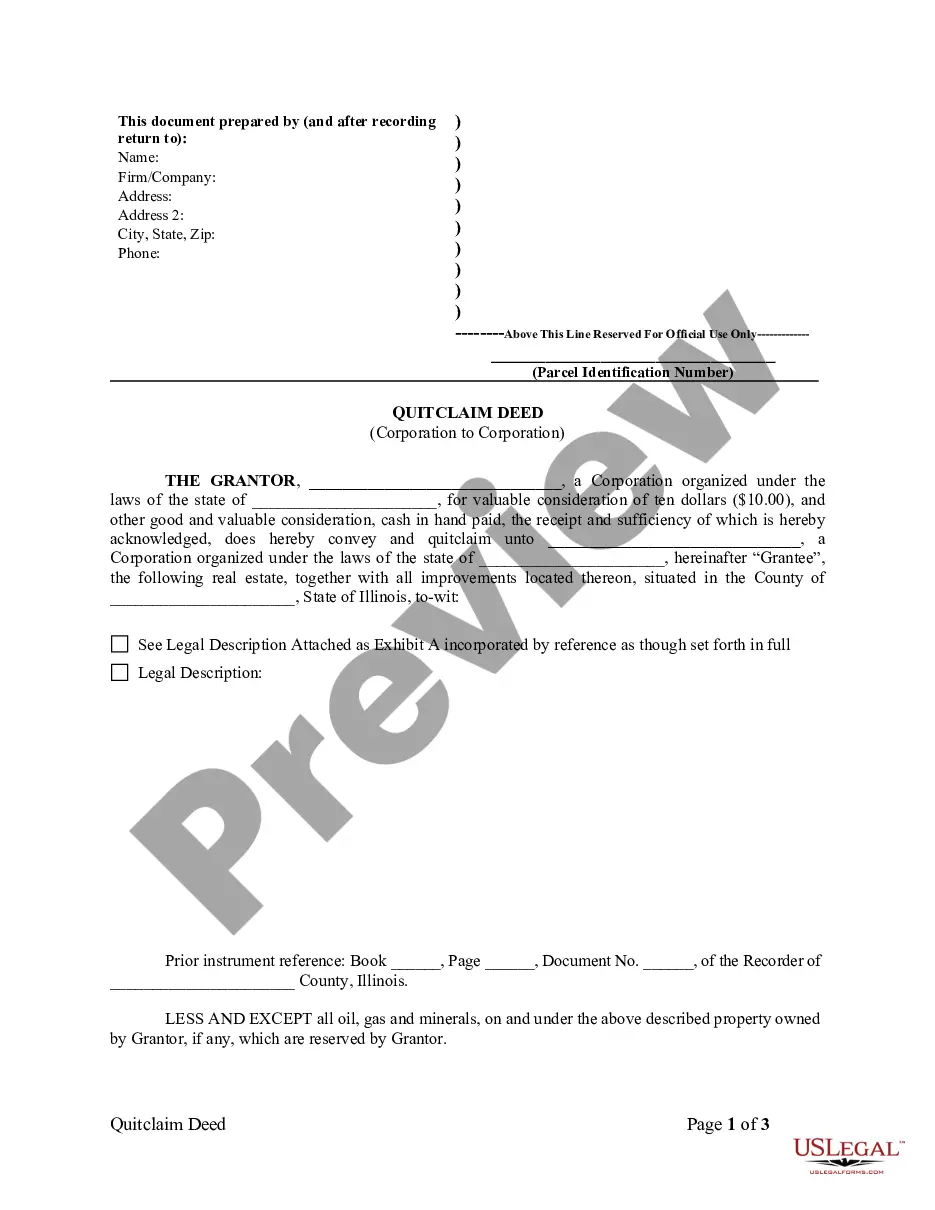

A Rockford Illinois Quitclaim Deed from Corporation to Corporation is a legal document used to transfer ownership of a property from one corporation to another without any guarantees regarding the title. This type of deed is commonly used in commercial real estate transactions where there is a pre-existing relationship between the transferring and receiving corporations. Below, we will explore the key elements of such a deed, its significance, and any subtypes that may exist. 1. Essential Elements: Granteror Corporation: The corporation that currently holds the property and is transferring ownership. — Grantee Corporation: The corporation that is receiving ownership of the property. — Property Description: A thorough and accurate description of the property being transferred, including its legal description, address, and any relevant parcel or lot numbers. — Consideration: The amount, if any, that the receiving corporation pays in exchange for the property. — Execution: The deed must be signed by both the authorized representative of the granter corporation and the authorized representative of the grantee corporation. — Notarization: The deed must be notarized to ensure its authenticity. 2. Significance: — Transfer of Ownership: The quitclaim deed allows the transferring corporation to relinquish any claim or interest it has in the property and transfer it to the receiving corporation. — No Warranty of Title: Unlike some other types of deeds, a quitclaim deed does not provide any guarantees or warranties regarding the title of the property. The receiving corporation takes ownership "as is," assuming the risk of any undisclosed liens, encumbrances, or defects in the title. 3. Subtypes: — Individual Quitclaim Deed: In addition to the specific Rockford Illinois Quitclaim Deed from Corporation to Corporation, there may be similar deeds used for transferring property between individuals or other entities, such as from an individual to a corporation or vice versa. — Special Purpose Quitclaim Deed: This type of quitclaim deed may be used for certain unique purposes, such as transferring property to a trust or releasing an easement on a property. — Non-Business Quitclaim Deed: This variant involves the transfer of property between non-business entities, such as transferring ownership between family members or divorcing spouses. In conclusion, a Rockford Illinois Quitclaim Deed from Corporation to Corporation facilitates the transfer of property ownership without any warranties or guarantees. It is a vital legal document used in commercial real estate transactions when one corporation wishes to transfer its property rights to another corporation.

Rockford Illinois Quitclaim Deed from Corporation to Corporation

Description

How to fill out Rockford Illinois Quitclaim Deed From Corporation To Corporation?

Finding verified templates specific to your local regulations can be challenging unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both personal and professional needs and any real-life situations. All the documents are properly categorized by area of usage and jurisdiction areas, so locating the Rockford Illinois Quitclaim Deed from Corporation to Corporation becomes as quick and easy as ABC.

For everyone already familiar with our service and has used it before, getting the Rockford Illinois Quitclaim Deed from Corporation to Corporation takes just a few clicks. All you need to do is log in to your account, choose the document, and click Download to save it on your device. This process will take just a couple of more actions to make for new users.

Follow the guidelines below to get started with the most extensive online form library:

- Check the Preview mode and form description. Make certain you’ve chosen the correct one that meets your requirements and fully corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you see any inconsistency, utilize the Search tab above to get the right one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and select the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the subscription.

- Download the Rockford Illinois Quitclaim Deed from Corporation to Corporation. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Benefit from the US Legal Forms library to always have essential document templates for any needs just at your hand!