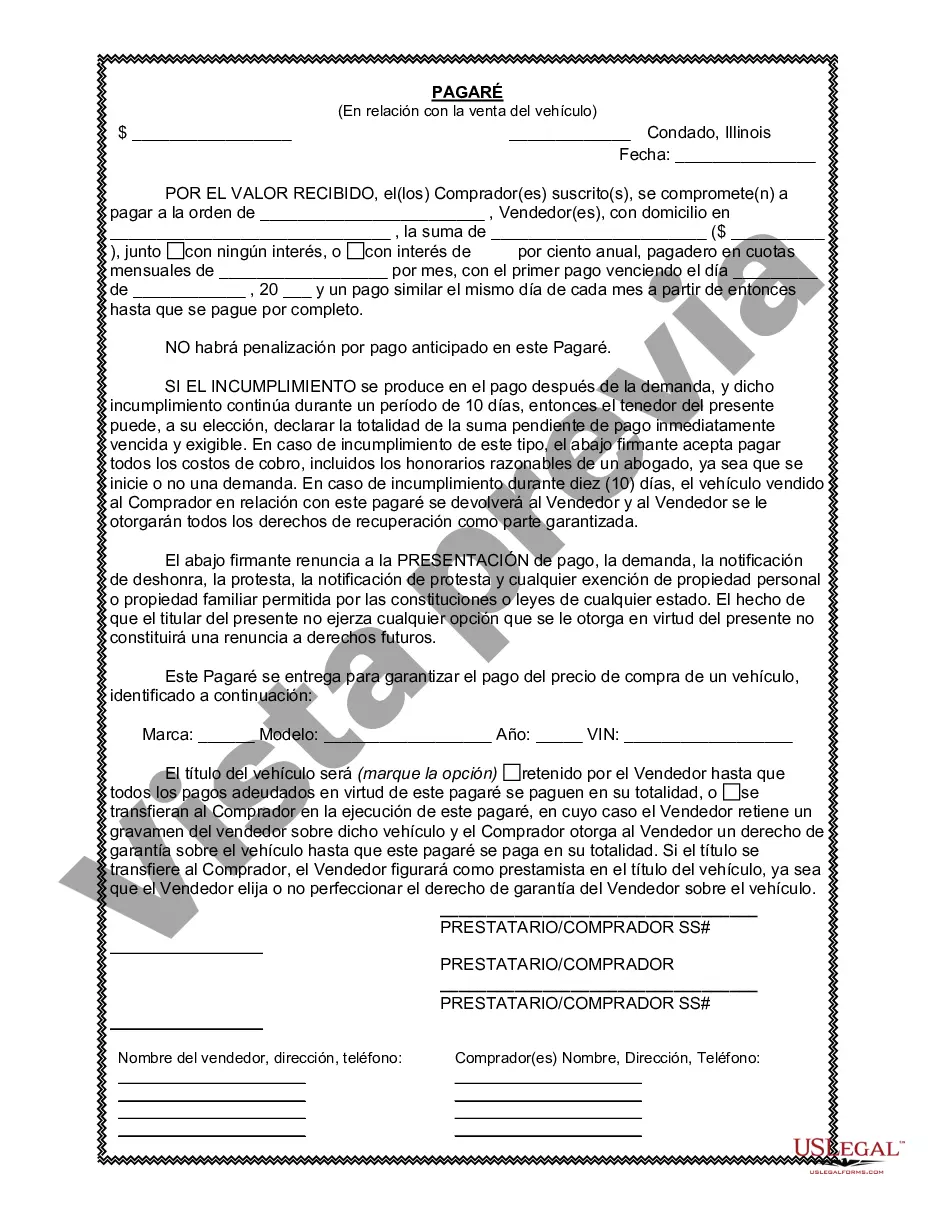

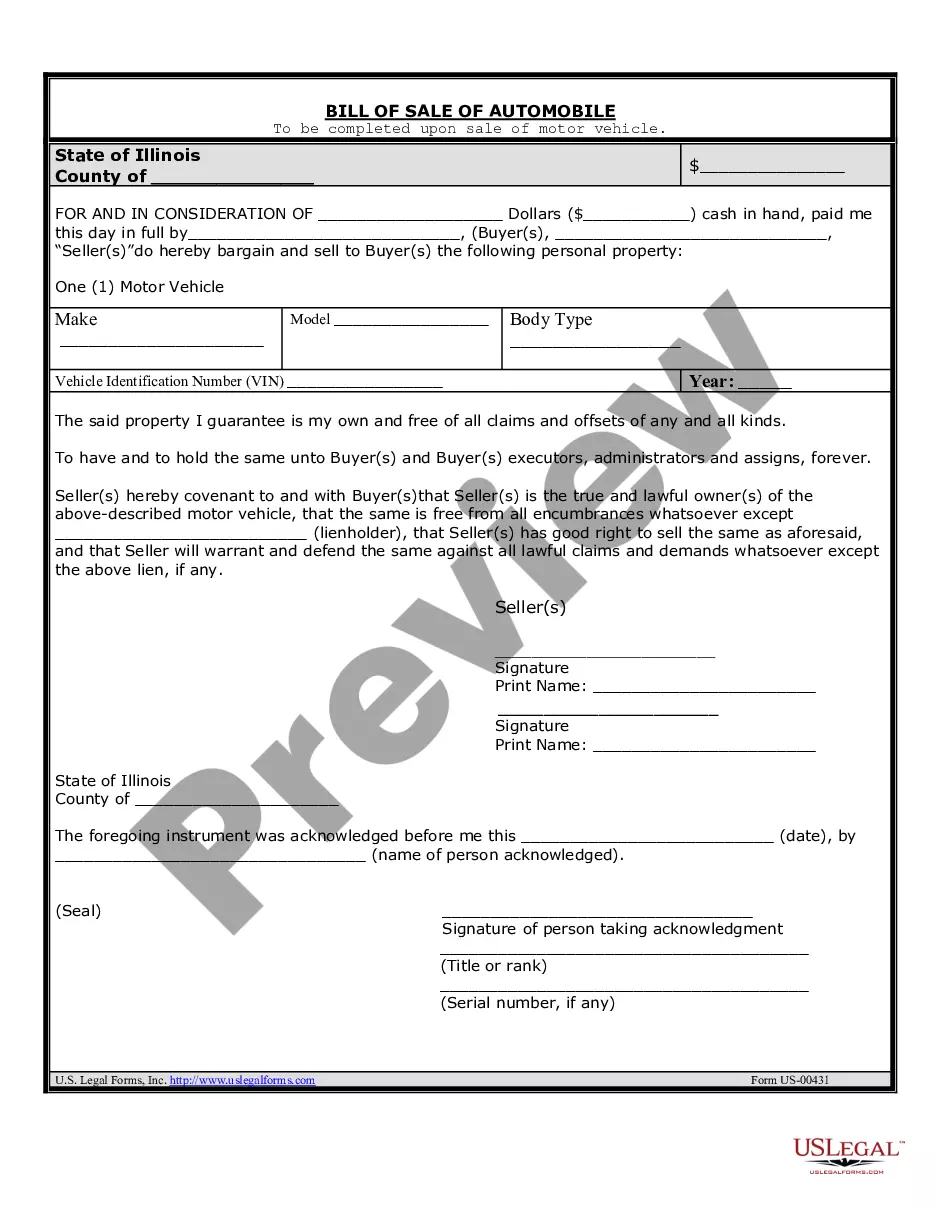

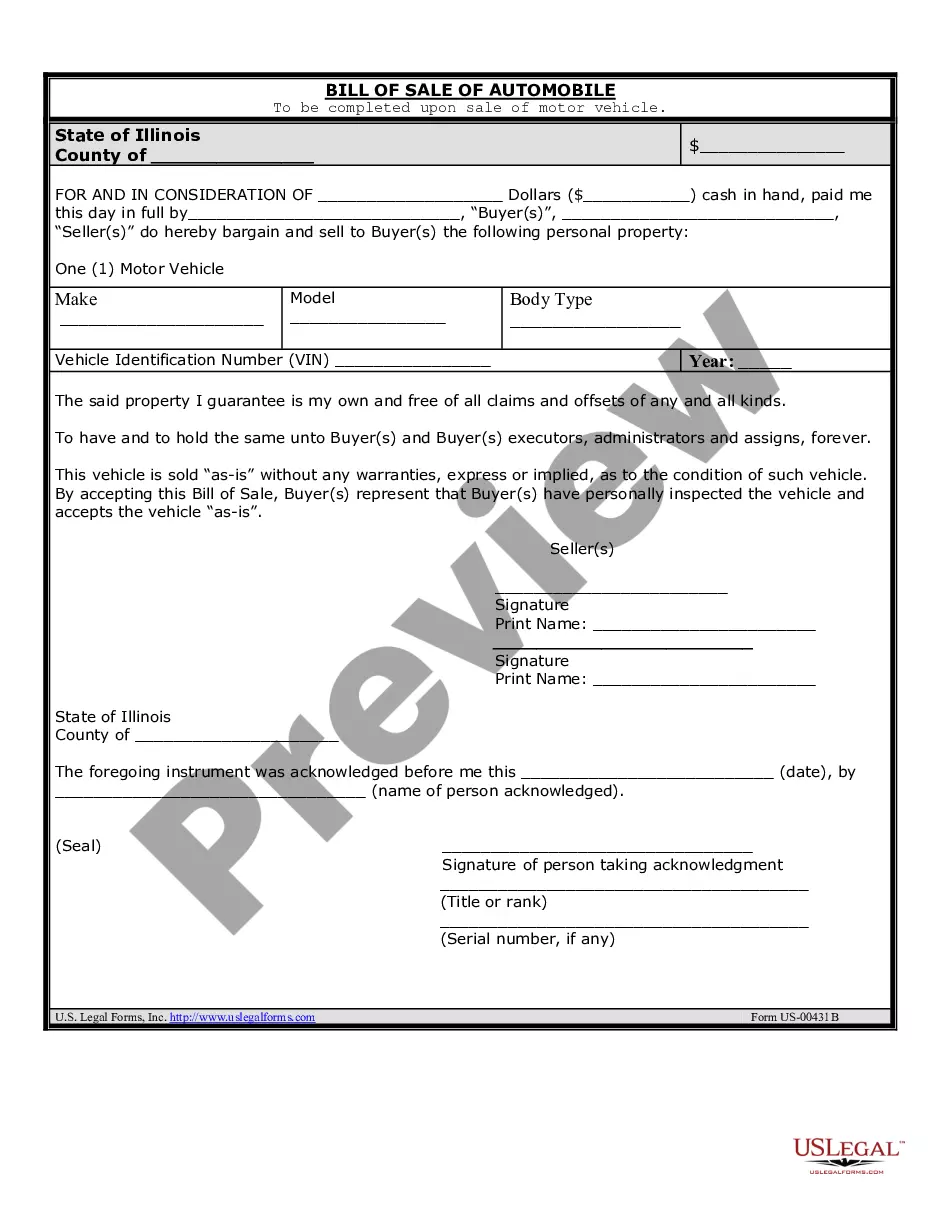

A promissory note is a legal document frequently used in Naperville, Illinois, for the sale of vehicles or automobiles. It acts as a binding contract between the buyer and seller, outlining the terms and conditions of the transaction. This note serves as proof of the agreement, clarifying the obligations and expectations of both parties involved in the sale. The Naperville Illinois Promissory Note in Connection with Sale of Vehicle or Automobile typically includes the following key details: 1. Parties Involved: The promissory note identifies the buyer and seller by their legal names and addresses. It ensures clarity and establishes accountability for both parties throughout the transaction. 2. Vehicle Description: The note provides a detailed description of the vehicle, including the make, model, year, VIN (Vehicle Identification Number), and any additional features or characteristics that might apply. This information ensures that both parties are aware of the exact vehicle being sold. 3. Payment Terms: The note outlines the agreed-upon purchase price and the method of payment. It will state whether the payment will be made in a lump sum or installments, along with the due dates and any interest rates or finance charges, if applicable. 4. Security Interest: If the buyer is obtaining financing for the purchase, the promissory note may include a provision regarding the security interest. This indicates that the seller retains a security interest in the vehicle until the buyer fulfills their payment obligations. It protects the seller's rights in case of default or breach of the agreement. 5. Default and Remedies: The note specifies the consequences if the buyer fails to make payments as agreed. It may address late payment penalties, repossession rights, and other remedies available to the seller in case of default. This section protects the seller's interests and provides a clear course of action in case of non-payment. 6. Governing Law and Jurisdiction: The promissory note includes a provision stating that the agreement shall be governed and interpreted according to the laws of Naperville, Illinois. It also establishes that any disputes arising from the agreement will be resolved within the jurisdiction of Naperville. Different types of Naperville Illinois Promissory Notes in Connection with Sale of Vehicle or Automobile may include: 1. Lump Sum Payment Note: This type of promissory note indicates that the buyer has agreed to pay the total purchase price of the vehicle in a single payment, typically due upon signing the note. 2. Installment Payment Note: With this type of promissory note, the buyer agrees to make multiple payments over a specified period until the full purchase price, including any interest or finance charges, is repaid. 3. Secured Promissory Note: This note includes a provision regarding the security interest, giving the seller certain rights to repossess the vehicle in case of default. 4. Unsecured Promissory Note: This type of note does not involve a security interest and is based solely on the buyer's promise to repay the agreed-upon amount. In conclusion, the Naperville Illinois Promissory Note in Connection with Sale of Vehicle or Automobile is a legally binding document that outlines the terms and conditions of a vehicle sale. It protects the interests of both the buyer and seller, ensuring a clear understanding of the obligations and expectations throughout the transaction. Different types of promissory notes exist based on the payment method and whether they involve a security interest.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Naperville Illinois Pagaré en relación con la venta de vehículos o automóviles - Illinois Promissory Note in Connection with Sale of Vehicle or Automobile

Description

How to fill out Naperville Illinois Pagaré En Relación Con La Venta De Vehículos O Automóviles?

Are you looking for a trustworthy and inexpensive legal forms supplier to buy the Naperville Illinois Promissory Note in Connection with Sale of Vehicle or Automobile? US Legal Forms is your go-to solution.

No matter if you need a simple arrangement to set regulations for cohabitating with your partner or a set of forms to move your separation or divorce through the court, we got you covered. Our website offers more than 85,000 up-to-date legal document templates for personal and company use. All templates that we offer aren’t universal and framed in accordance with the requirements of particular state and area.

To download the form, you need to log in account, find the needed template, and click the Download button next to it. Please take into account that you can download your previously purchased document templates anytime from the My Forms tab.

Are you new to our website? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Check if the Naperville Illinois Promissory Note in Connection with Sale of Vehicle or Automobile conforms to the regulations of your state and local area.

- Go through the form’s description (if available) to learn who and what the form is intended for.

- Restart the search if the template isn’t suitable for your legal scenario.

Now you can create your account. Then select the subscription plan and proceed to payment. Once the payment is completed, download the Naperville Illinois Promissory Note in Connection with Sale of Vehicle or Automobile in any available format. You can get back to the website when you need and redownload the form without any extra costs.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a try today, and forget about wasting hours researching legal papers online for good.