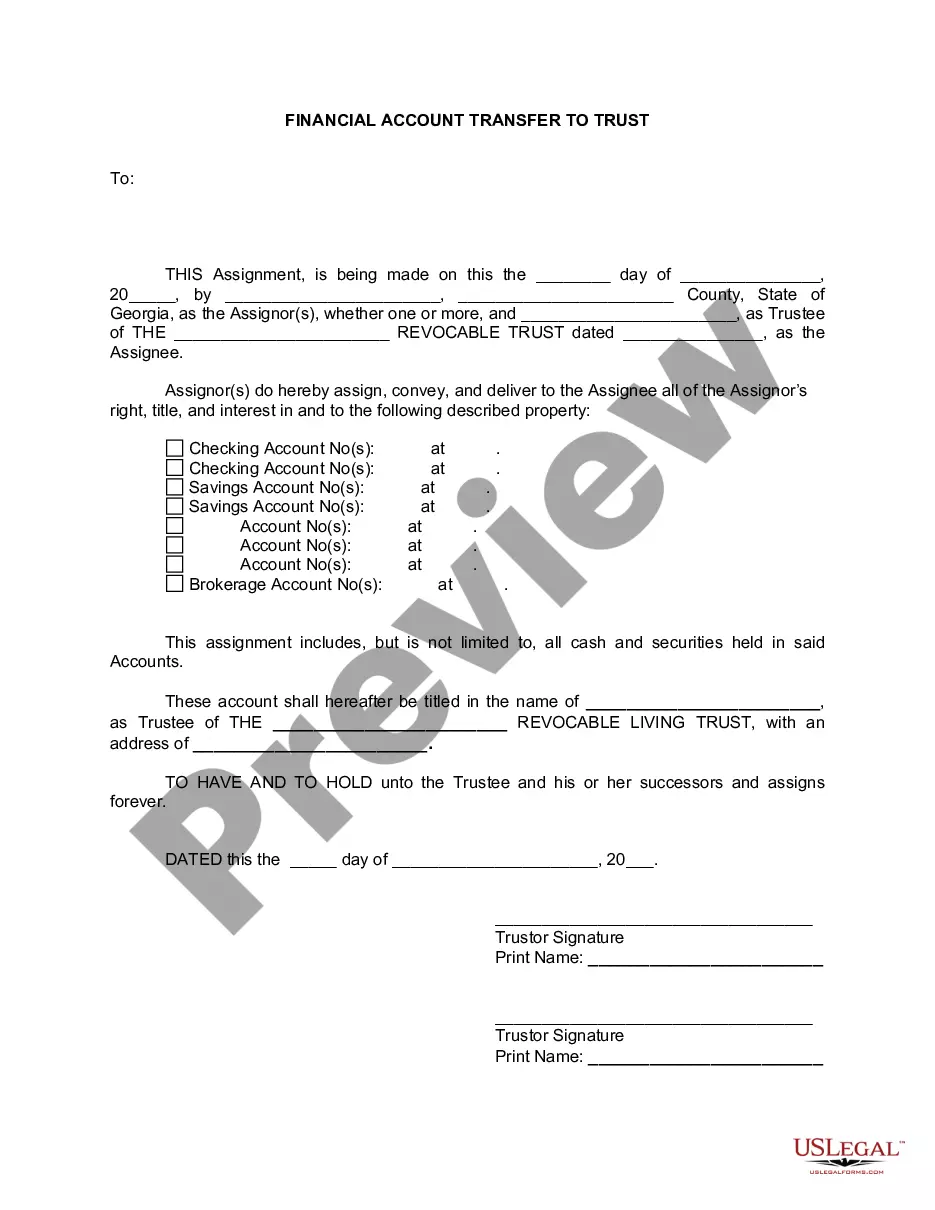

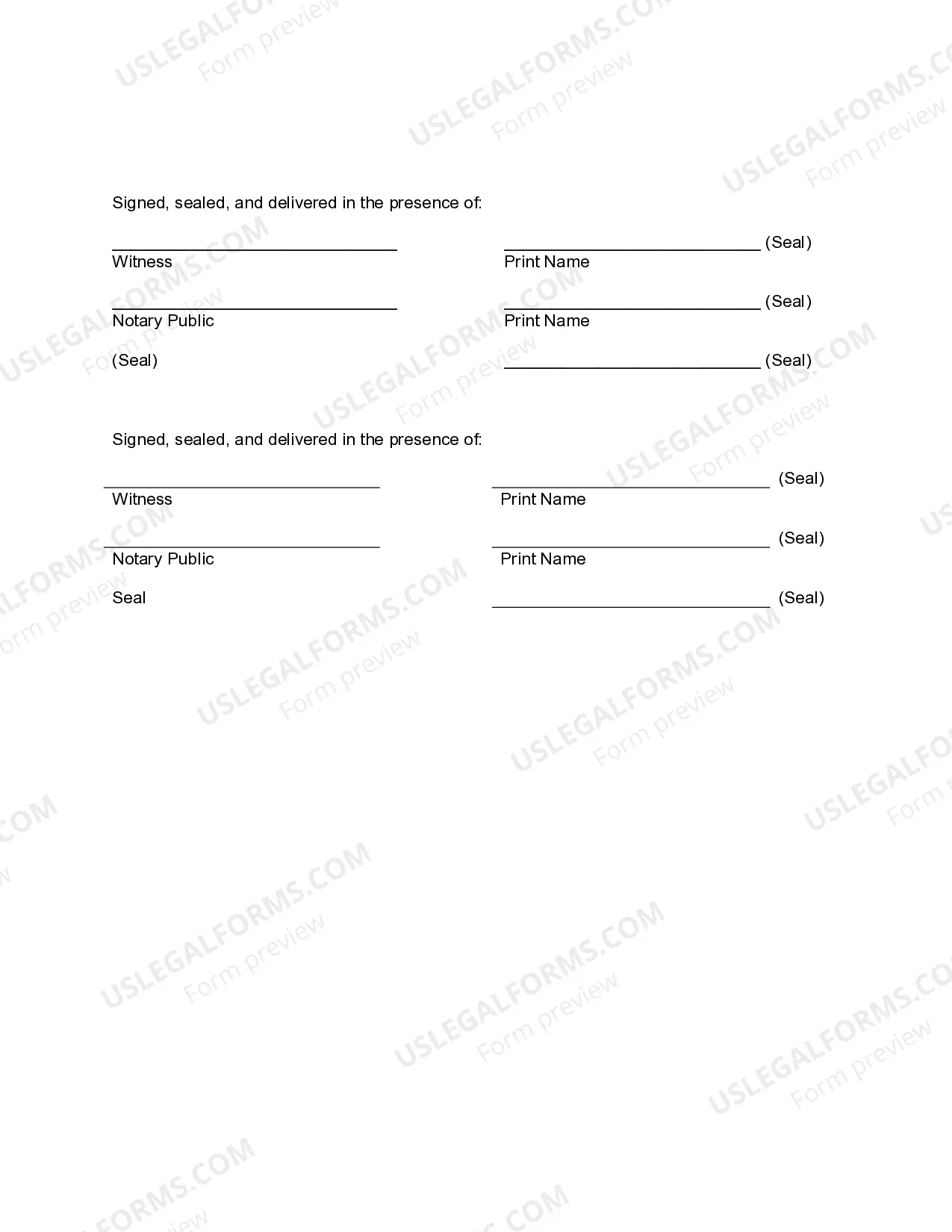

This Financial Account Transfer to Living Trust form is for transferring bank and other financial accounts to a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public. Assignor(s) with this form will assign, convey, and deliver to the Assignee all of the Assignors right, title, and interest in and to the described property.The assignment includes, but is not limited to, all cash and securities held in the accounts.

Savannah Georgia Financial Account Transfer to Living Trust refers to the process of transferring ownership of financial accounts or assets to a living trust in the city of Savannah, Georgia. A living trust is a legal document that allows an individual, referred to as the granter or settler, to maintain control over their assets during their lifetime and ensure a smooth transition of those assets upon their death. There are different types of Savannah Georgia Financial Account Transfer to Living Trust, including: 1. Bank Accounts Transfer: This type of transfer involves moving funds from various financial institutions, such as savings accounts, checking accounts, money market accounts, or certificates of deposit, into the living trust. By doing so, the granter can maintain control over their funds while alive and provide clear instructions for the distribution or management of those funds after their passing. 2. Investment Accounts Transfer: This type of transfer involves transferring ownership of investment accounts, such as brokerage accounts, stocks, bonds, mutual funds, or retirement accounts, to the living trust. By executing a Financial Account Transfer to Living Trust for investment assets, the granter ensures seamless management and distribution of these assets according to their wishes, potentially avoiding probate and simplifying the estate settlement process. 3. Real Estate Property Transfer: Although not strictly financial accounts, real estate properties in Savannah, Georgia can also be transferred to a living trust. This includes residential homes, commercial properties, land, or rental properties. Transferring real estate to a living trust can provide flexibility, privacy, and avoid the need for a probate process upon the granter's death. 4. Other Financial Accounts Transfer: Besides bank accounts, investments, and real estate, other types of financial accounts can also be transferred to a living trust. These may include vehicles, valuable personal property, intellectual property rights, business assets, or any other asset with financial value. The goal is to ensure comprehensive management, protection, and distribution of these assets according to the granter's intentions. Consulting an attorney experienced in estate planning and trust administration is highly recommended when considering a Savannah Georgia Financial Account Transfer to Living Trust. They can provide expert guidance on the legal and financial aspects of creating a living trust, selecting the appropriate assets for transfer, and ensuring compliance with Georgia state laws governing trusts and estates.