A security deposit is a payment required by a landlord from a tenant to cover the expenses of any repairs of damages to the premises greater than normal "wear and tear." Everyday usage is normal wear and tear, but excess damage is a debated definition. A security deposit is not the same as rent. It is money that actually belongs to the tenant but is held by the landlord for tenant-caused damages and sometimes past-due rent. Without the agreement of the landlord, a security deposit may not legally be used as the last month's rent.

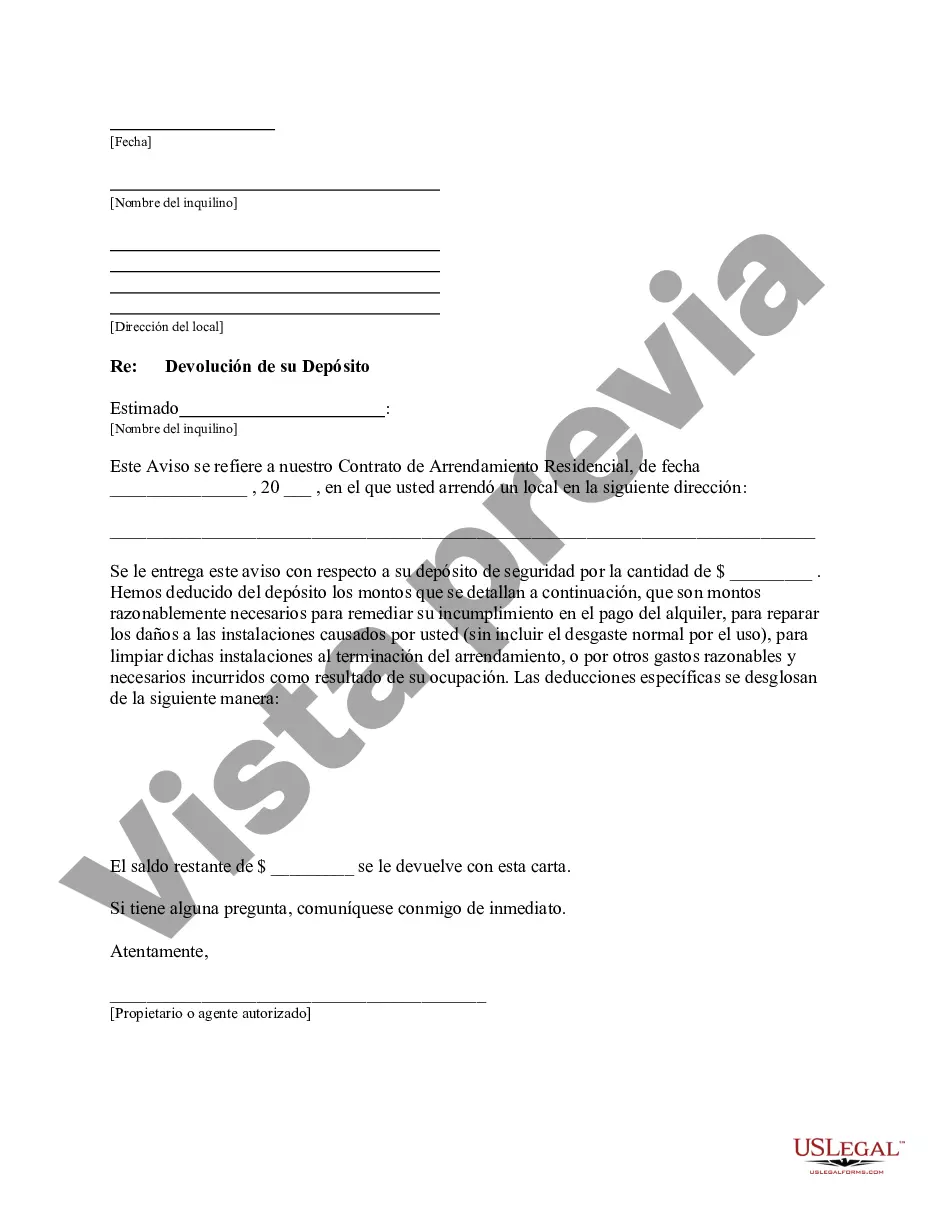

Laws vary by state, but some states place a limit on the amount of a security deposit that a landlord may charge. Some states also regulate where residential security deposits must be kept and when interest payments on the security deposits must be made to the tenant. State laws also define the time period after the tenant vacates within which the deposit must be returned to the tenant. Title: Meridian Idaho Letter from Landlord to Tenant Returning Security Deposit Less Deductions: A Comprehensive Guide Introduction: A Meridian Idaho Letter from Landlord to Tenant Returning Security Deposit Less Deductions is vital for ensuring a smooth and transparent end to a rental agreement. In this detailed description, we will explore the essential components of such a letter, highlighting various types and providing insight into common deductions. By utilizing relevant keywords, landlords and tenants in Meridian, Idaho, can effectively communicate and enforce applicable regulations. Types of Meridian Idaho Letters from Landlord to Tenant Returning Security Deposit Less Deductions: 1. Standard Security Deposit Return Letter: This type of letter is issued when a tenant completes their lease term, following all rental agreement guidelines and fulfilling payment obligations. 2. Security Deposit Deduction Letter: This letter is sent when the landlord identifies valid deductions from the tenant's security deposit, covering expenses for property damages, overdue rent, or unpaid utility bills. 3. Security Deposit Dispute Resolution Letter: In the event of disagreements regarding any deductions made from the security deposit, this type of letter initiates the conflict resolution process and provides a platform to address the concerns of both parties. Components of a Meridian Idaho Letter from Landlord to Tenant Returning Security Deposit Less Deductions: 1. Landlord's Information: The letter should include the landlord's full name, address, and contact details at the top, establishing clear communication channels. 2. Tenant's Information: It is crucial to include the tenant's full name, current address, and contact details in order to correctly identify the intended recipient. 3. Date and Subject Line: The letter should be dated using an appropriate date format (e.g., month, day, year). The subject line should clearly state the purpose of the letter, such as "Return of Security Deposit Less Deductions." 4. Security Deposit Amount: The initial deposit amount should be clearly mentioned, fostering transparency and trust between both parties. 5. Itemized Deductions: If any deductions were made from the security deposit, a detailed breakdown should be provided, listing the specific reasons and corresponding amounts for each deduction. This could include repairs, unpaid rent, utility bills, cleaning fees, or other relevant expenses. 6. Total Deducted Amount: A cumulative sum of all deductions must be clearly stated, along with the resulting balance after deductions. 7. Return of Remaining Balance: If any balance remains after applicable deductions, the letter should outline how and when the remaining amount will be returned to the tenant. This includes specifying acceptable payment methods and relevant timelines. Conclusion: By understanding the different types and components of a Meridian Idaho Letter from Landlord to Tenant Returning Security Deposit Less Deductions, landlords can effectively communicate deposit deductions to tenants while adhering to legal requirements. Open and transparent communication greatly contributes to a healthy landlord-tenant relationship, ensuring a smooth transition at the end of the tenancy.

Title: Meridian Idaho Letter from Landlord to Tenant Returning Security Deposit Less Deductions: A Comprehensive Guide Introduction: A Meridian Idaho Letter from Landlord to Tenant Returning Security Deposit Less Deductions is vital for ensuring a smooth and transparent end to a rental agreement. In this detailed description, we will explore the essential components of such a letter, highlighting various types and providing insight into common deductions. By utilizing relevant keywords, landlords and tenants in Meridian, Idaho, can effectively communicate and enforce applicable regulations. Types of Meridian Idaho Letters from Landlord to Tenant Returning Security Deposit Less Deductions: 1. Standard Security Deposit Return Letter: This type of letter is issued when a tenant completes their lease term, following all rental agreement guidelines and fulfilling payment obligations. 2. Security Deposit Deduction Letter: This letter is sent when the landlord identifies valid deductions from the tenant's security deposit, covering expenses for property damages, overdue rent, or unpaid utility bills. 3. Security Deposit Dispute Resolution Letter: In the event of disagreements regarding any deductions made from the security deposit, this type of letter initiates the conflict resolution process and provides a platform to address the concerns of both parties. Components of a Meridian Idaho Letter from Landlord to Tenant Returning Security Deposit Less Deductions: 1. Landlord's Information: The letter should include the landlord's full name, address, and contact details at the top, establishing clear communication channels. 2. Tenant's Information: It is crucial to include the tenant's full name, current address, and contact details in order to correctly identify the intended recipient. 3. Date and Subject Line: The letter should be dated using an appropriate date format (e.g., month, day, year). The subject line should clearly state the purpose of the letter, such as "Return of Security Deposit Less Deductions." 4. Security Deposit Amount: The initial deposit amount should be clearly mentioned, fostering transparency and trust between both parties. 5. Itemized Deductions: If any deductions were made from the security deposit, a detailed breakdown should be provided, listing the specific reasons and corresponding amounts for each deduction. This could include repairs, unpaid rent, utility bills, cleaning fees, or other relevant expenses. 6. Total Deducted Amount: A cumulative sum of all deductions must be clearly stated, along with the resulting balance after deductions. 7. Return of Remaining Balance: If any balance remains after applicable deductions, the letter should outline how and when the remaining amount will be returned to the tenant. This includes specifying acceptable payment methods and relevant timelines. Conclusion: By understanding the different types and components of a Meridian Idaho Letter from Landlord to Tenant Returning Security Deposit Less Deductions, landlords can effectively communicate deposit deductions to tenants while adhering to legal requirements. Open and transparent communication greatly contributes to a healthy landlord-tenant relationship, ensuring a smooth transition at the end of the tenancy.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.