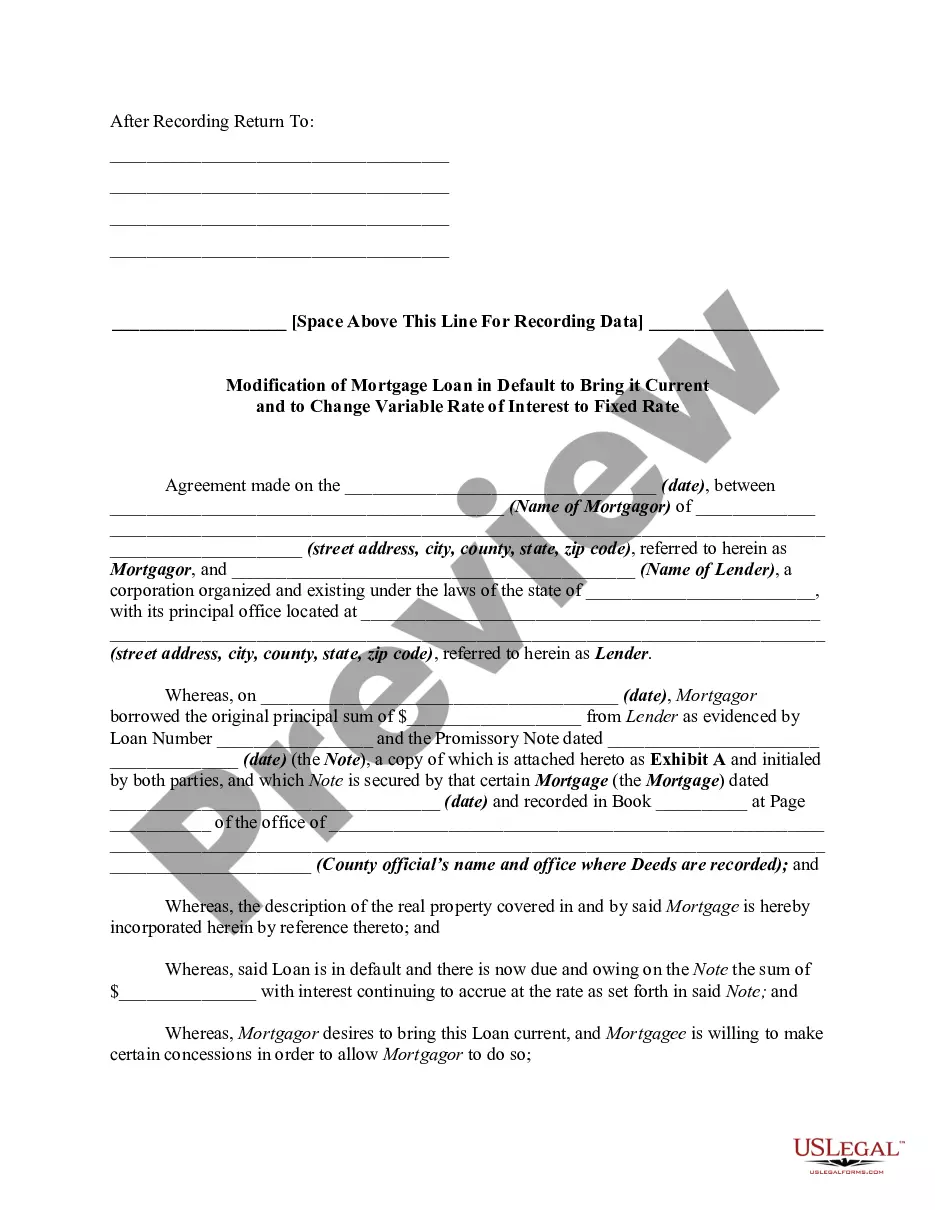

An agreement modifying a loan agreement and mortgage should be signed by both parties to the transaction and recorded in the office of the register of deeds and mortgages where the original mortgage was recorded. Such a modification is contractual in nature and should be supported by consideration.

Naperville Illinois Modification of Mortgage Loan in Default to Bring it Current and to Change Variable Rate of Interest to Fixed Rate

Description

How to fill out Illinois Modification Of Mortgage Loan In Default To Bring It Current And To Change Variable Rate Of Interest To Fixed Rate?

We consistently aim to reduce or avert legal complications when engaging with intricate legal or financial issues.

To achieve this, we enlist attorney services that are typically quite expensive.

However, not all legal concerns are as intricate. The majority can be addressed independently.

US Legal Forms is an online repository of current DIY legal documents covering everything from wills and powers of attorney to incorporation articles and dissolution petitions. Our library empowers you to manage your affairs independently without relying on legal counsel.

If you happen to misplace the form, you can always re-download it in the My documents section. The procedure is just as straightforward for newcomers to the platform! You can establish your account within minutes. Ensure that the Naperville Illinois Modification of Mortgage Loan in Default to Bring it Current and to Change Variable Rate of Interest to Fixed Rate adheres to the laws and regulations of your state and area. Moreover, it's crucial to review the form's outline (if available), and if you identify any inconsistencies with your initial expectations, look for an alternative form. Once you verify that the Naperville Illinois Modification of Mortgage Loan in Default to Bring it Current and to Change Variable Rate of Interest to Fixed Rate is suitable for you, you can select a subscription option and proceed to payment. After that, you can download the form in any preferred file format. With over 24 years in the industry, we have assisted millions by delivering ready-to-customize and up-to-date legal documents. Take advantage of US Legal Forms today to conserve time and resources!

- We offer legal document templates that aren't always publicly available.

- Our templates are tailored to specific states and regions, greatly simplifying the search process.

- Utilize US Legal Forms whenever you need to locate and download the Naperville Illinois Modification of Mortgage Loan in Default to Bring it Current and to Change Variable Rate of Interest to Fixed Rate or any other document easily and securely.

- Simply Log In to your account and click the Get button next to it.

Form popularity

FAQ

Loan modification fees may be charged if a person tries to change the terms of his or her loan. These fees may be charged by the lender or by a third-party professional that negotiates the modification process.

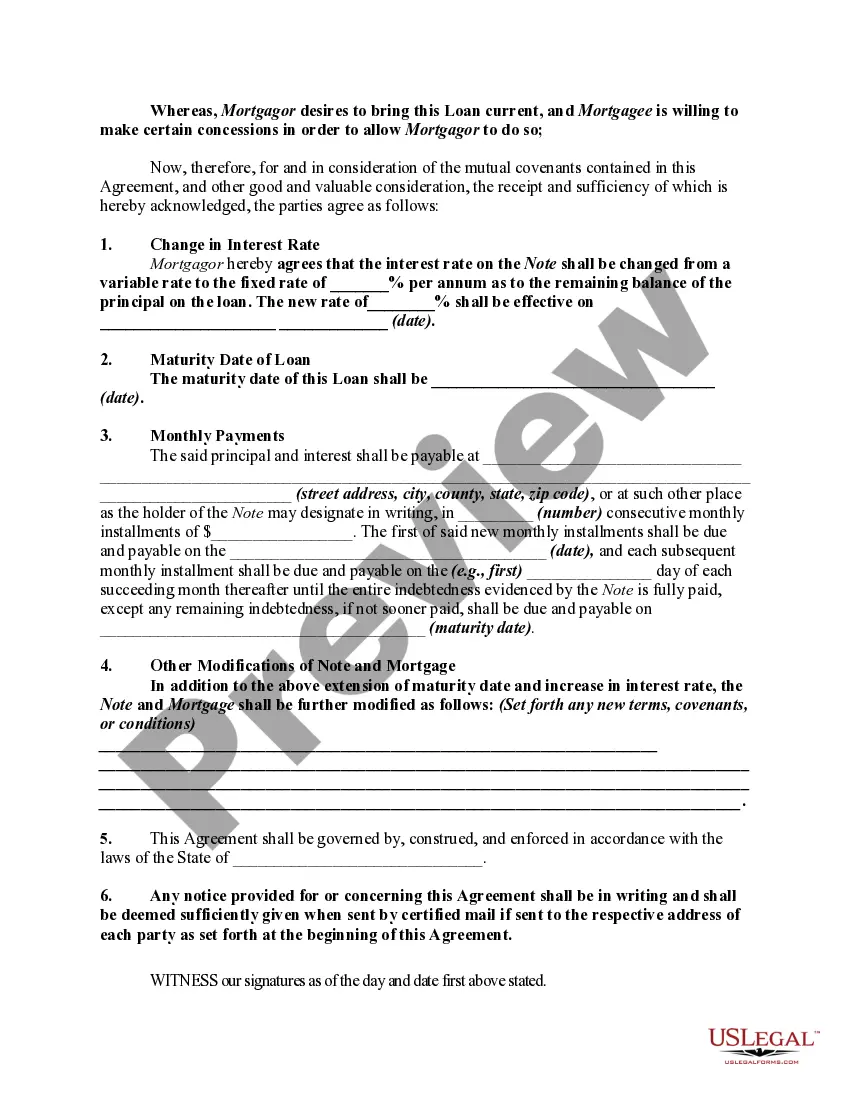

A modification involves one or more of the following: Extending the term of the mortgage (e.g., from a 30-year term to a 40-year term) Reducing the interest rate. Adding any past-due amounts, such as interest and escrow, to the unpaid principal balance, which is then reamortized over the new term.

1. Change your interest pricing regimen Change your interest pricing regimen.Change your interest pricing regimen.Transfer your loan to a new lender.Transfer your loan to a new lender.Move from fixed to floating rate.Move from fixed to floating rate.Make partial prepayment and get the EMI adjusted.

How to Negotiate a Loan Modification Do Not Ignore Your Lender. When facing foreclosure, your lender will likely contact you regularly.Stay in the Home.Collect Evidence.Contact a Foreclosure Defense Attorney.Contact Your Lender.Be Patient.Let Our Florida Foreclosure Defense Lawyers Help With Your Loan Modification.

Defaulting on a loan modification really isn't any different than defaulting on the original loan. The lender still has the ability to declare a default, to file a mortgage foreclosure lawsuit, to obtain a judgment, and to conduct a judicial auction.

Obtaining a loan modification can also hurt your credit. It will show up on your credit report, and it may lower your credit score, which can affect your ability to get another loan in the future. Loan modifications are also complex, time-consuming, and carry the risk of scams.

A modification typically changes the loan's rate or term (or both) to make monthly payments more affordable. Borrowers seeking a modification have to provide proof of hardship to their mortgage lender or servicer. Unlike forbearance, loan modifications are a permanent solution.

Loan modifications are a long-term mortgage relief option for borrowers experiencing financial hardship, such as loss of income due to illness. A modification typically changes the loan's rate or term (or both) to make monthly payments more affordable.