The Elgin Amendment to Postnuptial Property Agreement in Illinois is an important legal provision that addresses the distribution of assets and property rights among spouses in the event of a divorce or separation. This amendment explicitly pertains to the state of Illinois and is significant for individuals seeking clarity and protection in their postnuptial agreements. The Elgin Amendment adds a layer of protection and specificity, allowing spouses to exercise control over their predetermined financial arrangements, ensuring fairness and transparency in the transition from marital to individual property. While the specifics may vary depending on the agreement, the Elgin Amendment generally encompasses provisions for the division of properties, debts, income, and other relevant assets. There are several variations of the Elgin Amendment to Postnuptial Property Agreement — Illinois. These include: 1. Enhanced Asset Protection Elgin Amendment: This version intends to offer a higher level of financial safeguarding to one or both spouses, aiming to preserve and protect specific assets or investments acquired before or during the marriage. 2. Spousal Support Elgin Amendment: This amendment type emphasizes the terms and conditions of spousal support or alimony between spouses, outlining the financial obligations and responsibilities of each party involved. It may address the duration, amount, and nature of the support to be provided. 3. Business Interests Elgin Amendment: Specifically designed for spouses involved in jointly-owned businesses, this amendment establishes guidelines for the distribution and management of business assets, stocks, profits, and liabilities in case of divorce or dissolution of marriage. 4. Inheritance and Estate Planning Elgin Amendment: This variant concentrates on delineating the rights and obligations of spouses concerning inheritance, trusts, and other estate planning matters. It safeguards the interests of each party while ensuring a predetermined distribution of assets according to the wishes of the deceased spouse. When drafting an Elgin Amendment to a Postnuptial Property Agreement, it is crucial to consult a qualified family law attorney with expertise in Illinois laws. They can provide legal advice, assistance, and ensure the amendment complies with state regulations, thereby fortifying its enforceability in court. Overall, the Elgin Amendment to Postnuptial Property Agreement — Illinois offers spouses the opportunity to establish clear and comprehensive terms pertaining to their property rights, financial obligations, and division of assets in the unfortunate event of separation or divorce.

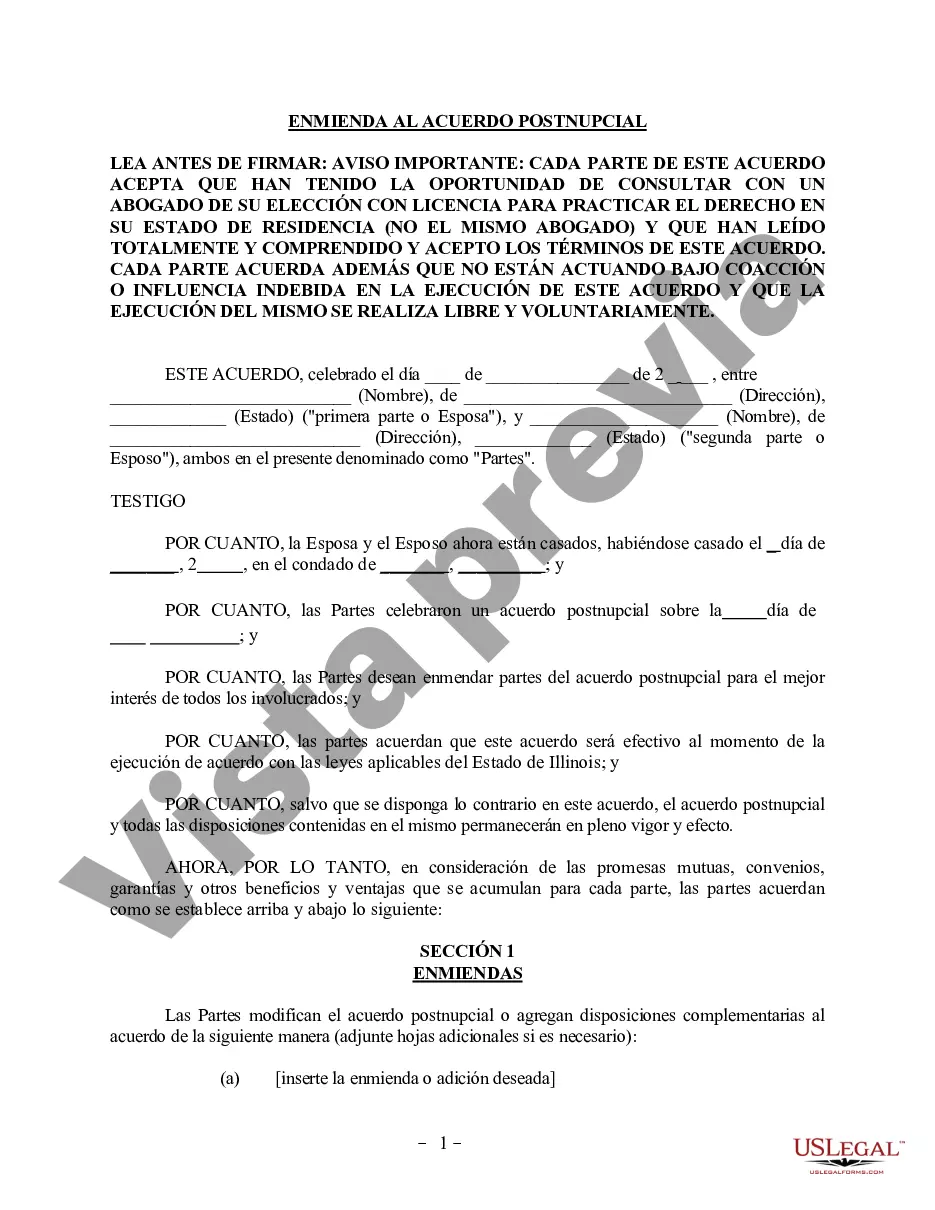

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Elgin Enmienda al Acuerdo de propiedad posnupcial - Illinois - Illinois Amendment to Postnuptial Property Agreement

State:

Illinois

City:

Elgin

Control #:

IL-01715-AZ

Format:

Word

Instant download

Description

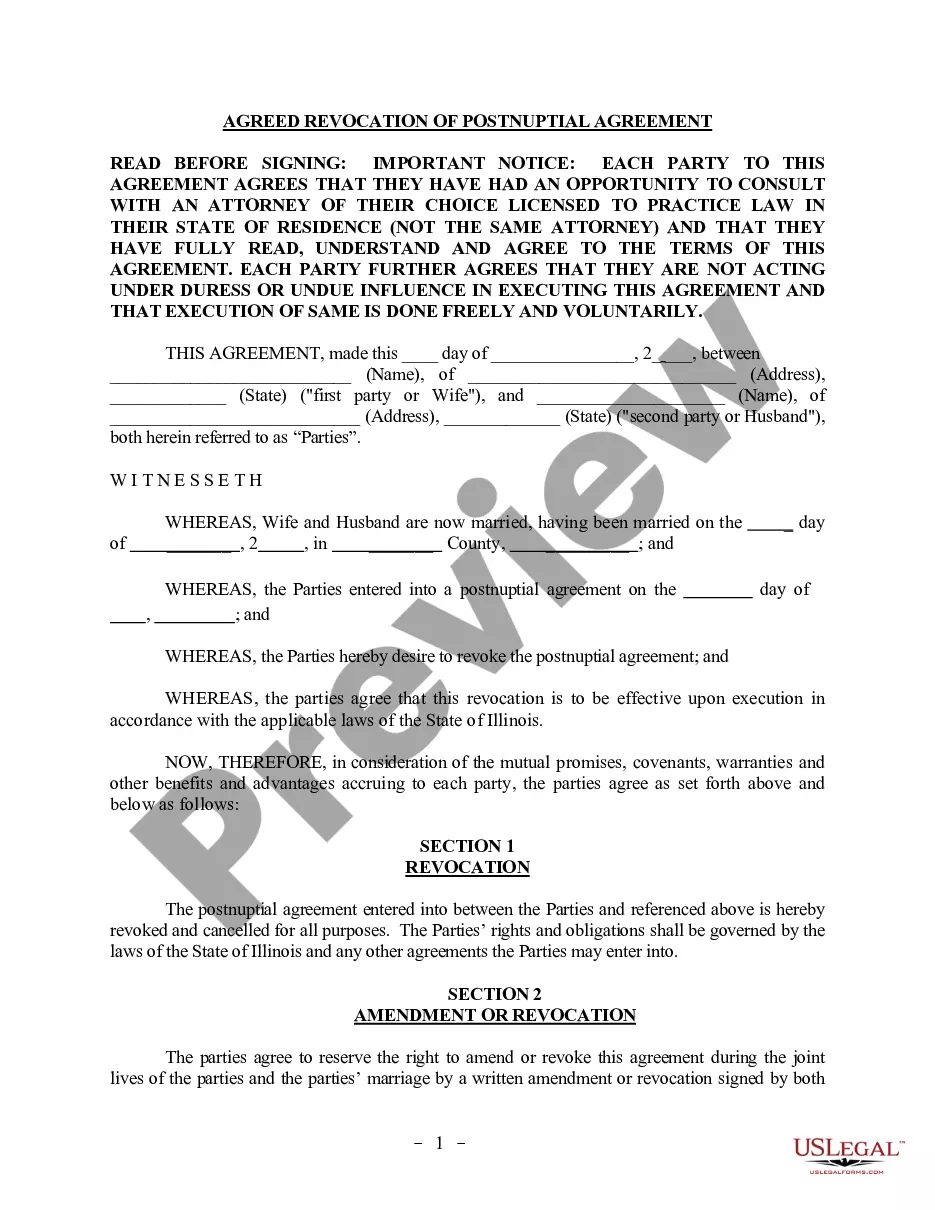

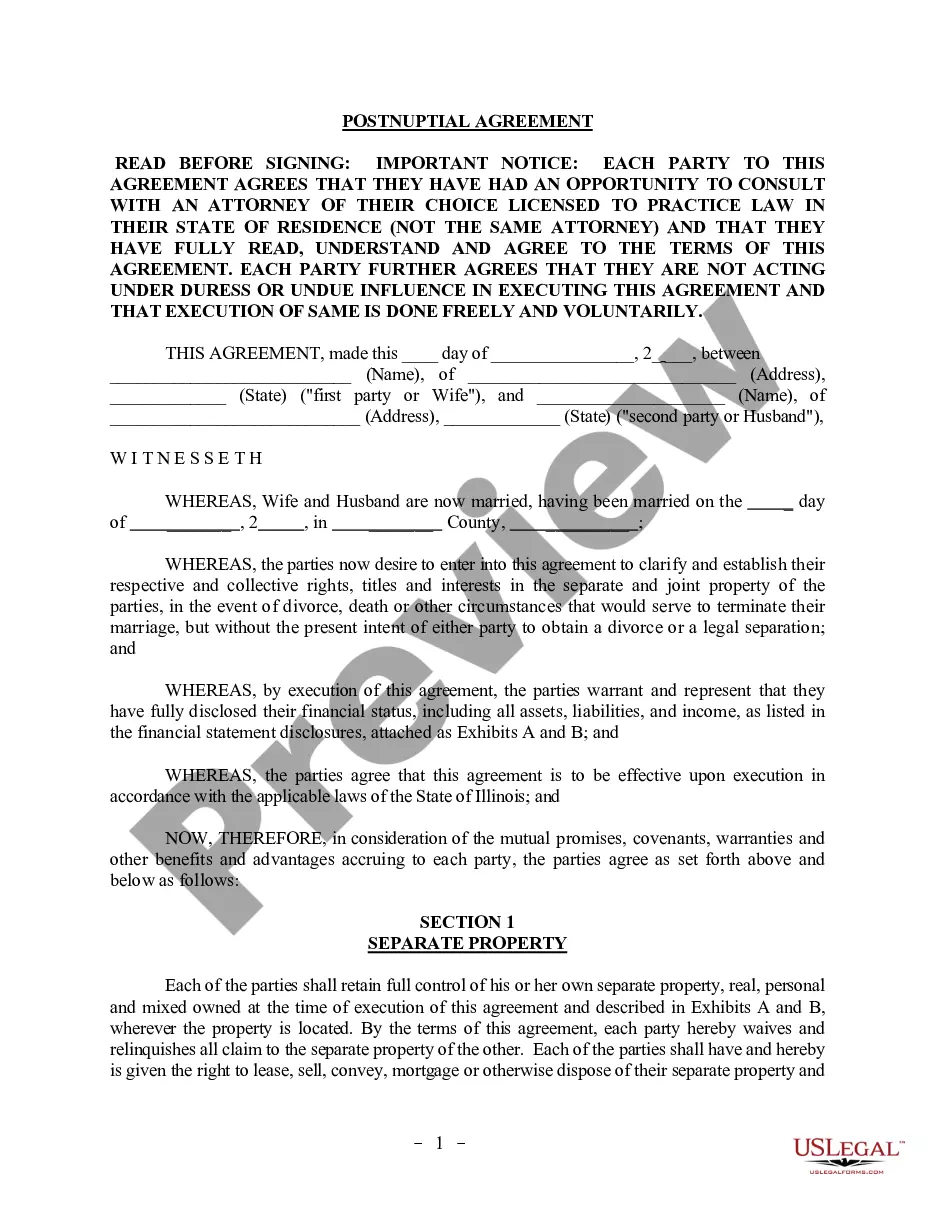

This Amendment to Postnuptial Property Agreement form is for use by parties to make amendments or additions to an existing postnuptial agreement. Both parties are required to sign the amendment in the presence of a notary public.

The Elgin Amendment to Postnuptial Property Agreement in Illinois is an important legal provision that addresses the distribution of assets and property rights among spouses in the event of a divorce or separation. This amendment explicitly pertains to the state of Illinois and is significant for individuals seeking clarity and protection in their postnuptial agreements. The Elgin Amendment adds a layer of protection and specificity, allowing spouses to exercise control over their predetermined financial arrangements, ensuring fairness and transparency in the transition from marital to individual property. While the specifics may vary depending on the agreement, the Elgin Amendment generally encompasses provisions for the division of properties, debts, income, and other relevant assets. There are several variations of the Elgin Amendment to Postnuptial Property Agreement — Illinois. These include: 1. Enhanced Asset Protection Elgin Amendment: This version intends to offer a higher level of financial safeguarding to one or both spouses, aiming to preserve and protect specific assets or investments acquired before or during the marriage. 2. Spousal Support Elgin Amendment: This amendment type emphasizes the terms and conditions of spousal support or alimony between spouses, outlining the financial obligations and responsibilities of each party involved. It may address the duration, amount, and nature of the support to be provided. 3. Business Interests Elgin Amendment: Specifically designed for spouses involved in jointly-owned businesses, this amendment establishes guidelines for the distribution and management of business assets, stocks, profits, and liabilities in case of divorce or dissolution of marriage. 4. Inheritance and Estate Planning Elgin Amendment: This variant concentrates on delineating the rights and obligations of spouses concerning inheritance, trusts, and other estate planning matters. It safeguards the interests of each party while ensuring a predetermined distribution of assets according to the wishes of the deceased spouse. When drafting an Elgin Amendment to a Postnuptial Property Agreement, it is crucial to consult a qualified family law attorney with expertise in Illinois laws. They can provide legal advice, assistance, and ensure the amendment complies with state regulations, thereby fortifying its enforceability in court. Overall, the Elgin Amendment to Postnuptial Property Agreement — Illinois offers spouses the opportunity to establish clear and comprehensive terms pertaining to their property rights, financial obligations, and division of assets in the unfortunate event of separation or divorce.

Free preview

How to fill out Elgin Enmienda Al Acuerdo De Propiedad Posnupcial - Illinois?

If you’ve already utilized our service before, log in to your account and download the Elgin Amendment to Postnuptial Property Agreement - Illinois on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, follow these simple actions to obtain your file:

- Ensure you’ve located the right document. Read the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t suit you, use the Search tab above to obtain the appropriate one.

- Buy the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Get your Elgin Amendment to Postnuptial Property Agreement - Illinois. Select the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have bought: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily find and save any template for your individual or professional needs!