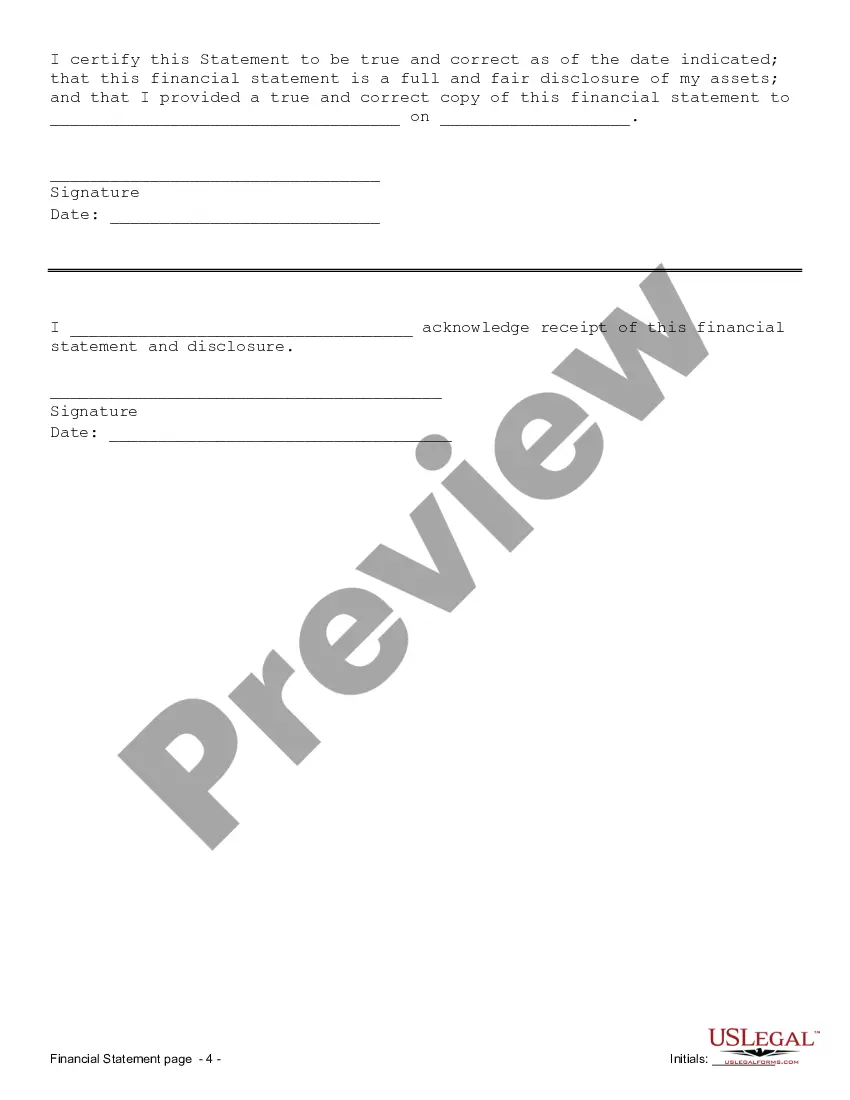

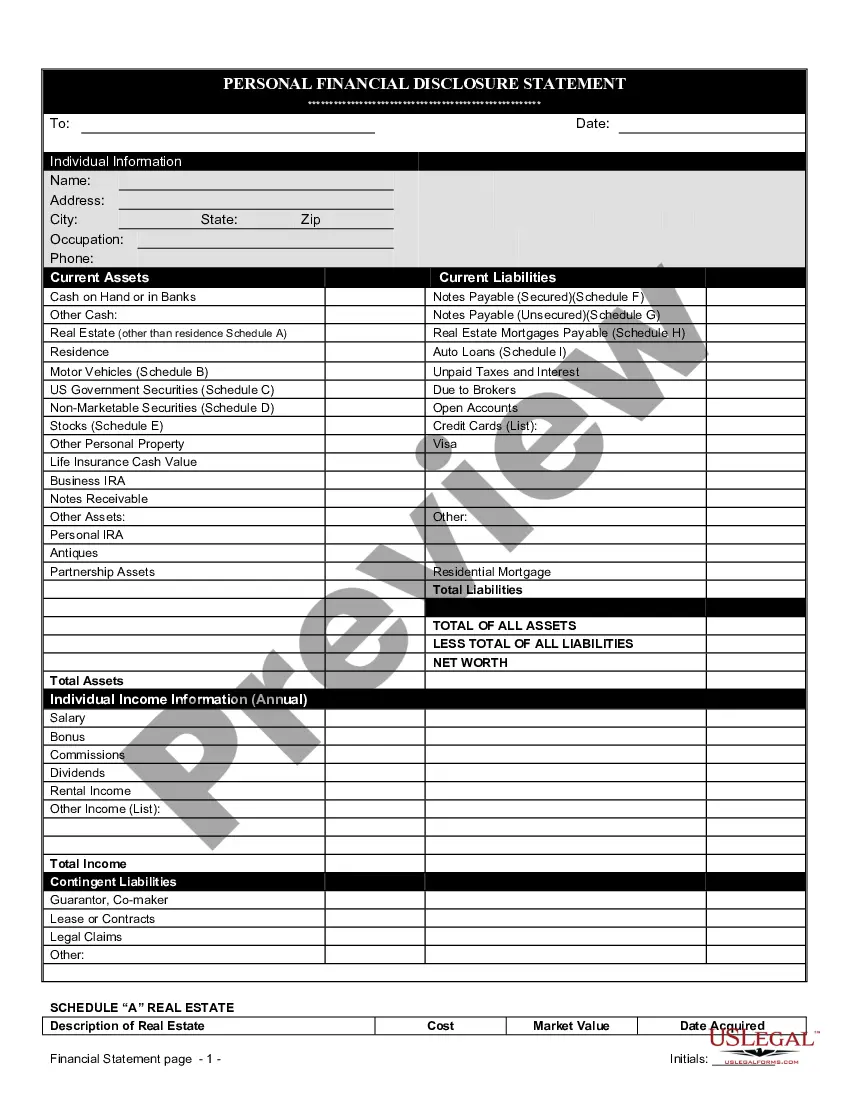

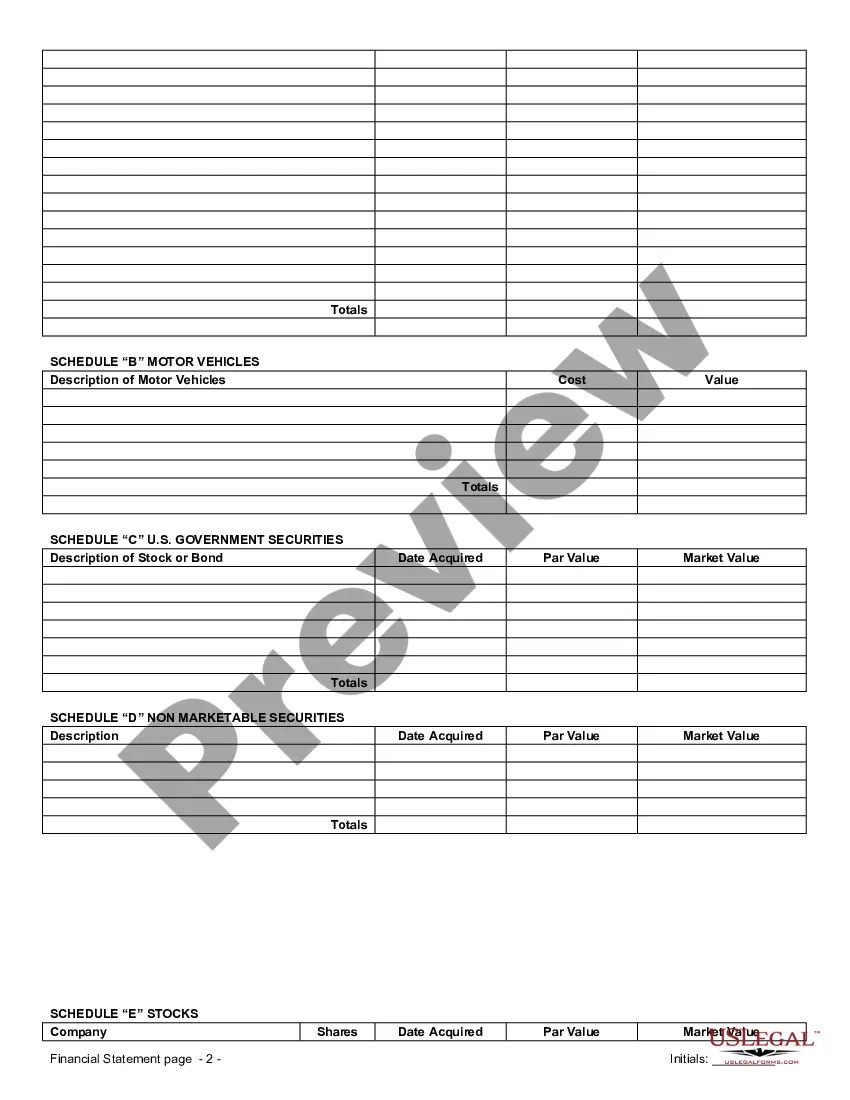

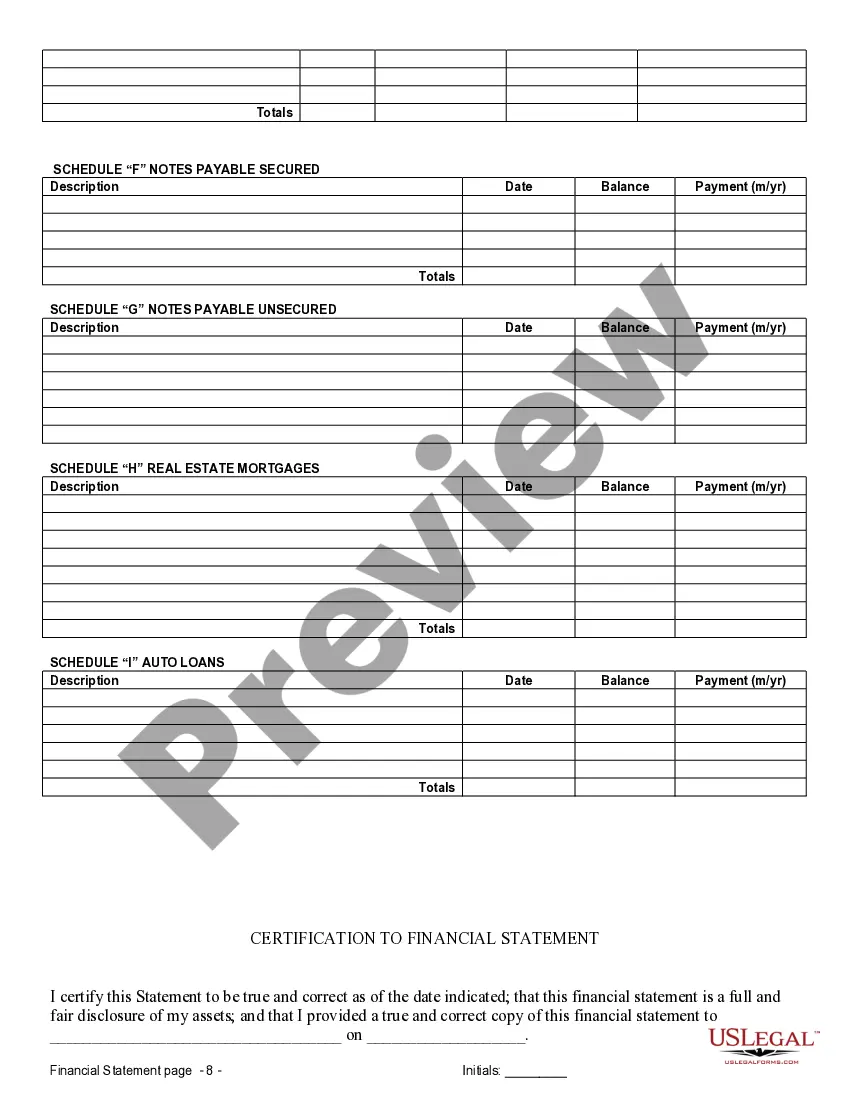

Atlanta Georgia Financial Statements only in Connection with Prenuptial Premarital Agreement

Description

How to fill out Georgia Financial Statements Only In Connection With Prenuptial Premarital Agreement?

We consistently aim to minimize or evade legal complications when managing intricate legal or financial matters.

To achieve this, we enlist legal services that, generally speaking, tend to be quite costly.

However, not all legal challenges are equally complicated. Many of them can be handled by ourselves.

US Legal Forms is an online repository of current DIY legal documents covering everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

Just Log In to your account and click the Get button next to it. If you misplace the form, you can always re-download it from the My documents tab. The process is equally simple if you’re new to the website! You can create your account within minutes. Ensure that the Atlanta Georgia Financial Statements only in Connection with Prenuptial Premarital Agreement complies with your state and local regulations. Additionally, it’s essential to review the form’s outline (if available), and if you identify any inconsistencies with your original requirements, look for an alternative form. Once you’ve confirmed that the Atlanta Georgia Financial Statements only in Connection with Prenuptial Premarital Agreement fits your needs, you can select a subscription plan and make a payment. Then, you can download the form in any preferred file format. For over 24 years, we’ve assisted millions by providing accessible, customizable, and up-to-date legal documents. Take full advantage of US Legal Forms now to save time and resources!

- Our collection empowers you to manage your affairs independently without needing to consult an attorney.

- We provide access to legal document templates that are not always accessible to the public.

- Our templates are tailored to specific states and regions, significantly easing the search process.

- Utilize US Legal Forms whenever you require obtaining and downloading the Atlanta Georgia Financial Statements only in Connection with Prenuptial Premarital Agreement or any other document quickly and securely.

Form popularity

FAQ

Be a written contract?no verbal agreements. Have lawful terms within the prenup. Include the signatures from both parties. Must be signed voluntarily (can't involve coercion, duress, intimidation, or deceit)

While it is certainly not the most romantic part of your wedding planning, any unwed couple can elect to form a prenuptial agreement not only to protect what they have prior to the marriage, or in some cases, protect any future assets they should acquire during the marriage.

A prenuptial agreement does not cover the following: Child custody or visitation matters. Child support. Alimony in the event of a divorce. Day-to-day household matters. Anything prohibited by the law.

Unconscionability Invalidates a Prenuptial Agreement One party signed the agreement involuntarily or not by choice. One party demonstrates that the other party did not divulge all relevant information. One party can prove he/she was not allowed access to an attorney before signing the prenup.

Reasons to Get a Prenup Future spouse(s) have a significant stake in family assets or a family business. Future spouse(s) fully or partially own a business. Future spouse(s) had children from a previous marriage. Future spouse(s) had one or multiple prior divorces.

Rather than leaving a grieving spouse to deal with huge medical debts, a prenup can shield one spouse from these debts. The more common scenario is that one spouse brings debt into the marriage, such as student loans or credit card debt.

The law does not allow a couple to include any terms regarding child custody, visitation or support in a prenuptial or postnuptial agreement. This is because a judge will make these decisions in a divorce case based on the child's best interests.

The short answer is that you can protect, or not protect, nearly anything you want. A valid prenup is legally binding, so whatever you and your partner put into it should stand up in court if you eventually divorce (though every case is different).

When it comes to monetary assets, a prenup can also protect the future earnings of one or both parties so they are not up for grabs during a divorce.

It's basically a prenuptial agreement that is entered into after the couple has married. Georgia law recognizes both pre- and post-nuptial agreements.