This special or limited power of attorney is for your agent to handle bank account matters for you, including, making deposits, writing checks, opening accounts, etc. A limited power of attorney allows the principal to give only specific powers to the agent. The limited power of attorney is used to allow the agent to handle specific matters when the principal is unavailable or unable to do so.

The Fulton Georgia Special Durable Power of Attorney for Bank Account Matters is a legal document that grants an appointed individual, known as the attorney-in-fact or agent, the authority to make financial decisions and manage bank accounts on behalf of the principal, who is the person creating the power of attorney. This power of attorney specifically focuses on matters related to bank accounts, allowing the agent to carry out various tasks and transactions relating to the principal's banking affairs. The agent may be authorized to open or close bank accounts, deposit or withdraw funds, write checks, transfer money between accounts, and perform other financial actions that are necessary to manage the principal's bank accounts. The Fulton Georgia Special Durable Power of Attorney for Bank Account Matters is durable, meaning that it remains in effect even if the principal becomes mentally incapacitated or unable to make decisions for themselves. This ensures that the agent can continue to act on behalf of the principal in handling their bank accounts and financial affairs. There may be different types or variations of the Fulton Georgia Special Durable Power of Attorney for Bank Account Matters, each tailored to meet specific requirements or circumstances. Some potential types or variations include: 1. Limited Power of Attorney for Bank Account Matters: This type of power of attorney grants the agent authority over only certain specified bank accounts or limited financial matters. It allows the principal to maintain control over other bank accounts or financial affairs that are not mentioned in the document. 2. General Power of Attorney for Bank Account Matters: In contrast to the limited power of attorney, this type confers broad authority to the agent, enabling them to manage all the principal's bank accounts and make various financial decisions on their behalf. 3. Springing Power of Attorney for Bank Account Matters: This particular type of power of attorney only becomes effective in the event that a specific condition or trigger occurs, such as the principal becoming incapacitated. Until the predetermined condition is met, the agent does not possess any authority to act on behalf of the principal. Regardless of the specific type or variation, the Fulton Georgia Special Durable Power of Attorney for Bank Account Matters provides a legal framework for individuals to designate someone they trust to handle their bank accounts and financial affairs during incapacitation or when unable to manage them personally. It is crucial to consult with a qualified attorney to ensure compliance with Georgia state laws and to customize the document to address individual needs and circumstances.The Fulton Georgia Special Durable Power of Attorney for Bank Account Matters is a legal document that grants an appointed individual, known as the attorney-in-fact or agent, the authority to make financial decisions and manage bank accounts on behalf of the principal, who is the person creating the power of attorney. This power of attorney specifically focuses on matters related to bank accounts, allowing the agent to carry out various tasks and transactions relating to the principal's banking affairs. The agent may be authorized to open or close bank accounts, deposit or withdraw funds, write checks, transfer money between accounts, and perform other financial actions that are necessary to manage the principal's bank accounts. The Fulton Georgia Special Durable Power of Attorney for Bank Account Matters is durable, meaning that it remains in effect even if the principal becomes mentally incapacitated or unable to make decisions for themselves. This ensures that the agent can continue to act on behalf of the principal in handling their bank accounts and financial affairs. There may be different types or variations of the Fulton Georgia Special Durable Power of Attorney for Bank Account Matters, each tailored to meet specific requirements or circumstances. Some potential types or variations include: 1. Limited Power of Attorney for Bank Account Matters: This type of power of attorney grants the agent authority over only certain specified bank accounts or limited financial matters. It allows the principal to maintain control over other bank accounts or financial affairs that are not mentioned in the document. 2. General Power of Attorney for Bank Account Matters: In contrast to the limited power of attorney, this type confers broad authority to the agent, enabling them to manage all the principal's bank accounts and make various financial decisions on their behalf. 3. Springing Power of Attorney for Bank Account Matters: This particular type of power of attorney only becomes effective in the event that a specific condition or trigger occurs, such as the principal becoming incapacitated. Until the predetermined condition is met, the agent does not possess any authority to act on behalf of the principal. Regardless of the specific type or variation, the Fulton Georgia Special Durable Power of Attorney for Bank Account Matters provides a legal framework for individuals to designate someone they trust to handle their bank accounts and financial affairs during incapacitation or when unable to manage them personally. It is crucial to consult with a qualified attorney to ensure compliance with Georgia state laws and to customize the document to address individual needs and circumstances.

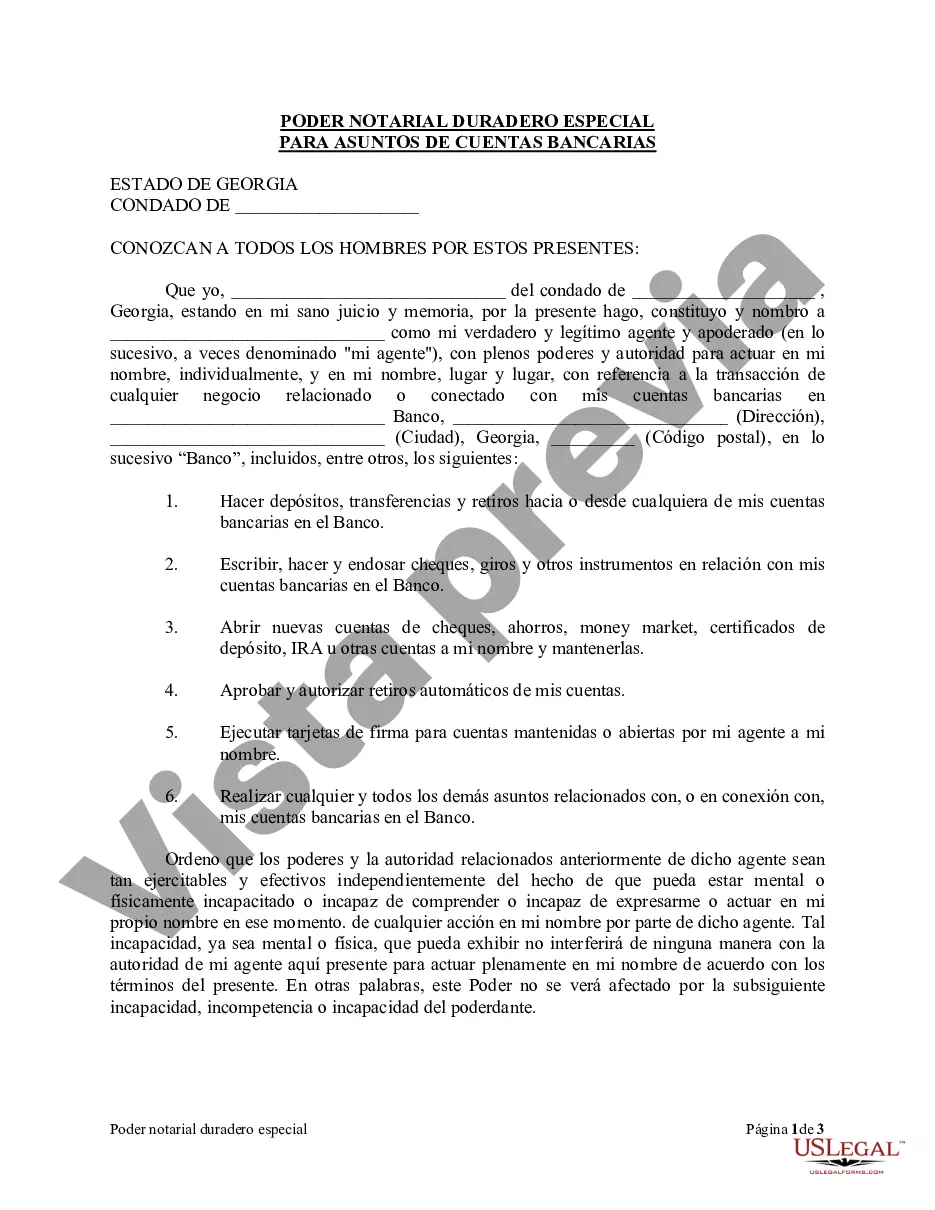

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.