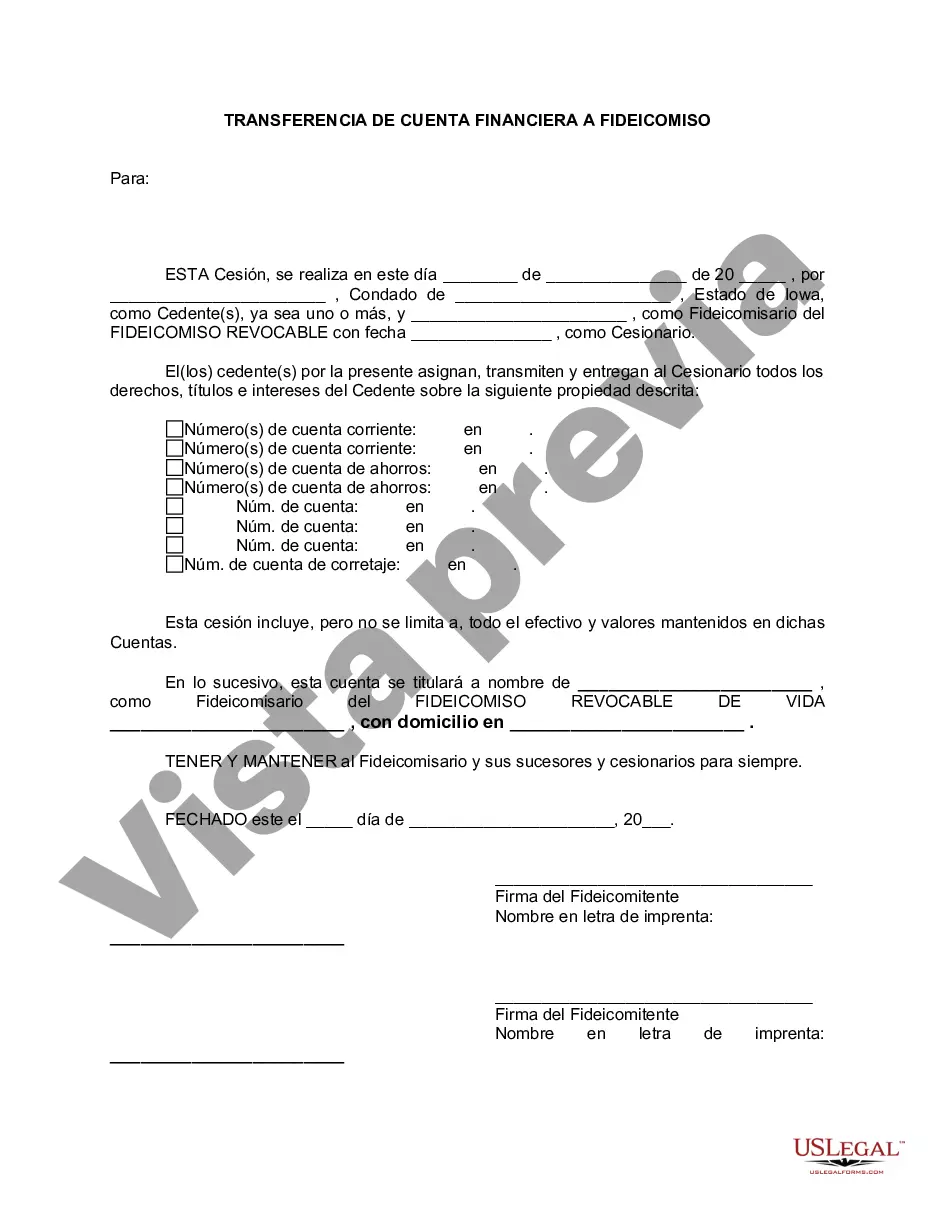

Cedar Rapids Iowa Financial Account Transfer to Living Trust: A Comprehensive Guide If you reside in Cedar Rapids, Iowa, and are planning to safeguard your financial assets by establishing a living trust, this detailed description will provide you with relevant information about the financial account transfer process. Understanding the intricacies of this type of legal procedure is crucial to ensure the smooth transfer of your accounts to the living trust, while protecting your assets and achieving your estate planning goals. Financial Account Transfer Basics: Transferring your financial accounts to a living trust in Cedar Rapids, Iowa involves a legal process wherein you retitle your accounts and assets from your individual name(s) to the name of your living trust. By doing so, you effectively establish your trust as the owner and beneficiary of these accounts. This helps you bypass probate and maintain control over your finances during your lifetime, while also enabling seamless asset distribution upon your passing. Types of Financial Accounts Transferable to a Living Trust: 1. Savings and Checking Accounts: Liquid assets held in bank accounts can be transferred to a living trust, including savings accounts, checking accounts, and money market accounts. This ensures that these funds are integrated and governed by the trust's terms. 2. Retirement Accounts: Certain retirement accounts, such as IRAs (Individual Retirement Accounts) and 401(k)s, can be transferred to a living trust, ensuring their continued management and distribution as per the trust's provisions. 3. Brokerage and Investment Accounts: Stocks, bonds, mutual funds, and other investment assets held in brokerage accounts can be transferred into a living trust. This allows for consolidated management, easy allocation, and eventual disposition in accordance with your trust's guidelines. 4. Certificates of Deposit (CDs): Time deposits, such as CDs, can also be transferred into a living trust. By doing so, the trust will gain ownership and control over these fixed-term accounts, enabling smooth administration and distribution according to your wishes. 5. Real Estate and Property: Depending on Iowa laws and trust provisions, you may be able to transfer real estate properties, such as residential and commercial properties, as well as other tangible assets like vehicles, boats, or artwork, into your living trust. Process of Cedar Rapids Iowa Financial Account Transfer to Living Trust: 1. Consultation with an Estate Planning Attorney: Seek guidance from an experienced estate planning attorney in Cedar Rapids, Iowa, to discuss the specifics of your financial accounts and determine the best approach to transfer them to your living trust. 2. Drafting or Amending the Living Trust: Your attorney will either draft a new living trust or amend your existing trust document to include provisions related to the financial accounts you wish to transfer. The trust document needs to clearly outline the accounts and assets included, their intended beneficiaries, and any specific conditions or instructions. 3. Gathering Necessary Documentation: Collect all relevant financial account statements, deeds, titles, or any required forms as instructed by your attorney to initiate the transfer process. Each financial institution may have specific requirements. 4. Contacting Financial Institutions: With the guidance of your attorney, contact each financial institution where your accounts are held to inform them about your intent to transfer ownership to your living trust. They will provide you with the necessary forms, instructions, and requirements to complete the transfer. 5. Completing Transfer Paperwork: Fill out the provided forms accurately, ensuring that the ownership is transferred from your name(s) to the name of the living trust. Attach any required supporting documents and submit them as per the specific instructions given by each financial institution. 6. Reviewing Transfer Confirmations: Once the transfer is complete, carefully review confirmations from each financial institution to ensure the accounts have been correctly retitled in the name of your living trust. 7. Updating Beneficiary Designations: If necessary, revise beneficiary designations to align with the living trust, ensuring consistency across all your financial accounts. By following this comprehensive guide, you can successfully transfer your financial accounts to a living trust in Cedar Rapids, Iowa. Consulting with a reputable estate planning attorney will provide you with personalized guidance and ensure compliance with legal and financial requirements, helping you protect your assets, avoid probate, and achieve your estate planning goals.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cedar Rapids Iowa Transferencia de cuenta financiera a fideicomiso en vida - Iowa Financial Account Transfer to Living Trust

Description

How to fill out Cedar Rapids Iowa Transferencia De Cuenta Financiera A Fideicomiso En Vida?

Regardless of social or professional status, completing legal documents is an unfortunate necessity in today’s world. Too often, it’s almost impossible for a person without any legal background to draft such papers from scratch, mostly due to the convoluted jargon and legal subtleties they come with. This is where US Legal Forms can save the day. Our platform provides a massive collection with over 85,000 ready-to-use state-specific documents that work for practically any legal situation. US Legal Forms also is an excellent asset for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI tpapers.

No matter if you need the Cedar Rapids Iowa Financial Account Transfer to Living Trust or any other document that will be valid in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how to get the Cedar Rapids Iowa Financial Account Transfer to Living Trust quickly employing our reliable platform. If you are presently an existing customer, you can proceed to log in to your account to download the needed form.

However, in case you are unfamiliar with our library, ensure that you follow these steps before obtaining the Cedar Rapids Iowa Financial Account Transfer to Living Trust:

- Be sure the form you have chosen is specific to your area because the regulations of one state or county do not work for another state or county.

- Review the form and read a short outline (if provided) of scenarios the paper can be used for.

- If the one you chosen doesn’t suit your needs, you can start over and look for the suitable form.

- Click Buy now and choose the subscription plan you prefer the best.

- utilizing your credentials or create one from scratch.

- Select the payment method and proceed to download the Cedar Rapids Iowa Financial Account Transfer to Living Trust as soon as the payment is completed.

You’re good to go! Now you can proceed to print the form or fill it out online. In case you have any issues locating your purchased documents, you can quickly find them in the My Forms tab.

Whatever situation you’re trying to solve, US Legal Forms has got you covered. Give it a try today and see for yourself.