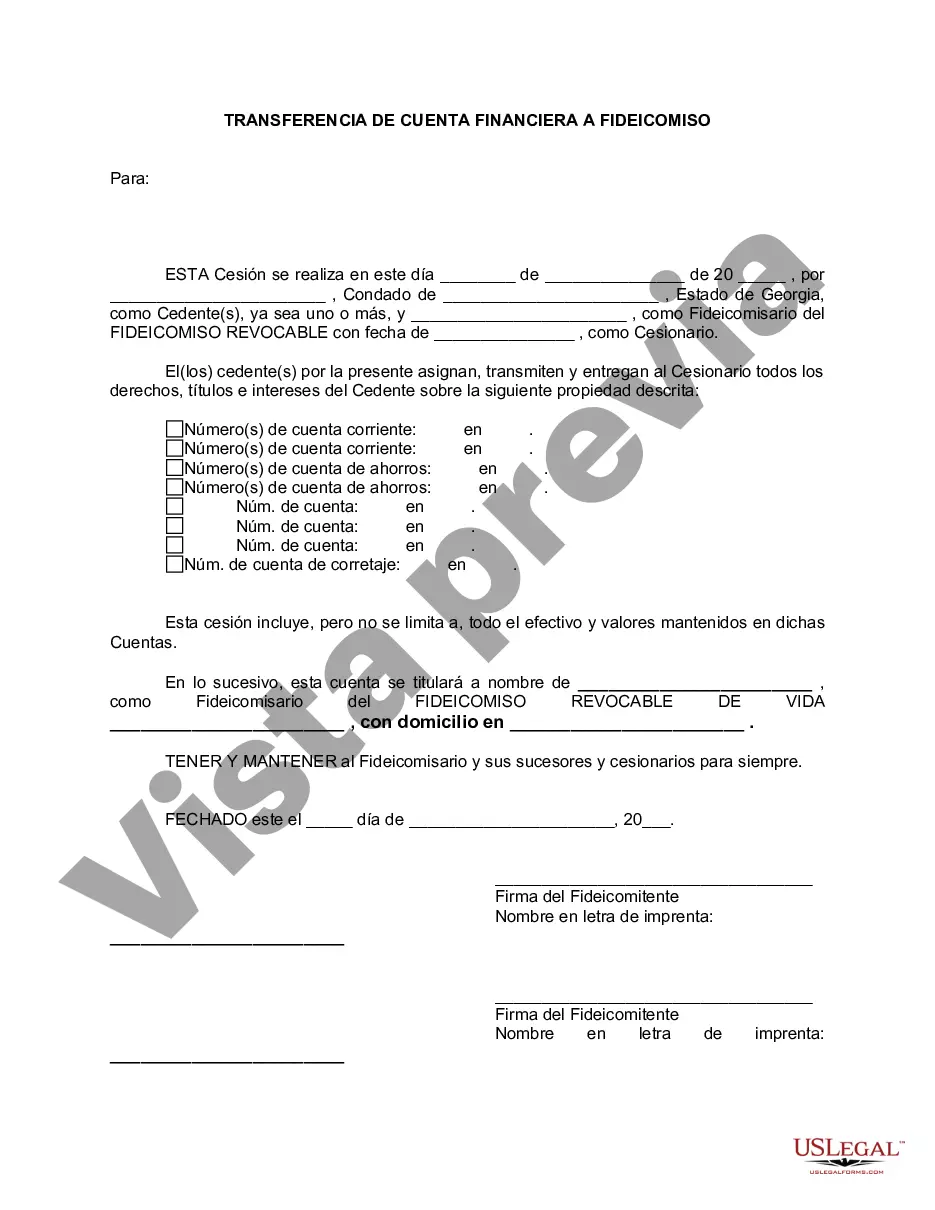

Title: Fulton Georgia Financial Account Transfer to Living Trust: A Comprehensive Guide Introduction: In Fulton, Georgia, transferring financial accounts to a living trust can be a beneficial step in estate planning. This article aims to provide a detailed description and useful information on Fulton Georgia Financial Account Transfer to Living Trust, exploring its significance, process, and different types available. 1. Understanding the Living Trust: A living trust is a legal entity created during an individual's lifetime to hold assets and manage them for beneficiaries. It allows for smoother estate distribution, privacy, and potential reduction of estate taxes. By transferring financial accounts to a living trust, individuals can gain control over the management and distribution of their assets. 2. The Importance of Financial Account Transfer to Living Trust: — Probate Avoidance: Transferring financial accounts to a living trust can help avoid the lengthy and costly probate process, allowing beneficiaries to access assets promptly. — Privacy Preservation: Unlike wills, living trusts are not subject to public probate proceedings, ensuring confidentiality in asset distribution. — Incapacity Planning: A living trust provides provisions for the management of assets in case the account holder becomes incapacitated, avoiding the need for conservatorship. 3. Process of Fulton Georgia Financial Account Transfer to Living Trust: a. Identify Eligible Accounts: Determine which financial accounts are eligible for transfer to a living trust, including bank accounts, investment portfolios, retirement accounts, and more. b. Review Legal Requirements: Consult with an attorney specializing in estate planning to understand the legal formalities and requirements specific to Fulton, Georgia. c. Document Preparation: Draft a trust document or amend an existing one to include the desired financial accounts, appoint trustees, and designate beneficiaries. d. Account Ownership Update: Contact financial institutions to change the ownership of accounts from individual to living trust. e. Maintain Beneficiary Designations: Ensure that beneficiary designations align with the stipulations in the living trust to avoid conflicts. f. Update Asset Registration: Update the registration of assets such as property titles, vehicle registrations, or shares to reflect the living trust's ownership. g. Seek Professional Guidance: Consult an accountant or financial advisor to navigate the tax implications and implications of the account transfer. 4. Types of Fulton Georgia Financial Account Transfers to Living Trust: a. Bank Account Transfer: This involves transferring funds from personal bank accounts to the living trust, ensuring smooth access for beneficiaries upon the individual's passing. b. Investment Account Transfer: Includes the transfer of securities, stocks, bonds, or mutual funds from individual ownership to the living trust. c. Retirement Account Transfer: Involves re-registering individual retirement accounts (IRAs), 401(k)s, or pensions under the living trust's name. Conclusion: The Fulton Georgia Financial Account Transfer to Living Trust is a prudent strategy to ensure a smooth transition of financial assets while preserving privacy, minimizing probate delays, and planning for incapacity. By following the process and seeking professional guidance, individuals can safeguard their wealth and provide for their loved ones efficiently.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Fulton Georgia Transferencia de cuenta financiera a fideicomiso en vida - Georgia Financial Account Transfer to Living Trust

Description

How to fill out Fulton Georgia Transferencia De Cuenta Financiera A Fideicomiso En Vida?

Make use of the US Legal Forms and obtain instant access to any form sample you require. Our useful website with a huge number of documents makes it easy to find and obtain almost any document sample you require. You can download, complete, and sign the Fulton Georgia Financial Account Transfer to Living Trust in just a couple of minutes instead of surfing the Net for several hours searching for a proper template.

Using our collection is a great way to raise the safety of your document submissions. Our experienced attorneys on a regular basis review all the documents to make certain that the forms are appropriate for a particular region and compliant with new laws and polices.

How can you obtain the Fulton Georgia Financial Account Transfer to Living Trust? If you already have a profile, just log in to the account. The Download option will appear on all the samples you look at. Furthermore, you can get all the earlier saved files in the My Forms menu.

If you don’t have a profile yet, follow the instructions below:

- Open the page with the template you need. Make sure that it is the template you were hoping to find: verify its title and description, and utilize the Preview function if it is available. Otherwise, make use of the Search field to look for the appropriate one.

- Start the downloading process. Click Buy Now and choose the pricing plan that suits you best. Then, sign up for an account and pay for your order using a credit card or PayPal.

- Save the file. Select the format to obtain the Fulton Georgia Financial Account Transfer to Living Trust and edit and complete, or sign it for your needs.

US Legal Forms is among the most significant and reliable template libraries on the internet. We are always happy to help you in any legal procedure, even if it is just downloading the Fulton Georgia Financial Account Transfer to Living Trust.

Feel free to take full advantage of our platform and make your document experience as efficient as possible!