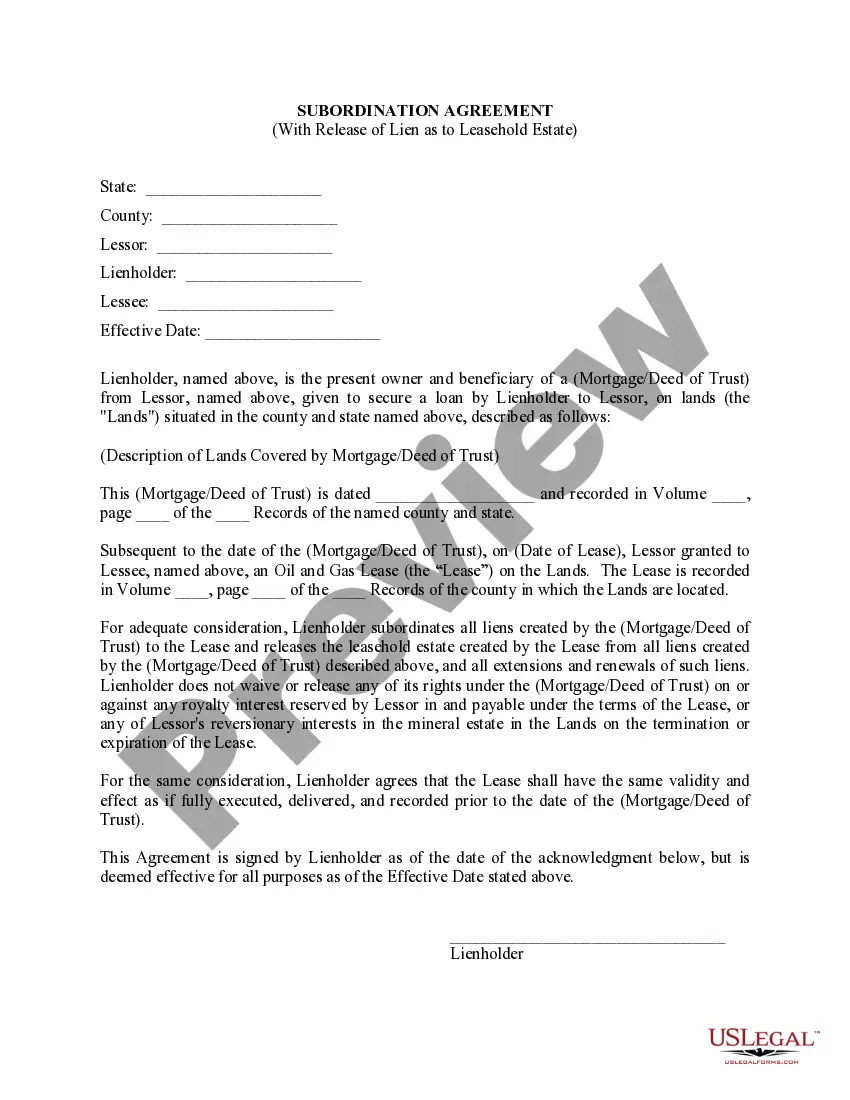

Subordination means an agreement to put a debt or claim which has priority in a lower position behind another debt, particularly a new loan. A property owner with a loan secured by the property who applies for a second mortgage to make additions or repairs usually must get a subordination of the original loan so the new loan has first priority. A declaration of homestead must always be subordinated to a loan.

The Atlanta Georgia Lease Subordination Agreement is a legal document that outlines the terms and conditions of subordination between the landlord, tenant, and lender for a commercial property lease in Atlanta, Georgia. This agreement is primarily used when a tenant wants to secure financing for improvements or to secure a loan backed by the leased property. The subordination agreement establishes the priority of rights between the landlord's leasehold interest and the lender's security interest. In Atlanta, there are two main types of Lease Subordination Agreements: 1. Non-Disturbance Agreement: This type of agreement is typically used when a tenant enters into a lease with a landlord and wants to ensure that in the event of foreclosure or sale of the property, their lease will not be disturbed by the new owner or lender. The non-disturbance agreement protects the tenant's rights and prevents the new owner or lender from terminating the lease or evicting the tenant. 2. Estoppel Certificate: An estoppel certificate is a document signed by the tenant that confirms the terms and conditions of the lease, including any amendments, rent payments, and current lease status. This certificate is often required by lenders before finalizing a loan or financing arrangement. It provides assurance to the lender that the tenant's lease is valid, and there are no undisclosed obligations or disputes. The Atlanta Georgia Lease Subordination Agreement typically includes the following details: 1. Parties involved: The agreement identifies the landlord, tenant, and lender. 2. Property details: The agreement provides a description of the leased property, including address, unit number, and any attached legal descriptions. 3. Subordination clause: The agreement establishes that the tenant's leasehold interest is subordinate to the lender's security interest in the event of foreclosure or sale. 4. Non-disturbance clause: In the case of a non-disturbance agreement, this clause ensures that the new owner or lender will not disturb the tenant's rights under the lease. 5. Estoppel certificate provision: If an estoppel certificate is required, this clause outlines the tenant's obligation to provide the certificate to the lender. 6. Governing law: The agreement states that it is governed by the laws of Atlanta, Georgia, and any disputes will be resolved in the appropriate courts. It is crucial for both tenants and landlords to consult with legal professionals when drafting or reviewing an Atlanta Georgia Lease Subordination Agreement to ensure that their rights and interests are protected.