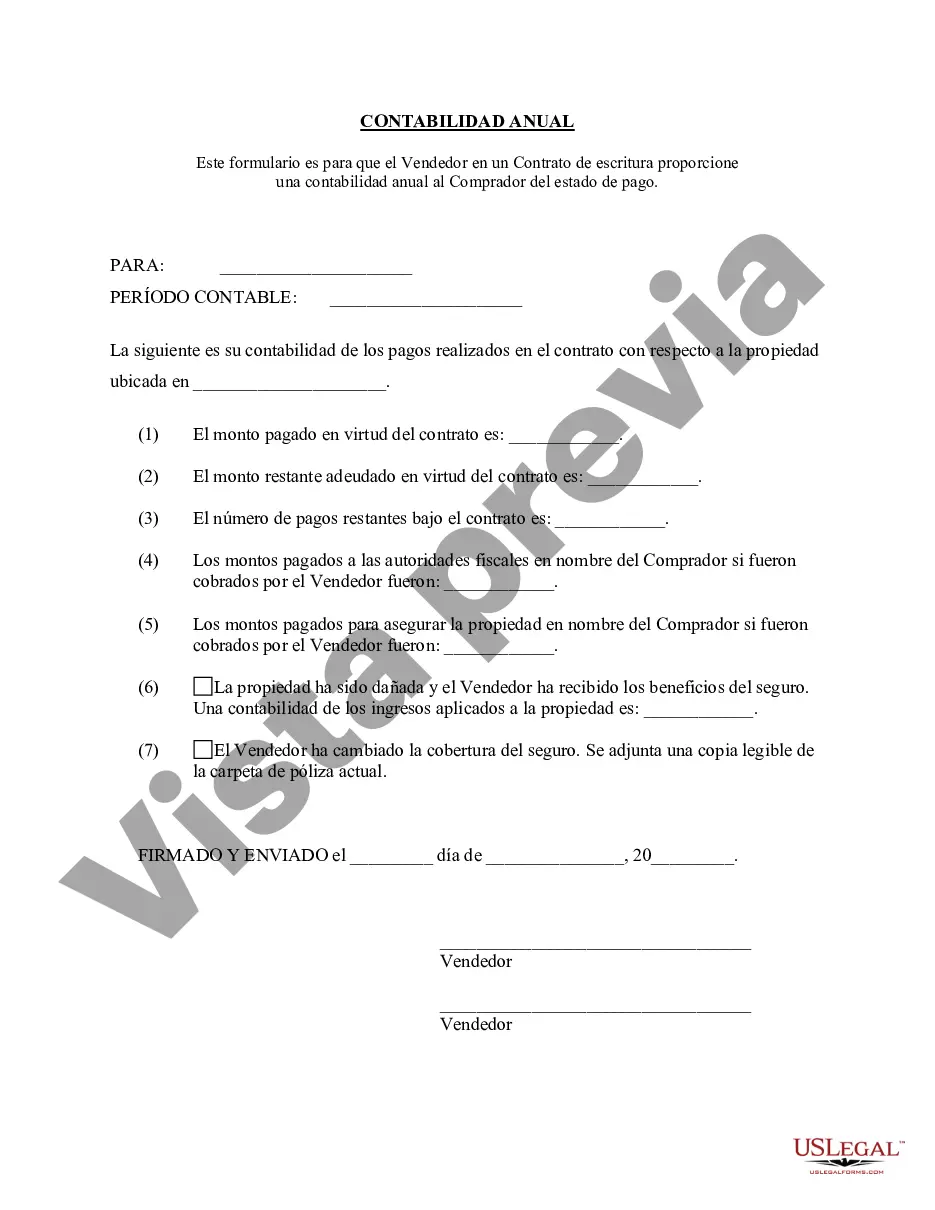

Davenport Iowa Contrato de Escrituración Estado Contable Anual del Vendedor - Iowa Contract for Deed Seller's Annual Accounting Statement

Description

How to fill out Iowa Contrato De Escrituración Estado Contable Anual Del Vendedor?

Are you searching for a trustworthy and affordable legal documents provider to obtain the Davenport Iowa Contract for Deed Seller's Annual Accounting Statement? US Legal Forms is your ideal choice.

Whether you require a fundamental agreement to establish guidelines for living with your partner or a collection of documents to facilitate your divorce through the legal system, we have you covered.

Our site offers more than 85,000 current legal document templates for both personal and business needs. All templates we provide are not universal and are tailored to meet the demands of specific states and regions.

To acquire the document, you must Log In to your account, locate the desired form, and click the Download button next to it. Please remember that you can download any previously purchased form templates at any time from the My documents section.

If the form isn’t suitable for your particular situation, start the search anew.

Now you can sign up for your account. Then choose the subscription plan and proceed with payment. Once the payment is complete, download the Davenport Iowa Contract for Deed Seller's Annual Accounting Statement in any available format. You can return to the site at any time and redownload the document free of charge.

- Is this your first visit to our platform.

- No problem.

- You can easily create an account, but first, ensure you do the following.

- Verify that the Davenport Iowa Contract for Deed Seller's Annual Accounting Statement meets the laws of your state and locality.

- Review the form’s details (if available) to learn who and what the document applies to.