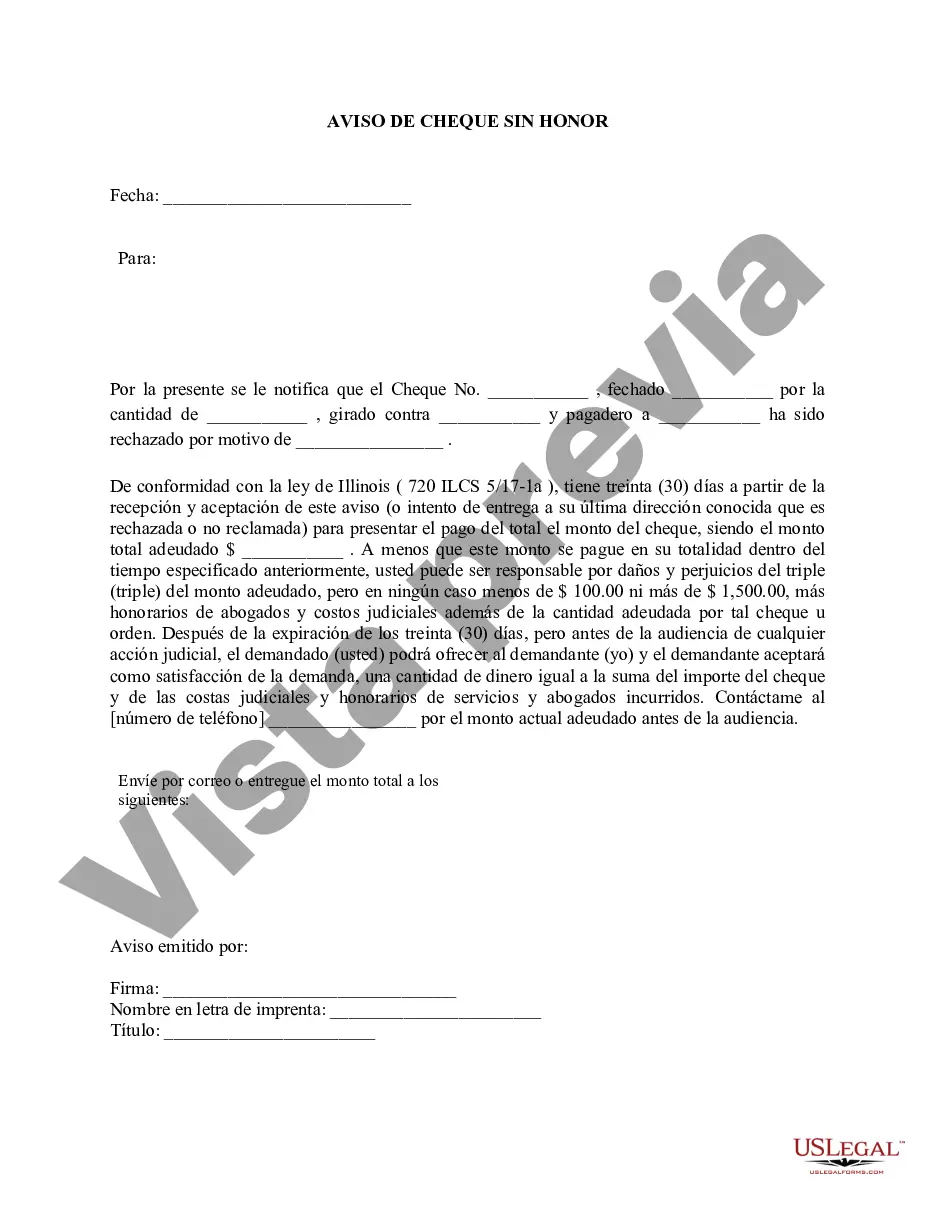

The Cook Illinois Notice of Dishonored Check — Civil is a legal document that notifies individuals or businesses when a check they have received has been returned unpaid by the bank. Commonly known as a bad check or bounced check, this notice serves as a formal communication to the check issuer regarding the non-payment of funds. A bad check refers to a check that is written with insufficient funds in the issuer's bank account. This occurs when the issuer does not have enough money to cover the amount stated on the check. When such a check is deposited or presented for payment, it is returned by the bank due to the lack of funds, resulting in a dishonored check. A bounced check is another term often used interchangeably with a bad check. It signifies a situation where the check "bounces" back unpaid by the bank, typically due to insufficient funds or a closed account. This can cause significant inconvenience for the recipient who may have relied on the check for financial transactions. The Cook Illinois Notice of Dishonored Check — Civil is specifically tailored to address the legal implications and consequences associated with receiving a bad check or a bounced check in Cook County, Illinois. The notice serves as a formal notification to the issuer, informing them of the dishonored check and the legal actions that may be taken against them if the issue is not resolved promptly. It is essential to take appropriate action upon receiving a Cook Illinois Notice of Dishonored Check — Civil. The notice typically includes instructions for the issuer to rectify the situation, such as providing payment for the dishonored check amount plus any applicable fees or penalties. Failure to respond to the notice or resolve the matter may result in legal consequences, including civil litigation or potential criminal charges. Different types or versions of the Cook Illinois Notice of Dishonored Check — Civil may exist, depending on the specific circumstances or requirements of the issuing entity. For example, a notice may vary based on the amount of the dishonored check or the number of times the issuer has bounced checks in the past. Each variation aims to address the unique circumstances while adhering to the relevant legal guidelines and regulations governing dishonored checks in Cook County, Illinois. In conclusion, the Cook Illinois Notice of Dishonored Check — Civil is a crucial legal document used to notify individuals or businesses of a bad check or bounced check. It outlines the steps that must be taken to rectify the situation and emphasizes the potential legal consequences if prompt action is not taken. It is important for both check recipients and check issuers to understand their rights and responsibilities when faced with a Cook Illinois Notice of Dishonored Check — Civil.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cook Illinois Aviso de cheque sin fondos - Civil - Palabras clave: cheque sin fondos, cheque sin fondos - Illinois Notice of Dishonored Check - Civil - Keywords: bad check, bounced check

Description

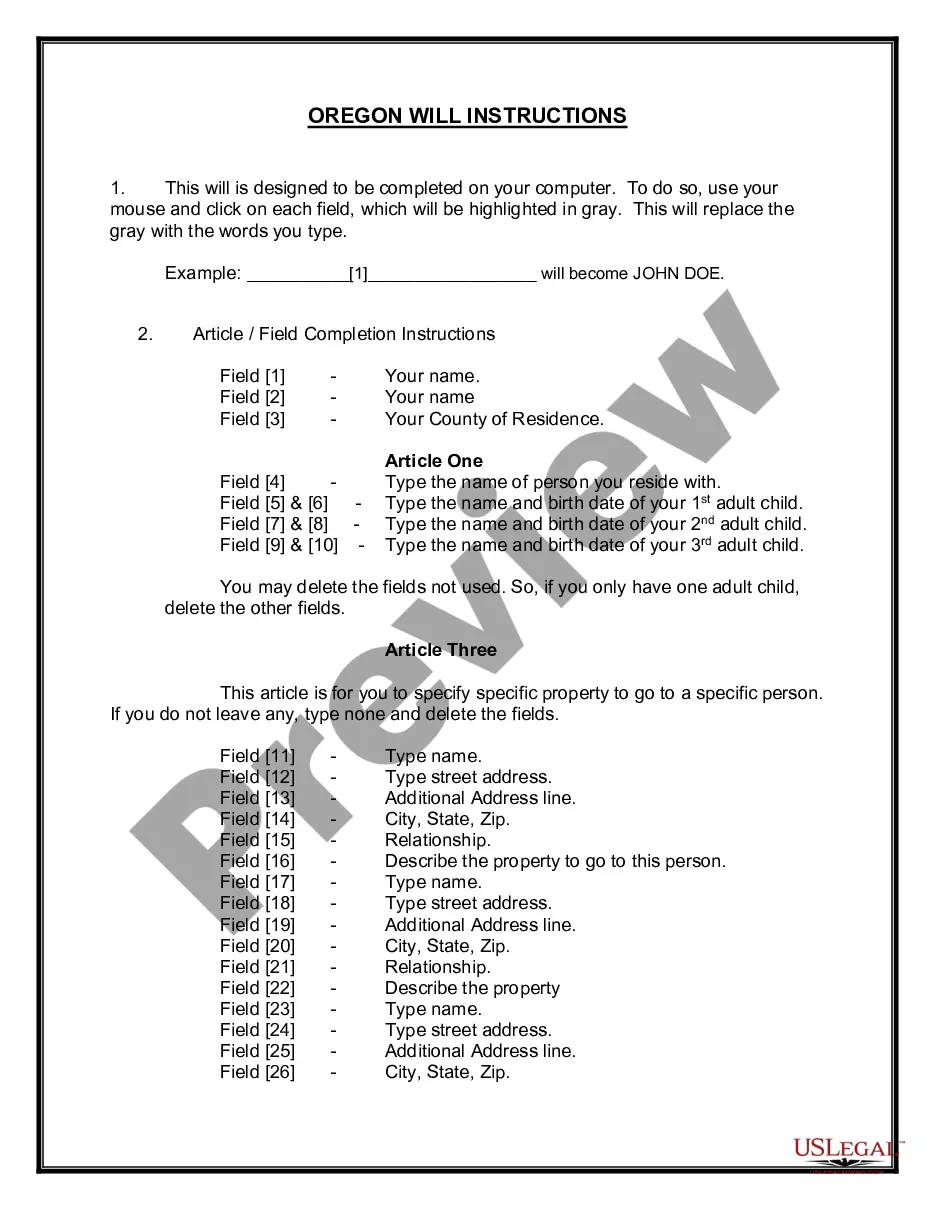

How to fill out Cook Illinois Aviso De Cheque Sin Fondos - Civil - Palabras Clave: Cheque Sin Fondos, Cheque Sin Fondos?

Regardless of social or professional status, filling out law-related documents is an unfortunate necessity in today’s professional environment. Too often, it’s almost impossible for someone without any law background to draft such paperwork cfrom the ground up, mostly because of the convoluted jargon and legal subtleties they involve. This is where US Legal Forms comes in handy. Our service provides a massive library with more than 85,000 ready-to-use state-specific documents that work for practically any legal situation. US Legal Forms also is a great resource for associates or legal counsels who want to to be more efficient time-wise using our DYI tpapers.

No matter if you want the Cook Illinois Notice of Dishonored Check - Civil - Keywords: bad check, bounced check or any other paperwork that will be good in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how to get the Cook Illinois Notice of Dishonored Check - Civil - Keywords: bad check, bounced check in minutes employing our trustworthy service. In case you are already an existing customer, you can go ahead and log in to your account to download the appropriate form.

Nevertheless, in case you are a novice to our library, make sure to follow these steps prior to obtaining the Cook Illinois Notice of Dishonored Check - Civil - Keywords: bad check, bounced check:

- Ensure the form you have chosen is good for your area since the regulations of one state or area do not work for another state or area.

- Review the form and read a brief outline (if provided) of scenarios the document can be used for.

- In case the one you chosen doesn’t suit your needs, you can start again and look for the necessary document.

- Click Buy now and choose the subscription plan that suits you the best.

- Log in to your account login information or register for one from scratch.

- Choose the payment gateway and proceed to download the Cook Illinois Notice of Dishonored Check - Civil - Keywords: bad check, bounced check once the payment is done.

You’re good to go! Now you can go ahead and print the form or complete it online. Should you have any issues getting your purchased documents, you can quickly find them in the My Forms tab.

Whatever case you’re trying to sort out, US Legal Forms has got you covered. Try it out today and see for yourself.

Form popularity

FAQ

Si resulta que se ha ofrecido un cheque sin fondos, las posibilidades existentes son: Ofrecerse a pagar a la otra persona por otros medios, incluso en efectivo. Ingresar el dinero en la cuenta, incluidas las comisiones por emitir cheque sin fondos, y pedir al beneficiario que vuelva a intentar cobrar.

La aplicacion movil Chequeas busca facilitar la comprobacion del estado del cheque: basta sacarle una foto o ingresar el CUIT de manera manual para comprobar si el emisor tiene fondos suficientes. La informacion que uno ingresa en la aplicacion no tiene peligro ya que es de acceso publico.

Si John Smith quiere firmar el cheque a otra persona En la seccion «Endosar aqui», escribira «Pagar a la orden de» y el nombre de la otra persona. Luego, debajo de eso, firma con su nombre. Despues, le dara ese cheque a la persona cuyo nombre escribio en el reverso del cheque para que lo cobre o lo deposite.

Su cheque sin fondos provoca varias responsabilidades diferentes. Tal como sucede con el cheque sin fondos que recibio, su banco le cobra una cuota NSF (sin fondos suficientes) para cubrir el costo de que su cheque sin fondos haya sido rebotado al beneficiario desafortunado.

¿Como depositar un cheque a nombre de otra persona? Tener un contrato, generalmente en escritura publica, en el que conste claramente que la persona que va a realizar el deposito es representante legal o mandatario del beneficiario. Aportar dicha documentacion junto con el cheque a depositar.

1) El beneficiario debe escribir en el dorso del cheque el nombre de otra persona, quien pasa a ser el nuevo beneficiario, y lo firma. 2) Se puede anadir algun dato mas del nuevo beneficiario, como su DNI, mejor.

Cuando se entrega un cheque y no se tiene dinero en la cuenta bancaria para respaldar la cantidad escrita en dicho documento, se dice que es un cheque sin fondos. Por lo tanto, un cheque sin fondos, es un papel sin ningun valor. Un cheque puede no tener fondos por diversas razones.

El cheque sin fondos o en descubierto es aquel expedido sin los fondos suficientes. Es decir, el importe del documento es mayor al capital registrado en la cuenta bancaria del emisor (librador). El otorgar este tipo de cheque se considera un delito cuya sancion depende de la legislacion de cada pais.

Su cheque sin fondos provoca varias responsabilidades diferentes. Tal como sucede con el cheque sin fondos que recibio, su banco le cobra una cuota NSF (sin fondos suficientes) para cubrir el costo de que su cheque sin fondos haya sido rebotado al beneficiario desafortunado.

Numero del cheque: Si no hay numero en la esquina superior derecha, o el numero no coincide con el del renglon de tinta magnetica en la parte inferior del cheque (MICR), el cheque es falso.

Interesting Questions

More info

Banking Online for Illinois — General — Keywords: Online banking Get online banking services for Illinois and learn about their requirements. Credit Repair — Consumer — Keywords: Credit repair, Credit reports, Credit repair Get access to free credit repair services to help you find your financing goals. Credit Unions in Illinois — Industrial — Keywords: credit unions, credit unions find a variety of resources for you to help build credit. Emergency Preparedness Check — Personal — Keywords: Emergency preparedness, preparedness Find out how to prepare your home and possessions for an emergency situation and find tips and suggestions from experts. Energy — Consumer — Keywords: energy Get information and guides about Illinois utilities for your home, office and car. Enterprise Search — Corporate — Keywords: search Find information in your enterprise on products and services.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.