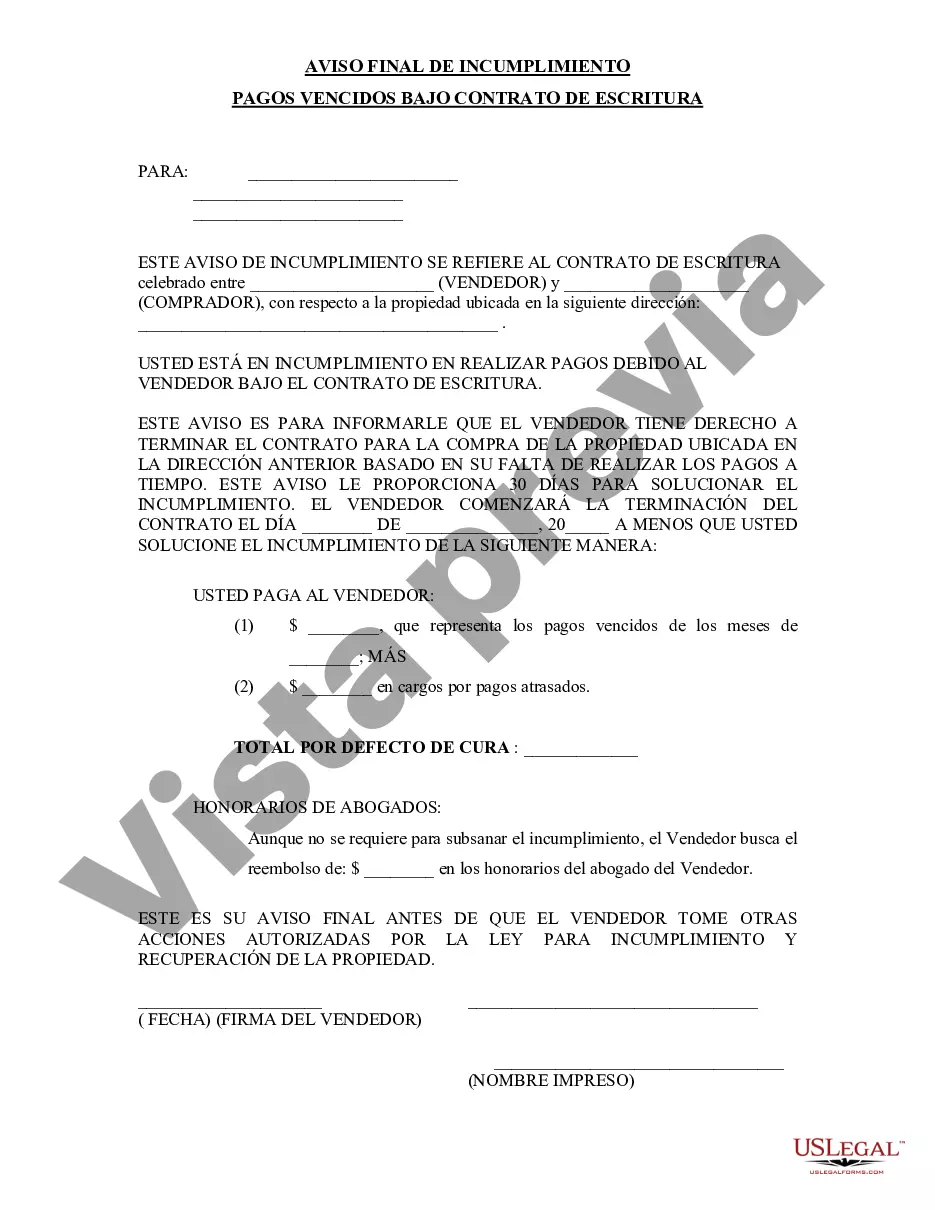

Title: Understanding Davenport Iowa Final Notice of Default for Past Due Payments in Connection with Contract for Deed Keywords: Davenport Iowa, Final Notice of Default, Past Due Payments, Contract for Deed, types Introduction: In the state of Iowa, specifically in Davenport, Final Notices of Default are issued to individuals who have fallen behind on their payments connected to a Contract for Deed. This comprehensive guide aims to provide a detailed description of what a Davenport Iowa Final Notice of Default entails, explaining its significance, implications, and possible outcomes. What is a Final Notice of Default? A Final Notice of Default serves as a formal communication issued by the lender or seller to the buyer under a Contract for Deed agreement, highlighting their failure to make timely payments. It serves as an official warning that the buyer's default has reached a critical phase and legal action may ensue if the payments are not promptly addressed. Key Elements: 1. Tailored Notice: The Davenport Iowa Final Notice of Default is typically customized to include specific details such as the buyer's name, address, property information, amount of overdue payments, and the required action to rectify the default. 2. Clear Statement: The notice explicitly states that the buyer has failed to fulfill their financial obligations as per the terms agreed upon in the Contract for Deed. 3. Grace Period: The notice typically grants a specific period (such as 30 days) for the buyer to bring their payments up to date and avoid further consequences. 4. Legal Consequences: The notice emphasizes the potential legal actions that may be pursued by the lender or seller if the default is not remedied within the provided grace period. Types of Davenport Iowa Final Notice of Default for Past Due Payments: 1. Strict Final Notice: This type of final notice is issued when the buyer has previously received multiple preliminary notices and has failed to address the payment default within the given timeframe. 2. Non-compliance Notice: A final notice is sent when the buyer has breached additional terms of the Contract for Deed apart from non-payment, such as unauthorized property alterations, violation of property use restrictions, or failure to maintain insurance. Possible Outcomes: 1. Legal Proceedings: If the buyer fails to address the payment default within the grace period, the lender or seller has the right to initiate legal proceedings, leading to foreclosure of the property. 2. Work-out Agreement: In some cases, the buyer may negotiate with the lender or seller to establish a work-out agreement, such as modifying the payment terms or extending the repayment schedule to prevent foreclosure. 3. Voluntary Property Transfer: If the buyer is unable to rectify the default, they may voluntarily transfer the property back to the seller, resulting in the cancellation of the Contract for Deed. Conclusion: Receiving a Davenport Iowa Final Notice of Default for Past Due Payments in connection with a Contract for Deed is a significant indication that immediate action is required to rectify the default. Buyers should carefully review the notice, seek professional legal advice, and explore all available options to avoid the serious consequences of foreclosure.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Davenport Iowa Aviso final de incumplimiento de pagos vencidos en relación con el contrato de escritura - Iowa Final Notice of Default for Past Due Payments in connection with Contract for Deed

Description

How to fill out Davenport Iowa Aviso Final De Incumplimiento De Pagos Vencidos En Relación Con El Contrato De Escritura?

Are you looking for a reliable and affordable legal forms provider to buy the Davenport Iowa Final Notice of Default for Past Due Payments in connection with Contract for Deed? US Legal Forms is your go-to option.

No matter if you require a basic agreement to set regulations for cohabitating with your partner or a package of forms to move your separation or divorce through the court, we got you covered. Our website provides over 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t generic and framed in accordance with the requirements of separate state and county.

To download the document, you need to log in account, find the required form, and hit the Download button next to it. Please keep in mind that you can download your previously purchased form templates anytime in the My Forms tab.

Is the first time you visit our platform? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Find out if the Davenport Iowa Final Notice of Default for Past Due Payments in connection with Contract for Deed conforms to the regulations of your state and local area.

- Go through the form’s description (if provided) to find out who and what the document is intended for.

- Restart the search if the form isn’t suitable for your legal situation.

Now you can register your account. Then pick the subscription option and proceed to payment. As soon as the payment is done, download the Davenport Iowa Final Notice of Default for Past Due Payments in connection with Contract for Deed in any provided file format. You can get back to the website when you need and redownload the document without any extra costs.

Finding up-to-date legal forms has never been easier. Give US Legal Forms a go today, and forget about spending hours learning about legal paperwork online once and for all.