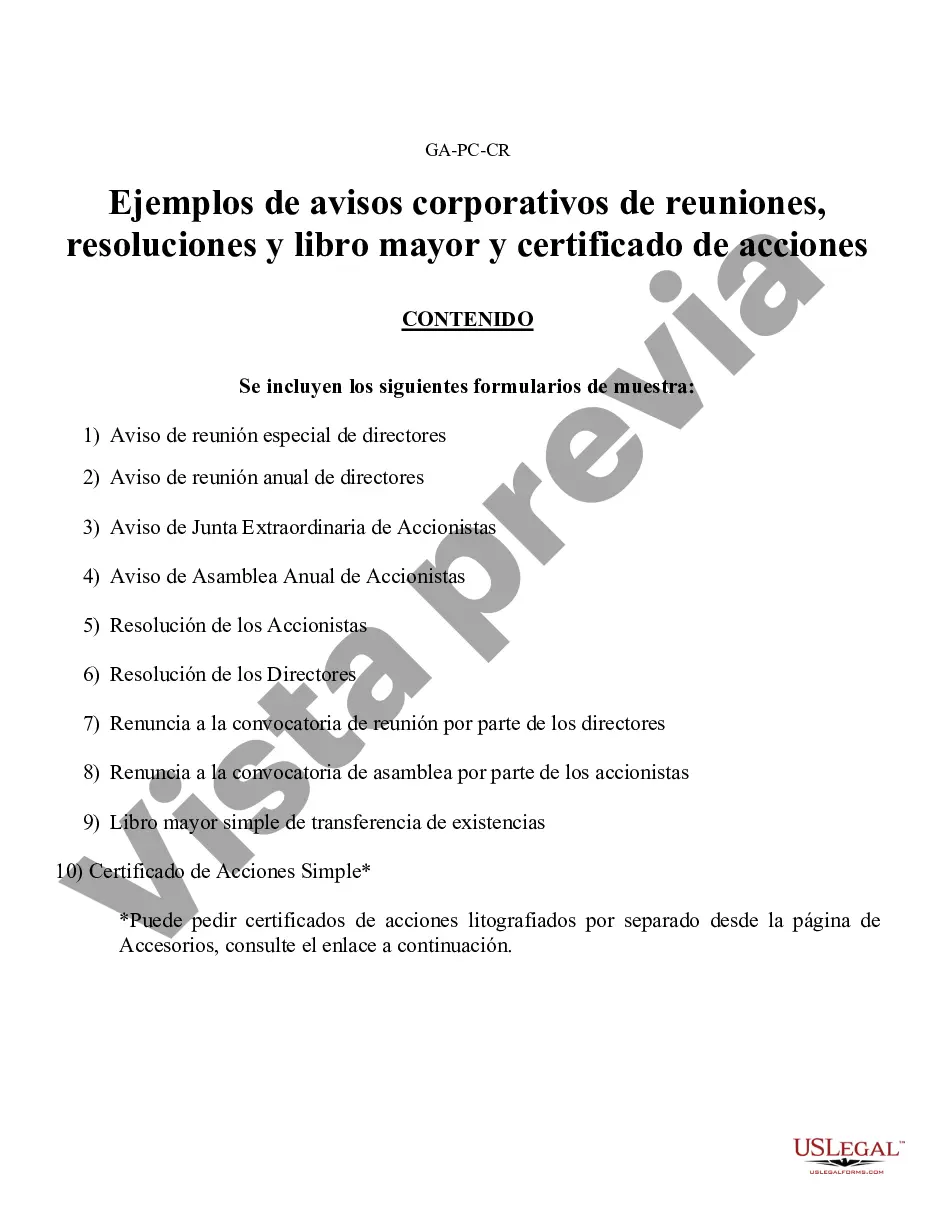

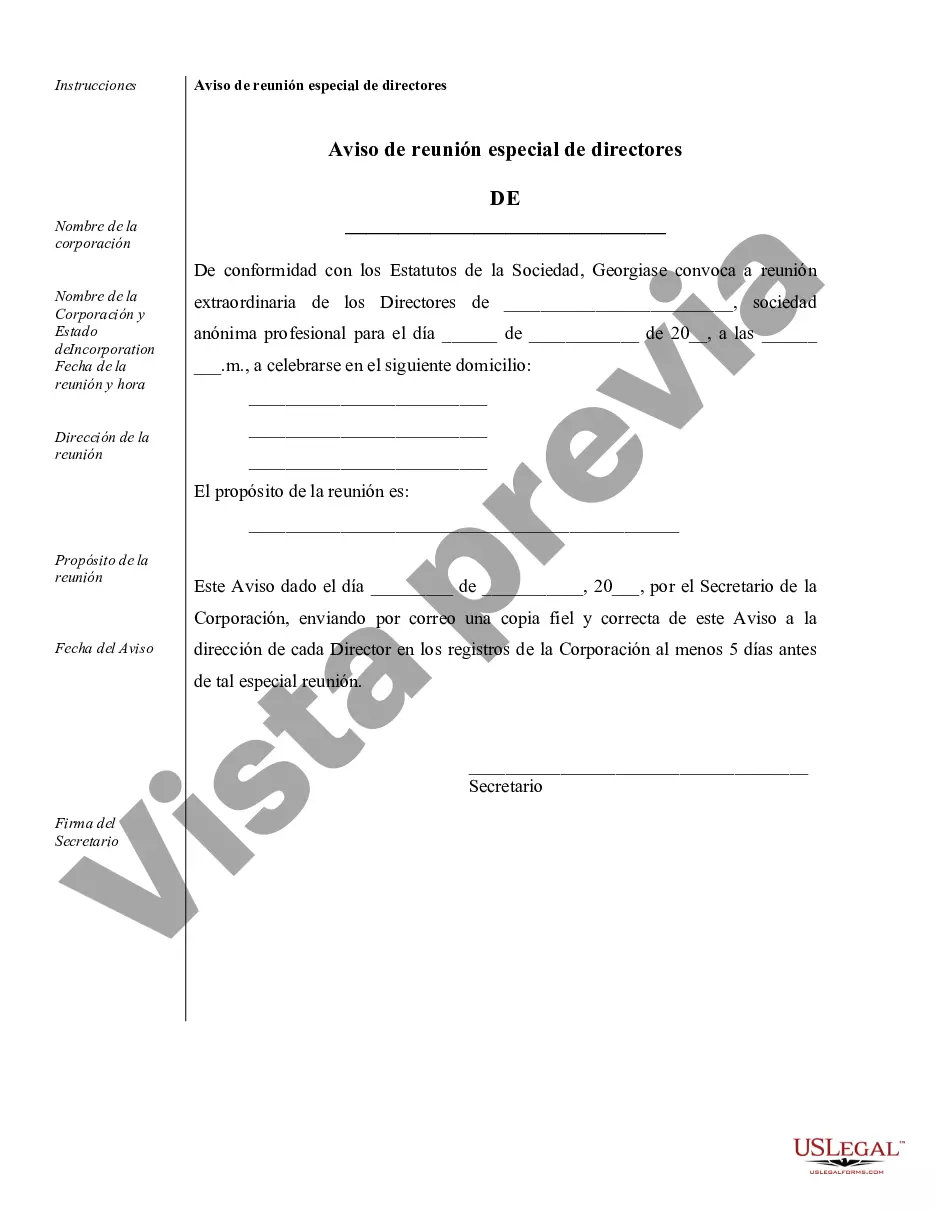

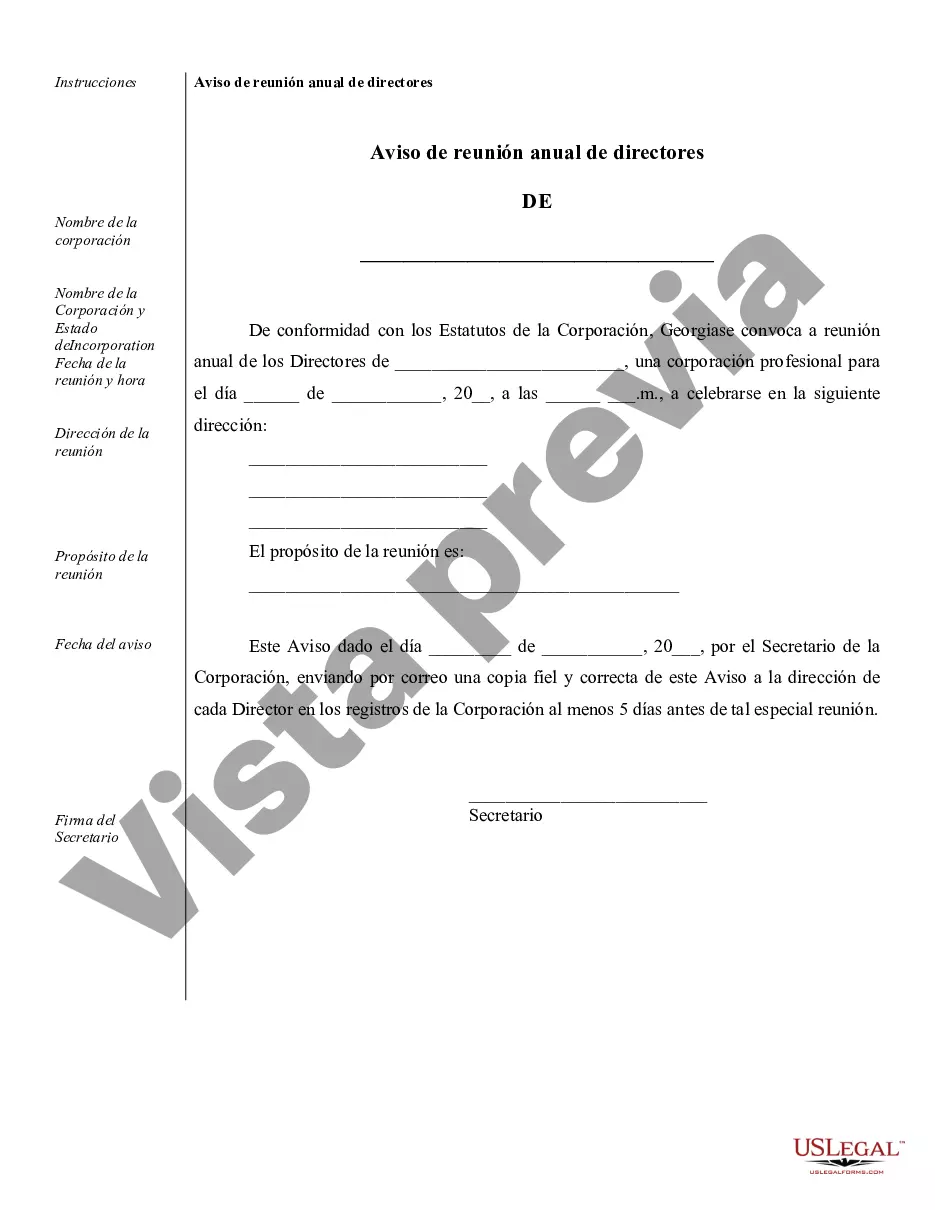

Sandy Springs Sample Corporate Records for a Georgia Professional Corporation are essential documents that record and maintain the legal and financial activities of the corporation. These records provide an organized and detailed account of the corporation's formation, structure, operations, governance, and compliance with state regulations. By maintaining accurate and updated corporate records, the corporation ensures transparency, accountability, and protection of its shareholders and directors. Keywords: Sandy Springs, Sample Corporate Records, Georgia Professional Corporation, legal, financial activities, formation, structure, operations, governance, compliance, state regulations, transparency, accountability, shareholders, directors. Types of Sandy Springs Sample Corporate Records for a Georgia Professional Corporation may include: 1. Articles of Incorporation: This legal document outlines the basic information about the corporation, such as its name, purpose, registered agent, and initial directors. It serves as a foundation for the corporate structure. 2. Bylaws: These are the internal rules and regulations that govern the corporation's daily operations and decision-making processes. Bylaws typically outline the roles and responsibilities of directors and officers, meeting procedures, voting rights, and other important corporate matters. 3. Meeting Minutes: Detailed records of board meetings and shareholder meetings are crucial for documenting major decisions, resolutions, discussions, and voting outcomes. Meeting minutes serve as evidence of compliance and transparency in corporate governance. 4. Shareholder and Director Registers: These registers maintain up-to-date information about the corporation's shareholders and directors, including their names, addresses, shareholdings, and appointment dates. They ensure accurate communication and facilitate legal compliance. 5. Financial Statements: Sandy Springs Sample Corporate Records include financial statements such as balance sheets, income statements, and cash flow statements. These records provide an overview of the corporation's financial health, profitability, and liquidity. 6. Tax Filings: Sandy Springs Sample Corporate Records may also include tax-related documents, such as federal and state tax returns, tax identification numbers, and any correspondence with tax authorities. These records are crucial for compliance with relevant tax laws and regulations. 7. Contracts and Agreements: Any legal contracts, agreements, or leases entered into by the corporation should be documented and included in the corporate records. These may include employment agreements, vendor contracts, lease agreements, and client contracts. It is important for a Georgia Professional Corporation in Sandy Springs to maintain organized and updated corporate records to demonstrate its legitimacy, protect its stakeholders, and ensure compliance with state laws and regulations. These records serve as a valuable resource for internal management, external audits, and potential legal disputes.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Sandy Springs Ejemplos de registros corporativos para una corporación profesional de Georgia - Sample Corporate Records for a Georgia Professional Corporation

State:

Georgia

City:

Sandy Springs

Control #:

GA-PC-CR

Format:

Word

Instant download

Description

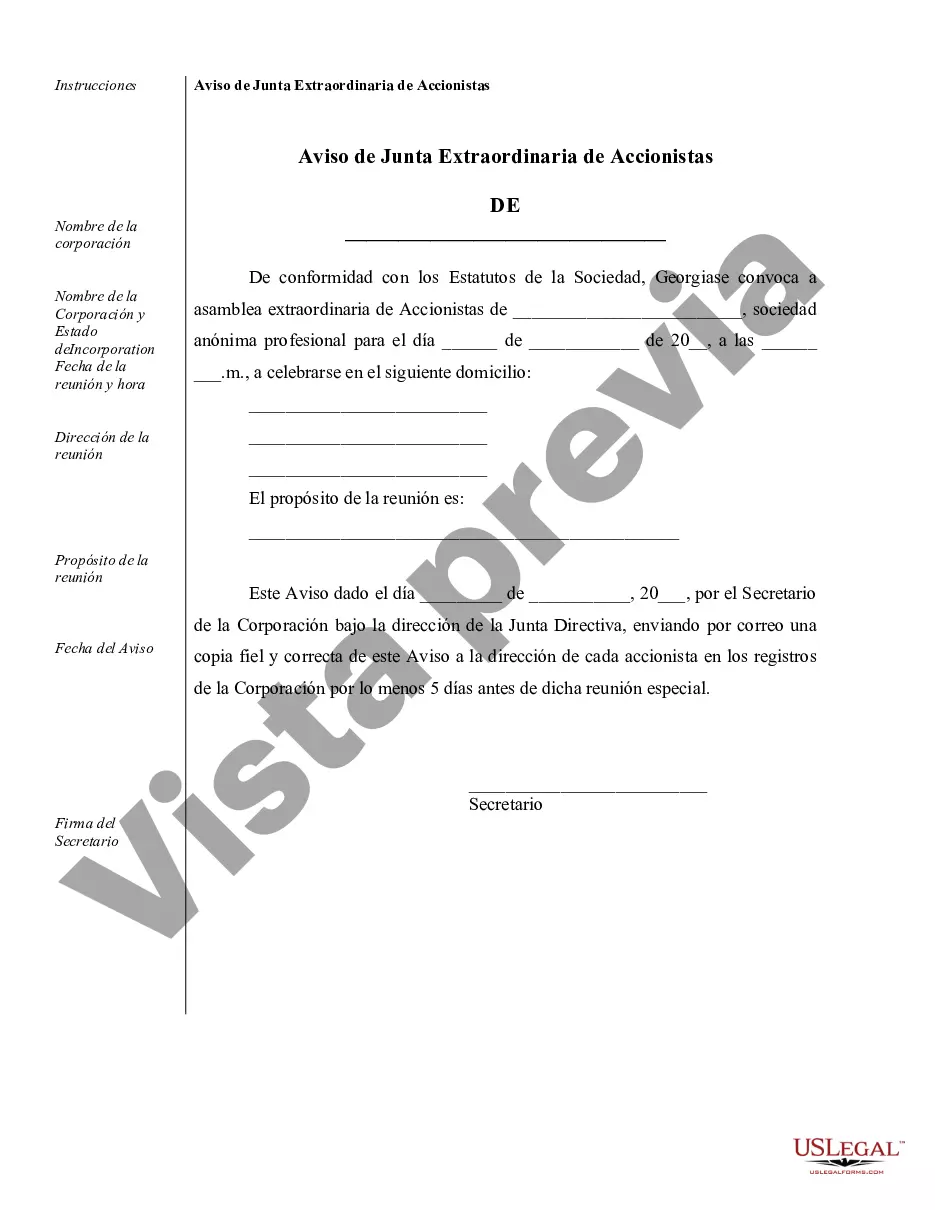

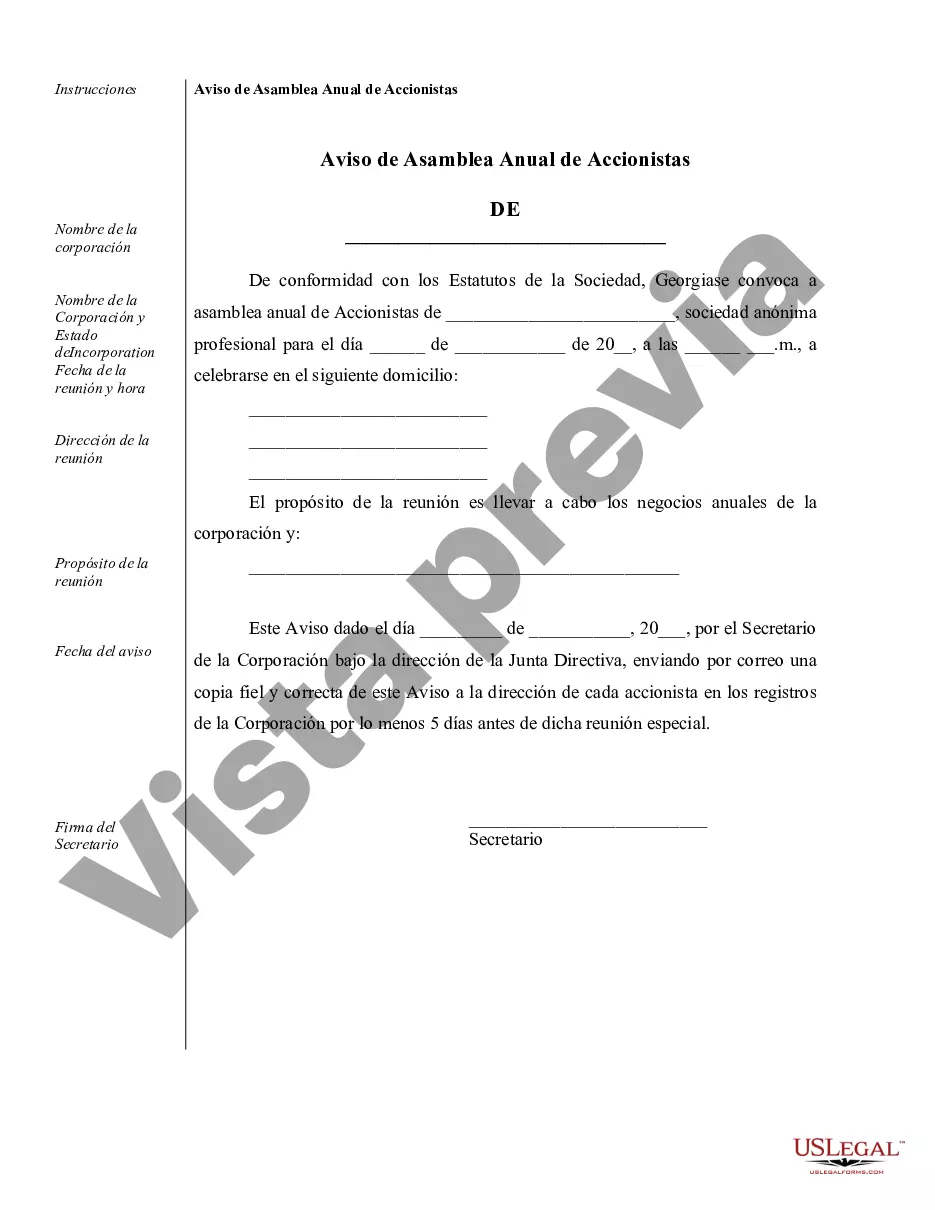

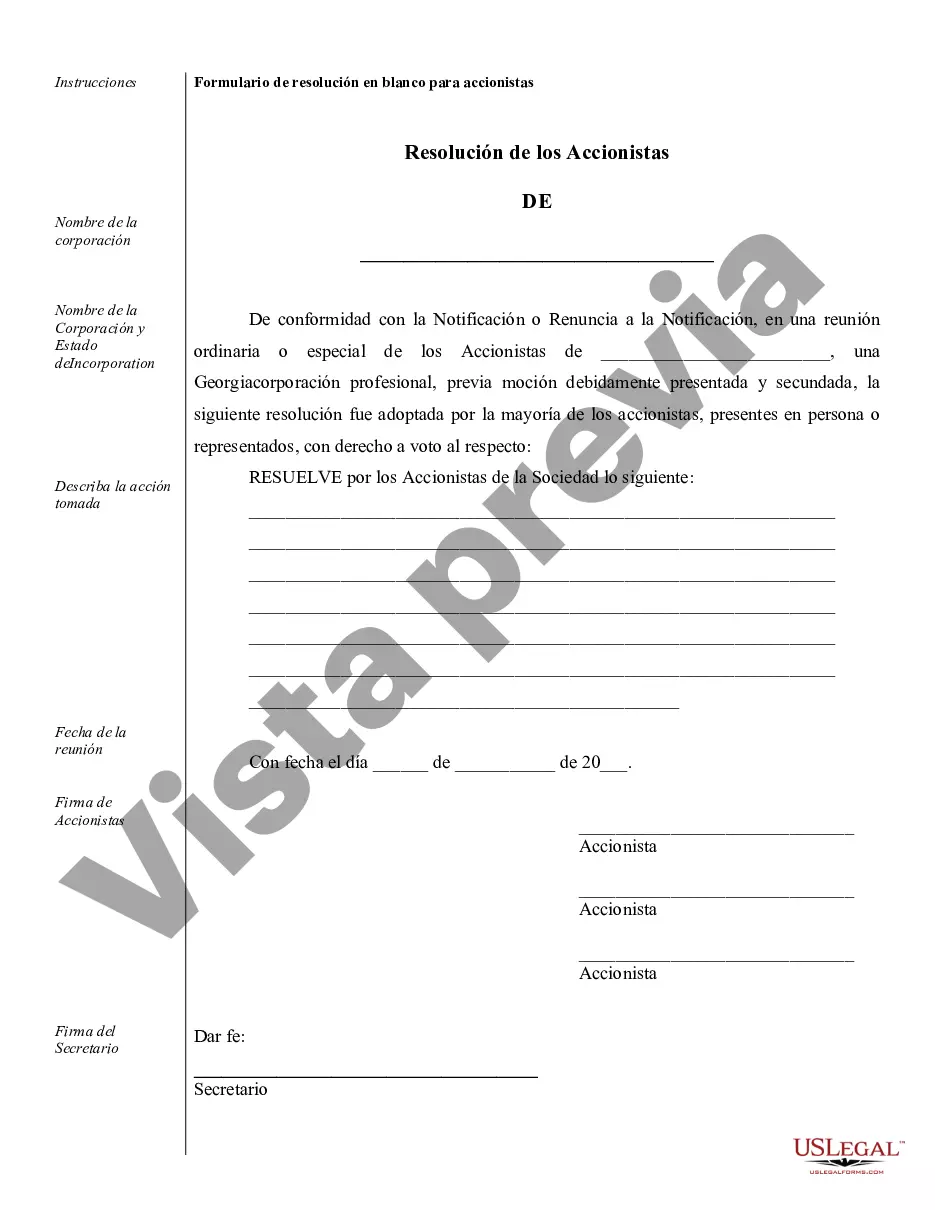

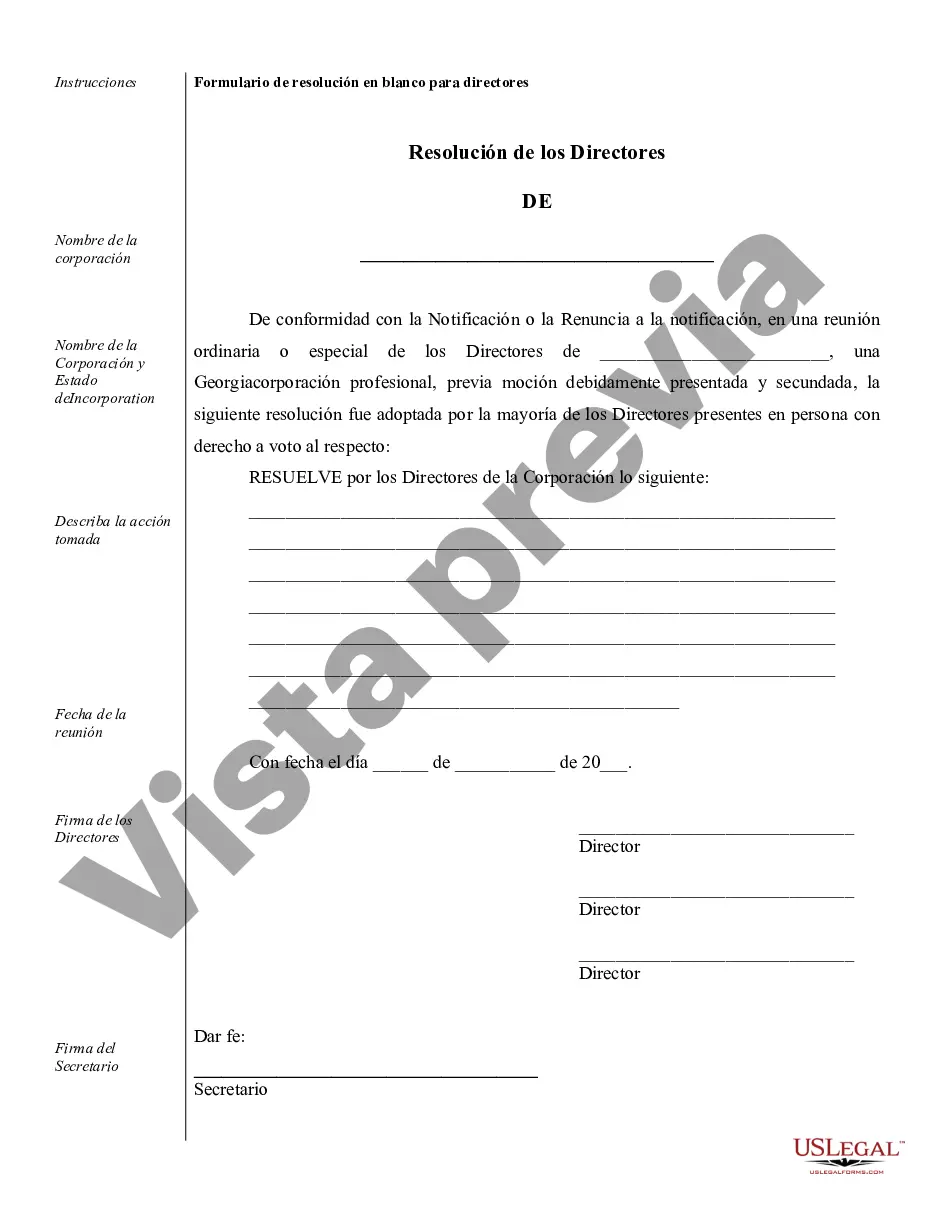

Ejemplos de avisos corporativos de reuniones, resoluciones, libro mayor simple de acciones y certificado.

Sandy Springs Sample Corporate Records for a Georgia Professional Corporation are essential documents that record and maintain the legal and financial activities of the corporation. These records provide an organized and detailed account of the corporation's formation, structure, operations, governance, and compliance with state regulations. By maintaining accurate and updated corporate records, the corporation ensures transparency, accountability, and protection of its shareholders and directors. Keywords: Sandy Springs, Sample Corporate Records, Georgia Professional Corporation, legal, financial activities, formation, structure, operations, governance, compliance, state regulations, transparency, accountability, shareholders, directors. Types of Sandy Springs Sample Corporate Records for a Georgia Professional Corporation may include: 1. Articles of Incorporation: This legal document outlines the basic information about the corporation, such as its name, purpose, registered agent, and initial directors. It serves as a foundation for the corporate structure. 2. Bylaws: These are the internal rules and regulations that govern the corporation's daily operations and decision-making processes. Bylaws typically outline the roles and responsibilities of directors and officers, meeting procedures, voting rights, and other important corporate matters. 3. Meeting Minutes: Detailed records of board meetings and shareholder meetings are crucial for documenting major decisions, resolutions, discussions, and voting outcomes. Meeting minutes serve as evidence of compliance and transparency in corporate governance. 4. Shareholder and Director Registers: These registers maintain up-to-date information about the corporation's shareholders and directors, including their names, addresses, shareholdings, and appointment dates. They ensure accurate communication and facilitate legal compliance. 5. Financial Statements: Sandy Springs Sample Corporate Records include financial statements such as balance sheets, income statements, and cash flow statements. These records provide an overview of the corporation's financial health, profitability, and liquidity. 6. Tax Filings: Sandy Springs Sample Corporate Records may also include tax-related documents, such as federal and state tax returns, tax identification numbers, and any correspondence with tax authorities. These records are crucial for compliance with relevant tax laws and regulations. 7. Contracts and Agreements: Any legal contracts, agreements, or leases entered into by the corporation should be documented and included in the corporate records. These may include employment agreements, vendor contracts, lease agreements, and client contracts. It is important for a Georgia Professional Corporation in Sandy Springs to maintain organized and updated corporate records to demonstrate its legitimacy, protect its stakeholders, and ensure compliance with state laws and regulations. These records serve as a valuable resource for internal management, external audits, and potential legal disputes.

Free preview

How to fill out Sandy Springs Ejemplos De Registros Corporativos Para Una Corporación Profesional De Georgia?

If you’ve already utilized our service before, log in to your account and save the Sandy Springs Sample Corporate Records for a Georgia Professional Corporation on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple actions to obtain your file:

- Make sure you’ve located the right document. Look through the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t fit you, utilize the Search tab above to get the proper one.

- Buy the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Get your Sandy Springs Sample Corporate Records for a Georgia Professional Corporation. Choose the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to every piece of paperwork you have purchased: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to rapidly find and save any template for your individual or professional needs!