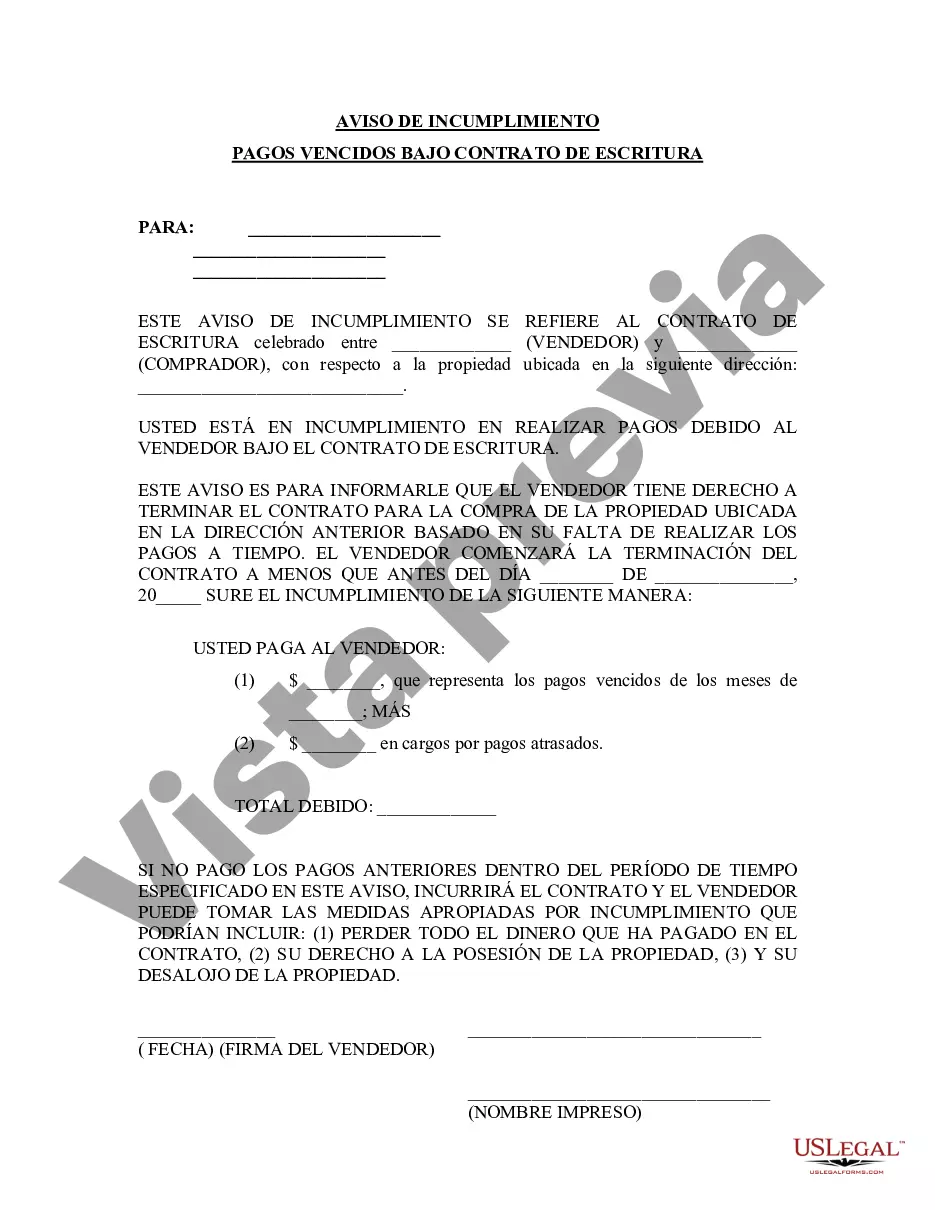

A Sandy Springs Georgia Notice of Default for Past Due Payments in connection with a Contract for Deed is a legal document served to the buyer or lessee of a property when they have failed to make the agreed-upon payments as outlined in the contract. This notice serves as a formal warning that the buyer is in default and must take immediate action to rectify the situation. The Notice of Default for Past Due Payments is an essential step in the foreclosure process for properties obtained through a Contract for Deed. It is important to understand the terms and conditions specified in the Contract for Deed, as they vary depending on the agreement between the buyer and the seller. Failure to comply with the contractual obligations may result in the initiation of foreclosure proceedings. There are different types of Sandy Springs Georgia Notices of Default for Past Due Payments that can be issued depending on the severity of the default: 1. Initial Notice of Default: This is the first notice sent to the buyer/lessee when they have missed one or more payments. The notice informs the buyer about the unpaid amounts and provides a grace period to catch up on payments. 2. Intent to Accelerate Notice: If the buyer fails to bring the payments up to date within the grace period mentioned in the initial notice, an Intent to Accelerate Notice is issued. This notice informs the buyer that all remaining payments, including the principal amount, interest, and any penalties, will become immediately due if they do not cure the default within a specified timeframe. 3. Demand Letter: If the buyer fails to cure the default within the timeframe provided in the Intent to Accelerate Notice, a Demand Letter is sent. This letter demands full payment of the outstanding amounts and provides a final opportunity for the buyer to rectify the default before foreclosure proceedings are initiated. It is crucial for buyers to take the Sandy Springs Georgia Notice of Default for Past Due Payments seriously and act promptly to address the outstanding amounts. Failure to do so may result in the loss of the property through foreclosure. Seeking legal advice and exploring potential options, such as negotiating new payment terms or seeking refinancing, can help buyers avoid foreclosure and protect their rights as outlined in their Contract for Deed.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Sandy Springs Georgia Notificación de Incumplimiento de Pagos Atrasados en relación con el Contrato de Escritura - Georgia Notice of Default for Past Due Payments in connection with Contract for Deed

Description

How to fill out Sandy Springs Georgia Notificación De Incumplimiento De Pagos Atrasados En Relación Con El Contrato De Escritura?

Make use of the US Legal Forms and have immediate access to any form sample you require. Our useful platform with a large number of document templates makes it easy to find and obtain virtually any document sample you want. It is possible to download, fill, and sign the Sandy Springs Georgia Notice of Default for Past Due Payments in connection with Contract for Deed in just a few minutes instead of surfing the Net for many hours attempting to find an appropriate template.

Utilizing our collection is a great strategy to raise the safety of your document submissions. Our experienced legal professionals regularly check all the records to ensure that the forms are appropriate for a particular region and compliant with new laws and regulations.

How do you get the Sandy Springs Georgia Notice of Default for Past Due Payments in connection with Contract for Deed? If you have a subscription, just log in to the account. The Download option will appear on all the documents you look at. In addition, you can find all the earlier saved files in the My Forms menu.

If you don’t have a profile yet, stick to the instruction below:

- Find the template you need. Make sure that it is the form you were hoping to find: verify its title and description, and use the Preview option if it is available. Otherwise, use the Search field to find the appropriate one.

- Launch the downloading procedure. Click Buy Now and select the pricing plan that suits you best. Then, sign up for an account and pay for your order with a credit card or PayPal.

- Save the file. Choose the format to obtain the Sandy Springs Georgia Notice of Default for Past Due Payments in connection with Contract for Deed and revise and fill, or sign it for your needs.

US Legal Forms is probably the most extensive and reliable document libraries on the internet. We are always happy to assist you in any legal case, even if it is just downloading the Sandy Springs Georgia Notice of Default for Past Due Payments in connection with Contract for Deed.

Feel free to benefit from our service and make your document experience as efficient as possible!