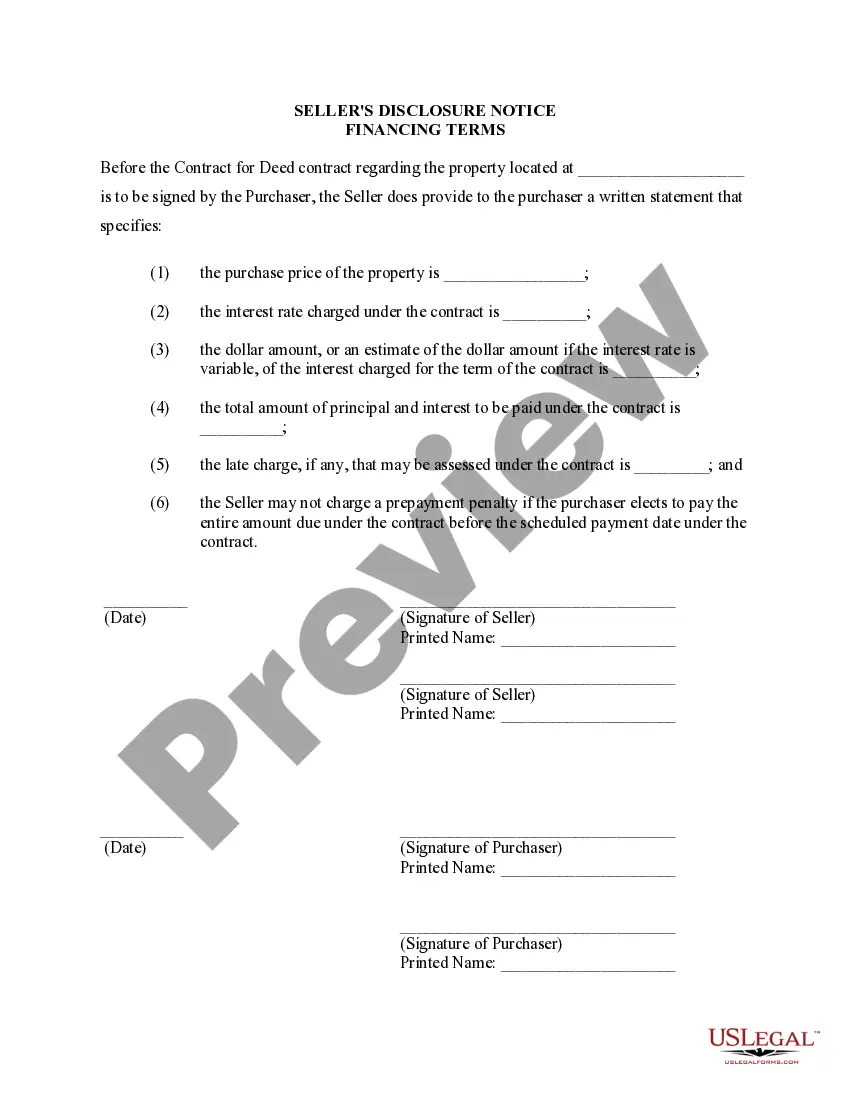

The Joliet Illinois Seller's Disclosure of Financing Terms for Residential Property in connection with a Contract or Agreement for Deed, also known as a Land Contract, is an important legal document that outlines the terms and conditions related to the financing of a residential property. This disclosure serves to protect both the seller and the buyer by ensuring transparency and clarity regarding the financial aspects of the transaction. Here, we will provide a detailed overview of the key components typically found in this disclosure, including relevant keywords such as interest rates, payment schedules, and default provisions. 1. Introduction: The disclosure starts with an introduction outlining the purpose and scope of the document. It explains that it relates to the financing terms associated with the sale of residential property via a Contract or Agreement for Deed. 2. Interest Rates: One of the essential elements in this disclosure is the interest rate agreed upon by both parties. It explicitly states the interest rate, which may be fixed or variable, and any specifics related to the calculation and adjustment of the interest rate over time. 3. Payment Schedule: The disclosure enumerates the payment schedule agreed upon by the buyer and seller. It mentions the frequency of payments (monthly, quarterly, etc.), the due dates, and the acceptable methods of payment (e.g., check, bank transfer). 4. Late Fees and Penalties: In this section, the disclosure outlines the consequences of late or missed payments. It may specify the amount of late fees, any grace periods provided, and the actions the seller can take in the case of repeated payment defaults. 5. Duration of Financing: The disclosure includes information regarding the duration of the financing arrangement. It mentions the total length of the financing term, whether it is a fixed period or subject to renewal, and any provisions for early repayment or penalties for prepayment. 6. Property Insurance: This section highlights the requirement for the buyer to obtain and maintain property insurance as a condition of the financing agreement. It may detail the minimum coverage limits, the named beneficiaries, and the obligation to provide proof of insurance to the seller. 7. Property Taxes: The disclosure addresses the responsibility of paying property taxes. It may indicate whether the seller or the buyer is responsible for property tax payments during the financing term. If the buyer is responsible, it may elaborate on the mechanism for transferring tax payments. 8. Title and Ownership: This section describes the ownership rights and title security associated with the land contract. It may state that the seller retains legal ownership until the buyer completes the payment obligations, highlighting any provisions for transfer of ownership upon fulfillment of the contract. Different types or variations of Joliet Illinois Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract may include additional clauses or requirements. However, the above keywords and content should cover the primary aspects typically found in such a disclosure. It is crucial to consult with a legal professional to ensure compliance with local regulations and tailor the content to specific circumstances.

Seller Disclosure Illinois

Description

How to fill out Joliet Illinois Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed A/k/a Land Contract?

Are you looking for a trustworthy and affordable legal forms provider to get the Joliet Illinois Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract? US Legal Forms is your go-to option.

Whether you need a simple arrangement to set regulations for cohabitating with your partner or a set of forms to move your divorce through the court, we got you covered. Our website offers over 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t universal and framed in accordance with the requirements of particular state and county.

To download the form, you need to log in account, locate the required template, and hit the Download button next to it. Please keep in mind that you can download your previously purchased form templates at any time from the My Forms tab.

Is the first time you visit our platform? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Find out if the Joliet Illinois Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract conforms to the laws of your state and local area.

- Read the form’s description (if provided) to learn who and what the form is good for.

- Start the search over if the template isn’t good for your specific situation.

Now you can create your account. Then choose the subscription plan and proceed to payment. Once the payment is done, download the Joliet Illinois Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract in any provided file format. You can return to the website when you need and redownload the form without any extra costs.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a go now, and forget about wasting hours learning about legal paperwork online once and for all.