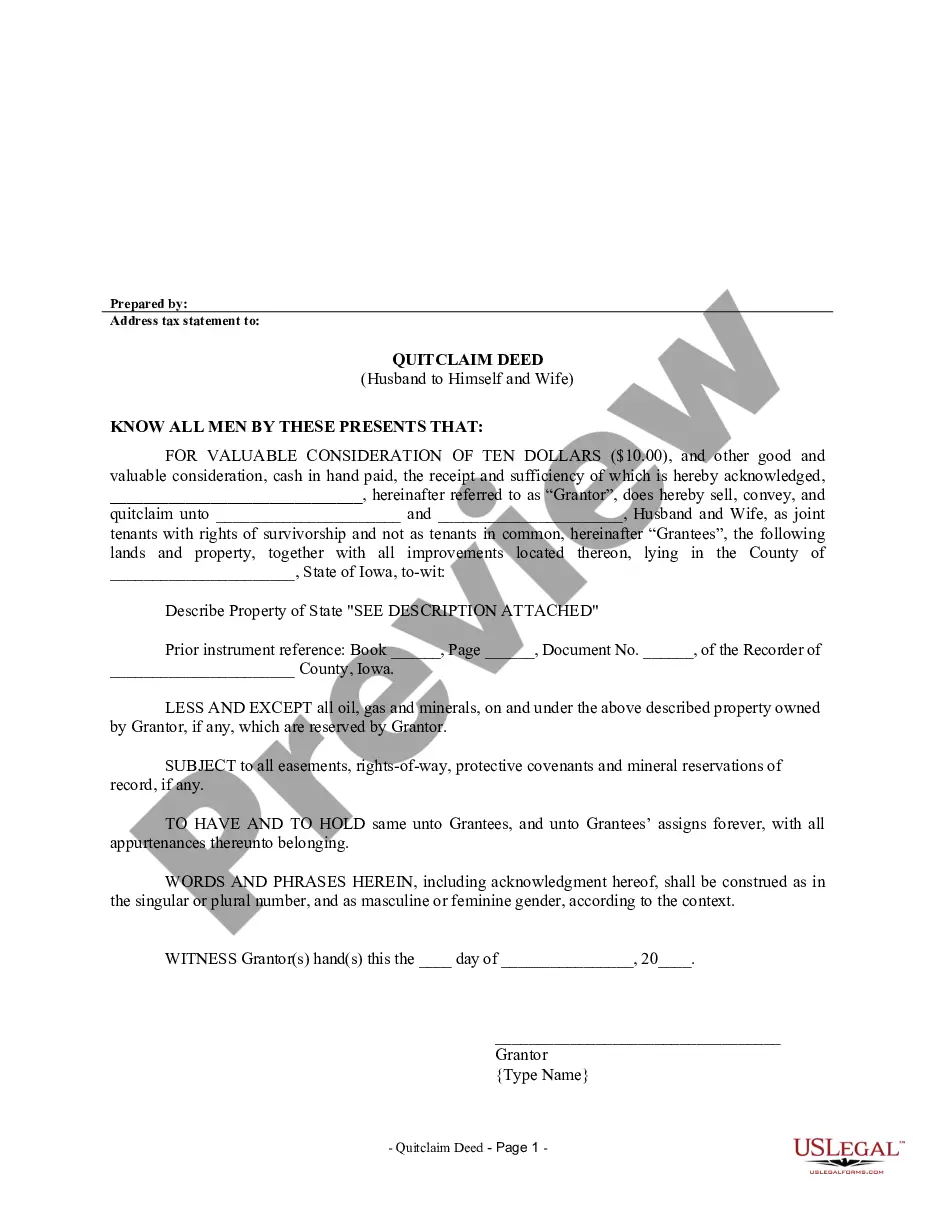

This Quitclaim Deed from Husband to Himself and Wife form is a Quitclaim Deed where the Grantor is the husband and the Grantees are the husband and his wife. Grantors convey and quitclaim the described property to Grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors. This deed complies with all state statutory laws.

A quitclaim deed is a legal document commonly used in real estate transactions to transfer property ownership from one party to another. In the context of Cedar Rapids, Iowa, a quitclaim deed from a husband to himself and his wife refers to the transfer of property ownership rights from the husband, acting individually, to himself and his spouse jointly. This type of deed ensures that both the husband and wife become co-owners with equal rights and responsibilities. The Cedar Rapids Iowa Quitclaim Deed from Husband to Himself and Wife is a legally binding document that solidifies the transfer of property ownership within the jurisdiction of Cedar Rapids, Iowa. By executing this deed, the husband effectively relinquishes his individual ownership rights over the property and conveys the title to both himself and his wife jointly. This quitclaim deed serves to protect the rights of both the husband and wife, ensuring that they both have equal claims and interests in the property. All terms and conditions regarding the transfer of ownership, such as the property description, legal boundaries, and any encumbrances, will be clearly outlined in the deed. It is worth noting that there aren't different types of Cedar Rapids Iowa Quitclaim Deed from Husband to Himself and Wife, as it refers to a specific scenario where the husband transfers sole ownership to himself and his spouse jointly. However, variations in the language and specific details of the deed may arise depending on individual circumstances, such as the purpose of the transfer, the presence of mortgages or liens, and any other unique considerations. When creating a Cedar Rapids Iowa Quitclaim Deed from Husband to Himself and Wife, it is crucial to consult with a qualified attorney or a real estate professional who is knowledgeable about Iowa state laws. This ensures that all legal requirements are met, and the deed accurately reflects the intended transfer of property ownership.A quitclaim deed is a legal document commonly used in real estate transactions to transfer property ownership from one party to another. In the context of Cedar Rapids, Iowa, a quitclaim deed from a husband to himself and his wife refers to the transfer of property ownership rights from the husband, acting individually, to himself and his spouse jointly. This type of deed ensures that both the husband and wife become co-owners with equal rights and responsibilities. The Cedar Rapids Iowa Quitclaim Deed from Husband to Himself and Wife is a legally binding document that solidifies the transfer of property ownership within the jurisdiction of Cedar Rapids, Iowa. By executing this deed, the husband effectively relinquishes his individual ownership rights over the property and conveys the title to both himself and his wife jointly. This quitclaim deed serves to protect the rights of both the husband and wife, ensuring that they both have equal claims and interests in the property. All terms and conditions regarding the transfer of ownership, such as the property description, legal boundaries, and any encumbrances, will be clearly outlined in the deed. It is worth noting that there aren't different types of Cedar Rapids Iowa Quitclaim Deed from Husband to Himself and Wife, as it refers to a specific scenario where the husband transfers sole ownership to himself and his spouse jointly. However, variations in the language and specific details of the deed may arise depending on individual circumstances, such as the purpose of the transfer, the presence of mortgages or liens, and any other unique considerations. When creating a Cedar Rapids Iowa Quitclaim Deed from Husband to Himself and Wife, it is crucial to consult with a qualified attorney or a real estate professional who is knowledgeable about Iowa state laws. This ensures that all legal requirements are met, and the deed accurately reflects the intended transfer of property ownership.