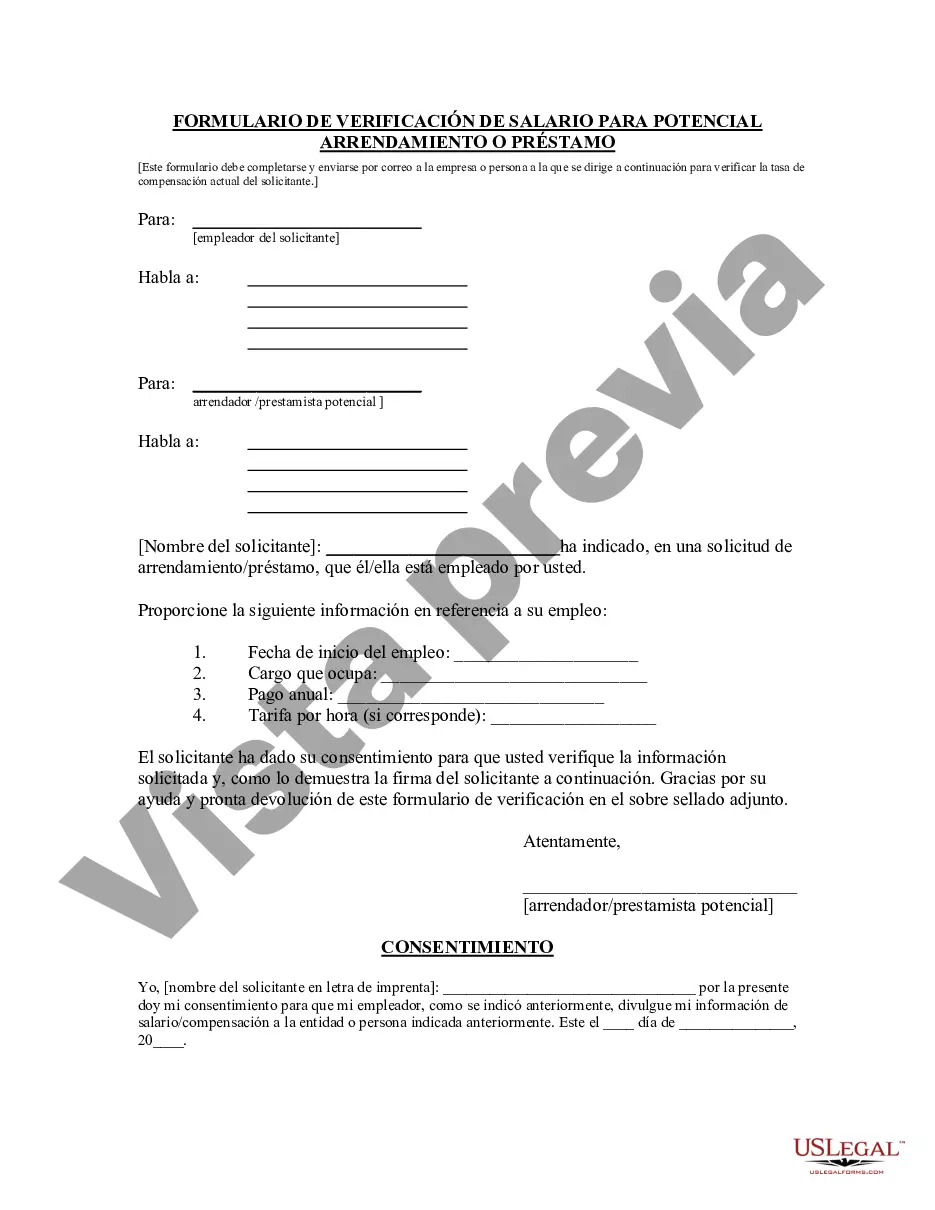

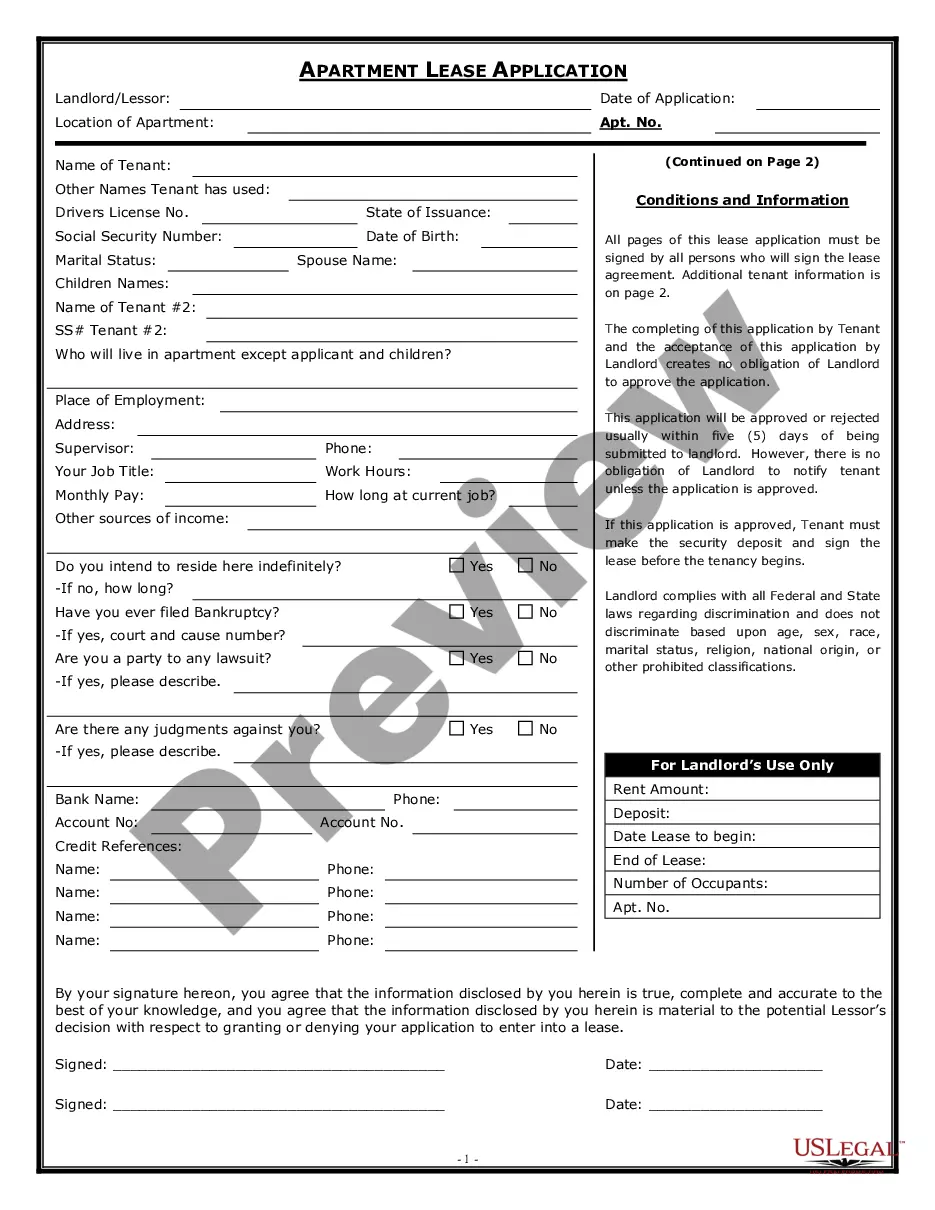

This Salary Verification form for Potential Lease is a form to be sent to a potential tenant's employer, in order for the Landlord to verify the lease applicant's income as reported on an application for lease (please see Form -827LT "Application for Residential Lease"). A Tenant Consent Form comes with the Salary Verification Form, and should also be sent to the employer.

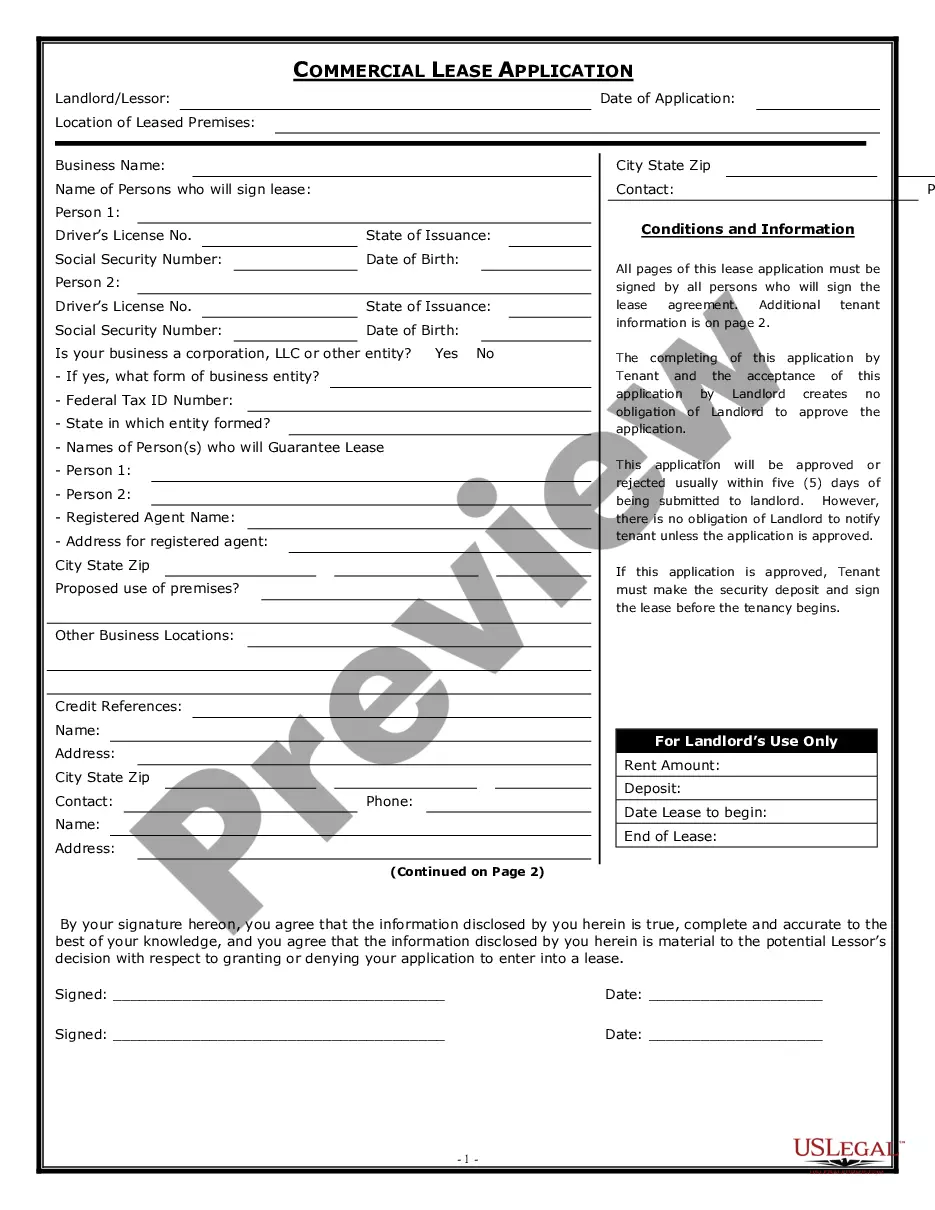

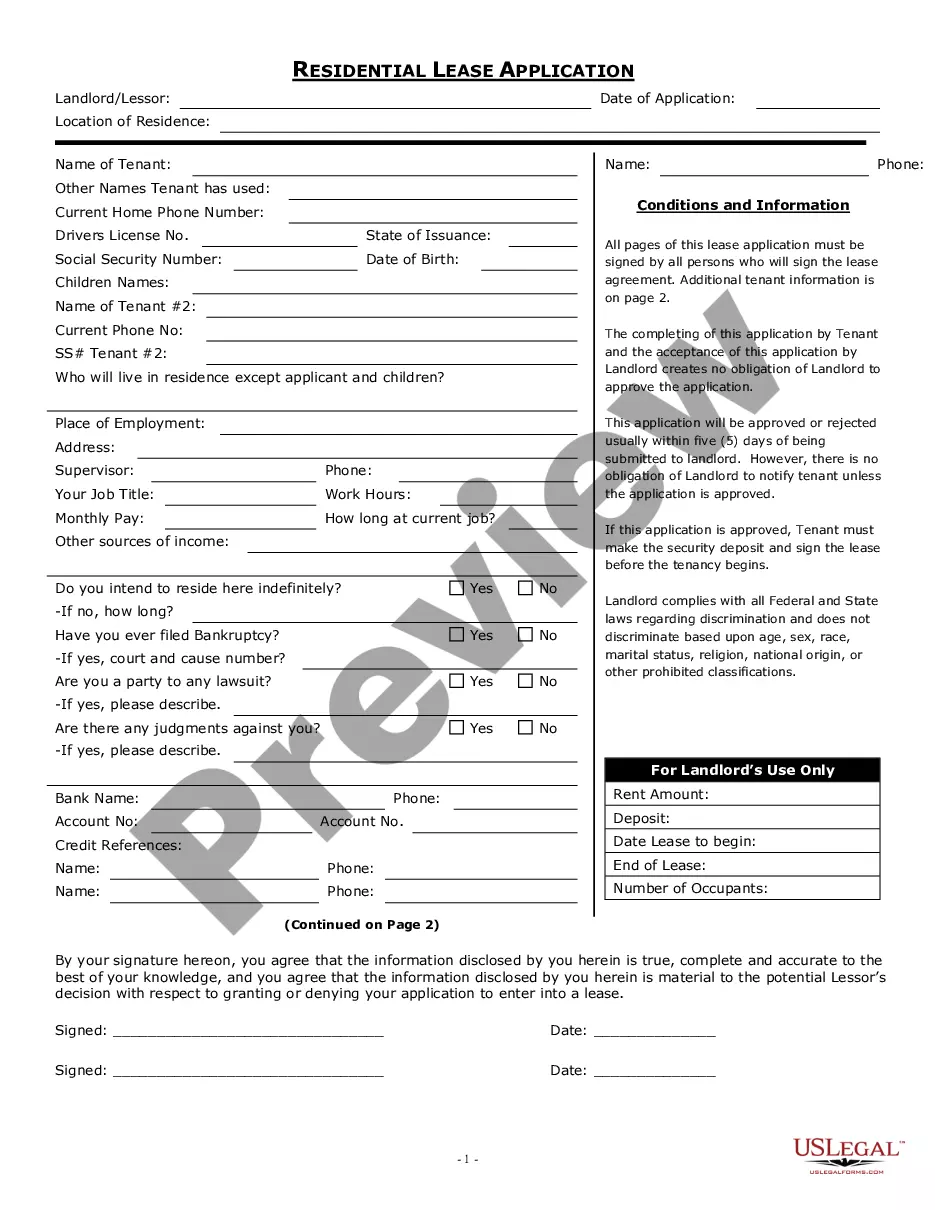

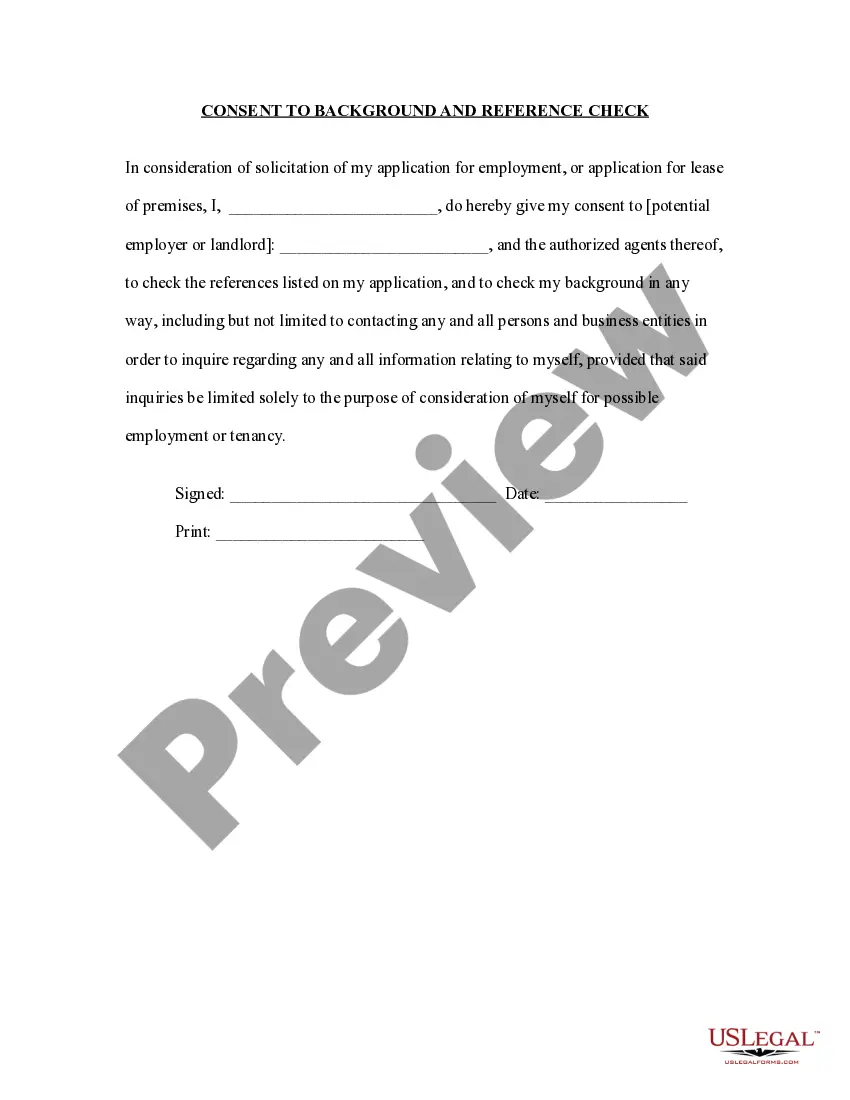

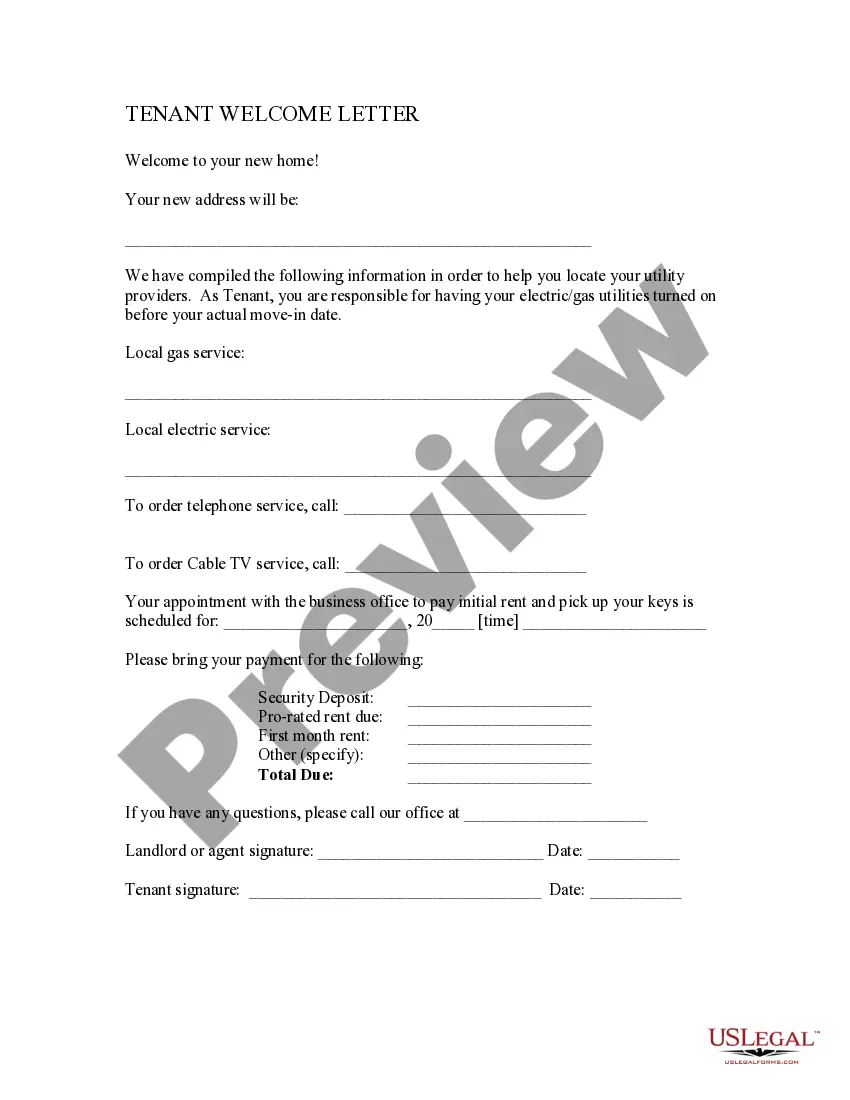

The Atlanta Georgia Salary Verification form for Potential Lease is a crucial document used by property owners or leasing agencies in Atlanta, Georgia, to ensure that potential tenants have a stable income to cover their rent payments. This form acts as a means for property owners to verify the salary and employment status of potential tenants, as well as assess their ability to meet financial obligations throughout the lease term. The form typically requests comprehensive information from tenants, including their full name, current address, contact details, and social security number. The tenant is required to fill in their employer's name, address, and contact information. Additionally, they must provide details about their job title, employment status (whether full-time, part-time, or self-employed), and length of employment. It is essential to mention the tenant's gross salary, including any additional income sources like bonuses, commissions, or investments. Furthermore, the document may also require additional financial information, such as the tenant's current bank account details, credit score, and details of outstanding debts or financial obligations. The form may also request permission from the tenant to contact their employer or financial institutions directly for verification purposes. There are different types of Atlanta Georgia Salary Verification forms for Potential Lease, each tailored to specific leasing scenarios. These variations may include: 1. Basic Salary Verification Form: This standard form captures the essential details of the tenant's employment and salary. It provides a comprehensive overview of the tenant's financial stability and is commonly used for lease applications in general. 2. Self-Employed Salary Verification Form: Specifically designed for individuals who are self-employed, this form requests information about the tenant's business, including revenue, expenses, and profit figures. It allows property owners to evaluate the stability and viability of the tenant's business. 3. Joint Salary Verification Form: When multiple tenants apply for a lease together, a Joint Salary Verification form is used. This document includes the salary and employment details of each tenant to assess the collective financial capacity to meet the rent requirements. 4. Employer Reference Salary Verification Form: In some cases, property owners may require a form to be completed by the tenant's employer directly. This helps verify the tenant's employment details, including income stability, position held, and length of employment. The Atlanta Georgia Salary Verification form for Potential Lease is a crucial tool for property owners and leasing agencies to minimize financial risks and ensure that potential tenants have a reliable source of income to fulfill their lease obligations. By accurately verifying and assessing the tenant's financial stability, property owners can select tenants who are more likely to meet their rental requirements, resulting in a secure and prosperous leasing agreement for both parties.The Atlanta Georgia Salary Verification form for Potential Lease is a crucial document used by property owners or leasing agencies in Atlanta, Georgia, to ensure that potential tenants have a stable income to cover their rent payments. This form acts as a means for property owners to verify the salary and employment status of potential tenants, as well as assess their ability to meet financial obligations throughout the lease term. The form typically requests comprehensive information from tenants, including their full name, current address, contact details, and social security number. The tenant is required to fill in their employer's name, address, and contact information. Additionally, they must provide details about their job title, employment status (whether full-time, part-time, or self-employed), and length of employment. It is essential to mention the tenant's gross salary, including any additional income sources like bonuses, commissions, or investments. Furthermore, the document may also require additional financial information, such as the tenant's current bank account details, credit score, and details of outstanding debts or financial obligations. The form may also request permission from the tenant to contact their employer or financial institutions directly for verification purposes. There are different types of Atlanta Georgia Salary Verification forms for Potential Lease, each tailored to specific leasing scenarios. These variations may include: 1. Basic Salary Verification Form: This standard form captures the essential details of the tenant's employment and salary. It provides a comprehensive overview of the tenant's financial stability and is commonly used for lease applications in general. 2. Self-Employed Salary Verification Form: Specifically designed for individuals who are self-employed, this form requests information about the tenant's business, including revenue, expenses, and profit figures. It allows property owners to evaluate the stability and viability of the tenant's business. 3. Joint Salary Verification Form: When multiple tenants apply for a lease together, a Joint Salary Verification form is used. This document includes the salary and employment details of each tenant to assess the collective financial capacity to meet the rent requirements. 4. Employer Reference Salary Verification Form: In some cases, property owners may require a form to be completed by the tenant's employer directly. This helps verify the tenant's employment details, including income stability, position held, and length of employment. The Atlanta Georgia Salary Verification form for Potential Lease is a crucial tool for property owners and leasing agencies to minimize financial risks and ensure that potential tenants have a reliable source of income to fulfill their lease obligations. By accurately verifying and assessing the tenant's financial stability, property owners can select tenants who are more likely to meet their rental requirements, resulting in a secure and prosperous leasing agreement for both parties.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.