Palm Beach Florida Pagaré - Florida Promissory Note

Instant download

Description

A promissory note, sometimes referred to as a note payable, is a legal instrument, in which one party promises in writing to pay a determinate sum of money to the other, either at a fixed or determinable future time or on demand of the payee, under specific terms.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés.

For your convenience, the complete English version of this form is attached below the Spanish version.

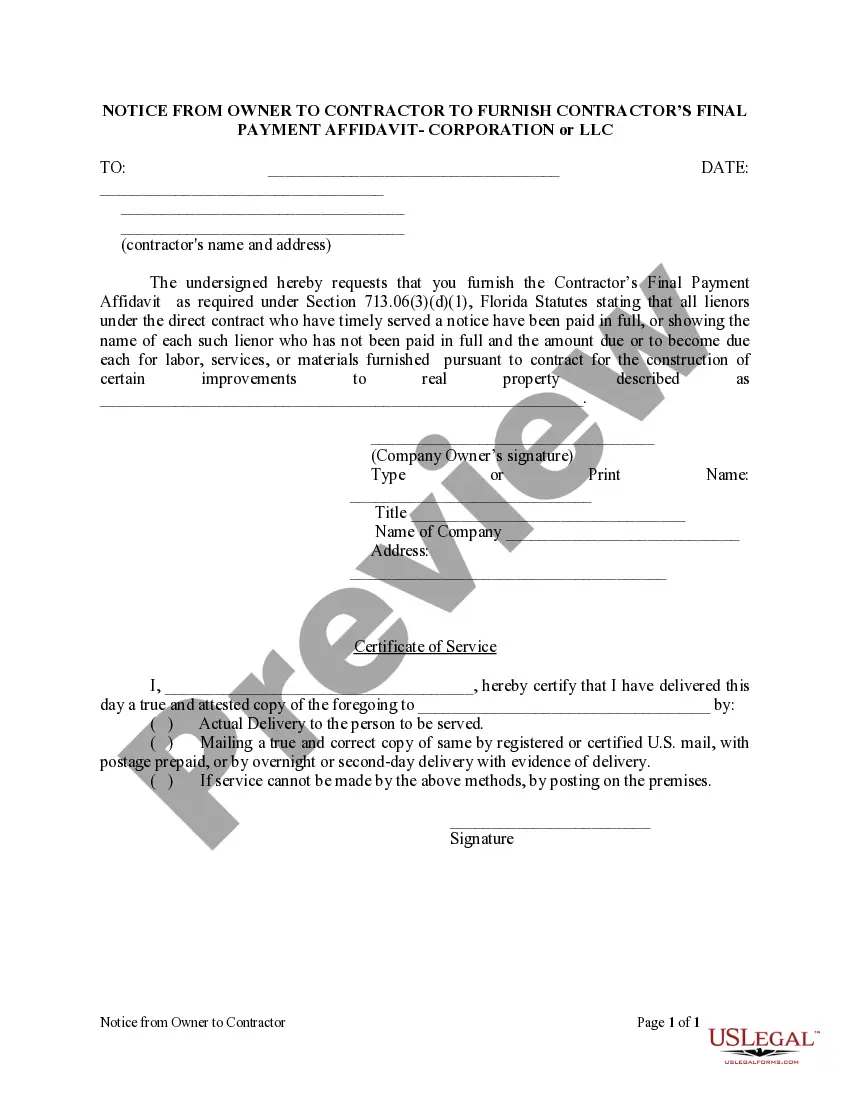

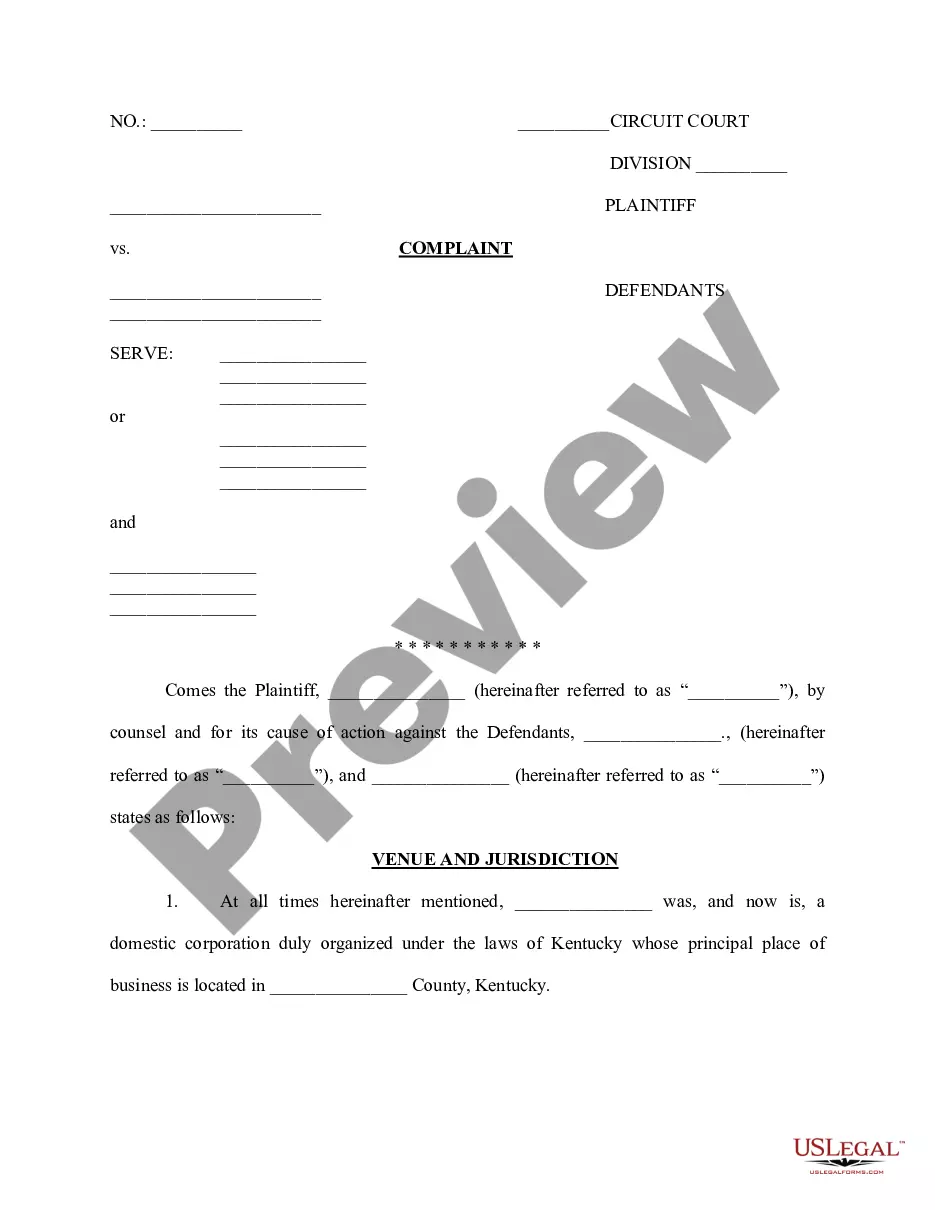

Free preview

How to fill out Florida Pagaré?

Regardless of social or occupational standing, completing legal forms has become an unfortunate requirement in the current professional landscape.

Frequently, it is nearly impossible for individuals lacking a legal background to create such documents from scratch, primarily due to the complex language and legal nuances involved.

This is where US Legal Forms steps in to assist.

Confirm that the template you select is tailored to your area, as laws vary between different states or regions.

Review the document and read a brief summary (if available) outlining the scenarios for which the document can be utilized.

- Our platform provides a vast collection of over 85,000 state-specific forms that cater to virtually any legal circumstance.

- US Legal Forms serves as a valuable resource for associates or legal advisors looking to economize time with our DIY forms.

- Whether you need the Palm Beach Florida Promissory Note or any other documentation applicable in your region, US Legal Forms has everything available.

- Here's how to swiftly obtain the Palm Beach Florida Promissory Note using our dependable platform.

- If you are already a member, simply Log In to access and download the necessary form.

- If you are new to our platform, make sure to adhere to these instructions before acquiring the Palm Beach Florida Promissory Note.