Savannah Georgia Renunciation And Disclaimer of Property received by Intestate Succession is a legal process through which an individual voluntarily abdicates their right to inherit property from someone who died without leaving a will or trust. This renunciation and disclaimer act as an effective way to relinquish any claim or interest an individual may have in the assets of the deceased. In Savannah, Georgia, there are different types of Renunciation And Disclaimer of Property received by Intestate Succession, namely: 1. Formal Renunciation: In this type, the heir formally declares in writing their decision to renounce their right to inherit the property. This written statement must be signed and notarized to be considered valid. 2. Informal Renunciation: Unlike a formal renunciation, an informal renunciation does not require a written statement. It can be expressed orally or through actions that clearly demonstrate the individual's intention to renounce their share in the intestate property. 3. Partial Renunciation: Sometimes, an individual may not wish to renounce their entire share of the intestate property. In such cases, a partial renunciation can be made, specifying the specific portion or asset that is being renounced. 4. Disclaimer of Property: This type of renunciation applies when an individual is named as a beneficiary of an intestate estate but wishes to disclaim their inheritance entirely. A disclaimer of property is a complete rejection of any interest in the estate, and the disclaiming party will be treated as if they never held any legal rights to the assets. Renunciation and disclaimer of property received by intestate succession in Savannah, Georgia are legal procedures governed by state laws and must comply with formalities to be valid and enforceable. It is essential to consult with an experienced probate attorney who can guide individuals through the process, ensuring that all legal requirements are met. By renouncing or disclaiming property received through intestate succession, individuals can avoid any potential legal or financial obligations associated with the estate, allowing the assets to pass to the next eligible beneficiaries smoothly and according to the laws of intestacy.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Savannah Renuncia de Georgia y renuncia de propiedad recibida por sucesión intestada - Georgia Renunciation And Disclaimer of Property received by Intestate Succession

State:

Georgia

City:

Savannah

Control #:

GA-03-03

Format:

Word

Instant download

Description

Este formulario NO está disponible para su descarga inmediata y se le enviará por correo electrónico dentro de las veinticuatro (24) horas posteriores a su pedido.

Savannah Georgia Renunciation And Disclaimer of Property received by Intestate Succession is a legal process through which an individual voluntarily abdicates their right to inherit property from someone who died without leaving a will or trust. This renunciation and disclaimer act as an effective way to relinquish any claim or interest an individual may have in the assets of the deceased. In Savannah, Georgia, there are different types of Renunciation And Disclaimer of Property received by Intestate Succession, namely: 1. Formal Renunciation: In this type, the heir formally declares in writing their decision to renounce their right to inherit the property. This written statement must be signed and notarized to be considered valid. 2. Informal Renunciation: Unlike a formal renunciation, an informal renunciation does not require a written statement. It can be expressed orally or through actions that clearly demonstrate the individual's intention to renounce their share in the intestate property. 3. Partial Renunciation: Sometimes, an individual may not wish to renounce their entire share of the intestate property. In such cases, a partial renunciation can be made, specifying the specific portion or asset that is being renounced. 4. Disclaimer of Property: This type of renunciation applies when an individual is named as a beneficiary of an intestate estate but wishes to disclaim their inheritance entirely. A disclaimer of property is a complete rejection of any interest in the estate, and the disclaiming party will be treated as if they never held any legal rights to the assets. Renunciation and disclaimer of property received by intestate succession in Savannah, Georgia are legal procedures governed by state laws and must comply with formalities to be valid and enforceable. It is essential to consult with an experienced probate attorney who can guide individuals through the process, ensuring that all legal requirements are met. By renouncing or disclaiming property received through intestate succession, individuals can avoid any potential legal or financial obligations associated with the estate, allowing the assets to pass to the next eligible beneficiaries smoothly and according to the laws of intestacy.

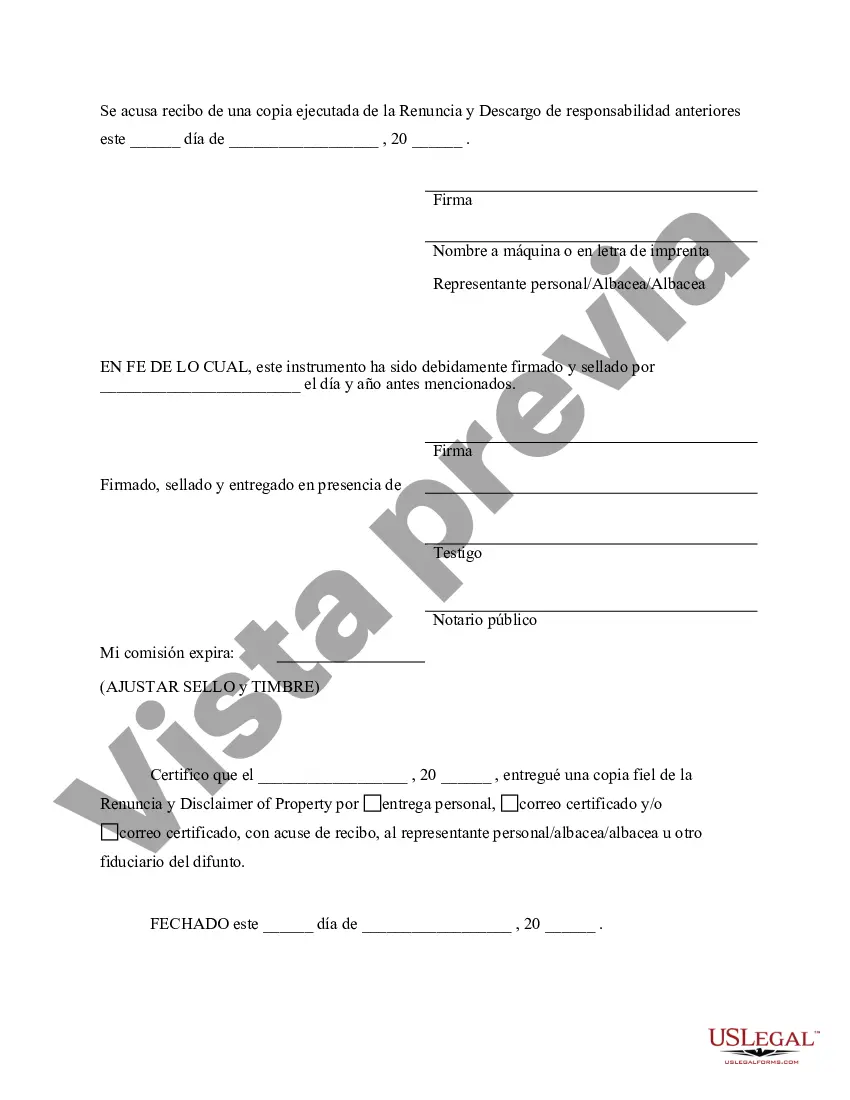

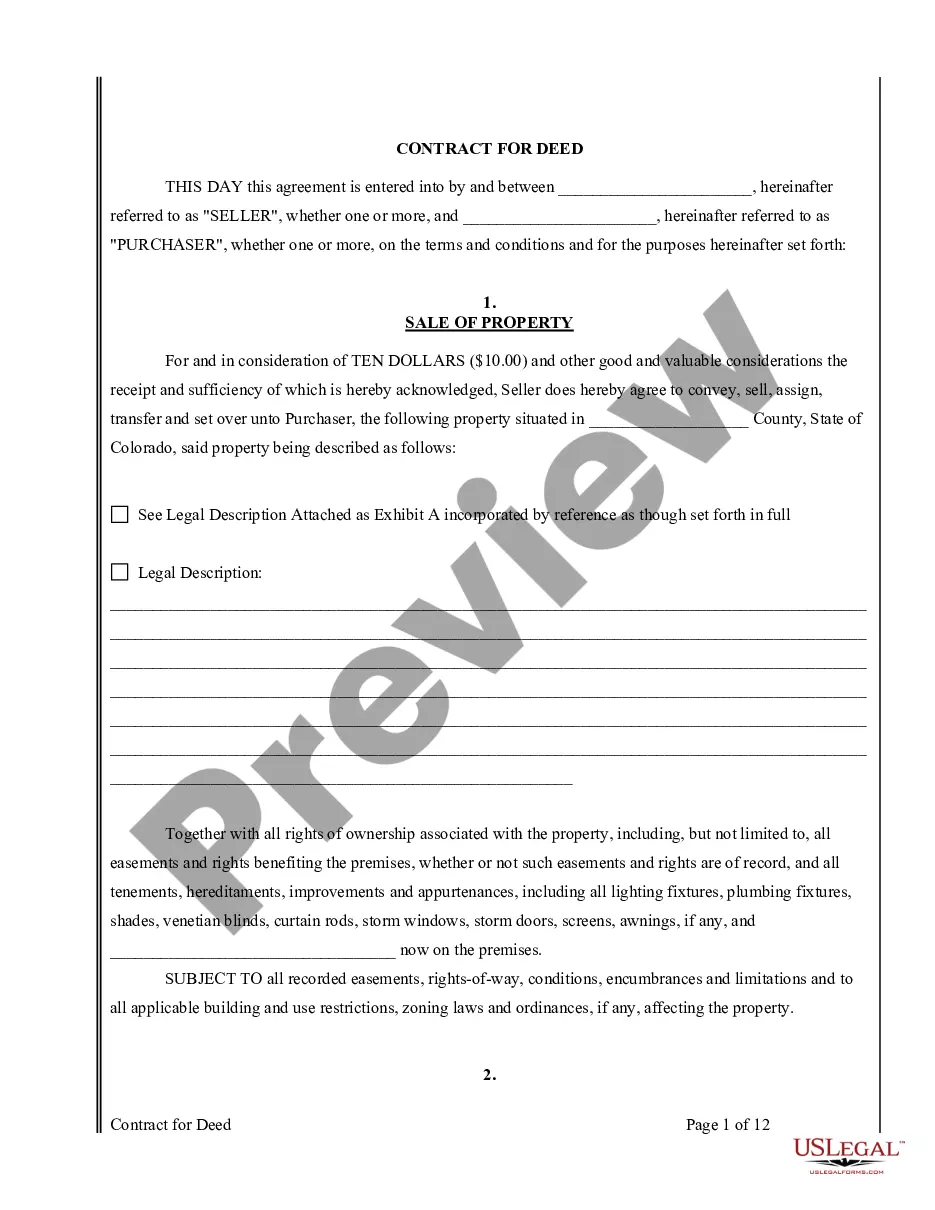

Free preview

How to fill out Savannah Renuncia De Georgia Y Renuncia De Propiedad Recibida Por Sucesión Intestada?

If you’ve already utilized our service before, log in to your account and save the Savannah Georgia Renunciation And Disclaimer of Property received by Intestate Succession on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple steps to obtain your document:

- Ensure you’ve found the right document. Read the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t fit you, use the Search tab above to find the appropriate one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Get your Savannah Georgia Renunciation And Disclaimer of Property received by Intestate Succession. Opt for the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have bought: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily find and save any template for your personal or professional needs!