A Jacksonville Florida Durable Power of Attorney for Property, Finances, and Health Care refers to a legal document that grants an individual, known as the agent or attorney-in-fact, the authority to make decisions on behalf of another person, called the principal, when it comes to their property, finances, and healthcare matters. This comprehensive power of attorney is specifically designed to remain in effect even if the principal becomes incapacitated or unable to make decisions for themselves. The primary purpose of a durable power of attorney is to ensure that the principal's affairs are taken care of promptly and efficiently by a trusted individual in the event they are unable to do so themselves. This document is especially important in situations where the principal anticipates future incapacity due to old age, illness, injury, or any other circumstances. Regarding property and finances, the agent appointed by the principal through a durable power of attorney can handle various tasks, including managing bank accounts, paying bills, collecting debts, selling or managing real estate, making investment decisions, and conducting other financial transactions. This broad authority allows the agent to act in the principal's best interests and make informed decisions on their behalf. In terms of healthcare, the durable power of attorney grants the agent the authority to make medical decisions for the principal when they are unable to do so. This includes decisions regarding medical treatment, choice of healthcare providers, consenting to or refusing medical procedures, and making end-of-life decisions in accordance with the principal's predetermined wishes. In Jacksonville, Florida, there are not necessarily different types of durable power of attorney for property, finances, and health care. However, the principal can tailor the document according to their specific needs and preferences. They can include specific instructions, limitations, or conditions that the agent must follow when making decisions on their behalf. It is crucial to note that executing a durable power of attorney should be done with great care and consideration. It is recommended to consult with an attorney who specializes in estate planning or elder law to ensure that the document is legally valid, adheres to Florida state laws, and accurately reflects the principal's wishes. The agent chosen should be someone trustworthy and reliable, as they will be entrusted with significant decision-making authority over the principal's affairs and well-being.

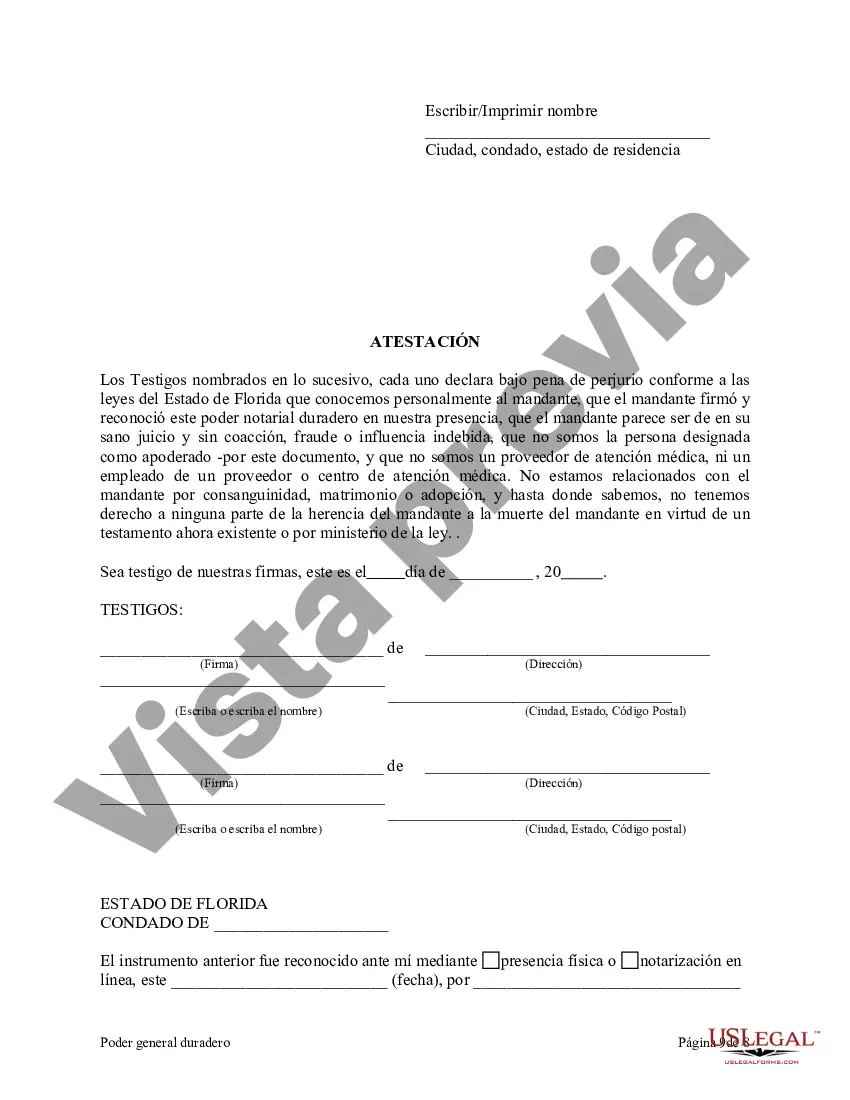

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Jacksonville Florida Poder notarial duradero para la propiedad, las finanzas y la atención médica - Florida Durable Power of Attorney for Property, Finances and Health Care

Description

How to fill out Jacksonville Florida Poder Notarial Duradero Para La Propiedad, Las Finanzas Y La Atención Médica?

Finding verified templates specific to your local laws can be challenging unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both individual and professional needs and any real-life situations. All the documents are properly categorized by area of usage and jurisdiction areas, so searching for the Jacksonville Florida Durable Power of Attorney for Property, Finances and Health Care gets as quick and easy as ABC.

For everyone already acquainted with our service and has used it before, getting the Jacksonville Florida Durable Power of Attorney for Property, Finances and Health Care takes just a few clicks. All you need to do is log in to your account, pick the document, and click Download to save it on your device. This process will take just a couple of additional actions to complete for new users.

Follow the guidelines below to get started with the most extensive online form catalogue:

- Look at the Preview mode and form description. Make certain you’ve selected the right one that meets your requirements and totally corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you find any inconsistency, use the Search tab above to obtain the right one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and select the subscription plan you prefer. You should sign up for an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the service.

- Download the Jacksonville Florida Durable Power of Attorney for Property, Finances and Health Care. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Take advantage of the US Legal Forms library to always have essential document templates for any needs just at your hand!