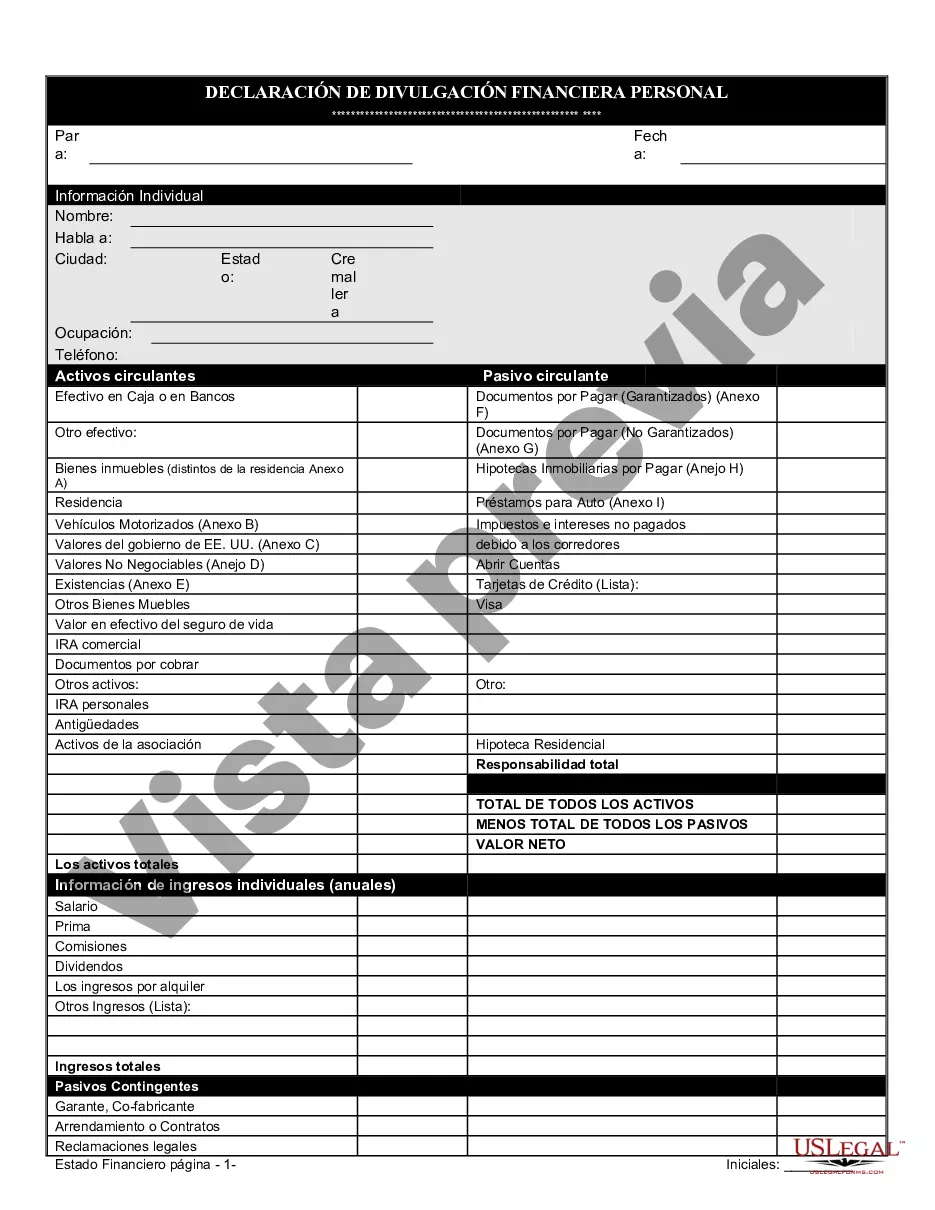

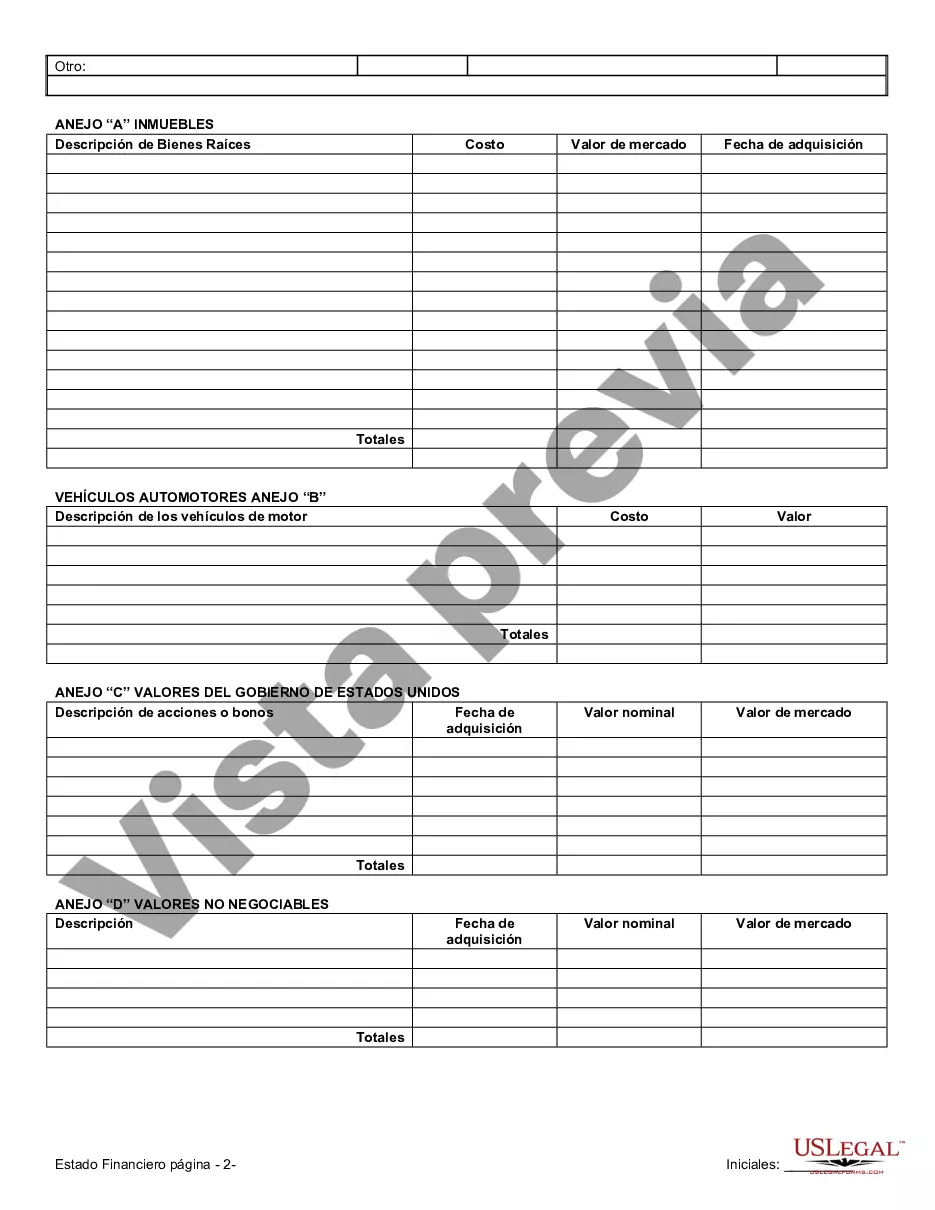

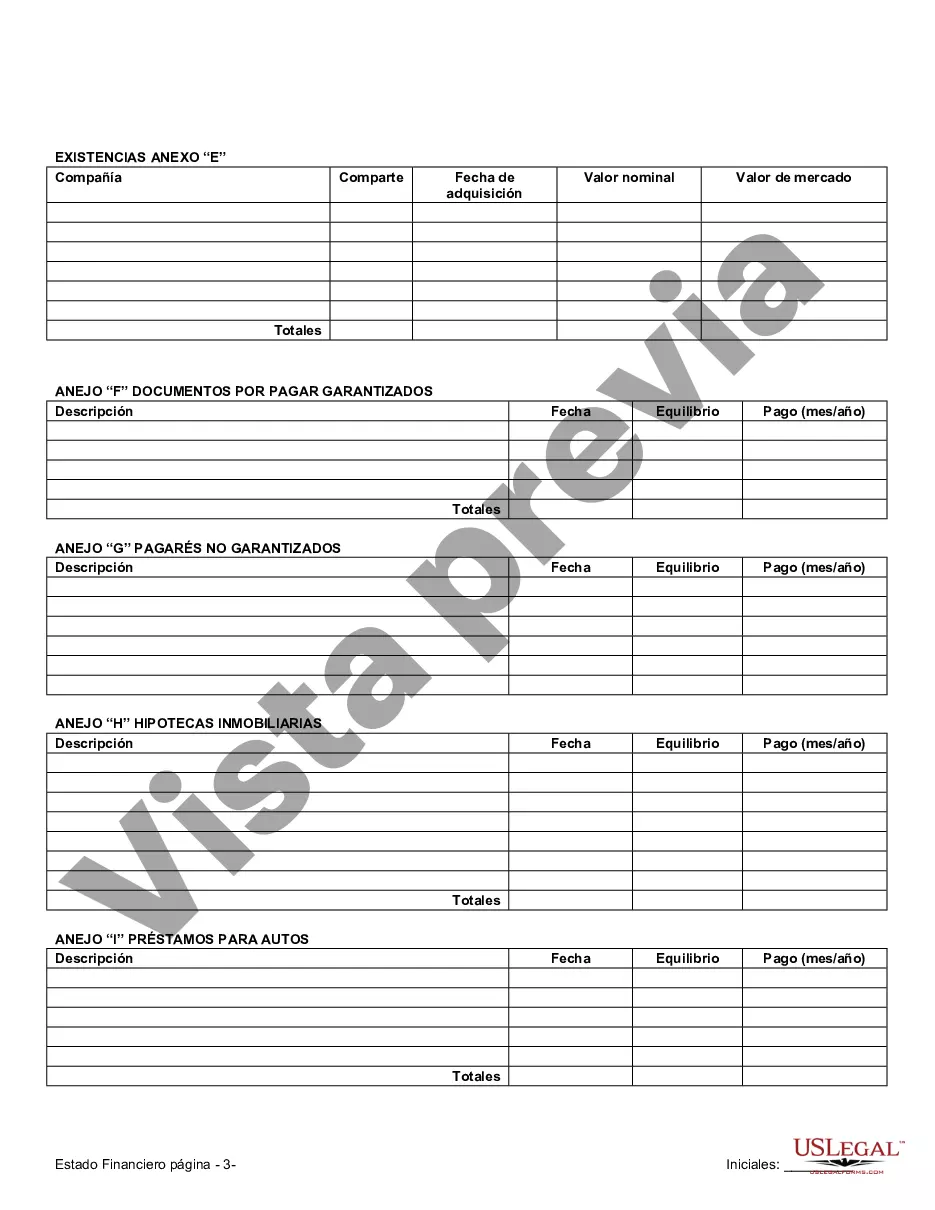

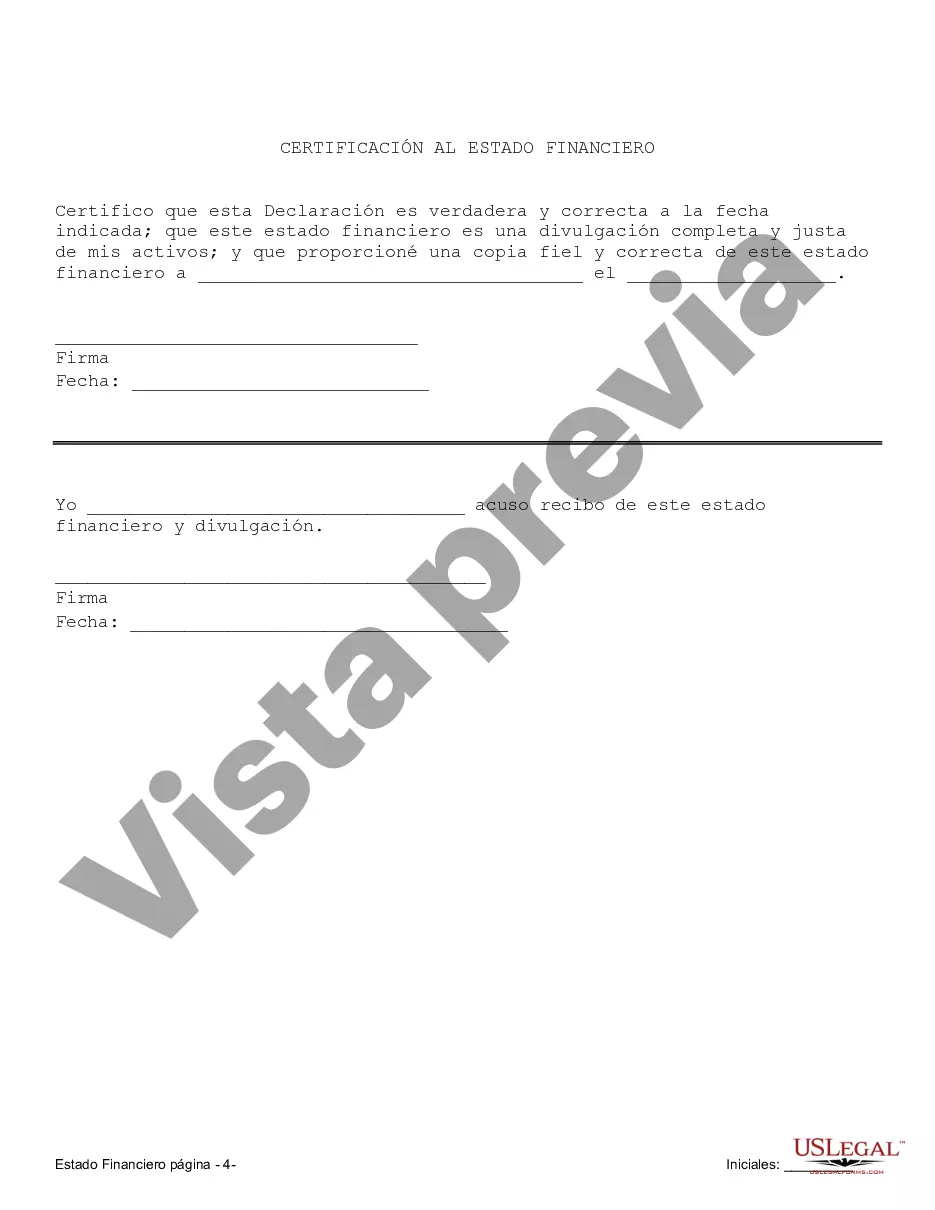

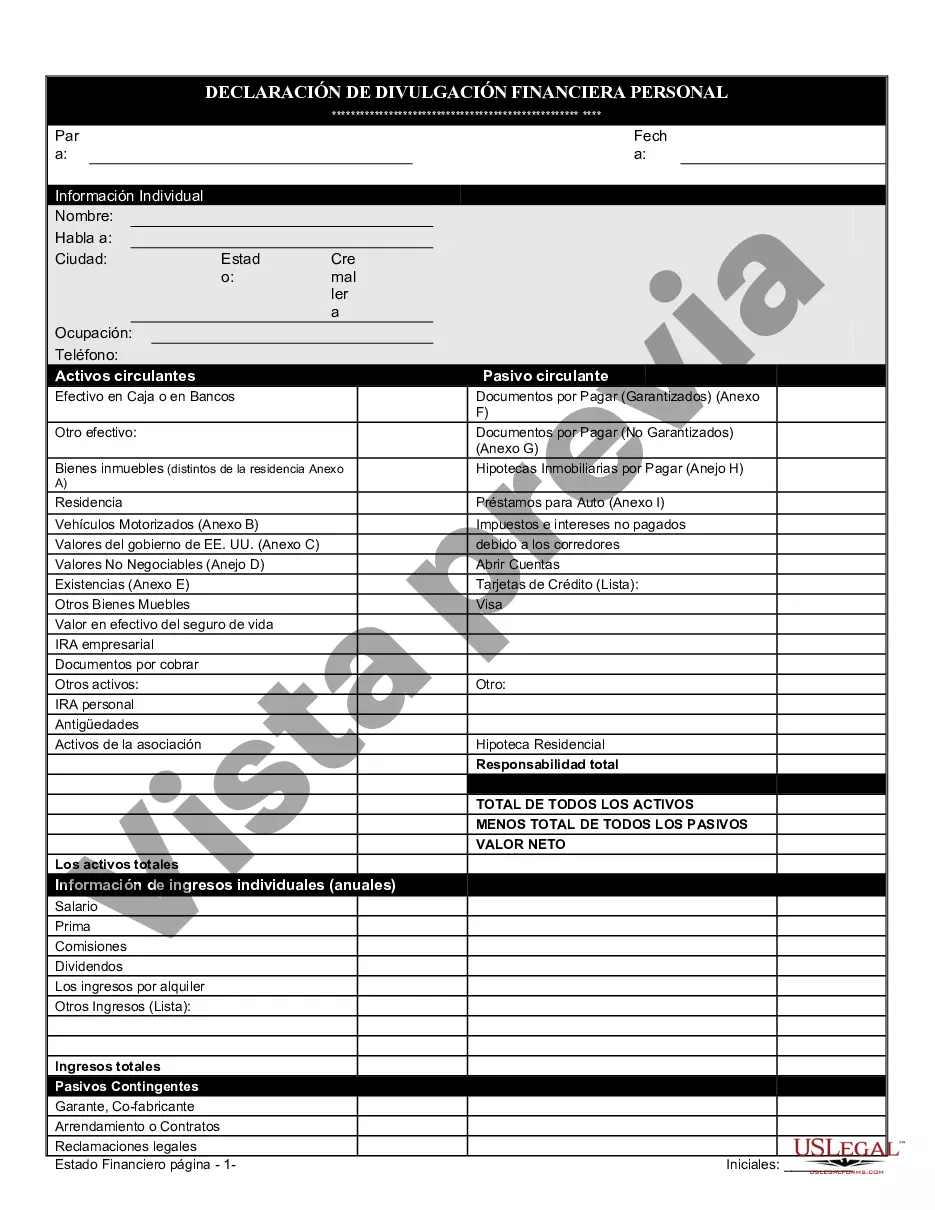

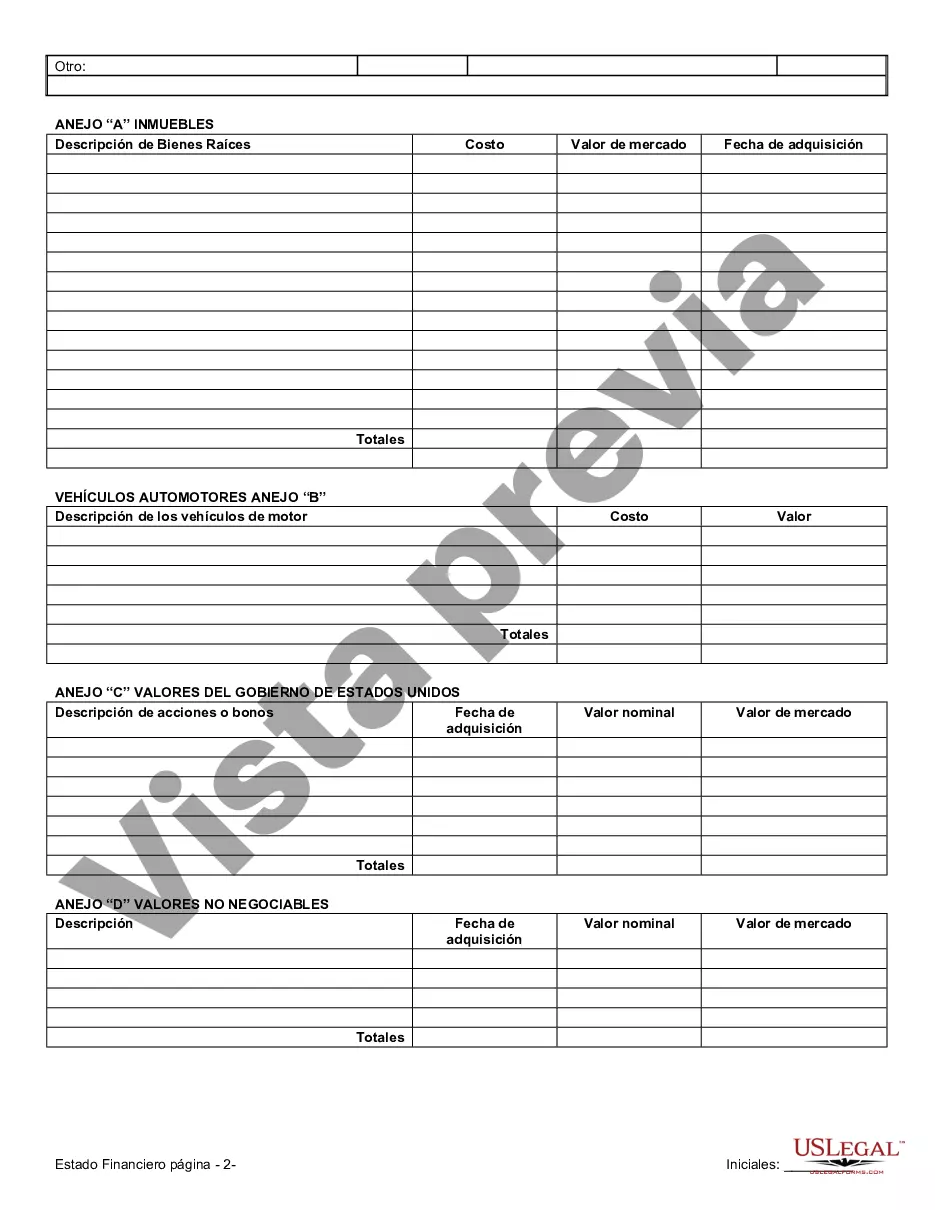

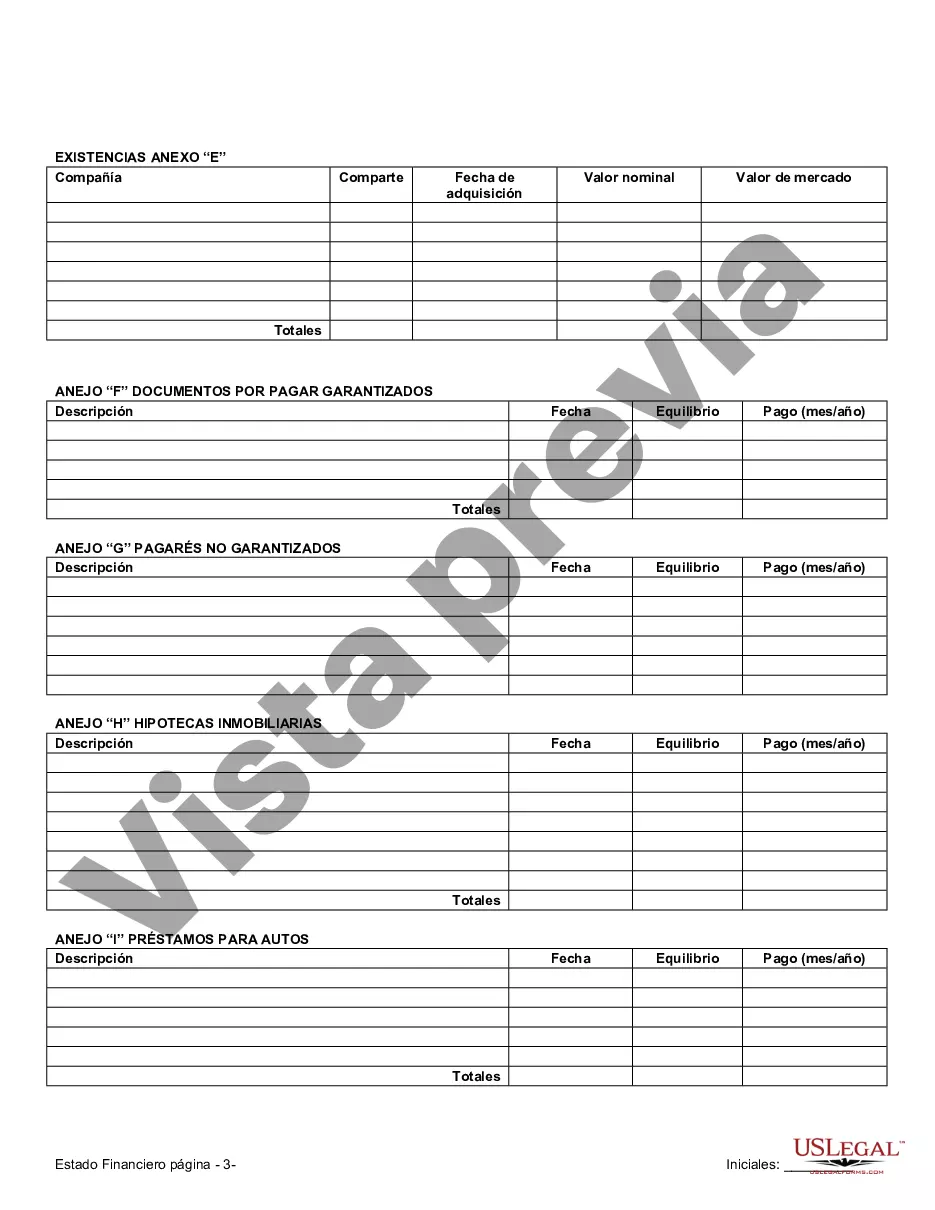

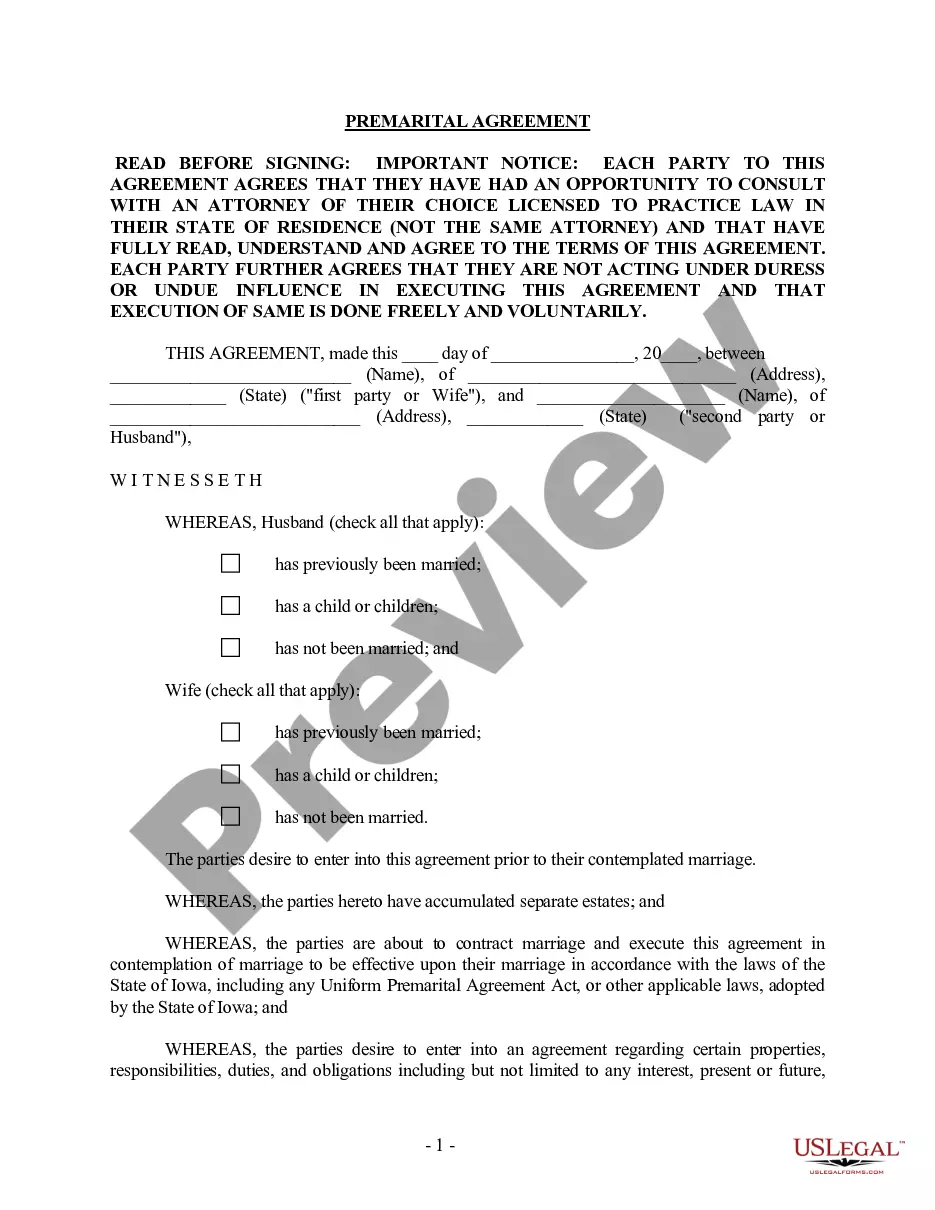

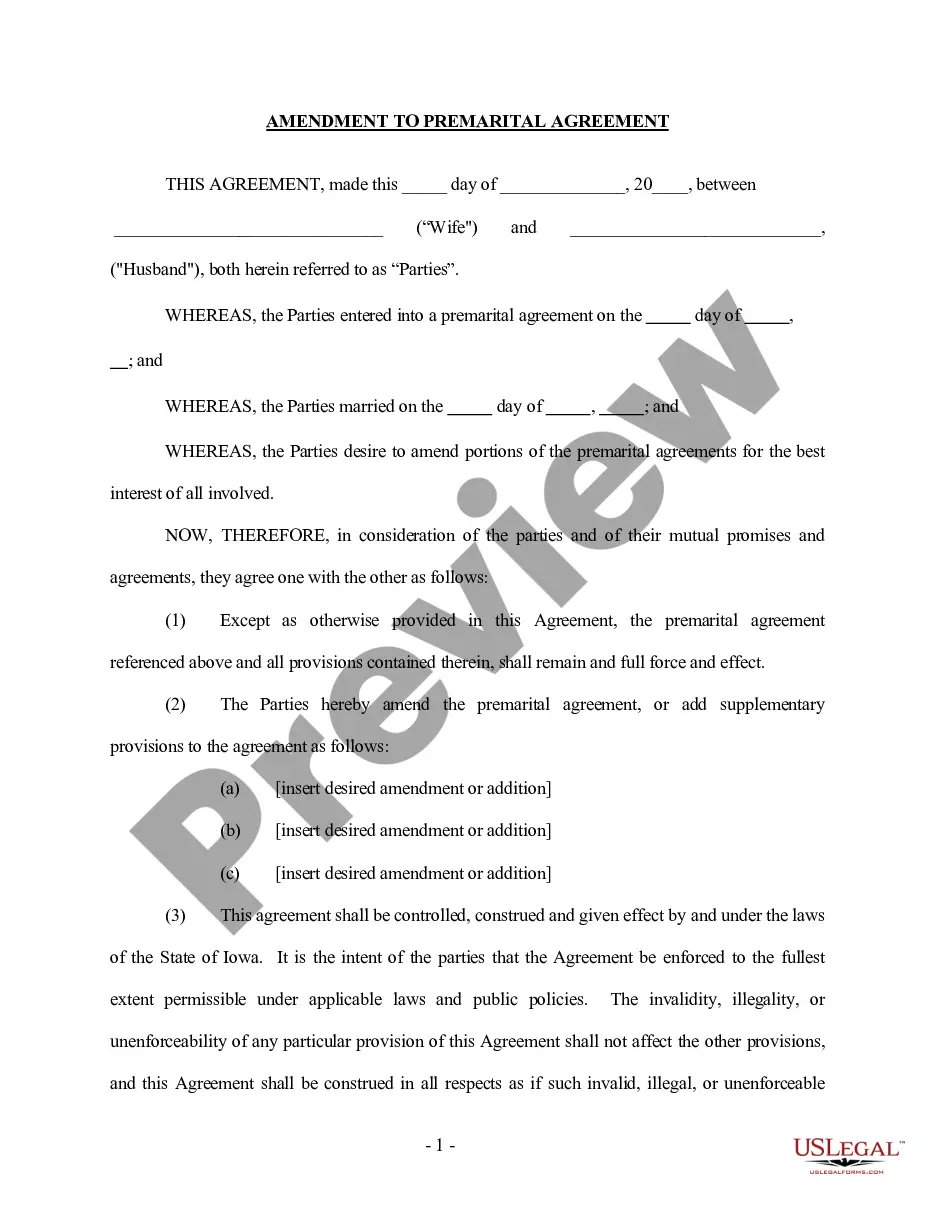

When entering into a prenuptial or premarital agreement in Cedar Rapids, Iowa, it is essential to understand the role and importance of financial statements. These statements provide a comprehensive overview of the financial situation of each spouse before entering into the marriage. They are crucial in establishing transparency, ensuring fair distribution of assets in case of divorce, and protecting both parties' financial interests. Let's delve into the different types of Cedar Rapids Iowa financial statements commonly used in prenuptial or premarital agreements. 1. Personal Financial Statement: This document outlines an individual's financial standing, including their assets, liabilities, income, and expenses. It helps determine each spouse's respective worth before entering into marriage. 2. Bank Statements: To verify the accuracy of financial information provided, bank statements serve as concrete evidence of each spouse's financial transactions, account balances, and history. 3. Investment Account Statements: Such statements highlight the value, performance, and nature of investment accounts held by each spouse. This may include stocks, bonds, mutual funds, retirement accounts, or any other investment vehicles. 4. Real Estate Documents: These documents encompass property deeds, mortgage statements, and property tax records. They disclose the value and ownership details of real estate assets. 5. Business Financial Statements: In cases where one or both spouses own a business or have ownership stakes, financial statements related to the business become relevant. This may include income statements, balance sheets, cash flow statements, and tax returns. 6. Debts and Liabilities Statements: A thorough assessment of debts and liabilities is crucial when drafting a prenuptial or premarital agreement. This may encompass credit card balances, loans, mortgages, car loans, or any other liabilities. 7. Tax Returns: Past tax returns provide insight into each spouse's income, deductions, and financial history. They play a crucial role in understanding the financial circumstances of both parties. It is important to note that each financial statement should be up-to-date and accurate to ensure the agreement's validity and reliability. Working with a qualified financial advisor or attorney experienced in Cedar Rapids, Iowa family law is highly recommended ensuring the completeness and legality of these financial statements within the context of a prenuptial or premarital agreement. By addressing these financial aspects upfront, couples can establish a solid foundation based on transparency, trust, and the protection of their financial well-being in the event of a divorce.

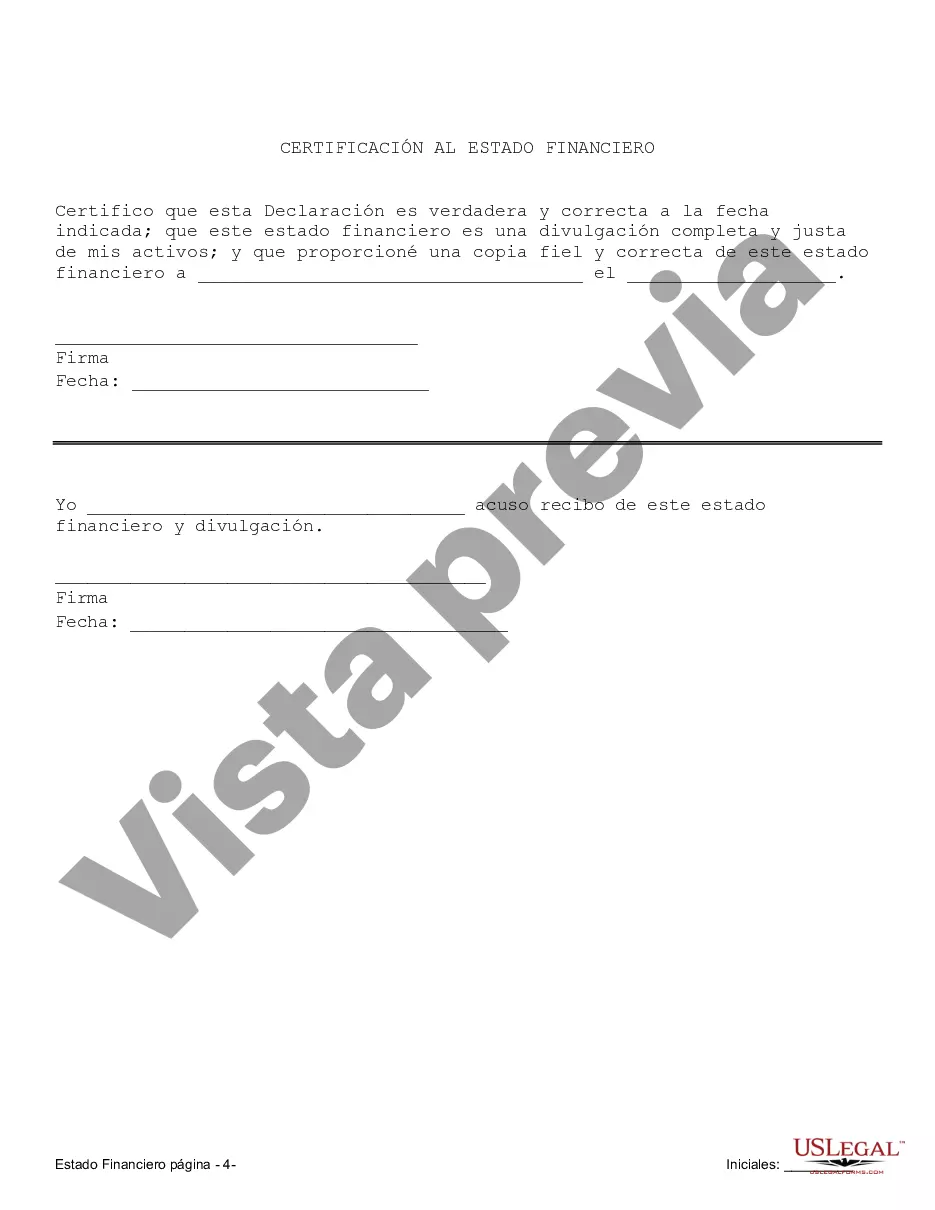

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cedar Rapids Iowa Estados financieros solo en relación con el acuerdo prematrimonial prenupcial - Iowa Financial Statements only in Connection with Prenuptial Premarital Agreement

State:

Iowa

City:

Cedar Rapids

Control #:

IA-00590-D

Format:

Word

Instant download

Description

Incluye dos estados financieros.

When entering into a prenuptial or premarital agreement in Cedar Rapids, Iowa, it is essential to understand the role and importance of financial statements. These statements provide a comprehensive overview of the financial situation of each spouse before entering into the marriage. They are crucial in establishing transparency, ensuring fair distribution of assets in case of divorce, and protecting both parties' financial interests. Let's delve into the different types of Cedar Rapids Iowa financial statements commonly used in prenuptial or premarital agreements. 1. Personal Financial Statement: This document outlines an individual's financial standing, including their assets, liabilities, income, and expenses. It helps determine each spouse's respective worth before entering into marriage. 2. Bank Statements: To verify the accuracy of financial information provided, bank statements serve as concrete evidence of each spouse's financial transactions, account balances, and history. 3. Investment Account Statements: Such statements highlight the value, performance, and nature of investment accounts held by each spouse. This may include stocks, bonds, mutual funds, retirement accounts, or any other investment vehicles. 4. Real Estate Documents: These documents encompass property deeds, mortgage statements, and property tax records. They disclose the value and ownership details of real estate assets. 5. Business Financial Statements: In cases where one or both spouses own a business or have ownership stakes, financial statements related to the business become relevant. This may include income statements, balance sheets, cash flow statements, and tax returns. 6. Debts and Liabilities Statements: A thorough assessment of debts and liabilities is crucial when drafting a prenuptial or premarital agreement. This may encompass credit card balances, loans, mortgages, car loans, or any other liabilities. 7. Tax Returns: Past tax returns provide insight into each spouse's income, deductions, and financial history. They play a crucial role in understanding the financial circumstances of both parties. It is important to note that each financial statement should be up-to-date and accurate to ensure the agreement's validity and reliability. Working with a qualified financial advisor or attorney experienced in Cedar Rapids, Iowa family law is highly recommended ensuring the completeness and legality of these financial statements within the context of a prenuptial or premarital agreement. By addressing these financial aspects upfront, couples can establish a solid foundation based on transparency, trust, and the protection of their financial well-being in the event of a divorce.

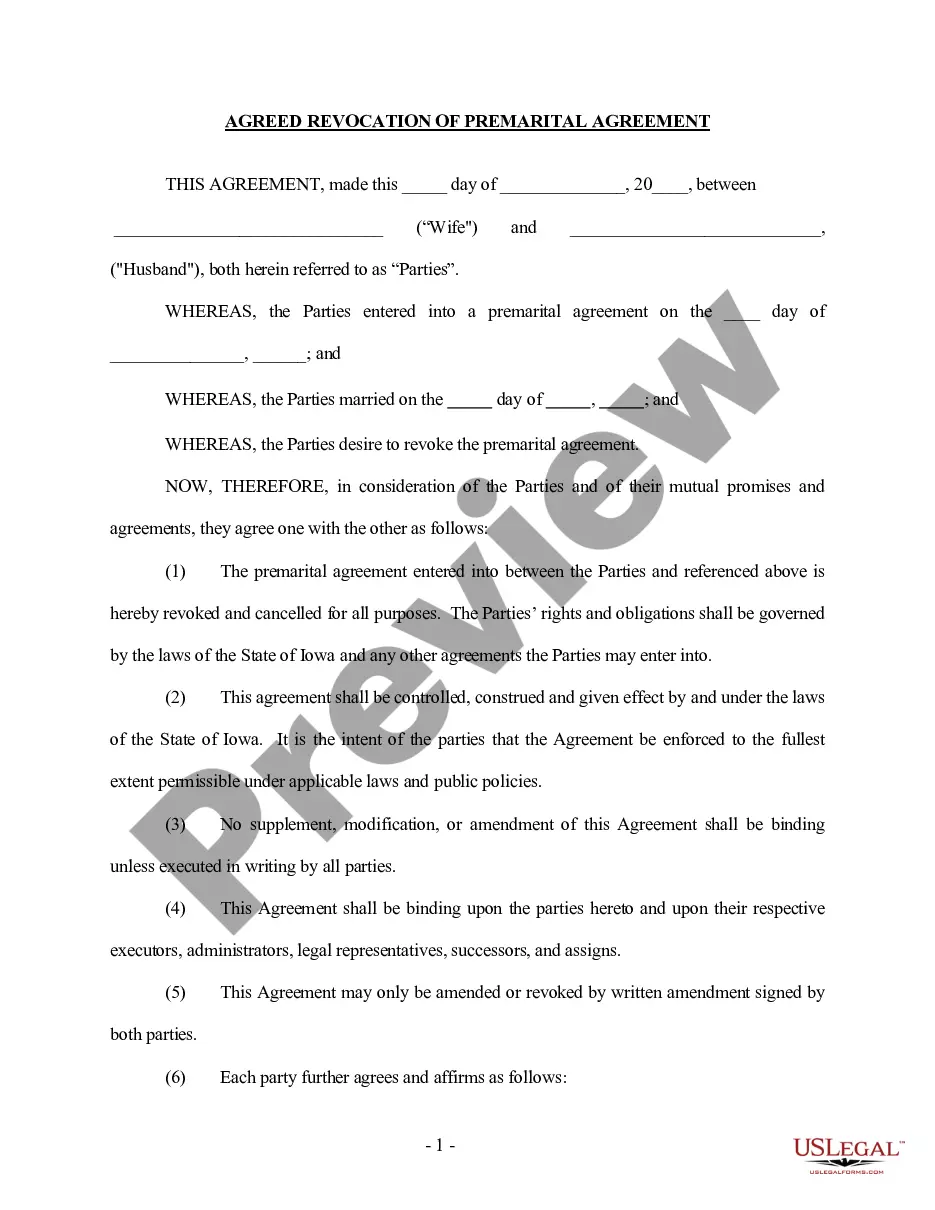

Free preview

How to fill out Cedar Rapids Iowa Estados Financieros Solo En Relación Con El Acuerdo Prematrimonial Prenupcial?

If you’ve already utilized our service before, log in to your account and download the Cedar Rapids Iowa Financial Statements only in Connection with Prenuptial Premarital Agreement on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple steps to obtain your file:

- Make sure you’ve located a suitable document. Look through the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t fit you, utilize the Search tab above to find the proper one.

- Buy the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Obtain your Cedar Rapids Iowa Financial Statements only in Connection with Prenuptial Premarital Agreement. Select the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have purchased: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your individual or professional needs!