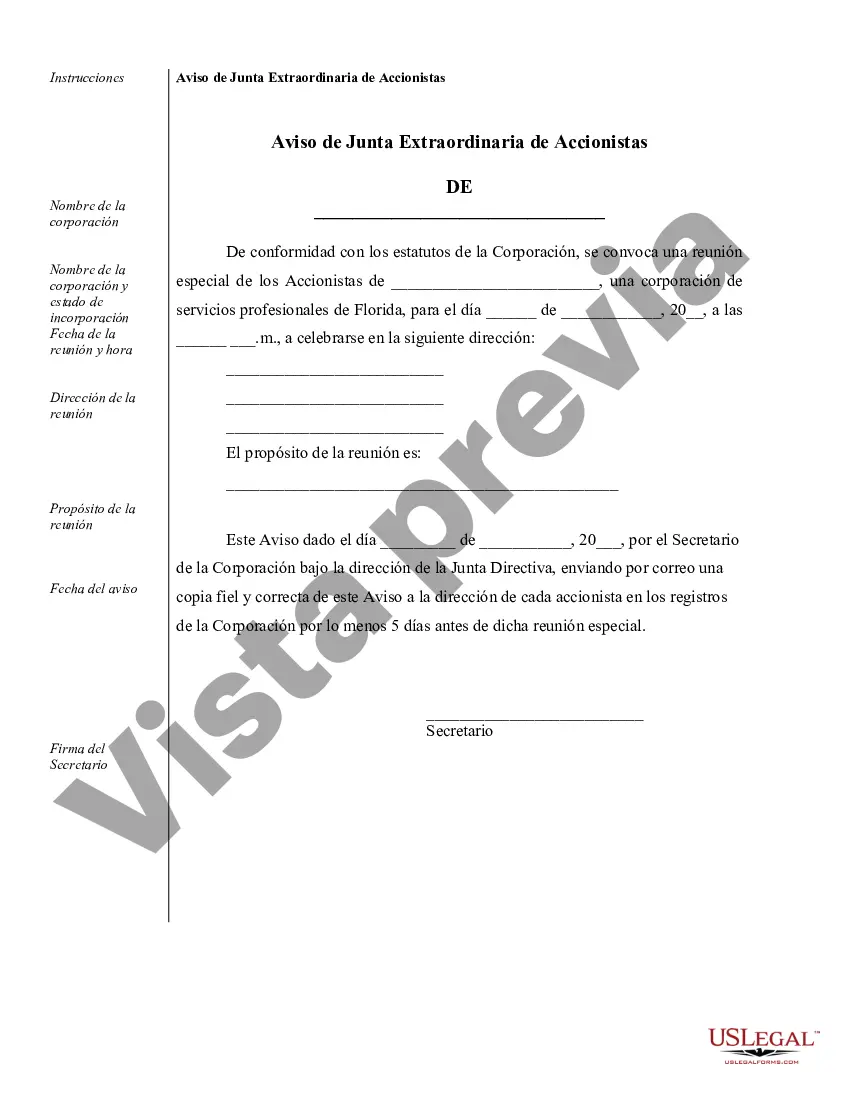

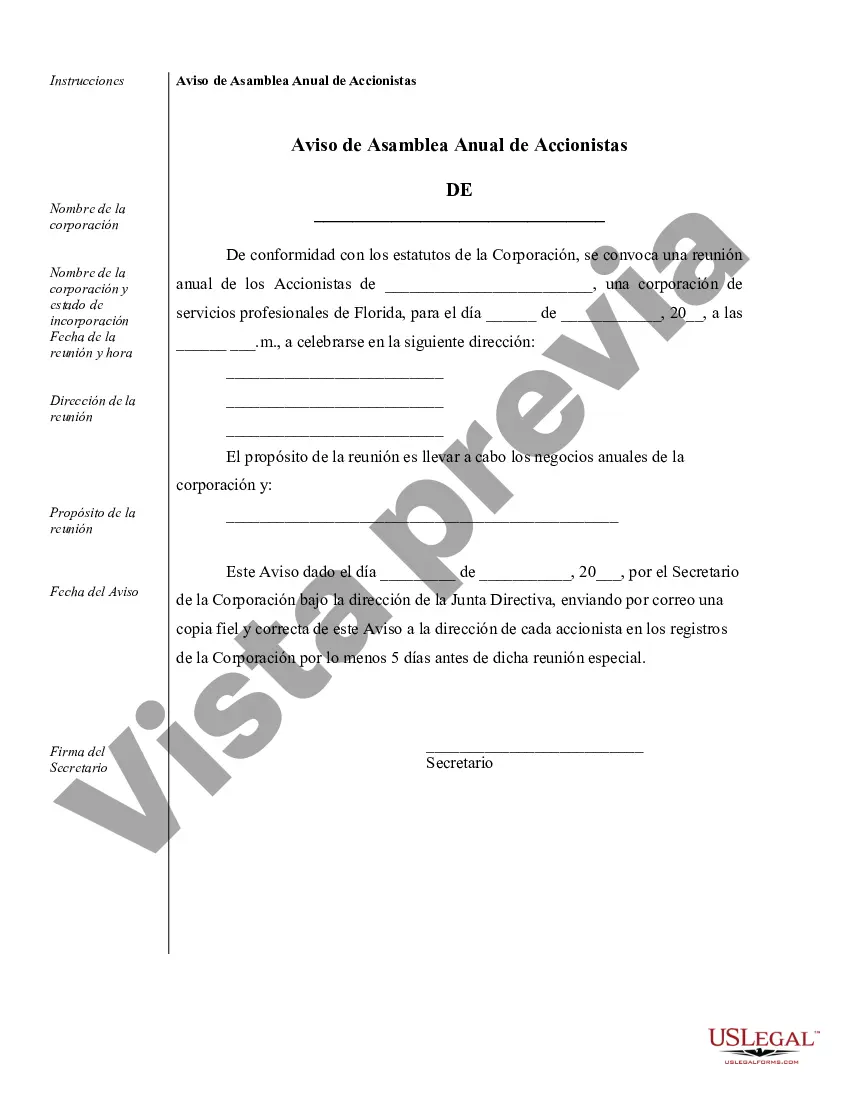

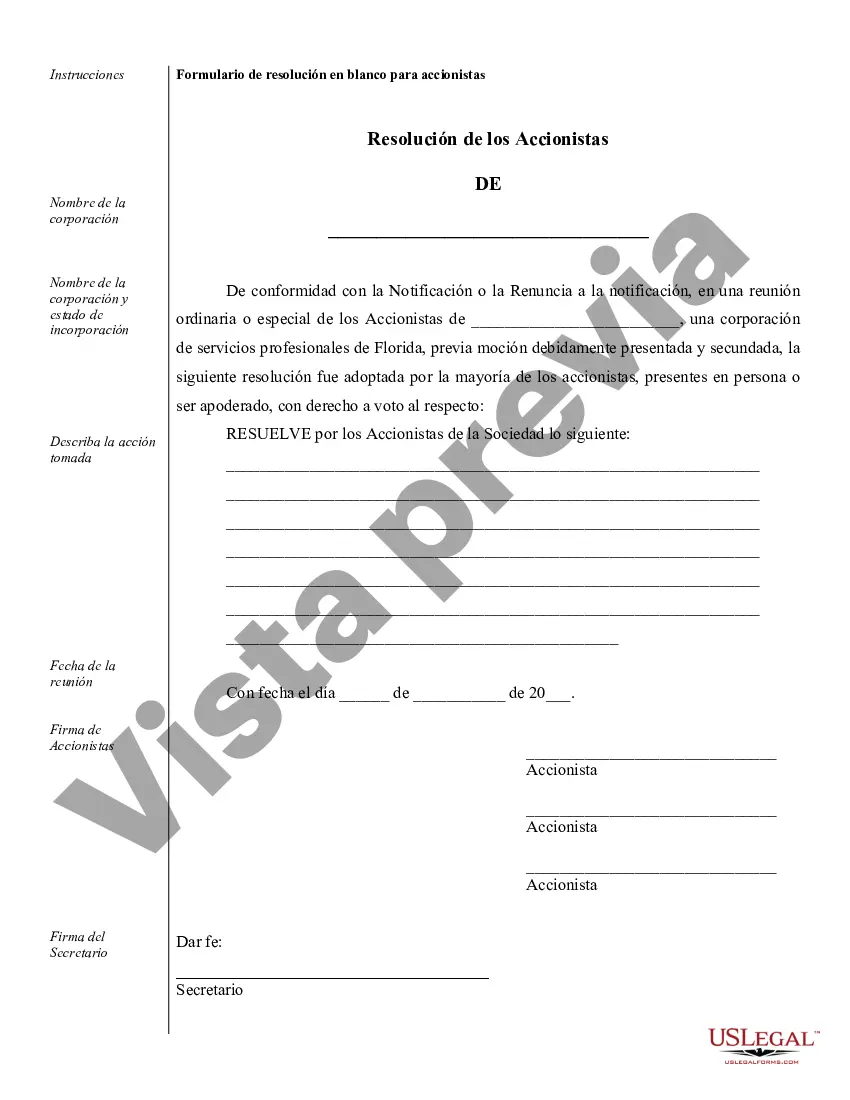

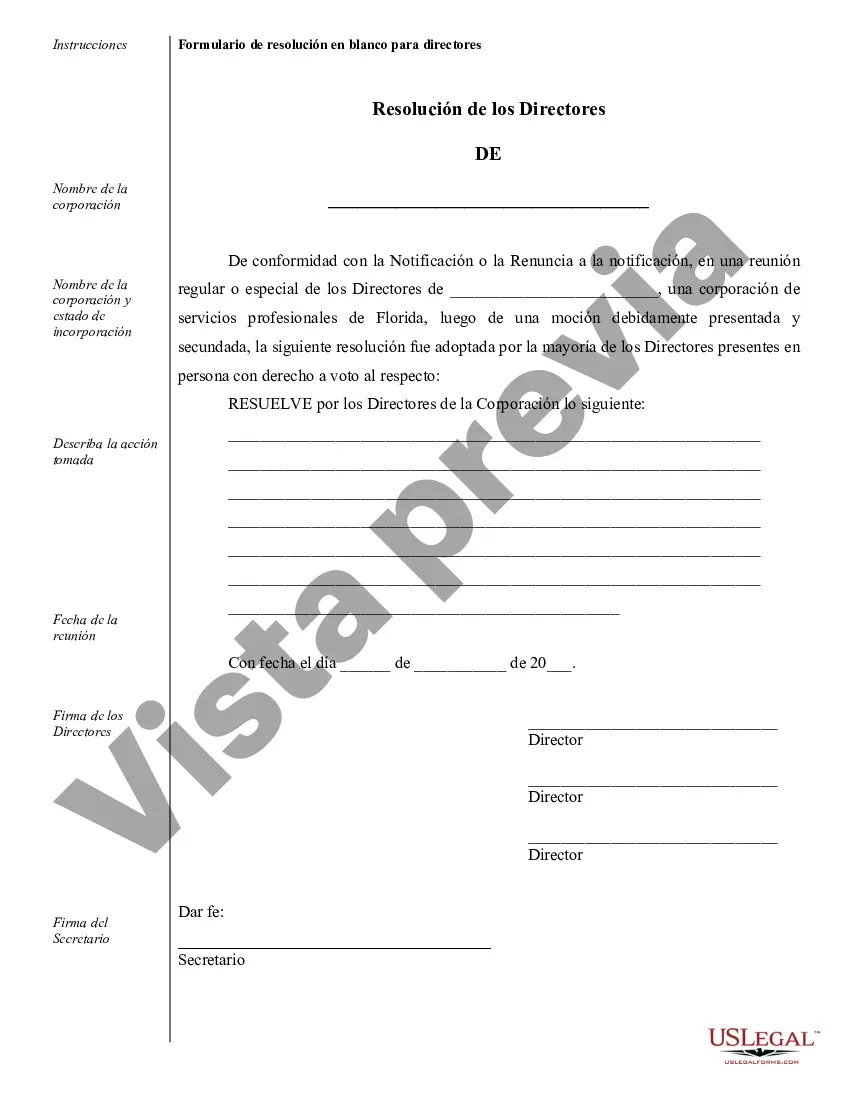

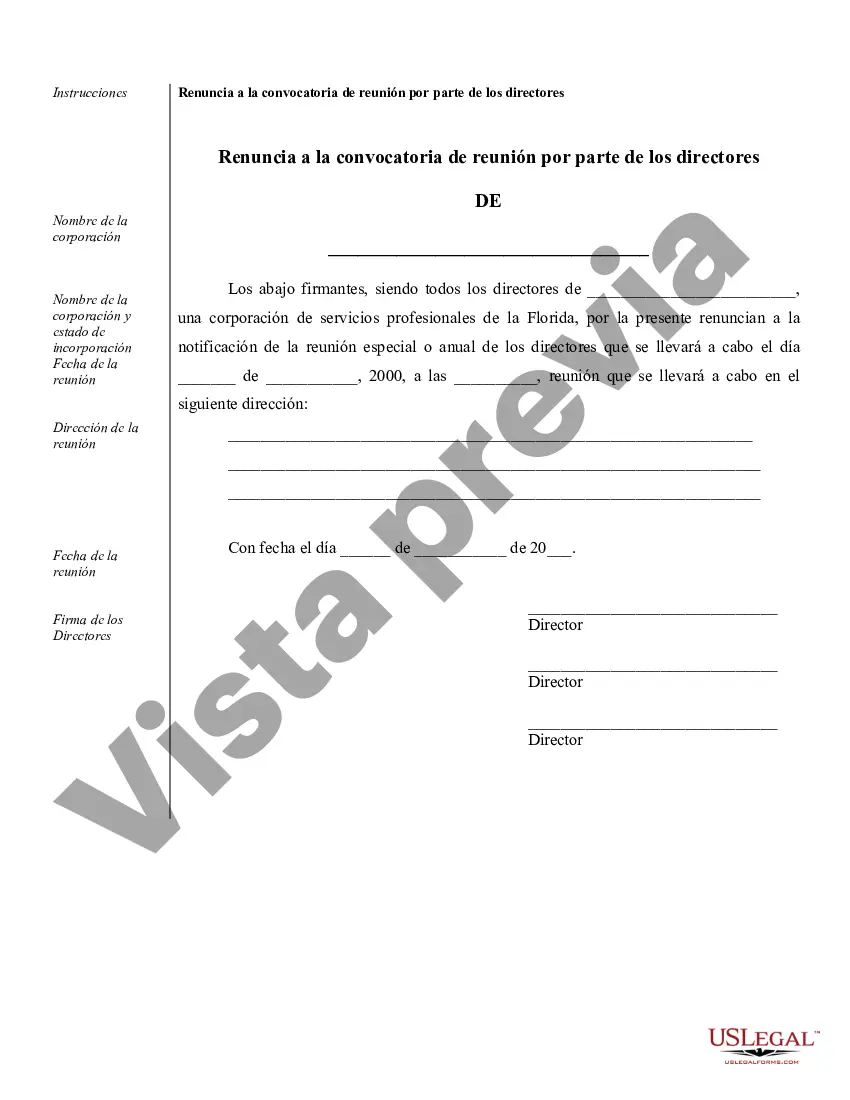

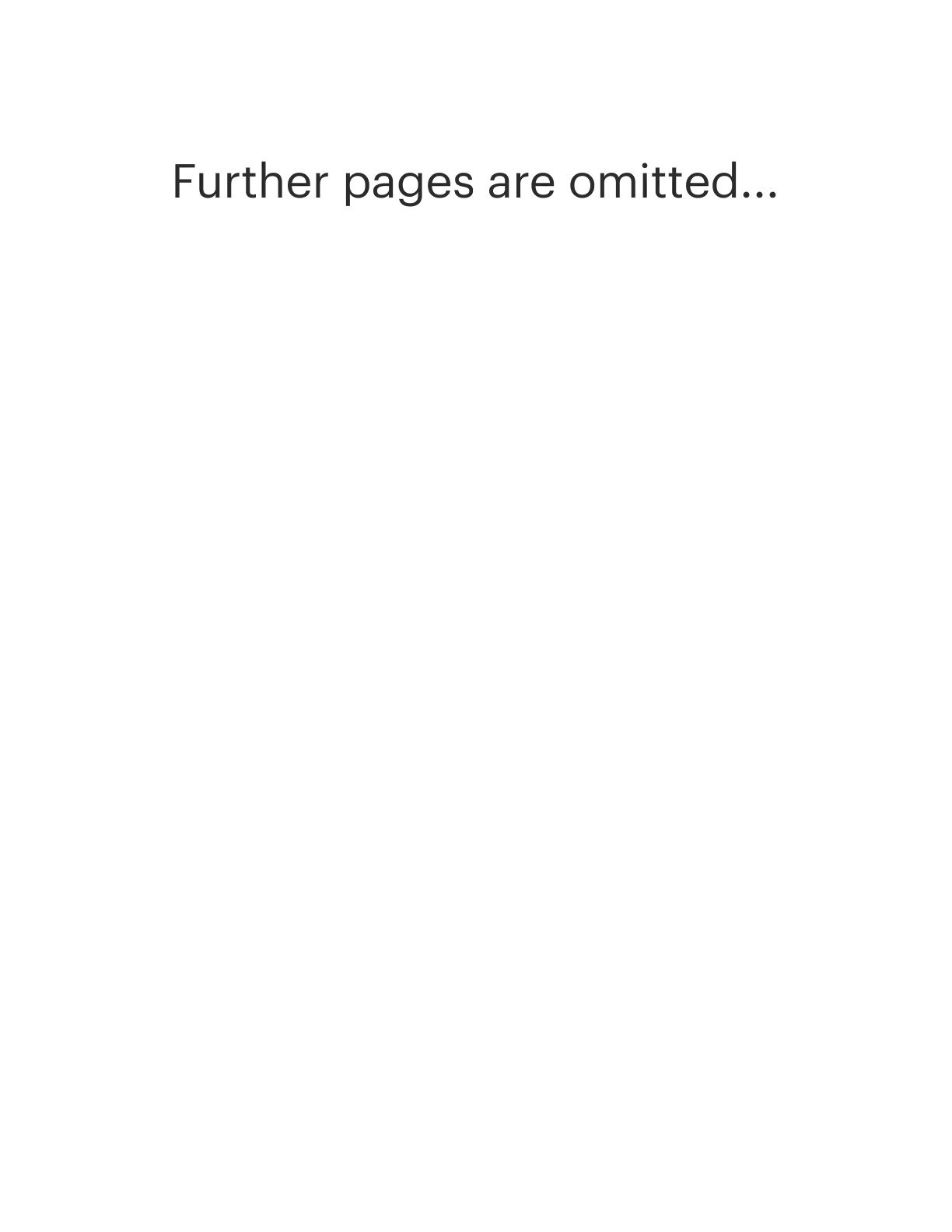

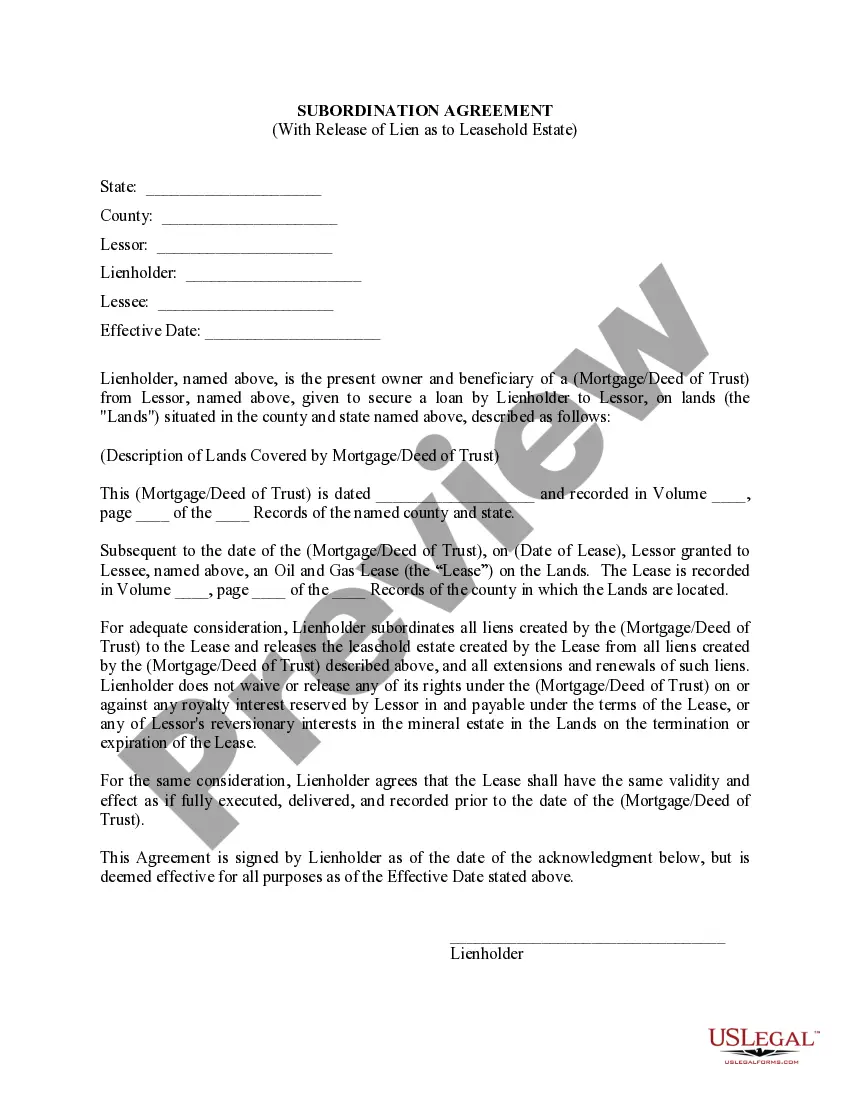

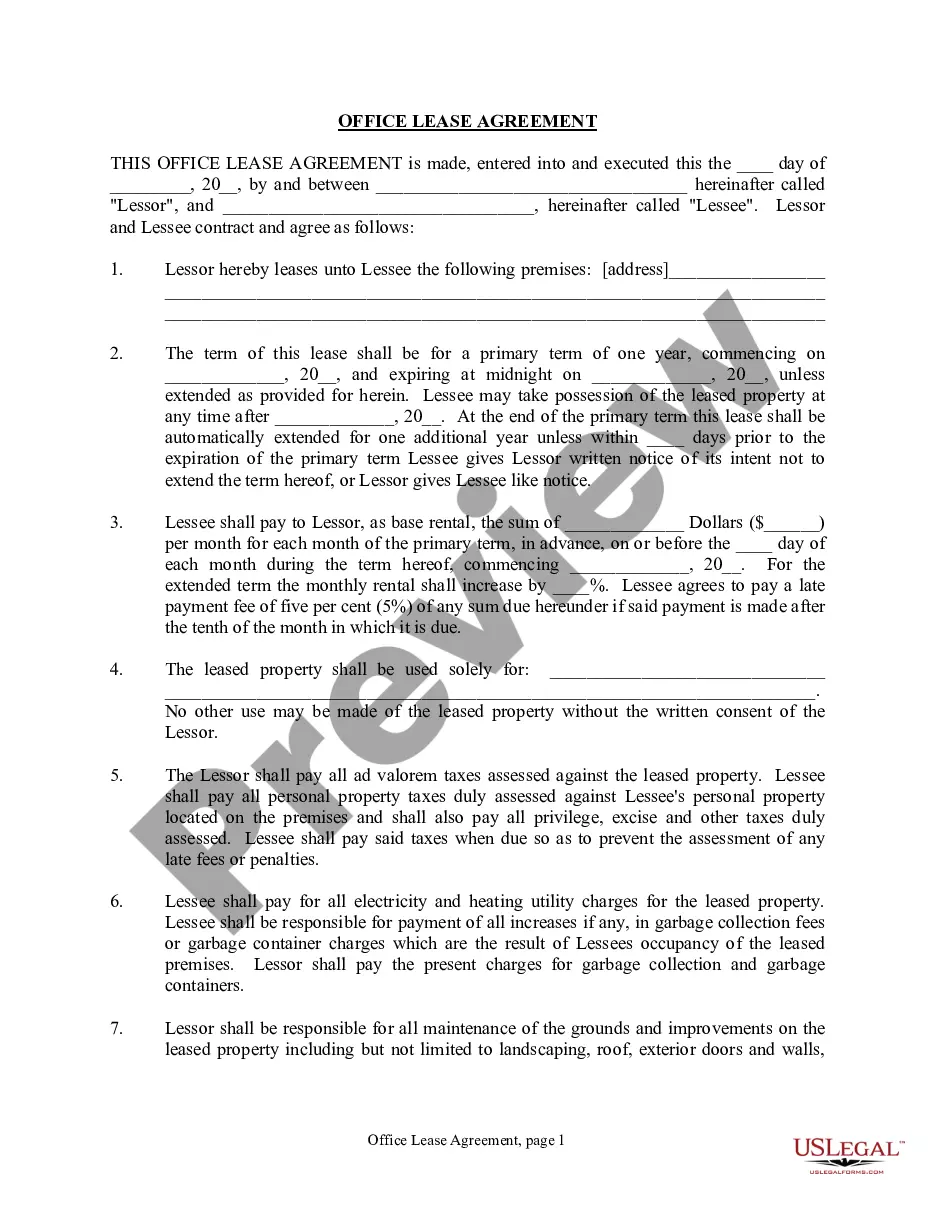

Tallahassee Sample Corporate Records for a Florida Professional Corporation play a crucial role in maintaining proper documentation and organizational structure for business entities operating in the state of Florida. These records are essential for demonstrating compliance with legal and regulatory obligations, and they provide a transparent view of a corporation's operations. Here are some key types of Tallahassee Sample Corporate Records for a Florida Professional Corporation: 1. Articles of Incorporation: This is a foundational document that establishes the corporation's existence and contains fundamental details such as the corporation's name, purpose, registered agent, and initial directors. 2. Bylaws: The bylaws define the internal rules and procedures for conducting business, including the roles and responsibilities of the corporation's officers, directors, and shareholders. They may cover issues such as meeting procedures, voting rights, and corporate governance. 3. Minutes of Meetings: These records document the proceedings of corporate meetings, including director and shareholder meetings. Minutes typically contain information regarding discussions, resolutions, voting outcomes, and any significant decisions made during the meeting. 4. Shareholder Agreements: If applicable, shareholders may enter into agreements that outline their rights, obligations, and restrictions regarding the corporation's shares, transfer of ownership, dividend distributions, and other matters affecting their interests. 5. Stock Certificates: If the corporation has issued stocks, stock certificates serve as legal evidence of ownership. These certificates provide details such as the shareholder's name, the number of shares held, and any specific restrictions or conditions associated with the shares. 6. Financial Statements: These records include key financial documents such as the corporation's balance sheet, income statement, and cash flow statement. They provide a snapshot of the corporation's financial health and performance over a specific period. 7. Annual Reports: Florida law requires corporations to file annual reports detailing essential information about the corporation, including its officers, directors, registered agent, and business address. These reports help maintain current and accurate records with the state. 8. Officer and Director Lists: These records maintain a comprehensive list of the corporation's officers and directors, including their names, positions, and contact information. This information is necessary for communication, legal compliance, and transparency. 9. Tax Records and Filings: Corporations must maintain records related to their tax obligations, including federal, state, and local tax filings, payroll records, and other relevant documents. These records are crucial for ensuring compliance with tax laws and regulations. 10. Shareholder Resolutions: Any important decisions made by the shareholders outside a formal meeting are documented in the form of shareholder resolutions. These records serve as evidence of the actions taken by the shareholders and may include changes to the corporation's bylaws, director appointments, or amendments to the Articles of Incorporation. It's essential for a Florida Professional Corporation to maintain accurate and up-to-date corporate records, as failure to do so can result in legal and financial consequences. By using Tallahassee Sample Corporate Records as a reference, corporations can ensure compliance with state laws while promoting transparency and sound corporate governance practices.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Tallahassee Ejemplos de registros corporativos para una corporación profesional de Florida - Sample Corporate Records for a Florida Professional Corporation

Description

How to fill out Tallahassee Ejemplos De Registros Corporativos Para Una Corporación Profesional De Florida?

No matter what social or professional status, completing legal forms is an unfortunate necessity in today’s professional environment. Too often, it’s almost impossible for someone without any legal background to draft this sort of paperwork cfrom the ground up, mostly due to the convoluted terminology and legal subtleties they involve. This is where US Legal Forms comes to the rescue. Our platform provides a huge catalog with over 85,000 ready-to-use state-specific forms that work for pretty much any legal situation. US Legal Forms also serves as an excellent resource for associates or legal counsels who want to to be more efficient time-wise using our DYI forms.

Whether you want the Tallahassee Sample Corporate Records for a Florida Professional Corporation or any other paperwork that will be valid in your state or area, with US Legal Forms, everything is on hand. Here’s how you can get the Tallahassee Sample Corporate Records for a Florida Professional Corporation quickly employing our trustworthy platform. In case you are presently a subscriber, you can go ahead and log in to your account to get the needed form.

Nevertheless, if you are new to our library, make sure to follow these steps before obtaining the Tallahassee Sample Corporate Records for a Florida Professional Corporation:

- Ensure the template you have found is good for your area since the rules of one state or area do not work for another state or area.

- Preview the form and go through a brief description (if available) of cases the document can be used for.

- If the form you chosen doesn’t meet your needs, you can start over and search for the needed document.

- Click Buy now and choose the subscription option that suits you the best.

- with your credentials or create one from scratch.

- Choose the payment gateway and proceed to download the Tallahassee Sample Corporate Records for a Florida Professional Corporation once the payment is through.

You’re good to go! Now you can go ahead and print the form or complete it online. In case you have any issues getting your purchased forms, you can quickly find them in the My Forms tab.

Regardless of what case you’re trying to solve, US Legal Forms has got you covered. Try it out today and see for yourself.