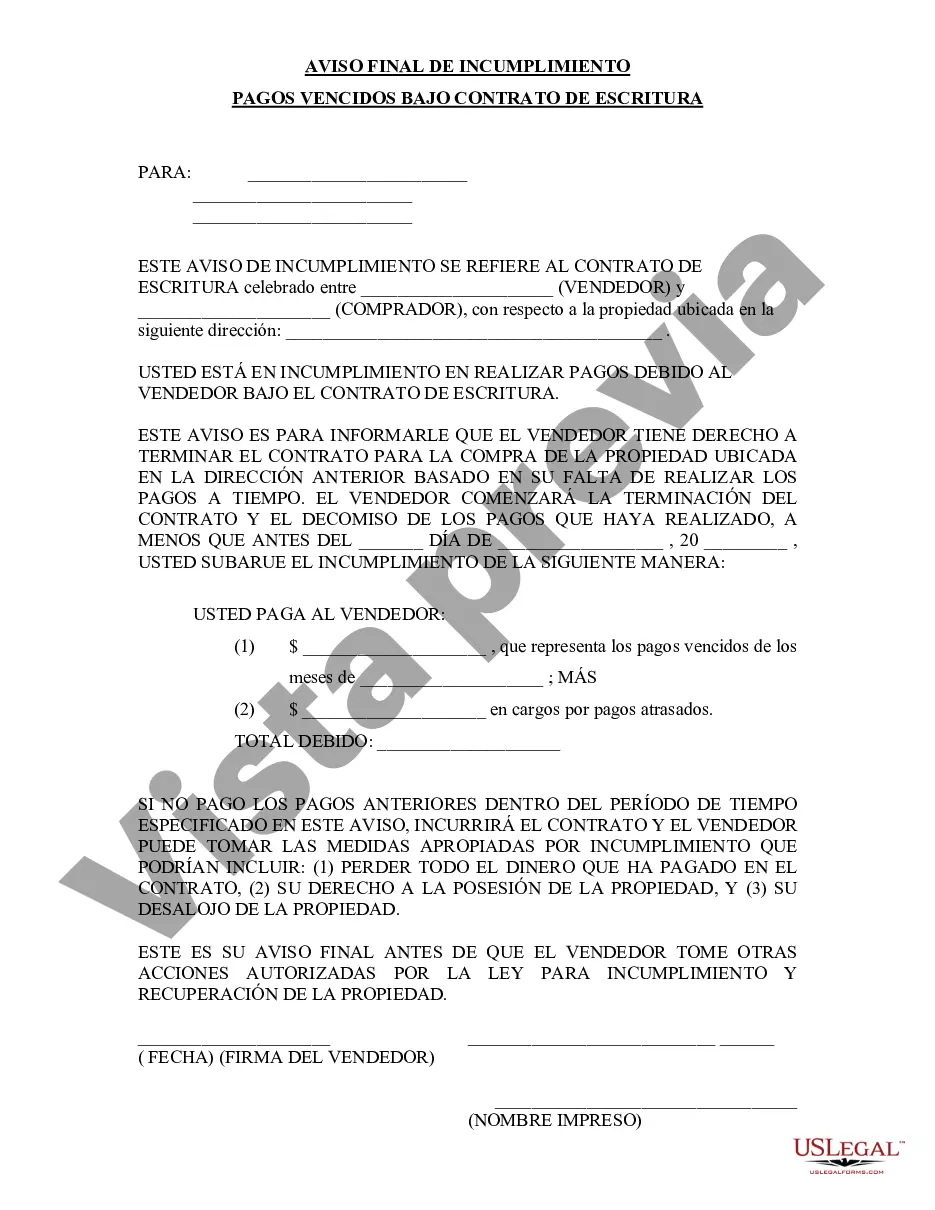

A Chicago Illinois Final Notice of Default for Past Due Payments in connection with a Contract for Deed is a legal document that serves as a warning to the buyer in a contract for deed arrangement who has failed to make timely payments on their installment agreement. This notice is sent by the seller or their representative, typically a lender or a party designated by the lender, informing the buyer that they are in default of their contract terms. Keywords: Chicago, Illinois, final notice, default, past due payments, contract for deed. In Chicago, Illinois, there may be variations of the Final Notice of Default for Past Due Payments in connection with a Contract for Deed, based on specific circumstances. Here are a few examples that may exist: 1. Standard Final Notice of Default for Past Due Payments: This notice is sent when a buyer has failed to make regular installment payments outlined in the contract for deed. The notice will typically include the total amount of past due payments, the payment due date, and a warning that failure to cure the default may result in further legal action or potential loss of the property. 2. Final Notice of Default with Cure Period: In some cases, the Final Notice of Default may provide a cure period for the buyer to rectify the default. The notice will specify the exact amount owed, the due date for payment, and the number of days the buyer has to cure the default. It may also include instructions on how to make the payment, such as providing wire transfer details or a mailing address. 3. Notice of Default with Intent to Accelerate: This type of notice is sent when the seller decides to terminate the contract for deed due to the buyer's persistent default on payments. The notice will state the exact amount of past due payments, the deadline for payment, and a statement that failure to cure the default within the specified time will result in acceleration of the remaining balance owed under the contract. It may also provide information on how to contact the lender or seller to discuss options for resolving the default. It's important to note that the specific language and requirements of these notices can vary depending on the terms outlined in the individual contract for deed. Additionally, local and state laws may also dictate the content and delivery methods for such notices. To ensure accuracy and compliance, it is advised to seek legal counsel or review the applicable laws and regulations governing contract for deed arrangements in Chicago, Illinois.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Chicago Illinois Aviso final de incumplimiento de pagos vencidos en relación con el contrato de escritura - Illinois Final Notice of Default for Past Due Payments in connection with Contract for Deed

State:

Illinois

City:

Chicago

Control #:

IL-00470-9

Format:

Word

Instant download

Description

Aviso final de mora en los pagos vencidos bajo contrato de escrituración.

A Chicago Illinois Final Notice of Default for Past Due Payments in connection with a Contract for Deed is a legal document that serves as a warning to the buyer in a contract for deed arrangement who has failed to make timely payments on their installment agreement. This notice is sent by the seller or their representative, typically a lender or a party designated by the lender, informing the buyer that they are in default of their contract terms. Keywords: Chicago, Illinois, final notice, default, past due payments, contract for deed. In Chicago, Illinois, there may be variations of the Final Notice of Default for Past Due Payments in connection with a Contract for Deed, based on specific circumstances. Here are a few examples that may exist: 1. Standard Final Notice of Default for Past Due Payments: This notice is sent when a buyer has failed to make regular installment payments outlined in the contract for deed. The notice will typically include the total amount of past due payments, the payment due date, and a warning that failure to cure the default may result in further legal action or potential loss of the property. 2. Final Notice of Default with Cure Period: In some cases, the Final Notice of Default may provide a cure period for the buyer to rectify the default. The notice will specify the exact amount owed, the due date for payment, and the number of days the buyer has to cure the default. It may also include instructions on how to make the payment, such as providing wire transfer details or a mailing address. 3. Notice of Default with Intent to Accelerate: This type of notice is sent when the seller decides to terminate the contract for deed due to the buyer's persistent default on payments. The notice will state the exact amount of past due payments, the deadline for payment, and a statement that failure to cure the default within the specified time will result in acceleration of the remaining balance owed under the contract. It may also provide information on how to contact the lender or seller to discuss options for resolving the default. It's important to note that the specific language and requirements of these notices can vary depending on the terms outlined in the individual contract for deed. Additionally, local and state laws may also dictate the content and delivery methods for such notices. To ensure accuracy and compliance, it is advised to seek legal counsel or review the applicable laws and regulations governing contract for deed arrangements in Chicago, Illinois.

How to fill out Chicago Illinois Aviso Final De Incumplimiento De Pagos Vencidos En Relación Con El Contrato De Escritura?

If you’ve already utilized our service before, log in to your account and download the Chicago Illinois Final Notice of Default for Past Due Payments in connection with Contract for Deed on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple steps to obtain your document:

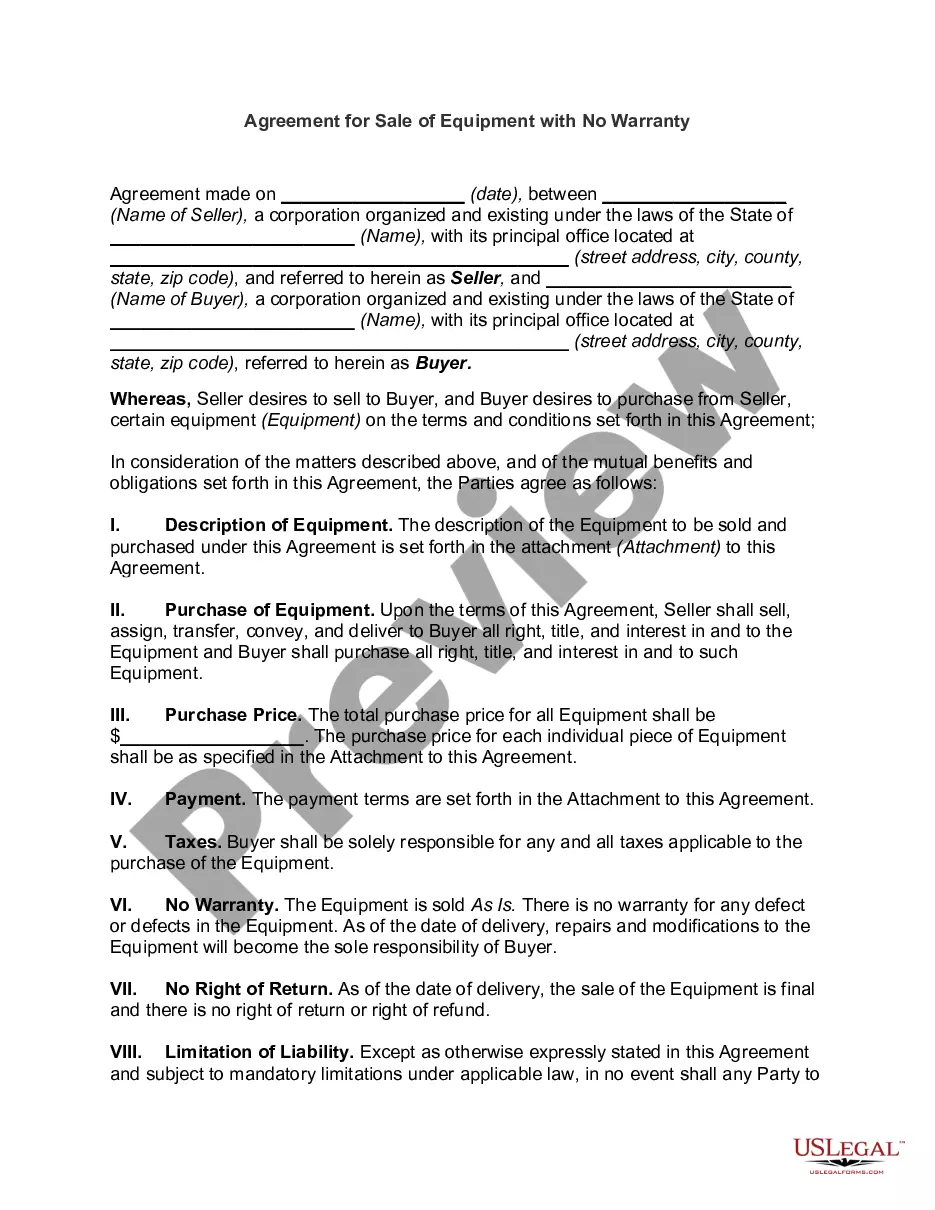

- Make sure you’ve found a suitable document. Look through the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t suit you, utilize the Search tab above to obtain the proper one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Get your Chicago Illinois Final Notice of Default for Past Due Payments in connection with Contract for Deed. Pick the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your individual or professional needs!