Elgin Illinois Quitclaim Deed from Corporation to LLC: Transfer of Ownership Simplified In Elgin, Illinois, a Quitclaim Deed from Corporation to LLC refers to the legal document that facilitates the transfer of real estate property ownership from a corporation to a limited liability company (LLC). This process allows businesses to effectively restructure their assets, providing more flexibility, liability protection, and seamless management. The Elgin Illinois Quitclaim Deed from Corporation to LLC is a critical instrument when a corporation decides to transfer property ownership to its associated LLC. This deed operates under the principle of a quitclaim, which means that the corporation is transferring its property interest without making any warranties or guarantees regarding the title to the property. Within Elgin, Illinois, there may be different types of Quitclaim Deeds from Corporation to LLC, including: 1. General Quitclaim Deed: This is the most common type of Quitclaim Deed used for property transfers between a corporation and an LLC. It provides a straightforward and simple process for transferring ownership, without any specific conditions or restrictions attached. 2. Special Quitclaim Deed: In some cases, a corporation may utilize a Special Quitclaim Deed to transfer ownership of specific portions or parcels of a property to the LLC. This type of deed allows for segmented transfers, giving more control over the specific assets being transferred. 3. Conditioned Quitclaim Deed: In certain situations, the corporation may impose certain conditions or restrictions on the transfer of property to the LLC. These conditions could include obligations, limitations, or future diversionary rights. A Conditioned Quitclaim Deed ensures that the corporation's interests are safeguarded during the transfer process. Key Considerations when Executing the Elgin Illinois Quitclaim Deed from Corporation to LLC: 1. Title Search: Before transferring the property, it is essential to conduct a thorough title search to ensure there are no outstanding liens, encumbrances, or legal disputes. This step helps to establish a clean title transfer and protects both the corporation and the LLC. 2. Legal Counsel: Engaging the services of a skilled real estate attorney is highly recommended, as they can guide both parties through the complex legal requirements and help draft the appropriate Quitclaim Deed specific to the needs of the corporation and the LLC. 3. Filing Requirements: The completed Quitclaim Deed must be filed with the appropriate county office in Elgin, Illinois. Compliance with the county's filing requirements ensures the transfer is officially recorded and legally recognized. Overall, the Elgin Illinois Quitclaim Deed from Corporation to LLC is a valuable tool for businesses looking to streamline their operations and consolidate property ownership within an associated limited liability company. It offers both corporations and LCS the benefits of liability protection, efficient asset management, and enhanced flexibility when it comes to future business endeavors.

Elgin Illinois Quitclaim Deed from Corporation to LLC

State:

Illinois

City:

Elgin

Control #:

IL-012-77

Format:

Word;

Rich Text

Instant download

Description

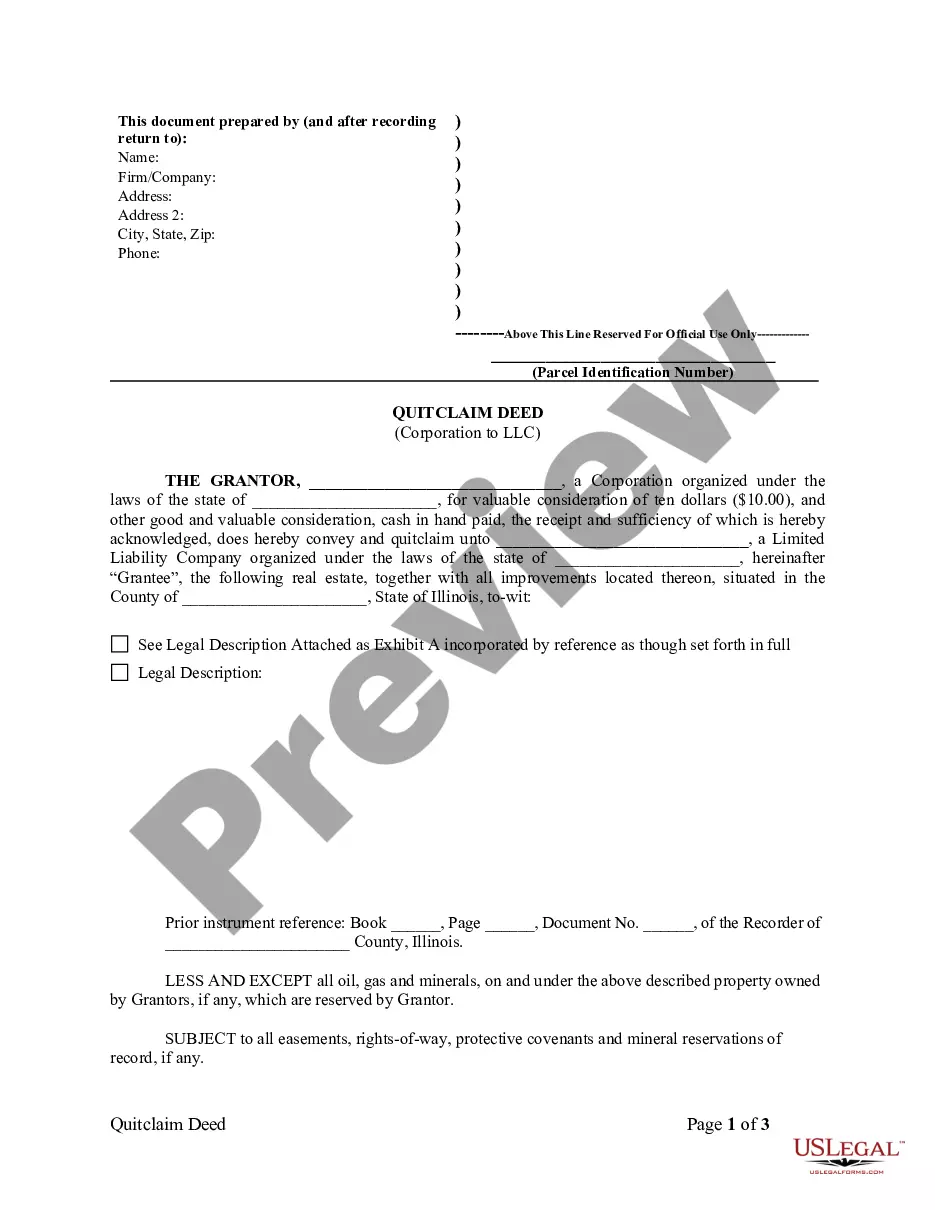

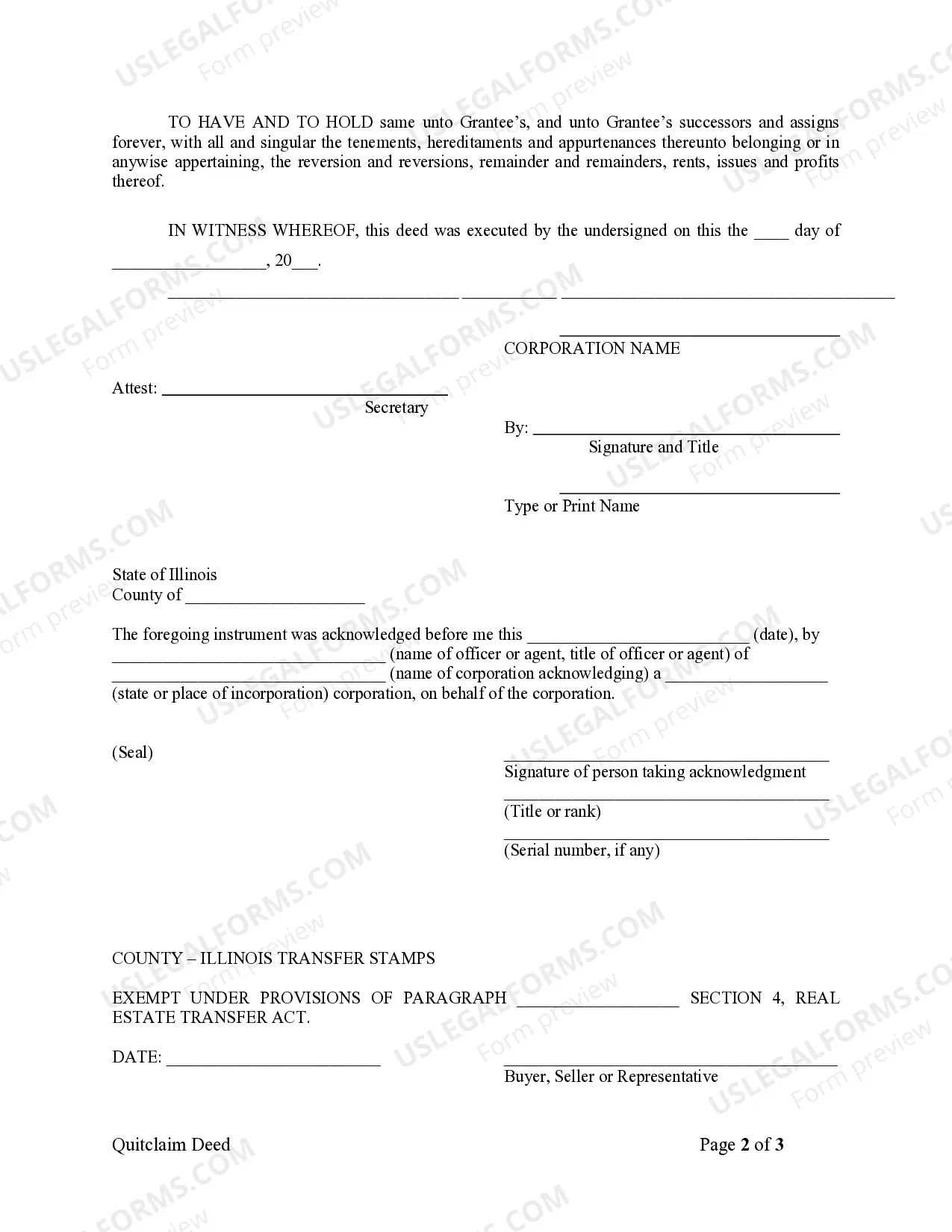

This Quitclaim Deed from Corporation to LLC form is a Quitclaim Deed where the Grantor is a corporation and the Grantee is a limited liability company. Grantor conveys and quitclaims the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

Elgin Illinois Quitclaim Deed from Corporation to LLC: Transfer of Ownership Simplified In Elgin, Illinois, a Quitclaim Deed from Corporation to LLC refers to the legal document that facilitates the transfer of real estate property ownership from a corporation to a limited liability company (LLC). This process allows businesses to effectively restructure their assets, providing more flexibility, liability protection, and seamless management. The Elgin Illinois Quitclaim Deed from Corporation to LLC is a critical instrument when a corporation decides to transfer property ownership to its associated LLC. This deed operates under the principle of a quitclaim, which means that the corporation is transferring its property interest without making any warranties or guarantees regarding the title to the property. Within Elgin, Illinois, there may be different types of Quitclaim Deeds from Corporation to LLC, including: 1. General Quitclaim Deed: This is the most common type of Quitclaim Deed used for property transfers between a corporation and an LLC. It provides a straightforward and simple process for transferring ownership, without any specific conditions or restrictions attached. 2. Special Quitclaim Deed: In some cases, a corporation may utilize a Special Quitclaim Deed to transfer ownership of specific portions or parcels of a property to the LLC. This type of deed allows for segmented transfers, giving more control over the specific assets being transferred. 3. Conditioned Quitclaim Deed: In certain situations, the corporation may impose certain conditions or restrictions on the transfer of property to the LLC. These conditions could include obligations, limitations, or future diversionary rights. A Conditioned Quitclaim Deed ensures that the corporation's interests are safeguarded during the transfer process. Key Considerations when Executing the Elgin Illinois Quitclaim Deed from Corporation to LLC: 1. Title Search: Before transferring the property, it is essential to conduct a thorough title search to ensure there are no outstanding liens, encumbrances, or legal disputes. This step helps to establish a clean title transfer and protects both the corporation and the LLC. 2. Legal Counsel: Engaging the services of a skilled real estate attorney is highly recommended, as they can guide both parties through the complex legal requirements and help draft the appropriate Quitclaim Deed specific to the needs of the corporation and the LLC. 3. Filing Requirements: The completed Quitclaim Deed must be filed with the appropriate county office in Elgin, Illinois. Compliance with the county's filing requirements ensures the transfer is officially recorded and legally recognized. Overall, the Elgin Illinois Quitclaim Deed from Corporation to LLC is a valuable tool for businesses looking to streamline their operations and consolidate property ownership within an associated limited liability company. It offers both corporations and LCS the benefits of liability protection, efficient asset management, and enhanced flexibility when it comes to future business endeavors.

Free preview

How to fill out Elgin Illinois Quitclaim Deed From Corporation To LLC?

If you’ve already used our service before, log in to your account and save the Elgin Illinois Quitclaim Deed from Corporation to LLC on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple actions to obtain your file:

- Ensure you’ve located an appropriate document. Read the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t fit you, use the Search tab above to obtain the appropriate one.

- Buy the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Obtain your Elgin Illinois Quitclaim Deed from Corporation to LLC. Select the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have bought: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly find and save any template for your individual or professional needs!