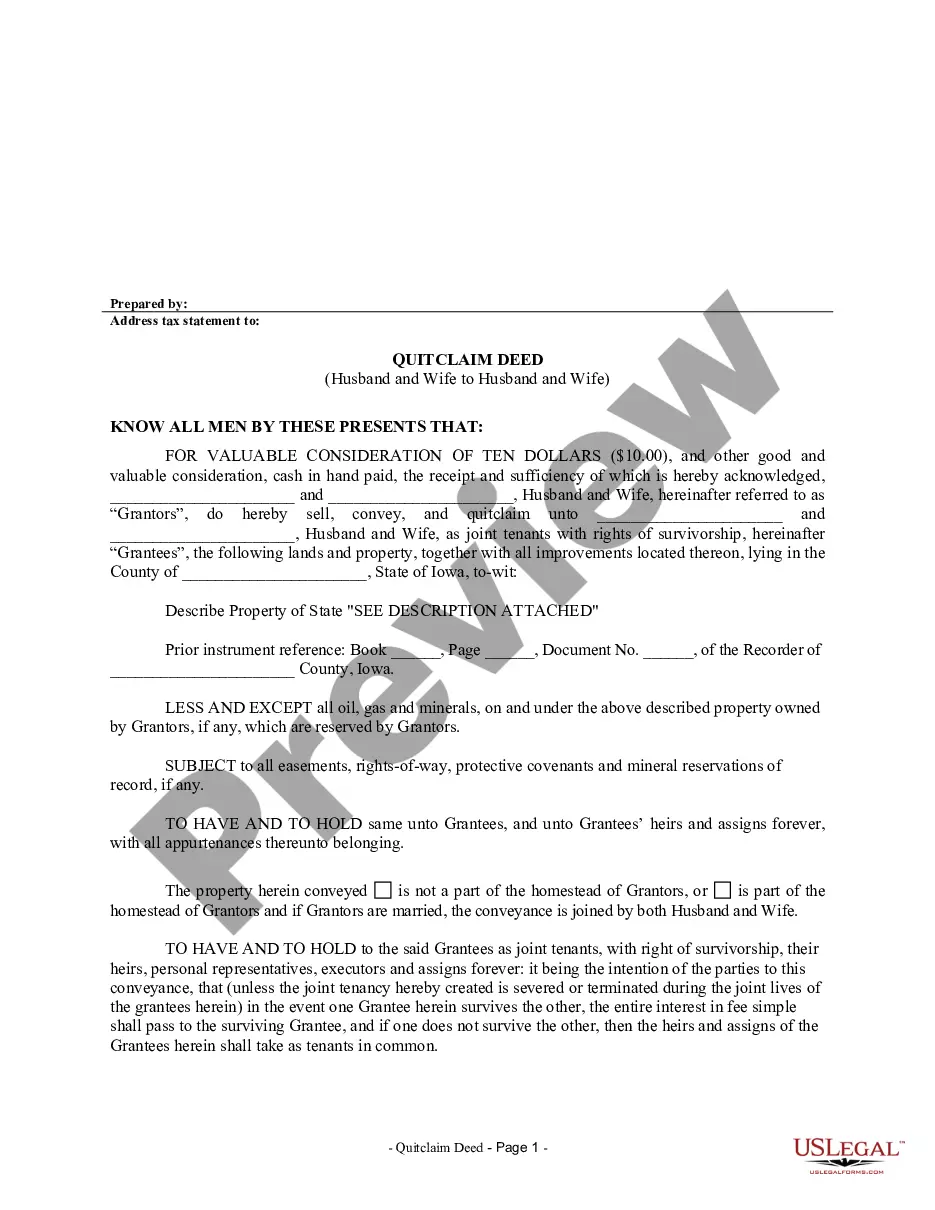

This form is a Quitclaim Deed where the grantors are husband and wife and the grantees are husband and wife. Grantors convey and quitclaim the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors. This deed complies with all state statutory laws.

A Cedar Rapids Iowa Quitclaim Deed from Husband and Wife to Husband and Wife is a legal document that allows a married couple to transfer their ownership interests in a property to themselves as co-owners. This type of deed is commonly used when a couple decides to change their ownership status or adjust the way they hold title to the property. It is important to note that the term "Quitclaim Deed" refers to the type of deed being used, while "Husband and Wife to Husband and Wife" represents the parties involved. There are a few variations of Cedar Rapids Iowa Quitclaim Deeds from Husband and Wife to Husband and Wife that may be encountered when engaging in real estate transactions: 1. Joint Tenancy with Rights of Survivorship: This type of quitclaim deed allows the married couple to hold equal shares of the property. In the event of a spouse's death, the surviving spouse automatically becomes the sole owner of the entire property. 2. Tenancy by the Entirety: This form of quitclaim deed is exclusively available to married couples and offers similar benefits to joint tenancy. It provides additional legal protection by limiting creditors' ability to seize the property from one spouse. 3. Community Property: Cedar Rapids, Iowa is not a community property state, so this particular type of quitclaim deed may not apply. However, it is worth mentioning that community property states treat all property acquired during the marriage as jointly owned by both spouses. Regardless of the specific type chosen, a Cedar Rapids Iowa Quitclaim Deed from Husband and Wife to Husband and Wife requires specific legal language and must be prepared and executed following the guidelines established by the state. It is strongly advised to consult with an attorney or a qualified real estate professional to ensure the process is handled correctly and legal obligations are fulfilled. Additionally, it is recommended to conduct a title search, obtain title insurance, and file the deed with the appropriate county recorder's office to protect against any potential title defects or disputes in the future.A Cedar Rapids Iowa Quitclaim Deed from Husband and Wife to Husband and Wife is a legal document that allows a married couple to transfer their ownership interests in a property to themselves as co-owners. This type of deed is commonly used when a couple decides to change their ownership status or adjust the way they hold title to the property. It is important to note that the term "Quitclaim Deed" refers to the type of deed being used, while "Husband and Wife to Husband and Wife" represents the parties involved. There are a few variations of Cedar Rapids Iowa Quitclaim Deeds from Husband and Wife to Husband and Wife that may be encountered when engaging in real estate transactions: 1. Joint Tenancy with Rights of Survivorship: This type of quitclaim deed allows the married couple to hold equal shares of the property. In the event of a spouse's death, the surviving spouse automatically becomes the sole owner of the entire property. 2. Tenancy by the Entirety: This form of quitclaim deed is exclusively available to married couples and offers similar benefits to joint tenancy. It provides additional legal protection by limiting creditors' ability to seize the property from one spouse. 3. Community Property: Cedar Rapids, Iowa is not a community property state, so this particular type of quitclaim deed may not apply. However, it is worth mentioning that community property states treat all property acquired during the marriage as jointly owned by both spouses. Regardless of the specific type chosen, a Cedar Rapids Iowa Quitclaim Deed from Husband and Wife to Husband and Wife requires specific legal language and must be prepared and executed following the guidelines established by the state. It is strongly advised to consult with an attorney or a qualified real estate professional to ensure the process is handled correctly and legal obligations are fulfilled. Additionally, it is recommended to conduct a title search, obtain title insurance, and file the deed with the appropriate county recorder's office to protect against any potential title defects or disputes in the future.