the loan according to the agreed-upon terms, while the lender agrees to provide the funds. There are different types of Palm Bay Florida promissory notes that can cater to various loan scenarios. Some commonly used promissory notes in Palm Bay, Florida include: 1. Simple Promissory Note: This is a straightforward and commonly used type of promissory note that outlines the essential details of the loan agreement. 2. Secured Promissory Note: In this type of promissory note, the borrower pledges collateral (such as a property or a vehicle) to secure the loan, assuring the lender that they will receive repayment even if the borrower defaults. 3. Unsecured Promissory Note: Unlike a secured promissory note, an unsecured promissory note does not require any collateral. This type of note relies solely on the borrower's promise to repay the borrowed funds. 4. Demand Promissory Note: This type of note allows the lender to demand repayment of the loan at any time they see fit, rather than adhering to a predetermined schedule. This can be beneficial for lenders who may require immediate repayment. 5. Installment Promissory Note: This note establishes a specific payment schedule, outlining the amount of each installment, the due dates, and the duration of the loan, allowing for gradual repayment. 6. Balloon Promissory Note: A balloon note requires the borrower to make smaller regular payments throughout the loan term, with a large final payment (the "balloon payment") due at the end of the term. Palm Bay Florida promissory notes are crucial legal documents that ensure clarity and protection for both lenders and borrowers. It is recommended to seek legal advice or use a professionally crafted promissory note template to ensure compliance with Florida laws and to safeguard the interests of all parties involved in the loan agreement.

Free preview

How to fill out Palm Bay Florida Pagaré?

If you’ve already utilized our service before, log in to your account and save the Palm Bay Florida Promissory Note on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple steps to get your document:

- Ensure you’ve found the right document. Look through the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t fit you, utilize the Search tab above to find the appropriate one.

- Buy the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Obtain your Palm Bay Florida Promissory Note. Pick the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have purchased: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly find and save any template for your personal or professional needs!