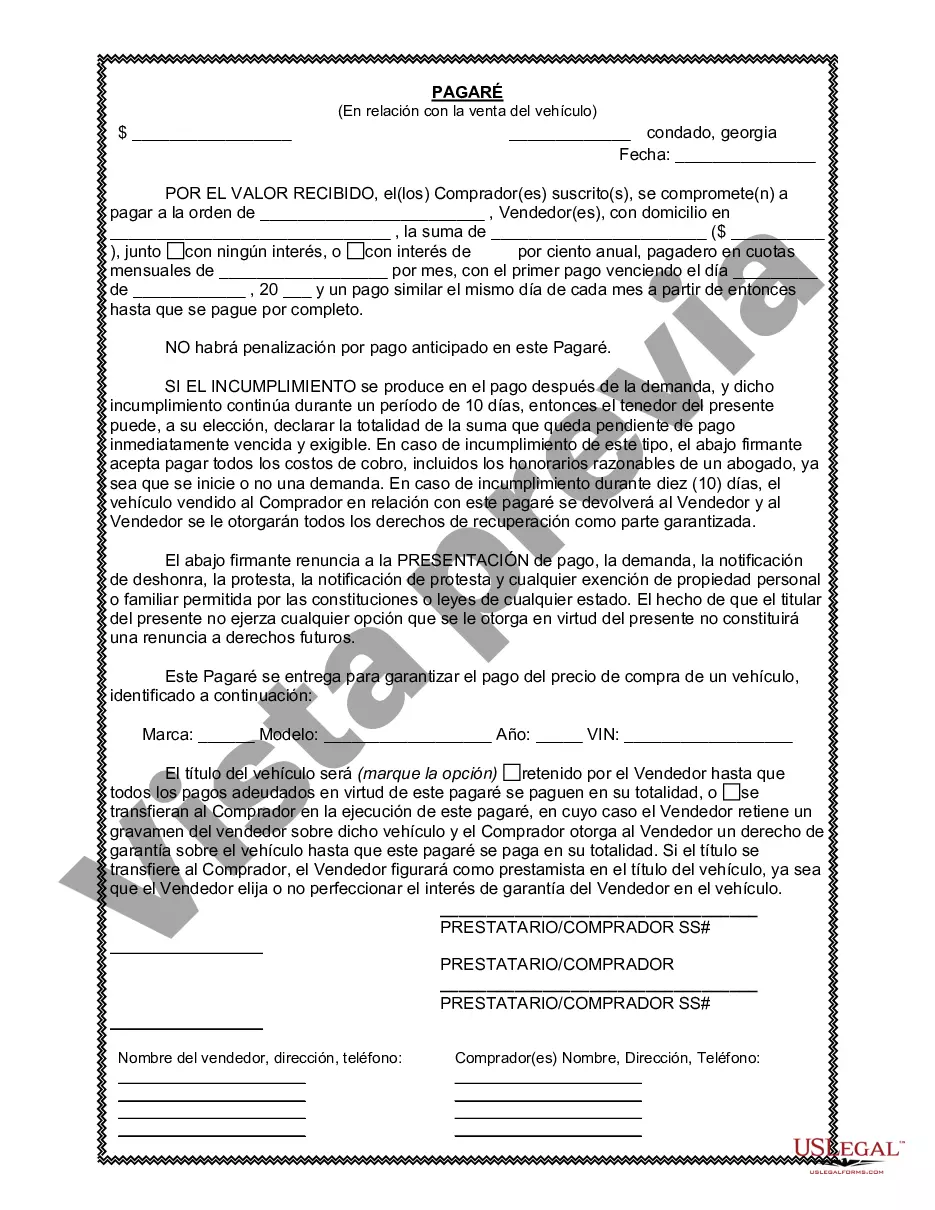

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

A South Fulton Georgia Promissory Note in Connection with Sale of Vehicle or Automobile is a legally binding contract that outlines the terms and conditions of a loan agreement between a vehicle seller and buyer. This document is used when the buyer wishes to purchase a vehicle but does not have the full amount of the purchase price upfront. Instead, the buyer agrees to make regular payments over a specified period, usually including interest, until the full amount is paid off. Keywords: South Fulton Georgia, Promissory Note, Sale of Vehicle, Automobile, loan agreement, purchase price, buyer, seller, payments, interest, specified period. There are different types of South Fulton Georgia Promissory Notes in Connection with Sale of Vehicle or Automobile, which include: 1. Installment Promissory Note: This type of promissory note states specific details about the installment plan for the payment of the vehicle. It outlines the amount of each payment, dates of payment, and any penalties or late fees in case of default. 2. Balloon Promissory Note: This note allows the buyer to make smaller monthly payments over a specified period, with a large "balloon payment" due at the end. The balloon payment typically encompasses the remaining balance of the loan. 3. Secured Promissory Note: In this type of note, the buyer must provide collateral, such as the purchased vehicle, to secure the loan. If the buyer defaults on payments, the seller has the right to repossess the vehicle. 4. Unsecured Promissory Note: This note does not require any collateral. It relies solely on the buyer's creditworthiness and trustworthiness to repay the loan. In case of default, the seller may have to pursue legal action to recover the outstanding amount. 5. Simple Interest Promissory Note: This note includes an interest rate charged on the loan amount. The interest accrues based on the remaining balance, and the buyer pays the interest along with the principal amount each month. 6. Personal Promissory Note: This type of note is between individuals and does not involve any financial institution or dealership. Both the buyer and seller must agree on the terms, including interest rate and payment schedule. It is important to consult a legal professional to ensure that the South Fulton Georgia Promissory Note adheres to local laws and regulations governing vehicle sales and financing.A South Fulton Georgia Promissory Note in Connection with Sale of Vehicle or Automobile is a legally binding contract that outlines the terms and conditions of a loan agreement between a vehicle seller and buyer. This document is used when the buyer wishes to purchase a vehicle but does not have the full amount of the purchase price upfront. Instead, the buyer agrees to make regular payments over a specified period, usually including interest, until the full amount is paid off. Keywords: South Fulton Georgia, Promissory Note, Sale of Vehicle, Automobile, loan agreement, purchase price, buyer, seller, payments, interest, specified period. There are different types of South Fulton Georgia Promissory Notes in Connection with Sale of Vehicle or Automobile, which include: 1. Installment Promissory Note: This type of promissory note states specific details about the installment plan for the payment of the vehicle. It outlines the amount of each payment, dates of payment, and any penalties or late fees in case of default. 2. Balloon Promissory Note: This note allows the buyer to make smaller monthly payments over a specified period, with a large "balloon payment" due at the end. The balloon payment typically encompasses the remaining balance of the loan. 3. Secured Promissory Note: In this type of note, the buyer must provide collateral, such as the purchased vehicle, to secure the loan. If the buyer defaults on payments, the seller has the right to repossess the vehicle. 4. Unsecured Promissory Note: This note does not require any collateral. It relies solely on the buyer's creditworthiness and trustworthiness to repay the loan. In case of default, the seller may have to pursue legal action to recover the outstanding amount. 5. Simple Interest Promissory Note: This note includes an interest rate charged on the loan amount. The interest accrues based on the remaining balance, and the buyer pays the interest along with the principal amount each month. 6. Personal Promissory Note: This type of note is between individuals and does not involve any financial institution or dealership. Both the buyer and seller must agree on the terms, including interest rate and payment schedule. It is important to consult a legal professional to ensure that the South Fulton Georgia Promissory Note adheres to local laws and regulations governing vehicle sales and financing.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.