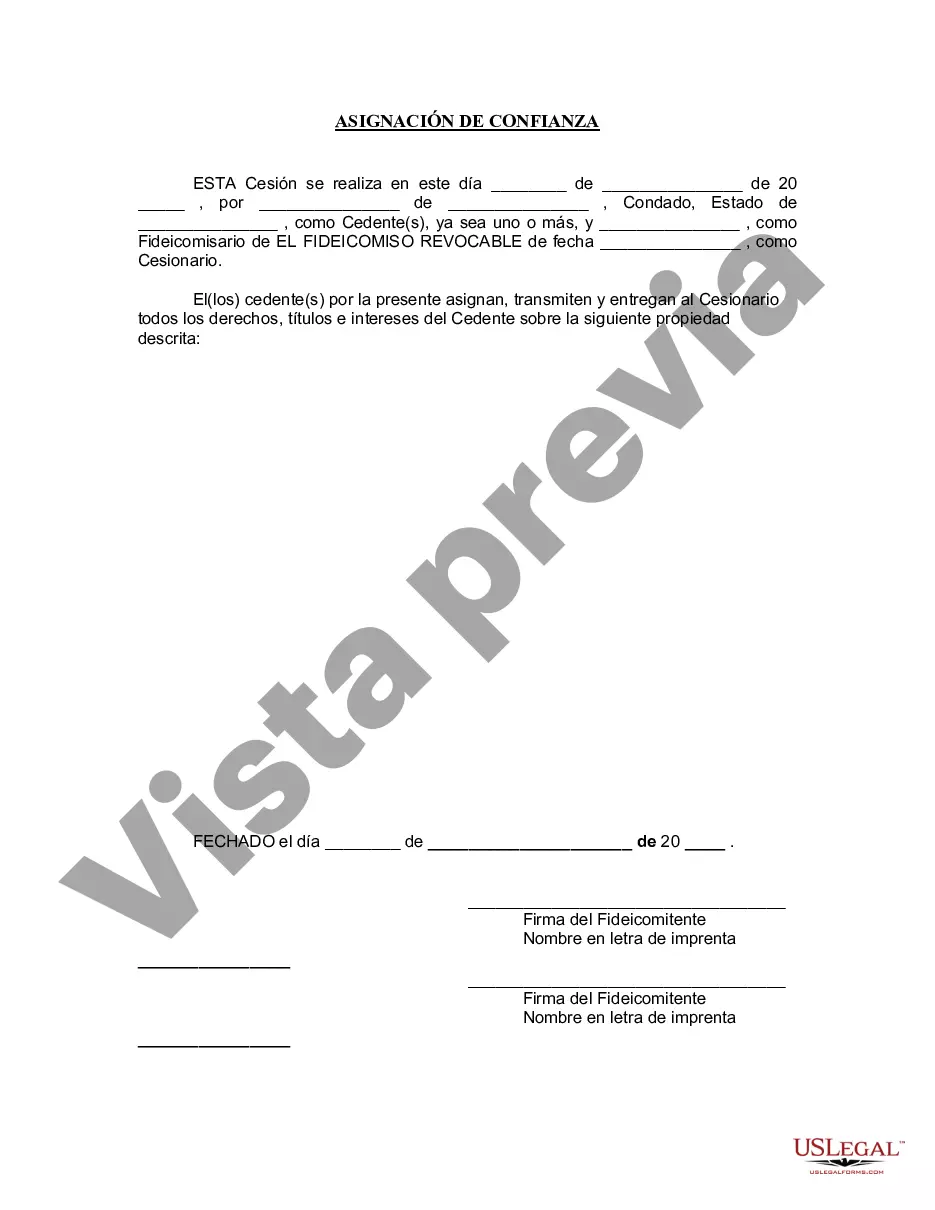

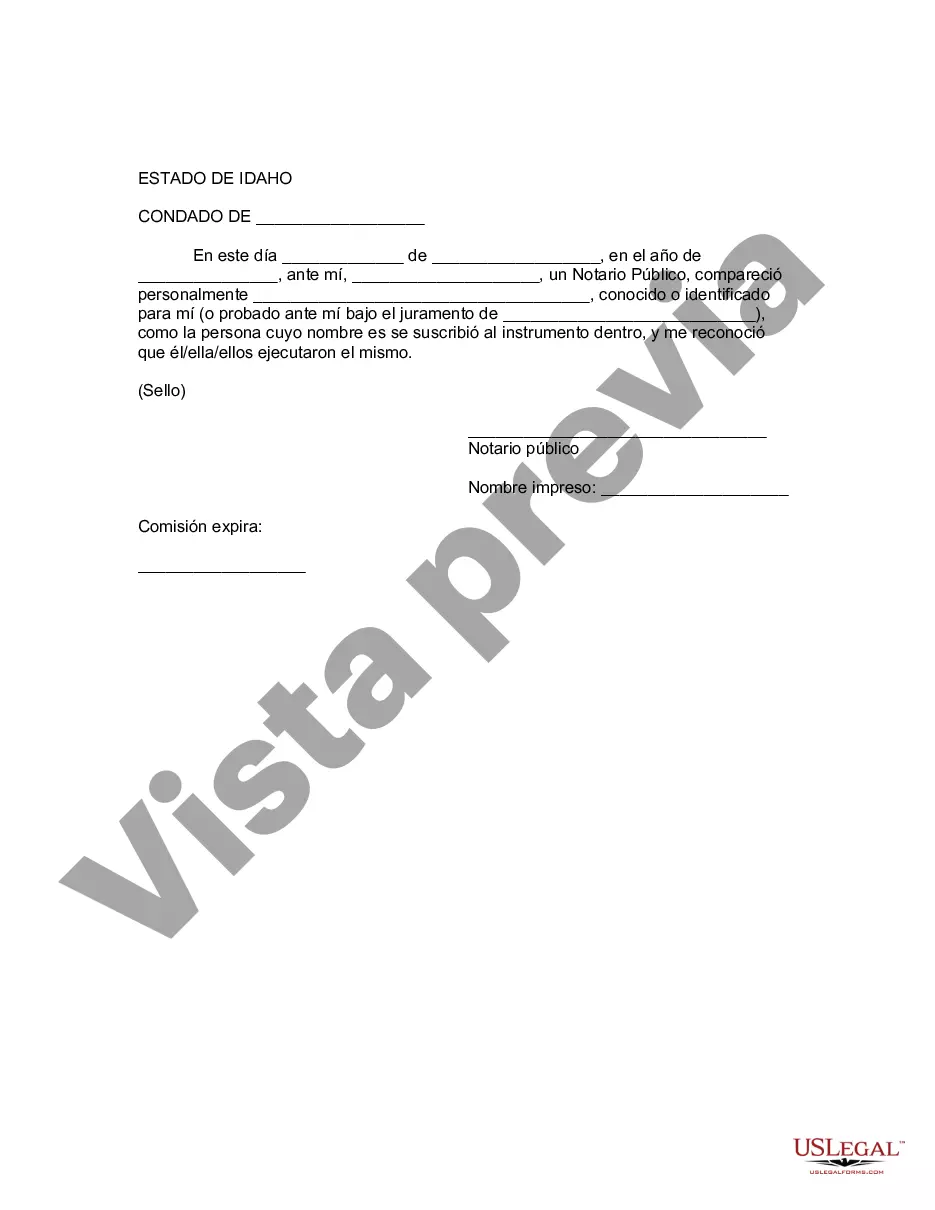

Meridian Idaho Assignment to Living Trust is a legal document that enables individuals to transfer their assets into a trust during their lifetime, ensuring smooth asset distribution upon their death. It provides a mechanism to avoid probate and allows for greater control, privacy, and flexibility in estate planning. In Meridian Idaho, there are various types of Assignment to Living Trust available, including: 1. Revocable Living Trust: This is the most common type, where the trust creator (known as the granter) retains the authority to modify or revoke the trust during their lifetime. Assets transferred to this trust are managed for the granter's benefit, and upon their death, distributed to designated beneficiaries without the requirement of probate. 2. Irrevocable Living Trust: Unlike a revocable trust, an irrevocable trust is generally not modifiable or revocable once created. It offers greater asset protection, estate tax planning benefits, and may be used to qualify for government assistance programs, such as Medicaid. Once assets are transferred into this trust, the granter relinquishes control over them. 3. Testamentary Trust: This type of trust is not created during the granter's lifetime but is established through their will. It becomes effective upon their death and allows the granter to determine how their assets will be managed and distributed after their passing. Testamentary trusts are subject to probate and are useful for individuals who have minor children or beneficiaries with special needs. The Meridian Idaho Assignment to Living Trust process typically involves the following steps: 1. Consultation: Seek the guidance of an experienced estate planning attorney in Meridian Idaho to understand the options and determine the best trust type suitable for your circumstances. 2. Drafting the Trust Agreement: The attorney will create a legally binding trust agreement that outlines the terms, beneficiaries, trustees, and rules for managing the assets. 3. Funding the Trust: Assets, such as real estate, bank accounts, investments, and personal property, must be titled in the name of the trust. This involves re-registering assets and changing beneficiary designations to ensure they are owned by the trust. 4. Trust Administration: During the granter's lifetime, they typically serve as both the trustee and beneficiary of a revocable living trust. However, successor trustees should be named to manage affairs if the granter becomes incapacitated or passes away. Irrevocable trusts are generally managed by appointed trustees from the creation of the trust. 5. Asset Distribution: Upon the granter's death, assets held in the trust are distributed according to the terms specified in the trust agreement, bypassing the probate process. Meridian Idaho Assignment to Living Trust is a vital tool in estate planning that offers many benefits, such as avoiding probate, maintaining privacy, minimizing estate taxes, and ensuring efficient asset distribution. It is crucial to consult an attorney specializing in estate planning to tailor the trust to your specific needs and goals.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Meridian Idaho Asignación a un fideicomiso en vida - Idaho Assignment to Living Trust

Description

How to fill out Meridian Idaho Asignación A Un Fideicomiso En Vida?

We always strive to minimize or prevent legal issues when dealing with nuanced legal or financial affairs. To do so, we sign up for legal solutions that, usually, are very expensive. Nevertheless, not all legal issues are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online catalog of up-to-date DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without turning to an attorney. We offer access to legal form templates that aren’t always openly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the Meridian Idaho Assignment to Living Trust or any other form easily and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always download it again from within the My Forms tab.

The process is equally effortless if you’re unfamiliar with the platform! You can create your account in a matter of minutes.

- Make sure to check if the Meridian Idaho Assignment to Living Trust adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s outline (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve ensured that the Meridian Idaho Assignment to Living Trust is suitable for your case, you can select the subscription plan and make a payment.

- Then you can download the form in any available format.

For over 24 years of our presence on the market, we’ve helped millions of people by offering ready to customize and up-to-date legal forms. Take advantage of US Legal Forms now to save efforts and resources!

Form popularity

Interesting Questions

More info

Case details (if known). Date filed. Type of Case. CAMP, JOHN M. DATE OF BIRTH: 01/21/1929 DATE OF DEATH: 02/06/2016 BORN: WILLIAM CITY, MO DENNIS, JERRY M DATE OF BIRTH: FEB 24, 1952 DATE OF DEATH: FEB 24, 2016 HOMETOWN: WILLIAM C. DEEMING, LA STATE OF ILLINOIS CERTIFICATE OF ALLEGIANCE I certify the above-entitled letter to be a true and correct copy of my death certificate and other documents as they appear on file at the Medical Examiner's Office in Urbana, Illinois, with the City of Urbana, Illinois. A copy of the letter is enclosed with my copy of the case to my executor. JOHN M. CAMP DIRECTOR RECRUIT CUSTODY CENTER CAMP, JOHN M., JR. DATE OF BIRTH: 04/29/1957 DATE OF DEATH: 06/25/2016 BORN: BASKERVILLE, MO DIET: LUNCHEON OF CHICKEN AND FRIED RICE DIETARY FIBER: BRAIN ENZYMES: LOWER MEDICAL ALGORITHM: DIETARY FIBER: BRAIN ENZYMES: LOWER MEDICAL ALGORITHM: UNDERDOG (UNITED STATES) I, JOHN M.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.