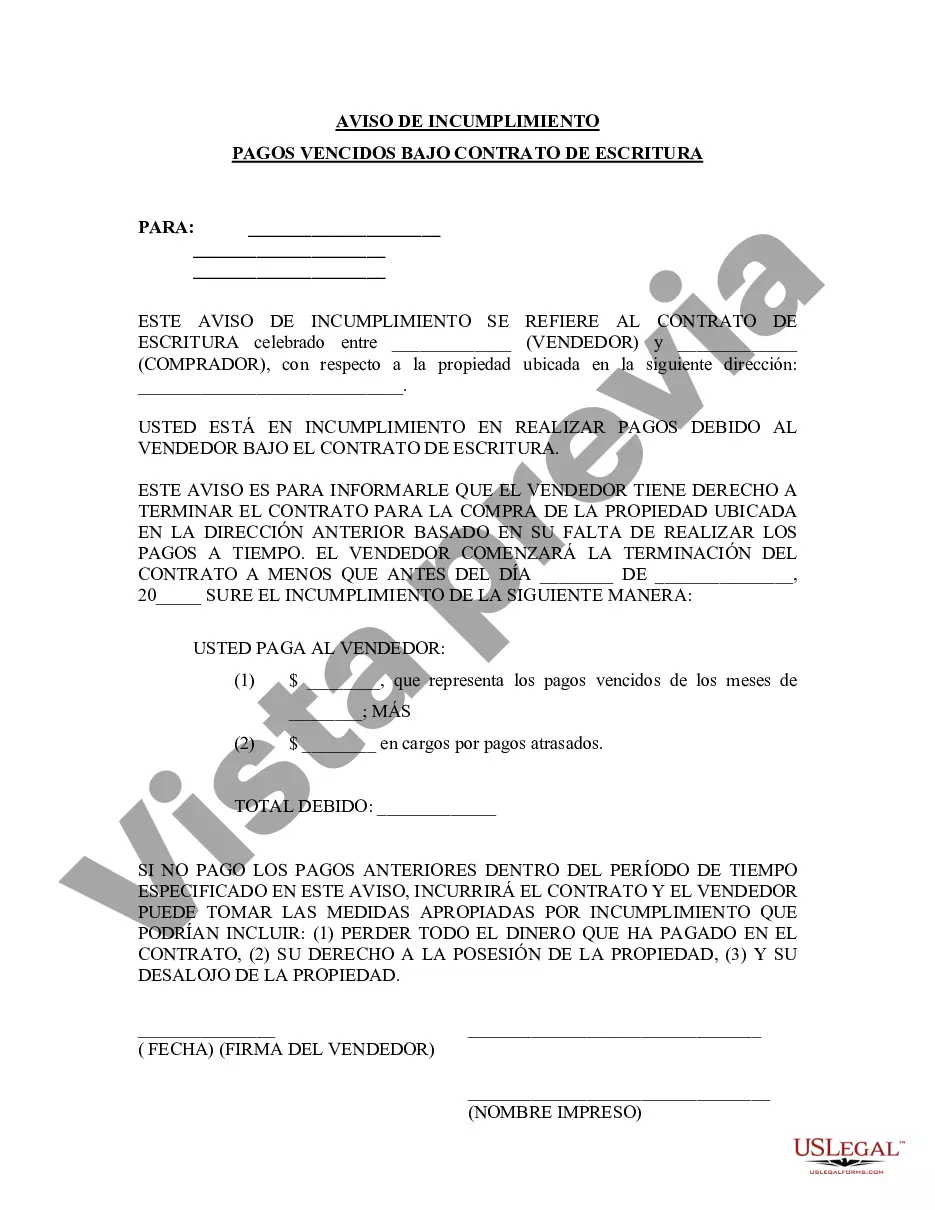

The Chicago Illinois Notice of Default for Past Due Payments in connection with Contract for Deed is a legal document that notifies the buyer and seller of a Contract for Deed when the buyer has defaulted on their payment obligations. A Contract for Deed is an agreement in which the seller finances the purchase of property by the buyer, in which the buyer makes regular installment payments until the agreed-upon price is paid in full. When the buyer fails to make timely payments, the seller has the right to issue a Notice of Default, informing the buyer of their delinquency and initiating the process of potentially terminating the contract. This notice serves as a formal communication, highlighting the buyer's breach of contract and providing a specified period for the buyer to remedy the default and fulfill their financial obligations. There are different types of Chicago Illinois Notice of Default for Past Due Payments in connection with Contract for Deed, categorized based on the stage of the default: 1. Initial Notice of Default: This is the first notice sent by the seller to the buyer when they miss a payment or fail to adhere to the agreed-upon payment schedule. It typically states the amount due, the date it was due, and requests immediate payment or remedial action within a specified grace period. 2. Notice of Intent to Accelerate: If the buyer fails to rectify the default within the given grace period outlined in the initial notice, the seller may issue a Notice of Intent to Accelerate. This notice informs the buyer that the seller intends to accelerate the payment schedule, making the entire remaining balance due immediately unless prompt payment is made or a mutual resolution is reached within a stated timeframe. 3. Notice of Termination: If the buyer does not rectify the default or reach a resolution as requested in the Notice of Intent to Accelerate, the seller may proceed to issue a Notice of Termination. This notice terminates the Contract for Deed and notifies the buyer of their upcoming eviction if the payment remains unpaid or unresolved within a specified timeframe. It is essential for sellers to adhere to the legal requirements and procedures outlined by the state of Illinois when issuing a Notice of Default for Past Due Payments. The notice should include accurate information regarding the default amount, grace periods, and any options available for the buyer to cure the default. Additionally, it is crucial to consult with a qualified attorney or legal professional to ensure compliance with all relevant regulations and contractual obligations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Chicago Illinois Notificación de Incumplimiento de Pagos Atrasados en relación con el Contrato de Escritura - Illinois Notice of Default for Past Due Payments in connection with Contract for Deed

Description

How to fill out Chicago Illinois Notificación De Incumplimiento De Pagos Atrasados En Relación Con El Contrato De Escritura?

If you are searching for a valid form, it’s impossible to choose a better service than the US Legal Forms website – one of the most extensive libraries on the web. With this library, you can get a large number of form samples for company and individual purposes by categories and regions, or key phrases. With the high-quality search feature, finding the most recent Chicago Illinois Notice of Default for Past Due Payments in connection with Contract for Deed is as easy as 1-2-3. In addition, the relevance of every document is verified by a group of expert lawyers that regularly check the templates on our platform and update them based on the latest state and county demands.

If you already know about our system and have a registered account, all you should do to receive the Chicago Illinois Notice of Default for Past Due Payments in connection with Contract for Deed is to log in to your user profile and click the Download option.

If you use US Legal Forms the very first time, just refer to the instructions listed below:

- Make sure you have opened the sample you want. Look at its information and make use of the Preview feature to see its content. If it doesn’t suit your needs, use the Search option near the top of the screen to discover the appropriate record.

- Confirm your selection. Choose the Buy now option. After that, select your preferred pricing plan and provide credentials to sign up for an account.

- Make the transaction. Make use of your credit card or PayPal account to complete the registration procedure.

- Get the template. Choose the file format and save it to your system.

- Make changes. Fill out, modify, print, and sign the received Chicago Illinois Notice of Default for Past Due Payments in connection with Contract for Deed.

Each and every template you save in your user profile has no expiry date and is yours permanently. It is possible to gain access to them using the My Forms menu, so if you want to have an extra duplicate for editing or printing, you may come back and download it again anytime.

Take advantage of the US Legal Forms extensive catalogue to get access to the Chicago Illinois Notice of Default for Past Due Payments in connection with Contract for Deed you were looking for and a large number of other professional and state-specific samples in one place!