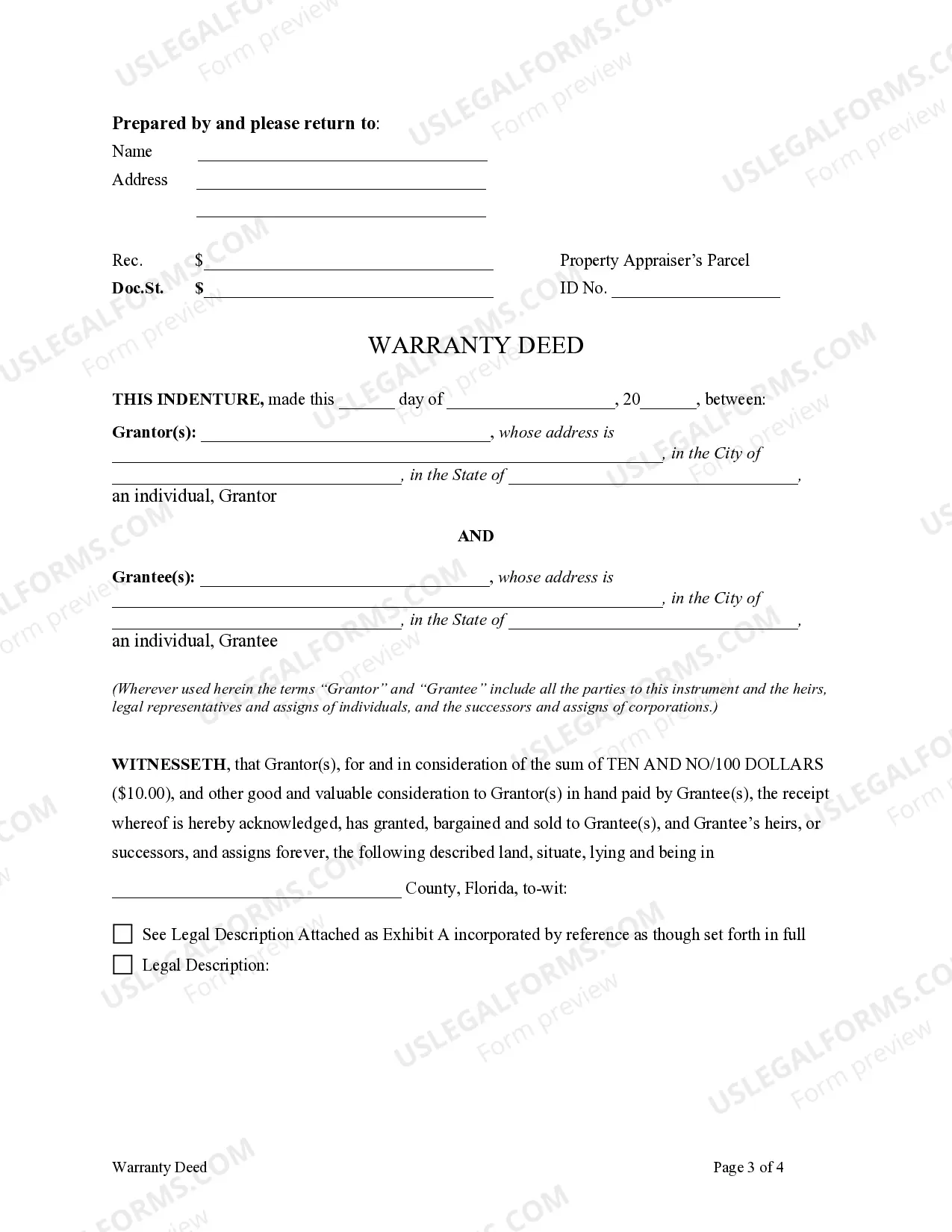

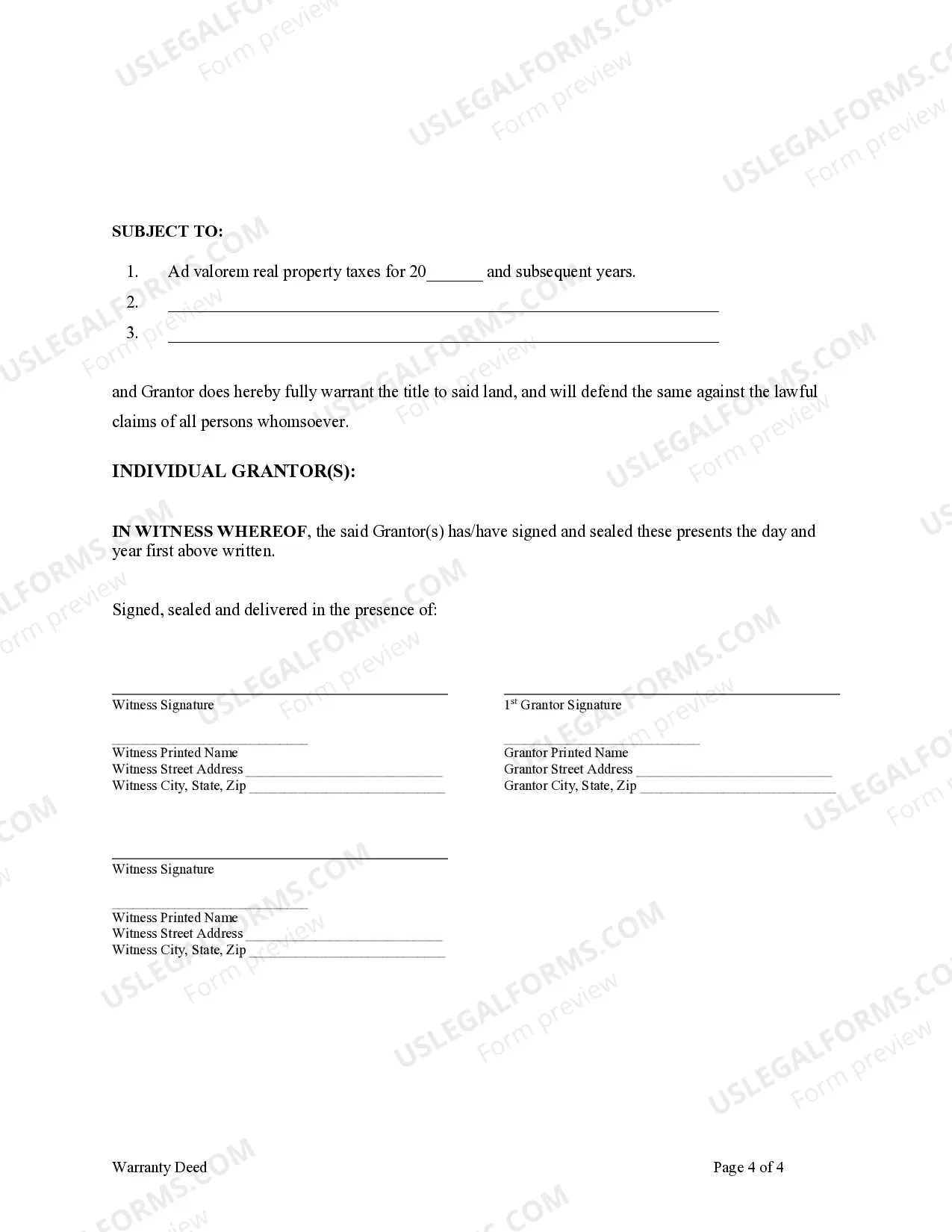

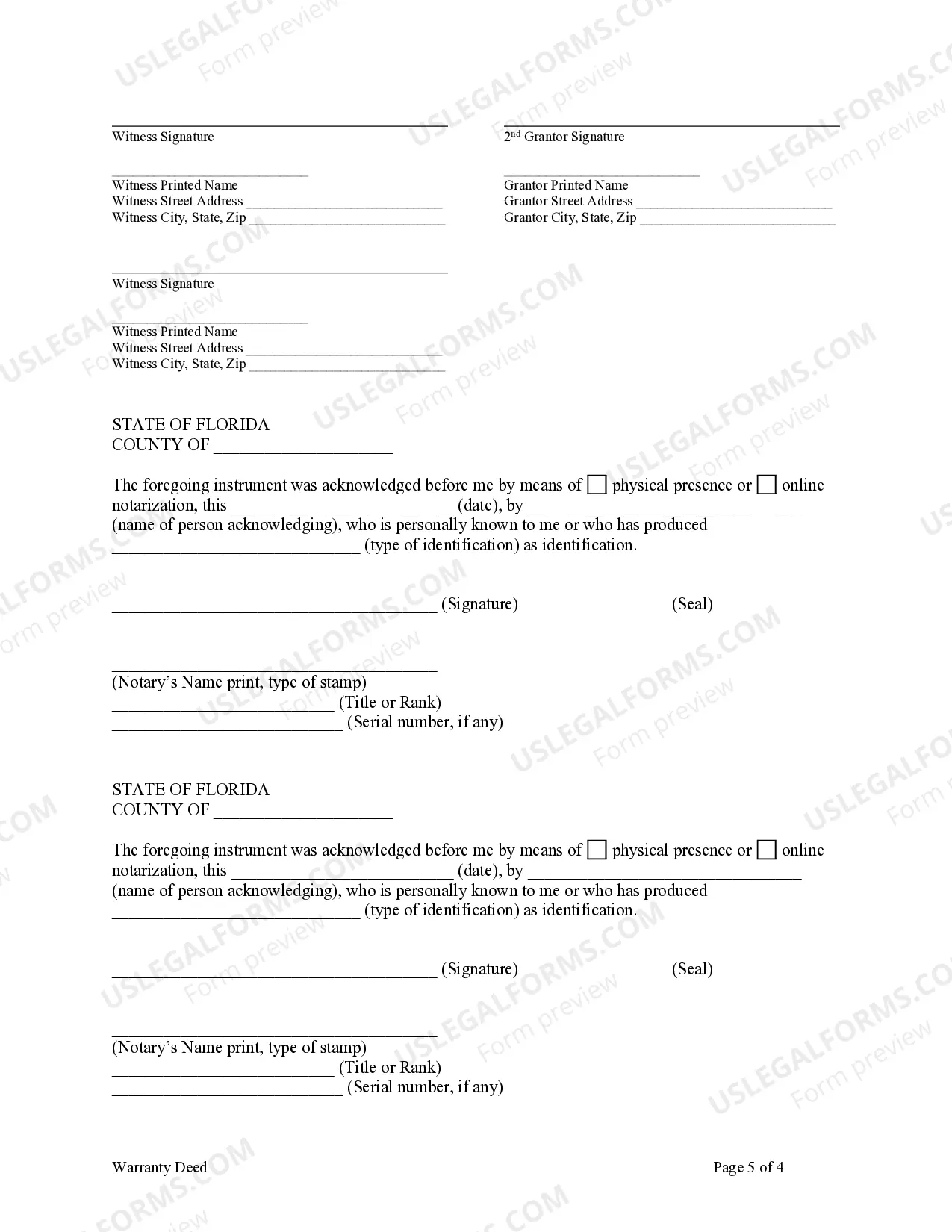

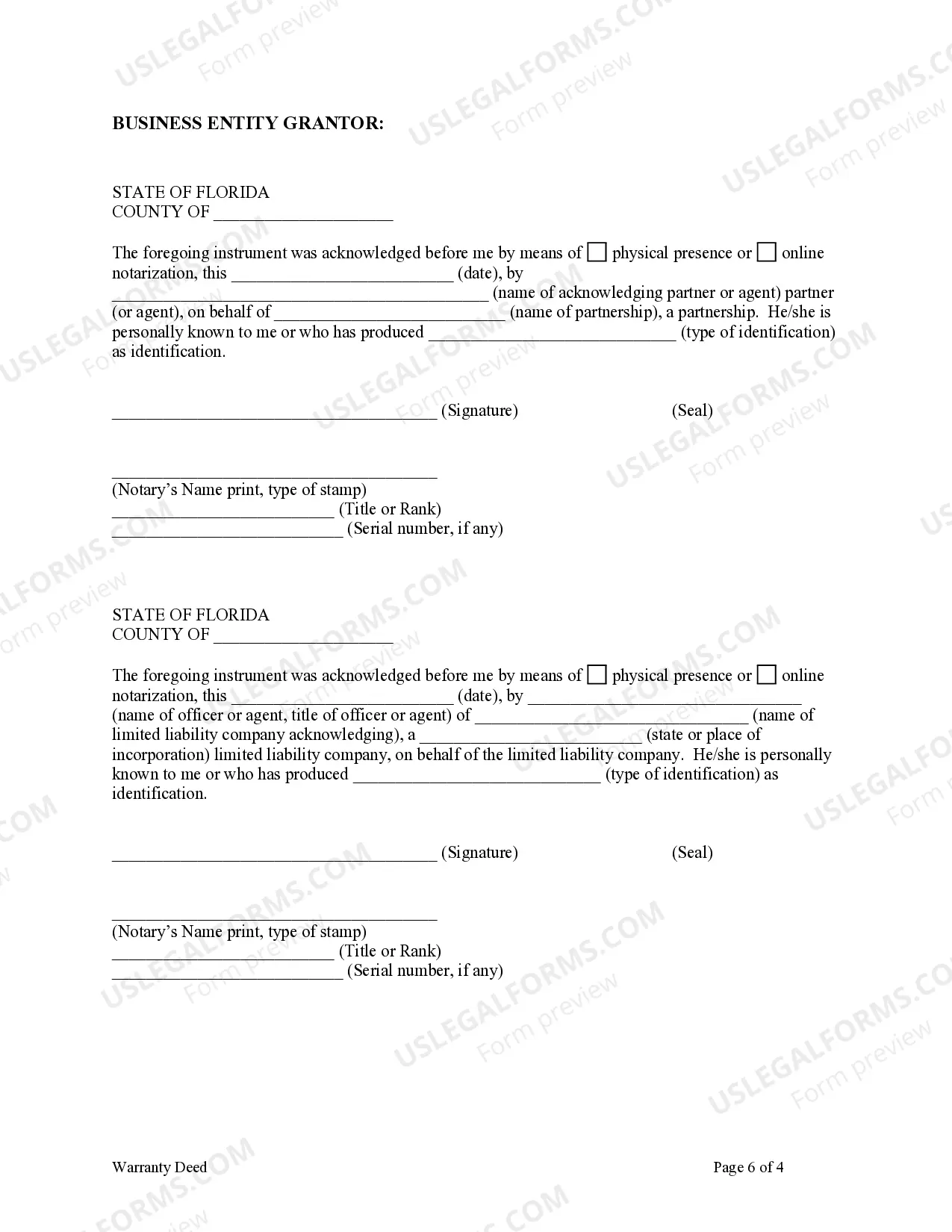

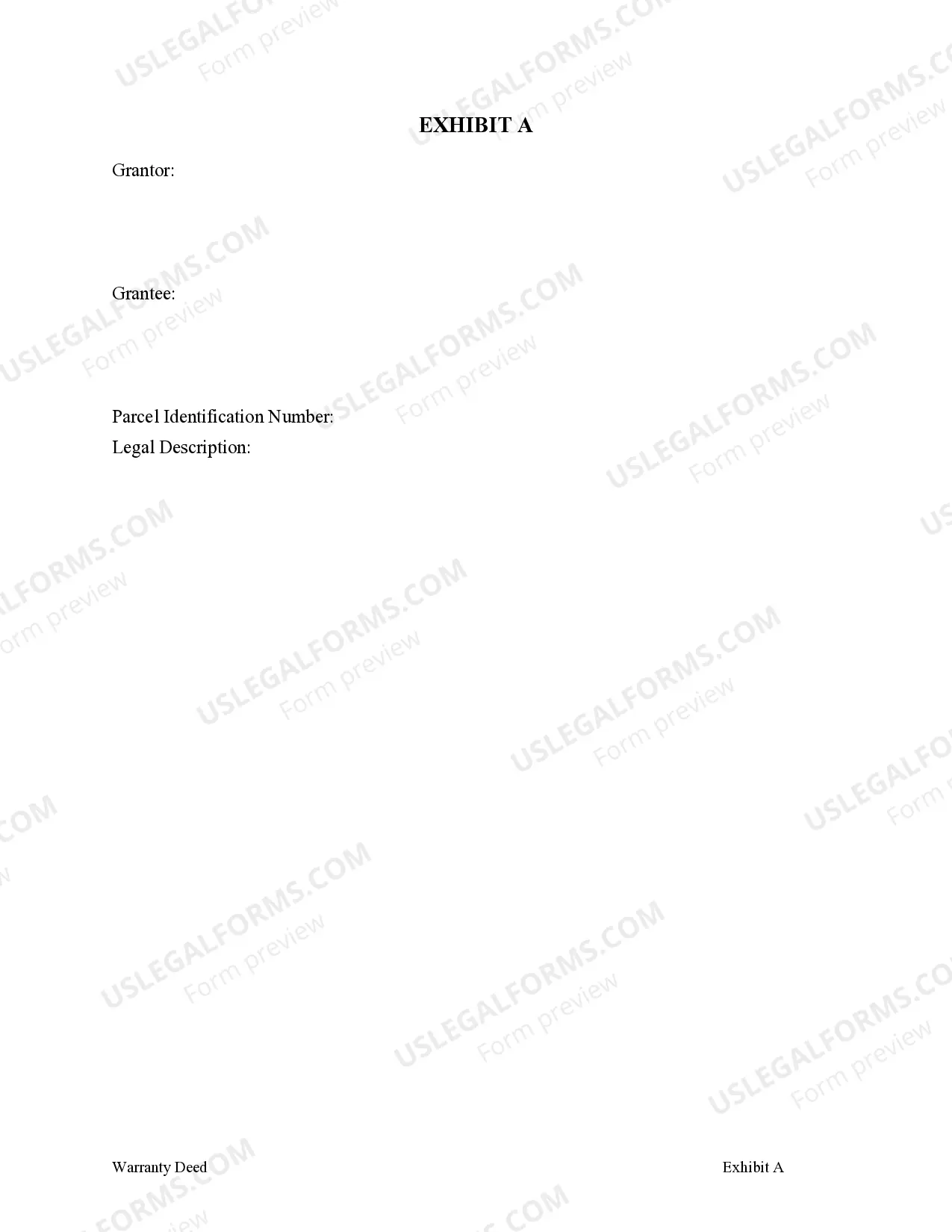

A Fort Lauderdale Florida Warranty Deed from Limited Partnership or LLC serves as a legal document that transfers property ownership rights between a limited partnership or limited liability company (LLC) as the Granter or Grantee. This type of deed ensures that the Granter has the legal authority to transfer the property and guarantees that there are no outstanding claims or encumbrances on the property title. The Fort Lauderdale Florida Warranty Deed from Limited Partnership and LLC comes in various forms, depending on the specific circumstances of the transaction. Different types of deeds include: 1. General Warranty Deed: This type of Warranty Deed guarantees the Granter's full legal ownership of the property and provides the most extensive protection to the Grantee. It ensures that the Granter will defend the title against any future claims or legal issues that might arise. 2. Special Warranty Deed: A Special Warranty Deed, also known as a Limited Warranty Deed, guarantees that the Granter has not caused any encumbrances on the property title during their ownership. It offers less protection to the Grantee compared to a General Warranty Deed, as it only covers issues that occurred during the Granter's ownership. 3. Quitclaim Deed: Although not a Warranty Deed, a Quitclaim Deed is commonly used in Fort Lauderdale Florida for transfers between limited partnerships or LCS. In this type of deed, the Granter transfers their ownership interest in the property without providing any warranties or guarantees regarding the property's title. When drafting a Fort Lauderdale Florida Warranty Deed from Limited Partnership or LLC, certain essential elements should be included: 1. Clear Identification: The deed must accurately identify the Granter(s) and Grantee(s). This includes the legal names and addresses of the limited partnership or LLC, as well as the individuals signing on behalf of the companies. 2. Property Description: A detailed description of the property being transferred is crucial, including the legal description, address, and any other relevant identifying information. 3. Consideration: The deed should state the value or consideration provided in exchange for the property transfer. This can be monetary or non-monetary, such as the assumption of a debt or other liabilities. 4. Statement of Conveyance: The deed must clearly state the Granter's intention to convey the property to the Grantee. 5. Granting Clause: The deed must contain a granting clause that expresses the Granter's intent to transfer the property rights, typically using language such as "convey" or "grant." 6. Legal Acknowledgment: The deed must be signed by all parties involved and notarized, certifying the authenticity of the signatures. It is crucial to consult with a qualified real estate attorney or experienced professional to ensure compliance with all legal requirements when executing a Fort Lauderdale Florida Warranty Deed from Limited Partnership or LLC. This will provide confidence in the validity and enforceability of the deed for both the Granter and the Grantee in Fort Lauderdale, Florida.

Fort Lauderdale Florida Warranty Deed from Limited Partnership or LLC is the Grantor, or Grantee

Description

How to fill out Fort Lauderdale Florida Warranty Deed From Limited Partnership Or LLC Is The Grantor, Or Grantee?

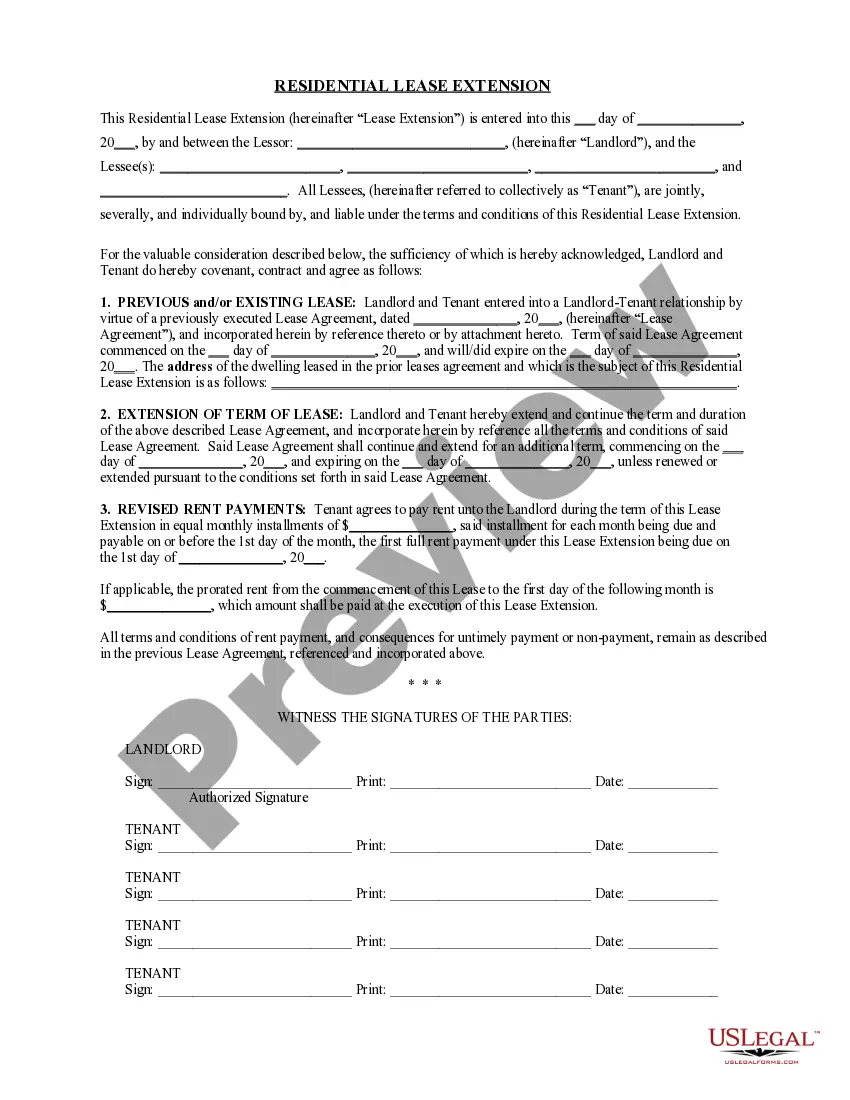

Regardless of social or professional status, filling out legal forms is an unfortunate necessity in today’s world. Too often, it’s virtually impossible for someone without any law education to create such papers from scratch, mostly because of the convoluted terminology and legal subtleties they involve. This is where US Legal Forms comes to the rescue. Our service offers a massive collection with more than 85,000 ready-to-use state-specific forms that work for pretty much any legal situation. US Legal Forms also is an excellent asset for associates or legal counsels who want to save time using our DYI forms.

Whether you need the Fort Lauderdale Florida Warranty Deed from Limited Partnership or LLC is the Grantor, or Grantee or any other document that will be valid in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Fort Lauderdale Florida Warranty Deed from Limited Partnership or LLC is the Grantor, or Grantee quickly using our trusted service. In case you are presently an existing customer, you can go ahead and log in to your account to download the needed form.

Nevertheless, in case you are a novice to our platform, make sure to follow these steps before obtaining the Fort Lauderdale Florida Warranty Deed from Limited Partnership or LLC is the Grantor, or Grantee:

- Be sure the form you have chosen is good for your area since the rules of one state or area do not work for another state or area.

- Review the document and go through a short description (if available) of scenarios the document can be used for.

- If the one you selected doesn’t meet your requirements, you can start over and look for the suitable form.

- Click Buy now and pick the subscription plan that suits you the best.

- utilizing your credentials or create one from scratch.

- Pick the payment method and proceed to download the Fort Lauderdale Florida Warranty Deed from Limited Partnership or LLC is the Grantor, or Grantee as soon as the payment is through.

You’re good to go! Now you can go ahead and print the document or complete it online. Should you have any problems getting your purchased forms, you can quickly access them in the My Forms tab.

Regardless of what situation you’re trying to solve, US Legal Forms has got you covered. Try it out today and see for yourself.