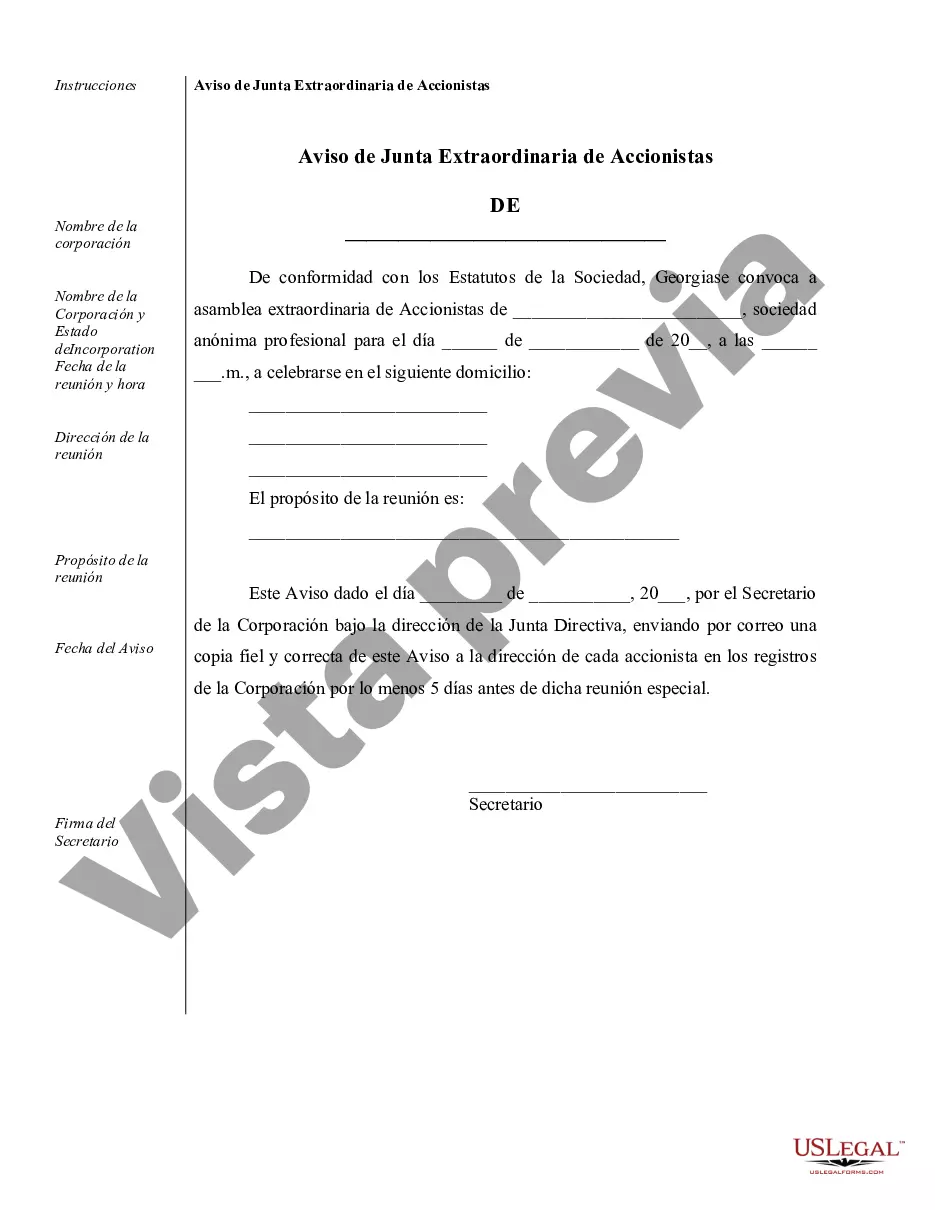

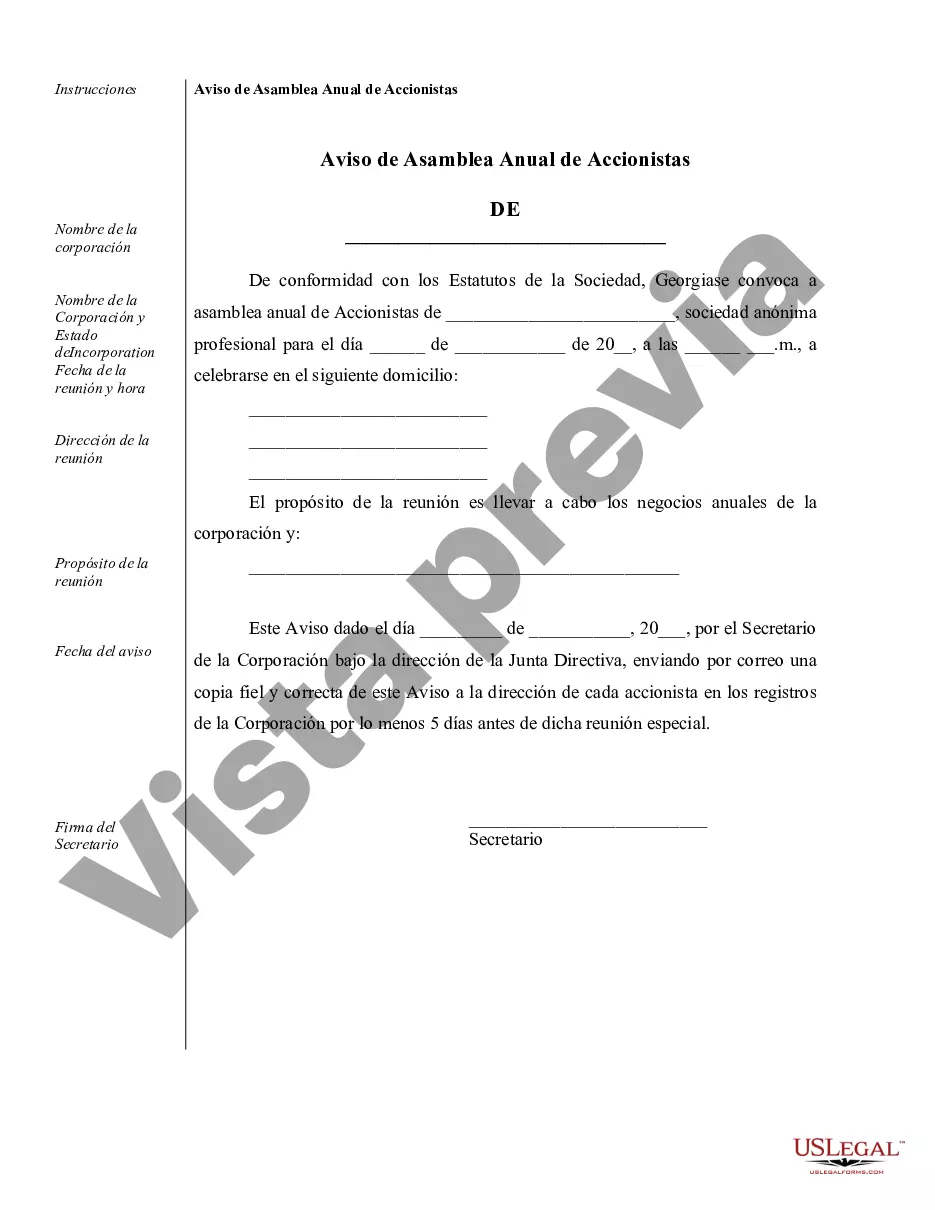

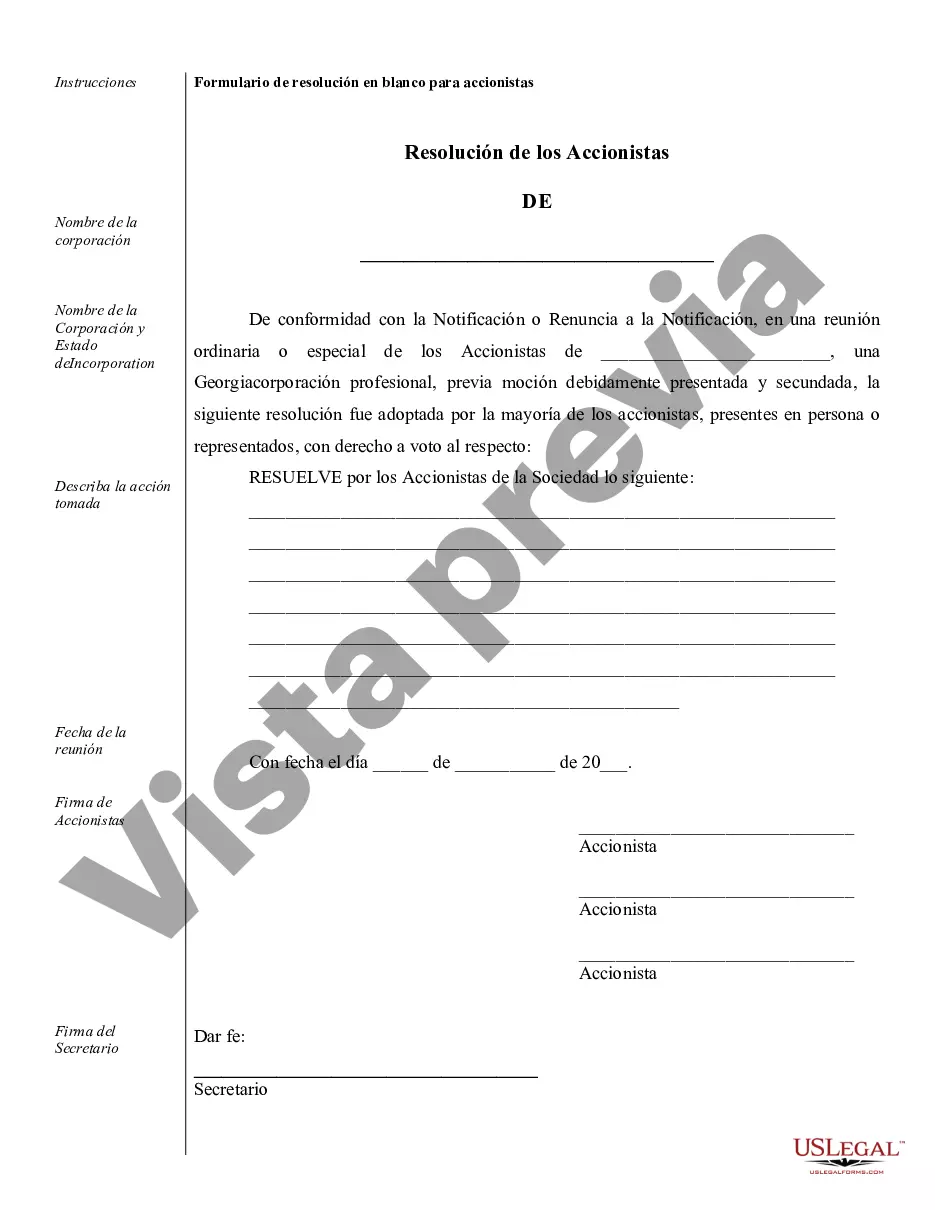

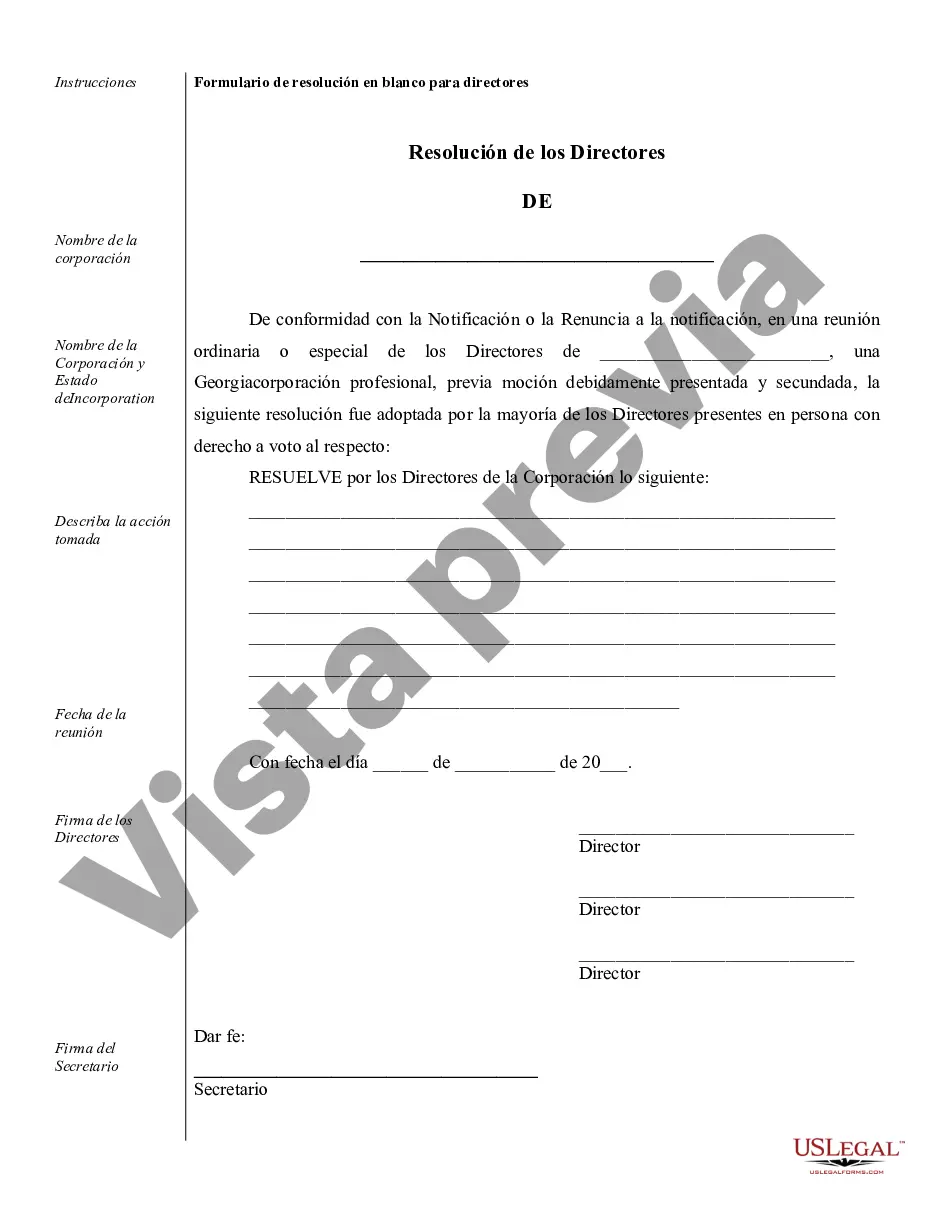

Savannah Sample Corporate Records for a Georgia Professional Corporation are essential documents that help maintain a clear, organized, and legally compliant record of the company's operations. These records are crucial for both internal purposes and when dealing with external entities such as regulatory bodies, investors, or during potential acquisitions. In Georgia, a Professional Corporation (PC) is a specialized business entity that offers professional services and requires specific record-keeping procedures. These Savannah Sample Corporate Records typically include: 1. Articles of Incorporation: This document establishes the existence of the Professional Corporation and includes important details such as the company's name, purpose, registered agent, directors' names, and the number of authorized shares. It serves as a foundation for all other corporate records. 2. Bylaws: The bylaws outline the internal operating rules and regulations of the Professional Corporation. This document covers aspects such as shareholder meetings, governance structure, voting procedures, director and officer roles, and other essential corporate governance details. 3. Shareholder Agreements: These agreements define the rights and obligations of the corporation's shareholders, addressing matters such as share ownership, voting rights, dividend distribution, transfer restrictions, and buy-sell provisions. Shareholder agreements provide clarity and protection for all parties involved. 4. Board of Directors Resolutions: These are written resolutions made by the board of directors concerning significant corporate decisions and actions. They provide a record of decisions related to issues such as the appointment or removal of officers, amendments to the bylaws, approval of financial audits, or any other matters requiring board approval. 5. Meeting Minutes: Meeting minutes document the discussions, decisions, and actions taken during board and shareholder meetings. These records are vital for demonstrating compliance with legal requirements, transparency, and accountability. They also serve as historical references and evidence of corporate decision-making. 6. Annual Reports: Professional Corporations in Georgia are required to file annual reports with the state's Secretary of State. These reports provide an update on the corporation's status, including changes in officers, registered agent, address, and any other required information. Keeping copies of these annual reports in the corporate records is necessary for compliance purposes. 7. Financial Statements: Maintaining financial statements, such as balance sheets, income statements, and cash flow statements, is crucial to demonstrate the corporation's financial health. These records are invaluable for both internal analysis and providing accurate financial information to authorities or potential stakeholders. 8. Contracts and Agreements: This category includes copies of all legally binding contracts and agreements entered into by the Professional Corporation. Examples may include client contracts, vendor agreements, employment contracts, non-disclosure agreements, and lease or purchase agreements. By having these comprehensive Savannah Sample Corporate Records for a Georgia Professional Corporation, businesses can provide evidence of compliance with state regulations, facilitate communication between shareholders, protect the interests of all parties involved, and ensure the long-term success of the entity.

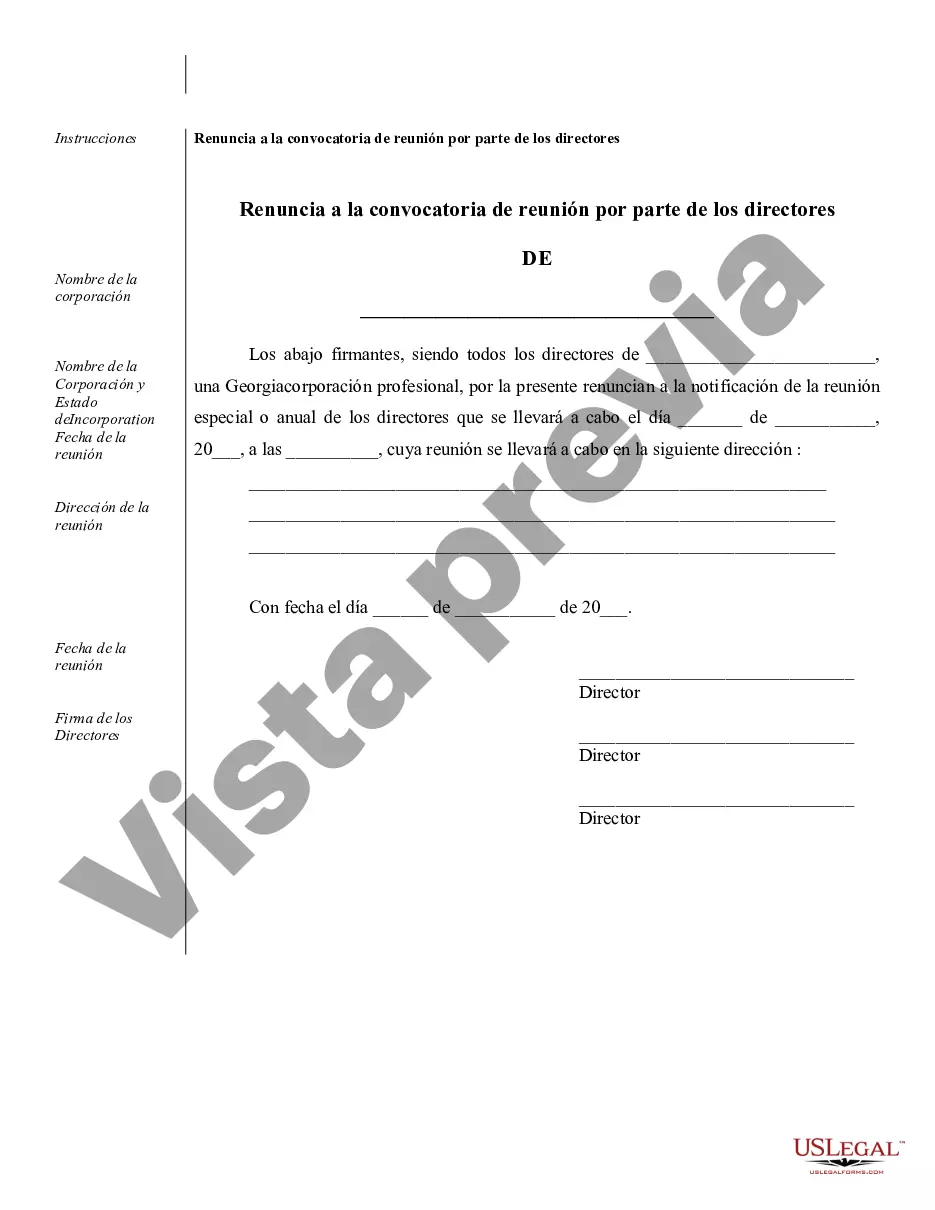

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Savannah Ejemplos de registros corporativos para una corporación profesional de Georgia - Sample Corporate Records for a Georgia Professional Corporation

Description

How to fill out Savannah Ejemplos De Registros Corporativos Para Una Corporación Profesional De Georgia?

Benefit from the US Legal Forms and get instant access to any form you need. Our beneficial platform with thousands of templates makes it simple to find and obtain virtually any document sample you will need. You are able to save, fill, and sign the Savannah Sample Corporate Records for a Georgia Professional Corporation in a few minutes instead of surfing the Net for many hours searching for a proper template.

Using our catalog is a superb way to improve the safety of your record filing. Our experienced lawyers regularly review all the records to ensure that the templates are appropriate for a particular region and compliant with new acts and regulations.

How do you get the Savannah Sample Corporate Records for a Georgia Professional Corporation? If you have a subscription, just log in to the account. The Download button will be enabled on all the documents you view. Moreover, you can find all the earlier saved files in the My Forms menu.

If you haven’t registered a profile yet, follow the tips below:

- Open the page with the form you need. Ensure that it is the template you were seeking: verify its title and description, and make use of the Preview feature if it is available. Otherwise, use the Search field to look for the needed one.

- Launch the downloading procedure. Click Buy Now and choose the pricing plan you prefer. Then, create an account and process your order utilizing a credit card or PayPal.

- Save the document. Pick the format to obtain the Savannah Sample Corporate Records for a Georgia Professional Corporation and modify and fill, or sign it for your needs.

US Legal Forms is probably the most considerable and reliable document libraries on the web. Our company is always happy to assist you in virtually any legal process, even if it is just downloading the Savannah Sample Corporate Records for a Georgia Professional Corporation.

Feel free to take full advantage of our platform and make your document experience as efficient as possible!