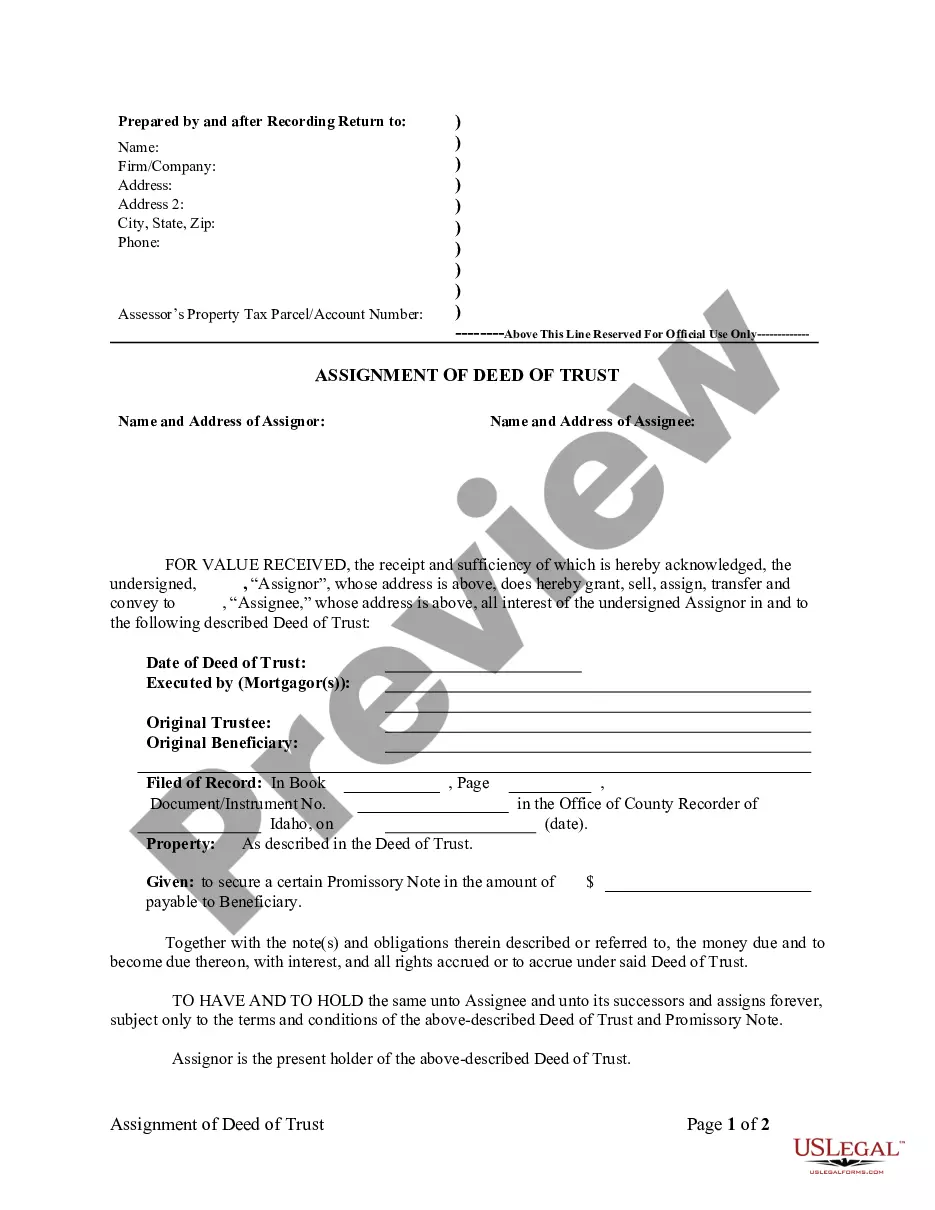

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

Title: Nampa, Idaho Assignment of Deed of Trust by Corporate Mortgage Holder: Understanding its Types and Implications Introduction: Nampa, Idaho, known for its charming community and vibrant atmosphere, witnesses numerous real estate transactions, including assignments of deeds of trust. In this article, we delve into the intricacies of Nampa Idaho Assignment of Deed of Trust by Corporate Mortgage Holder, exploring its different types and discussing their significance. 1. What is an Assignment of Deed of Trust? An Assignment of Deed of Trust is the legal transfer of a mortgage or deed of trust from one party (the assignor) to another (the assignee). This transfer occurs when a lender, who is a corporate mortgage holder, transfers the rights and interests in a mortgage to another entity, often a service or investor. 2. Types of Nampa Idaho Assignment of Deed of Trust by Corporate Mortgage Holder: a) Full Assignment: A full assignment refers to the complete transfer of the corporate mortgage holder's interest in the deed of trust to another party. The assignee then becomes the new beneficiary of the trust deed, acquiring all the rights, benefits, and responsibilities associated with it. b) Partial Assignment: A partial assignment involves the transfer of only a portion of the corporate mortgage holder's rights and interests in the deed of trust. This type of assignment typically occurs when a lender wants to divide responsibilities or when selling portions of a loan to investors in the secondary market. c) Assignment for Value: Also known as an assignment "with recourse," this type of assignment involves the transfer of a deed of trust to a third party in exchange for a specific value or consideration. The assignee may be entitled to recourse against the assignor in case of default by the borrower. d) Assignment in Blank: An assignment in blank refers to an assignment where the assignee's identity is not specified. This could happen when a loan is bundled with other mortgages and sold as part of a mortgage-backed security. In such cases, the assignee may be identified later or remain unknown. 3. Importance and Implications: a) Loan Servicing: Assignments allow mortgage lenders to transfer the administrative tasks associated with the loan, including collecting payments, escrow billing, and foreclosure proceedings. b) Secondary Market Transactions: Many mortgage holders sell loans in the secondary market to reduce risk or raise capital. Assignments facilitate the smooth transfer of mortgages from the original lender to the purchasers, ensuring legal continuity. c) Protecting Rights: Assignments of deeds of trust protect the rights and interests of the corporate mortgage holder, allowing them to enforce loan terms, apply late fees, and initiate foreclosure if necessary. Conclusion: Understanding the intricacies of Nampa Idaho Assignment of Deed of Trust by Corporate Mortgage Holder provides valuable insight into the real estate transactions taking place in the region. With various types of assignments available, it is crucial for all parties involved to comprehend the implications and legalities surrounding each. Whether it's a full or partial assignment, a transaction for value, or an assignment in blank, these processes play a vital role in mortgage-related activities in Nampa, Idaho.Title: Nampa, Idaho Assignment of Deed of Trust by Corporate Mortgage Holder: Understanding its Types and Implications Introduction: Nampa, Idaho, known for its charming community and vibrant atmosphere, witnesses numerous real estate transactions, including assignments of deeds of trust. In this article, we delve into the intricacies of Nampa Idaho Assignment of Deed of Trust by Corporate Mortgage Holder, exploring its different types and discussing their significance. 1. What is an Assignment of Deed of Trust? An Assignment of Deed of Trust is the legal transfer of a mortgage or deed of trust from one party (the assignor) to another (the assignee). This transfer occurs when a lender, who is a corporate mortgage holder, transfers the rights and interests in a mortgage to another entity, often a service or investor. 2. Types of Nampa Idaho Assignment of Deed of Trust by Corporate Mortgage Holder: a) Full Assignment: A full assignment refers to the complete transfer of the corporate mortgage holder's interest in the deed of trust to another party. The assignee then becomes the new beneficiary of the trust deed, acquiring all the rights, benefits, and responsibilities associated with it. b) Partial Assignment: A partial assignment involves the transfer of only a portion of the corporate mortgage holder's rights and interests in the deed of trust. This type of assignment typically occurs when a lender wants to divide responsibilities or when selling portions of a loan to investors in the secondary market. c) Assignment for Value: Also known as an assignment "with recourse," this type of assignment involves the transfer of a deed of trust to a third party in exchange for a specific value or consideration. The assignee may be entitled to recourse against the assignor in case of default by the borrower. d) Assignment in Blank: An assignment in blank refers to an assignment where the assignee's identity is not specified. This could happen when a loan is bundled with other mortgages and sold as part of a mortgage-backed security. In such cases, the assignee may be identified later or remain unknown. 3. Importance and Implications: a) Loan Servicing: Assignments allow mortgage lenders to transfer the administrative tasks associated with the loan, including collecting payments, escrow billing, and foreclosure proceedings. b) Secondary Market Transactions: Many mortgage holders sell loans in the secondary market to reduce risk or raise capital. Assignments facilitate the smooth transfer of mortgages from the original lender to the purchasers, ensuring legal continuity. c) Protecting Rights: Assignments of deeds of trust protect the rights and interests of the corporate mortgage holder, allowing them to enforce loan terms, apply late fees, and initiate foreclosure if necessary. Conclusion: Understanding the intricacies of Nampa Idaho Assignment of Deed of Trust by Corporate Mortgage Holder provides valuable insight into the real estate transactions taking place in the region. With various types of assignments available, it is crucial for all parties involved to comprehend the implications and legalities surrounding each. Whether it's a full or partial assignment, a transaction for value, or an assignment in blank, these processes play a vital role in mortgage-related activities in Nampa, Idaho.