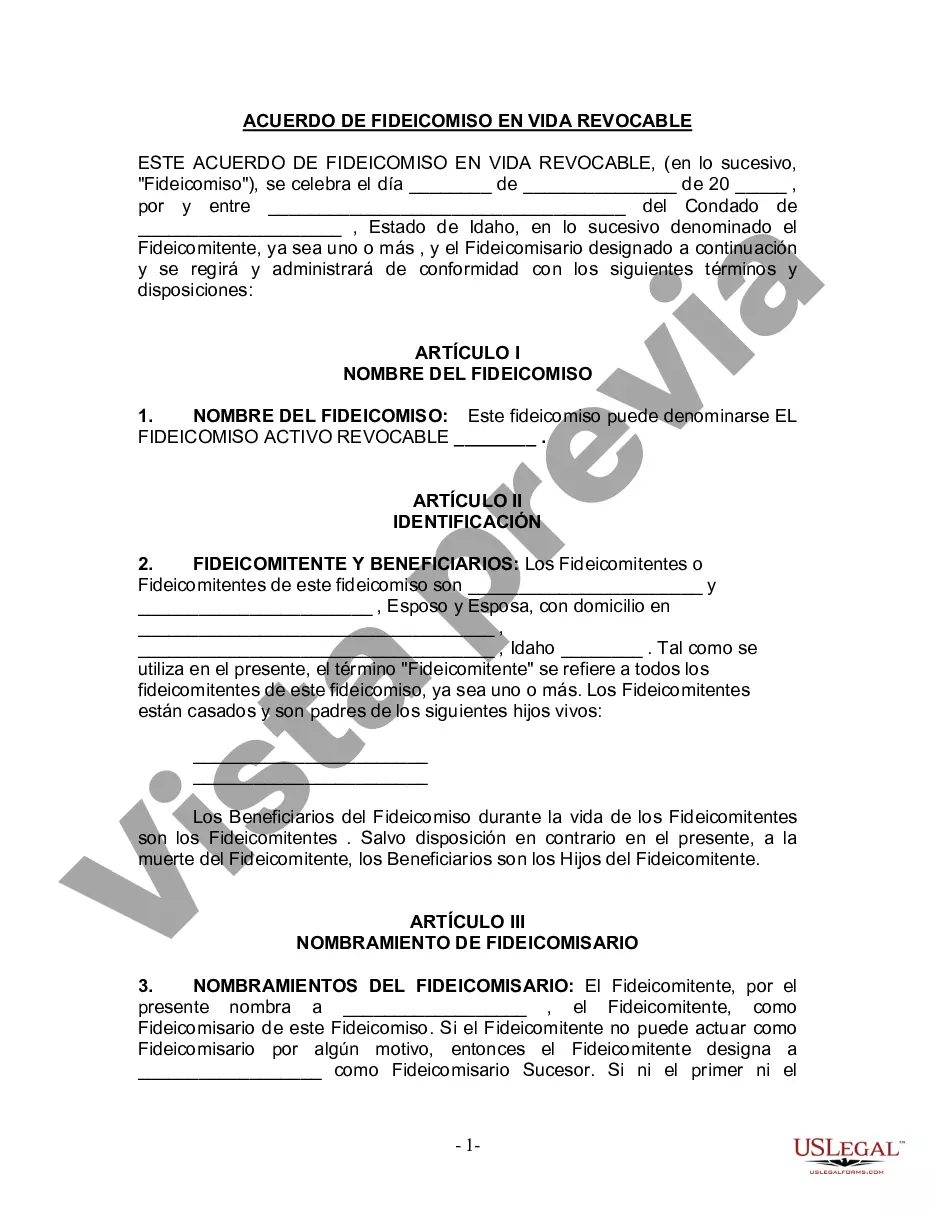

A Meridian Idaho Living Trust for Husband and Wife with Minor and/or Adult Children is a legal arrangement that allows a couple to protect and manage their assets during their lifetime and efficiently transfer them to their children upon their death. This type of trust provides numerous advantages, such as avoiding probate, ensuring privacy, reducing estate taxes, and providing for the financial wellbeing of both minor and adult children. One type of living trust for a couple with minor children is the Revocable Living Trust. This trust allows the parents to maintain control over their assets while designating a trusted individual or institution as the successor trustee to manage and distribute the assets for the benefit of the minor children. It ensures that the children's needs and expenses are provided for and allows for flexibility in adjusting the distribution plan as circumstances change. In the case of a couple with adult children, a different type of living trust called the Family Trust or AB Trust may be suitable. This trust is designed to minimize estate taxes and ensure a smooth transition of assets to the surviving spouse and subsequently to the adult children. It involves dividing the trust into two parts upon the death of the first spouse, with the survivor's trust providing for their needs while keeping the deceased spouse's share protected for the benefit of the children. A Meridian Idaho Living Trust for Husband and Wife with Minor and/or Adult Children provides the following key features: 1. Probate Avoidance: By placing assets in a trust, they do not pass through the probate process, ensuring a faster and less expensive transfer of assets to the intended beneficiaries. 2. Privacy: Trusts are private documents and do not become public record like wills do. This allows for a more discreet transfer of assets and protects the family's financial affairs from public scrutiny. 3. Asset Protection: The trust can include provisions to protect assets from creditors or lawsuits, ensuring their preservation for the beneficiaries. 4. Flexibility: Living trusts can be modified or revoked during the lifetime of the couple, allowing for adjustments as circumstances change, such as the birth of another child or a change in financial situation. 5. Tax Efficiency: Certain trust structures can help minimize estate taxes, ensuring that more of the estate is passed on to the intended beneficiaries rather than being lost to taxes. When establishing a Meridian Idaho Living Trust for Husband and Wife with Minor and/or Adult Children, it is crucial to consult with an experienced estate planning attorney who specializes in Idaho law to ensure the trust is tailored to the family's specific needs and goals.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Meridian Idaho Fideicomiso en vida para esposo y esposa con hijos menores o adultos - Idaho Living Trust for Husband and Wife with Minor and or Adult Children

Description

How to fill out Meridian Idaho Fideicomiso En Vida Para Esposo Y Esposa Con Hijos Menores O Adultos?

Benefit from the US Legal Forms and have immediate access to any form template you require. Our beneficial website with a huge number of document templates allows you to find and obtain virtually any document sample you require. It is possible to export, complete, and sign the Meridian Idaho Living Trust for Husband and Wife with Minor and or Adult Children in a few minutes instead of surfing the Net for many hours seeking a proper template.

Utilizing our library is a great way to improve the safety of your form filing. Our professional attorneys regularly review all the documents to ensure that the templates are appropriate for a particular region and compliant with new acts and regulations.

How do you get the Meridian Idaho Living Trust for Husband and Wife with Minor and or Adult Children? If you already have a profile, just log in to the account. The Download button will be enabled on all the documents you view. Furthermore, you can get all the previously saved files in the My Forms menu.

If you don’t have a profile yet, follow the tips below:

- Find the template you need. Ensure that it is the template you were hoping to find: verify its headline and description, and utilize the Preview function when it is available. Otherwise, use the Search field to look for the appropriate one.

- Launch the downloading process. Click Buy Now and choose the pricing plan you like. Then, sign up for an account and pay for your order with a credit card or PayPal.

- Download the file. Choose the format to obtain the Meridian Idaho Living Trust for Husband and Wife with Minor and or Adult Children and modify and complete, or sign it according to your requirements.

US Legal Forms is among the most extensive and reliable template libraries on the internet. Our company is always happy to help you in virtually any legal process, even if it is just downloading the Meridian Idaho Living Trust for Husband and Wife with Minor and or Adult Children.

Feel free to benefit from our platform and make your document experience as convenient as possible!