The Cook Illinois Residential Rental Lease Agreement is a legally binding document that establishes the terms and conditions between a landlord and a tenant for renting residential property within the Cook County area of Illinois. This agreement outlines the rights, responsibilities, and obligations of both parties during the tenancy period. The Cook Illinois Residential Rental Lease Agreement covers various aspects related to the rental property, such as the monthly rent, security deposit, duration of the lease, maintenance responsibilities, and any additional rules and regulations that may govern the tenancy. It ensures a clear understanding between the landlord and the tenant, minimizing any potential disputes. Different types of Cook Illinois Residential Rental Lease Agreements may vary depending on the specific conditions and requirements of the rental property. Some common types include: 1. Fixed-Term Lease Agreement: This type of agreement specifies a set duration of the lease, typically for a specific number of months or years. Both parties must adhere to the terms until the lease expires, after which they can choose to renew or terminate the agreement. 2. Month-to-Month Lease Agreement: This type of agreement provides more flexibility for both the landlord and the tenant. It typically renews automatically on a monthly basis unless either party provides sufficient notice to terminate the lease. The terms and conditions can be adjusted more easily with this type of agreement. 3. Sublease Agreement: In certain situations, a tenant may sublet their rental unit to another person. A sublease agreement permits the tenant to transfer their lease rights and responsibilities to the subtenant, who pays rent directly to the tenant. 4. Lease with Option to Purchase Agreement: This type of agreement gives the tenant the opportunity to purchase the rental property at a predetermined price within a specified period. It provides tenants with the chance to test out living in the property before committing to buy it. In conclusion, the Cook Illinois Residential Rental Lease Agreement is a comprehensive document that outlines the terms and conditions of a residential tenancy in Cook County, Illinois. It ensures both parties have a clear understanding of their rights and responsibilities. Different types of agreements, such as fixed-term, month-to-month, sublease, and lease with option to purchase, cater to varying circumstances and preferences of landlords and tenants.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.- US Legal Forms

- Localized forms in Spanish

- Illinois

- Cook

-

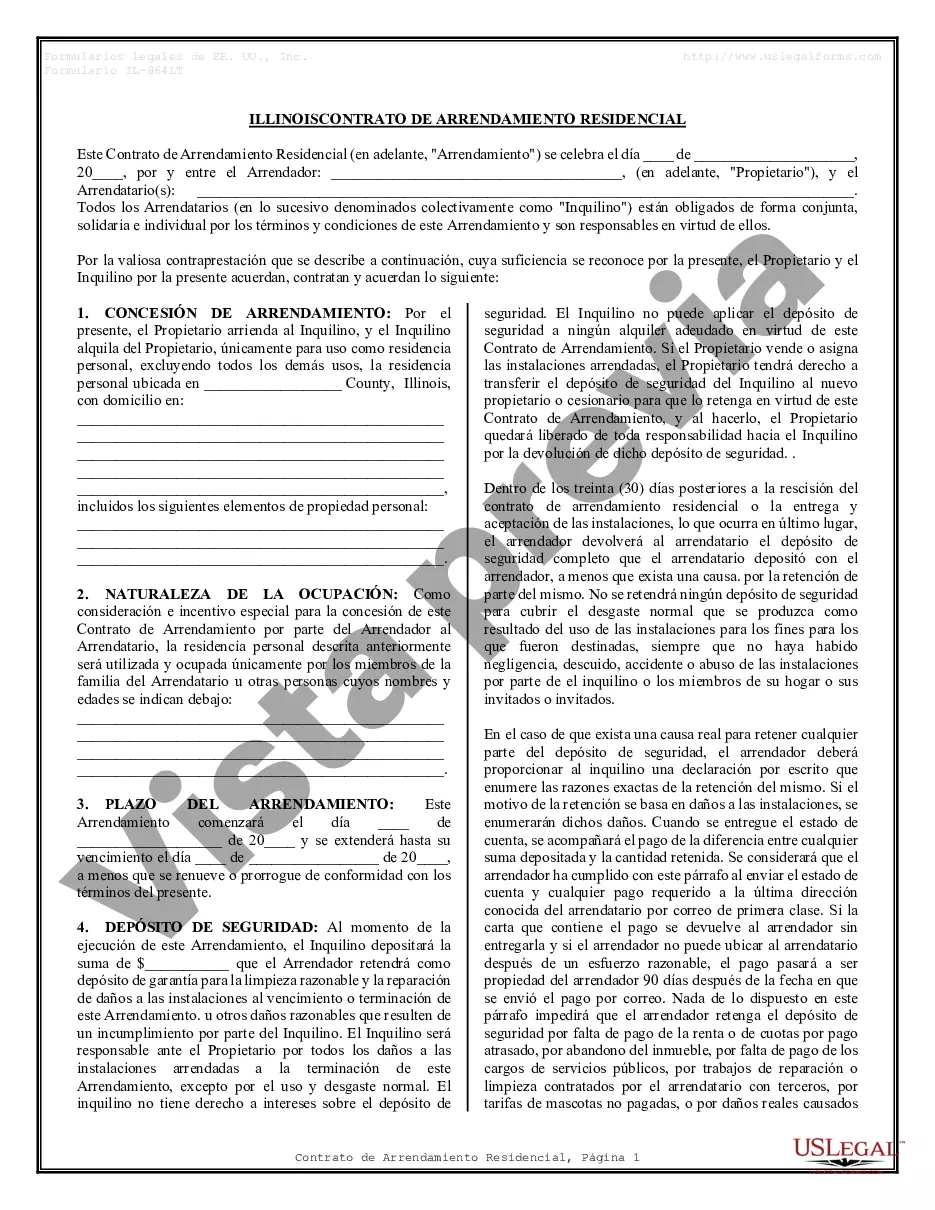

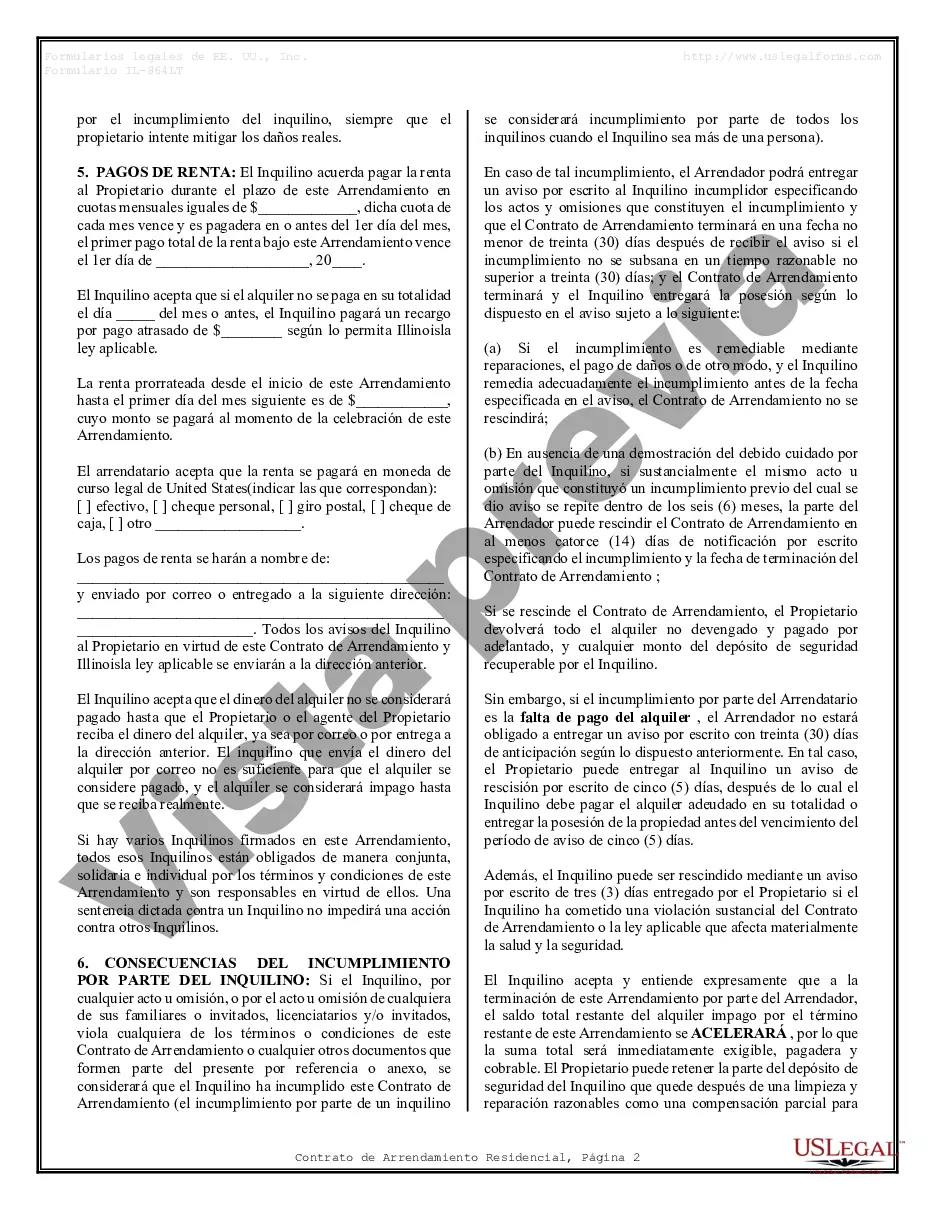

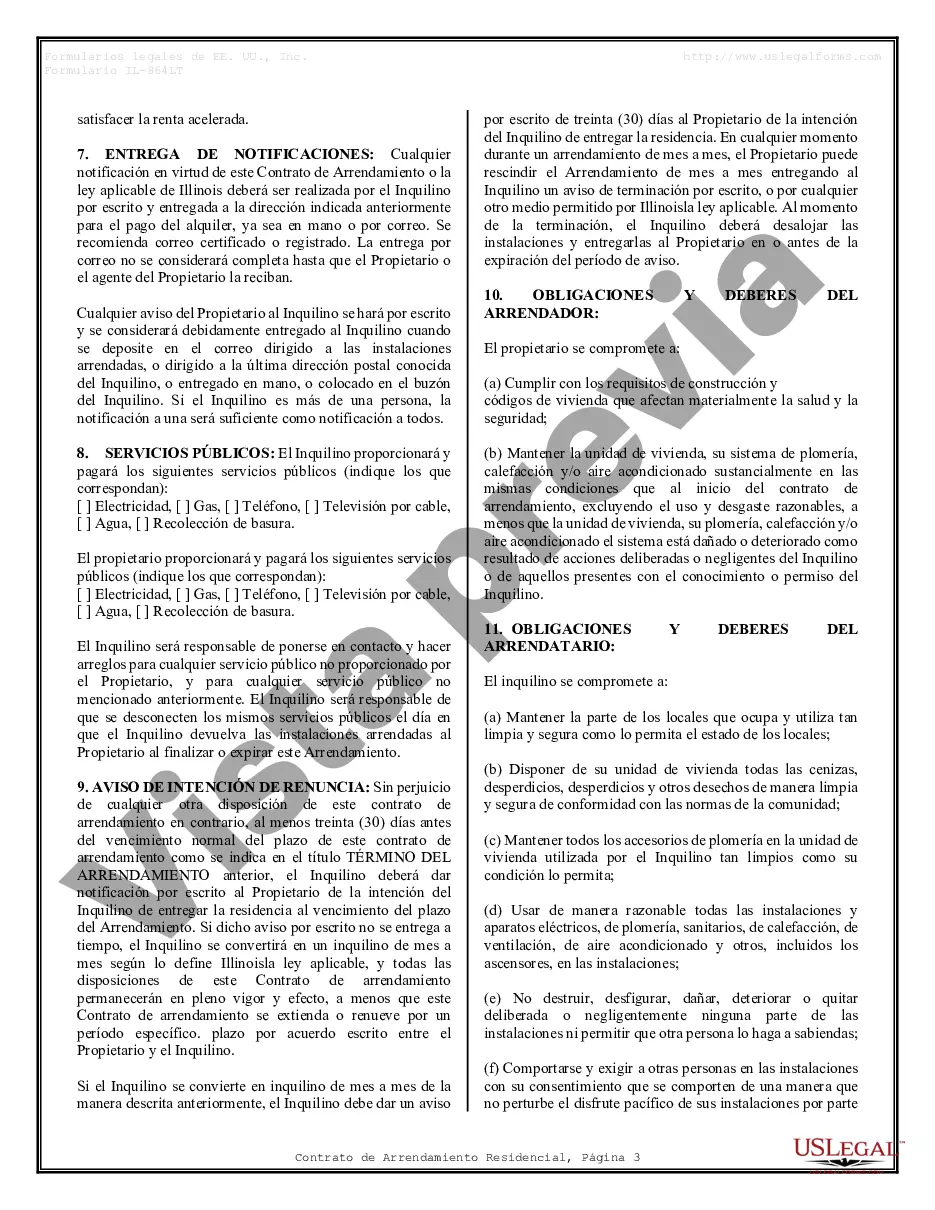

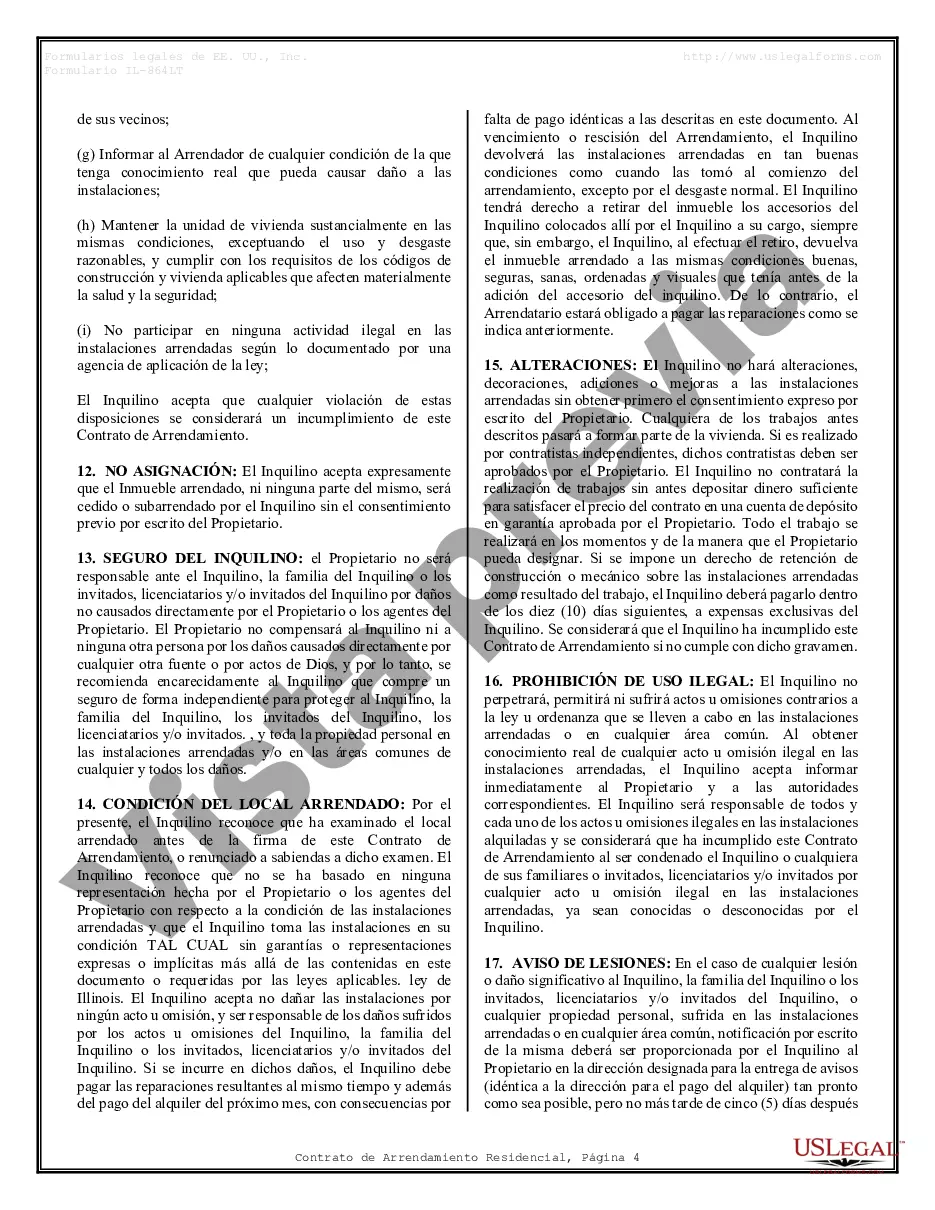

Illinois Contrato de arrendamiento de alquiler residencial

Cook Illinois Contrato de arrendamiento de alquiler residencial - Illinois Residential Rental Lease Agreement

Description

Related Forms

Illinois Residential Landlord Tenant Rental Lease Forms and Agreements Package

View Minneapolis

View Mesa

View Memphis

View Louisville

View Long Beach

How to fill out Cook Illinois Contrato De Arrendamiento De Alquiler Residencial?

Getting verified templates specific to your local regulations can be challenging unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly categorized by area of usage and jurisdiction areas, so searching for the Cook Illinois Residential Rental Lease Agreement gets as quick and easy as ABC.

For everyone already familiar with our catalogue and has used it before, obtaining the Cook Illinois Residential Rental Lease Agreement takes just a couple of clicks. All you need to do is log in to your account, select the document, and click Download to save it on your device. This process will take just a few additional steps to complete for new users.

Follow the guidelines below to get started with the most extensive online form catalogue:

- Check the Preview mode and form description. Make sure you’ve picked the right one that meets your needs and fully corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you see any inconsistency, use the Search tab above to find the right one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the subscription.

- Download the Cook Illinois Residential Rental Lease Agreement. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Take advantage of the US Legal Forms library to always have essential document templates for any demands just at your hand!

Form Rating

Form popularity

FAQ

El costo de un contrato de arrendamiento con un notario es variable segun la empresa que se contrate para el tramite. Sin embargo, una aproximacion estaria entre los 10.200 y los 14.000 CLP.

Suggested clip · 57 seconds ¿Como diligenciar formulario? - YouTube YouTube Start of suggested clip End of suggested clip

Caracteristicas y elementos: La identificacion con nombre completo y cedula del arrendador (propietario) La identificacion del arrendatario. La identificacion plena del bien objeto de arrendamiento. Determinacion del valor del canon o valor mensual del arrendamiento.

Suggested clip 57 seconds ¿Como diligenciar formulario? - YouTube YouTube Start of suggested clip End of suggested clip

Elementos y clausulas del contrato de arrendamiento Nombre e identificacion de los contratantes. Identificacion del inmueble objeto del contrato de arrendamiento. Precio o canon o renta. Forma de pago. Relacion de servicios. Termino de duracion del contrato.

Un contrato de arrendamiento debe incluir al menos la siguiente informacion: Nombre y datos generales del propietario o de la persona con las facultades legales para rentar la propiedad. Nombre y datos generales de la persona que habitara la propiedad. Ubicacion y descripcion del inmueble a arrendar.

Descarga y llena un contrato de arrendamiento muy sencillo Identificacion de las partes involucradas. La identificacion de la propiedad. El tiempo de vigencia del contrato. El monto inicial a pagar por el arriendo y modalidad de pago (opcional). Fianza o deposito.

¿Como se hace un contrato de arrendamiento Ecuador? Identificacion de ambas partes, arrendatario y arrendador. Datos de identificacion y ubicacion del bien inmueble a alquilar. Valor y forma de pago. Destino del bien a alquilar.

Elementos del Contrato de Arrendamiento de Local Comercial Nombre y datos generales del propietario. Nombre y datos generales de la(s) persona(s) (arrendatario) Ubicacion y descripcion del inmueble que se van a rentar. El objeto o proposito del contrato (dar en arrendamiento el inmueble).

El Ministerio de Vivienda y Urbanismo aclara en su web que los gastos notariales del contrato de arriendo los deben asumir las partes que firman. Todos reciben una copia del valor de contrato de arriendo en notaria.

El costo de un contrato de arrendamiento con un notario es variable segun la empresa que se contrate para el tramite. Sin embargo, una aproximacion estaria entre los 10.200 y los 14.000 CLP.

Suggested clip · 57 seconds ¿Como diligenciar formulario? - YouTube YouTube Start of suggested clip End of suggested clip

Caracteristicas y elementos: La identificacion con nombre completo y cedula del arrendador (propietario) La identificacion del arrendatario. La identificacion plena del bien objeto de arrendamiento. Determinacion del valor del canon o valor mensual del arrendamiento.

Suggested clip 57 seconds ¿Como diligenciar formulario? - YouTube YouTube Start of suggested clip End of suggested clip

Elementos y clausulas del contrato de arrendamiento Nombre e identificacion de los contratantes. Identificacion del inmueble objeto del contrato de arrendamiento. Precio o canon o renta. Forma de pago. Relacion de servicios. Termino de duracion del contrato.

Un contrato de arrendamiento debe incluir al menos la siguiente informacion: Nombre y datos generales del propietario o de la persona con las facultades legales para rentar la propiedad. Nombre y datos generales de la persona que habitara la propiedad. Ubicacion y descripcion del inmueble a arrendar.

Descarga y llena un contrato de arrendamiento muy sencillo Identificacion de las partes involucradas. La identificacion de la propiedad. El tiempo de vigencia del contrato. El monto inicial a pagar por el arriendo y modalidad de pago (opcional). Fianza o deposito.

¿Como se hace un contrato de arrendamiento Ecuador? Identificacion de ambas partes, arrendatario y arrendador. Datos de identificacion y ubicacion del bien inmueble a alquilar. Valor y forma de pago. Destino del bien a alquilar.

Elementos del Contrato de Arrendamiento de Local Comercial Nombre y datos generales del propietario. Nombre y datos generales de la(s) persona(s) (arrendatario) Ubicacion y descripcion del inmueble que se van a rentar. El objeto o proposito del contrato (dar en arrendamiento el inmueble).

El Ministerio de Vivienda y Urbanismo aclara en su web que los gastos notariales del contrato de arriendo los deben asumir las partes que firman. Todos reciben una copia del valor de contrato de arriendo en notaria.

El costo de un contrato de arrendamiento con un notario es variable segun la empresa que se contrate para el tramite. Sin embargo, una aproximacion estaria entre los 10.200 y los 14.000 CLP.

Suggested clip · 57 seconds ¿Como diligenciar formulario? - YouTube YouTube Start of suggested clip End of suggested clip

Caracteristicas y elementos: La identificacion con nombre completo y cedula del arrendador (propietario) La identificacion del arrendatario. La identificacion plena del bien objeto de arrendamiento. Determinacion del valor del canon o valor mensual del arrendamiento.

Suggested clip 57 seconds ¿Como diligenciar formulario? - YouTube YouTube Start of suggested clip End of suggested clip

Elementos y clausulas del contrato de arrendamiento Nombre e identificacion de los contratantes. Identificacion del inmueble objeto del contrato de arrendamiento. Precio o canon o renta. Forma de pago. Relacion de servicios. Termino de duracion del contrato.

Un contrato de arrendamiento debe incluir al menos la siguiente informacion: Nombre y datos generales del propietario o de la persona con las facultades legales para rentar la propiedad. Nombre y datos generales de la persona que habitara la propiedad. Ubicacion y descripcion del inmueble a arrendar.

Descarga y llena un contrato de arrendamiento muy sencillo Identificacion de las partes involucradas. La identificacion de la propiedad. El tiempo de vigencia del contrato. El monto inicial a pagar por el arriendo y modalidad de pago (opcional). Fianza o deposito.

¿Como se hace un contrato de arrendamiento Ecuador? Identificacion de ambas partes, arrendatario y arrendador. Datos de identificacion y ubicacion del bien inmueble a alquilar. Valor y forma de pago. Destino del bien a alquilar.

Elementos del Contrato de Arrendamiento de Local Comercial Nombre y datos generales del propietario. Nombre y datos generales de la(s) persona(s) (arrendatario) Ubicacion y descripcion del inmueble que se van a rentar. El objeto o proposito del contrato (dar en arrendamiento el inmueble).

El Ministerio de Vivienda y Urbanismo aclara en su web que los gastos notariales del contrato de arriendo los deben asumir las partes que firman. Todos reciben una copia del valor de contrato de arriendo en notaria.

El costo de un contrato de arrendamiento con un notario es variable segun la empresa que se contrate para el tramite. Sin embargo, una aproximacion estaria entre los 10.200 y los 14.000 CLP.

Suggested clip · 57 seconds ¿Como diligenciar formulario? - YouTube YouTube Start of suggested clip End of suggested clip

Caracteristicas y elementos: La identificacion con nombre completo y cedula del arrendador (propietario) La identificacion del arrendatario. La identificacion plena del bien objeto de arrendamiento. Determinacion del valor del canon o valor mensual del arrendamiento.

Suggested clip 57 seconds ¿Como diligenciar formulario? - YouTube YouTube Start of suggested clip End of suggested clip

Elementos y clausulas del contrato de arrendamiento Nombre e identificacion de los contratantes. Identificacion del inmueble objeto del contrato de arrendamiento. Precio o canon o renta. Forma de pago. Relacion de servicios. Termino de duracion del contrato.

Un contrato de arrendamiento debe incluir al menos la siguiente informacion: Nombre y datos generales del propietario o de la persona con las facultades legales para rentar la propiedad. Nombre y datos generales de la persona que habitara la propiedad. Ubicacion y descripcion del inmueble a arrendar.

Descarga y llena un contrato de arrendamiento muy sencillo Identificacion de las partes involucradas. La identificacion de la propiedad. El tiempo de vigencia del contrato. El monto inicial a pagar por el arriendo y modalidad de pago (opcional). Fianza o deposito.

¿Como se hace un contrato de arrendamiento Ecuador? Identificacion de ambas partes, arrendatario y arrendador. Datos de identificacion y ubicacion del bien inmueble a alquilar. Valor y forma de pago. Destino del bien a alquilar.

Elementos del Contrato de Arrendamiento de Local Comercial Nombre y datos generales del propietario. Nombre y datos generales de la(s) persona(s) (arrendatario) Ubicacion y descripcion del inmueble que se van a rentar. El objeto o proposito del contrato (dar en arrendamiento el inmueble).

El Ministerio de Vivienda y Urbanismo aclara en su web que los gastos notariales del contrato de arriendo los deben asumir las partes que firman. Todos reciben una copia del valor de contrato de arriendo en notaria.

El costo de un contrato de arrendamiento con un notario es variable segun la empresa que se contrate para el tramite. Sin embargo, una aproximacion estaria entre los 10.200 y los 14.000 CLP.

Suggested clip · 57 seconds ¿Como diligenciar formulario? - YouTube YouTube Start of suggested clip End of suggested clip

Caracteristicas y elementos: La identificacion con nombre completo y cedula del arrendador (propietario) La identificacion del arrendatario. La identificacion plena del bien objeto de arrendamiento. Determinacion del valor del canon o valor mensual del arrendamiento.

Suggested clip 57 seconds ¿Como diligenciar formulario? - YouTube YouTube Start of suggested clip End of suggested clip

Elementos y clausulas del contrato de arrendamiento Nombre e identificacion de los contratantes. Identificacion del inmueble objeto del contrato de arrendamiento. Precio o canon o renta. Forma de pago. Relacion de servicios. Termino de duracion del contrato.

Un contrato de arrendamiento debe incluir al menos la siguiente informacion: Nombre y datos generales del propietario o de la persona con las facultades legales para rentar la propiedad. Nombre y datos generales de la persona que habitara la propiedad. Ubicacion y descripcion del inmueble a arrendar.

Descarga y llena un contrato de arrendamiento muy sencillo Identificacion de las partes involucradas. La identificacion de la propiedad. El tiempo de vigencia del contrato. El monto inicial a pagar por el arriendo y modalidad de pago (opcional). Fianza o deposito.

¿Como se hace un contrato de arrendamiento Ecuador? Identificacion de ambas partes, arrendatario y arrendador. Datos de identificacion y ubicacion del bien inmueble a alquilar. Valor y forma de pago. Destino del bien a alquilar.

Elementos del Contrato de Arrendamiento de Local Comercial Nombre y datos generales del propietario. Nombre y datos generales de la(s) persona(s) (arrendatario) Ubicacion y descripcion del inmueble que se van a rentar. El objeto o proposito del contrato (dar en arrendamiento el inmueble).

El Ministerio de Vivienda y Urbanismo aclara en su web que los gastos notariales del contrato de arriendo los deben asumir las partes que firman. Todos reciben una copia del valor de contrato de arriendo en notaria.

Cook Illinois Contrato de arrendamiento de alquiler residencial Related Searches

-

modelo de contrato de alquiler de casa

-

contrato de renta de casa para imprimir corto

-

modelo de contrato de alquiler de casa para imprimir gratis

-

contrato de renta de terreno pdf

-

contrato de arrendamiento de terreno

-

contrato de arrendamiento de habitación

-

contrato de renta de cuarto pdf

-

que es canon de arrendamiento wikipedia

-

modelo de contrato de alquiler simple en word

-

contrato de arrendamiento sencillo

Interesting Questions

A Cook Residential Rental Lease Agreement is a legal document that outlines the terms and conditions between a landlord and a tenant for renting a property.

A Cook Residential Rental Lease Agreement is typically valid for a period of one year, but it can vary depending on the agreement between the landlord and tenant.

Yes, the landlord has the right to increase the rent during the lease period if specified in the Cook Residential Rental Lease Agreement. However, any rent increase must comply with local laws and regulations.

If a tenant breaks a Cook Residential Rental Lease Agreement, they may be required to pay penalties or forfeit their security deposit. The specific consequences depend on the terms outlined in the agreement and local laws.

Generally, a tenant cannot make major modifications or renovations without the landlord's consent as stated in the Cook Residential Rental Lease Agreement. Minor alterations like hanging pictures might be allowed, but it's best to consult with the landlord beforehand.

The Cook Residential Rental Lease Agreement should clearly define the responsibilities of both the landlord and tenant regarding repairs and maintenance. Generally, it is the landlord's responsibility to address major repairs, while minor maintenance tasks may fall on the tenant.

More info

— Paperwork provided to those seeking the rental of a property for lease. This lease is up to date with Cook County and Illinois law for 2021.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.

Trusted and secure by over 3 million people of the world’s leading companies

-

No results found.

-

Illinois

-

Alabama

-

Alaska

-

Arizona

-

Arkansas

-

California

-

Colorado

-

Connecticut

-

Delaware

-

District of Columbia

-

Florida

-

Georgia

-

Hawaii

-

Idaho

-

Indiana

-

Iowa

-

Kansas

-

Kentucky

-

Louisiana

-

Maine

-

Maryland

-

Massachusetts

-

Michigan

-

Minnesota

-

Mississippi

-

Missouri

-

Montana

-

Multi-State

-

Nebraska

-

Nevada

-

New Hampshire

-

New Jersey

-

New Mexico

-

New York

-

North Carolina

-

North Dakota

-

Ohio

-

Oklahoma

-

Oregon

-

Pennsylvania

-

Rhode Island

-

South Carolina

-

South Dakota

-

Tennessee

-

Texas

-

Utah

-

Vermont

-

Virginia

-

Washington

-

West Virginia

-

Wisconsin

-

Wyoming

Property

LANDLORD AND TENANT

Short title. This Act may be cited as the Landlord and Tenant Act. (765 ILCS 705/0.01) Sec. 0.01. (Source: P.A. 89-82, eff. 6-30-95.) Every covenant, agreement or understanding in or in connection with or collateral to any lease of real property, exempting the lessor from liability for damages for injuries to person or property caused by or resulting from the negligence of the lessor, his or her agents, servants or employees, in the operation or maintenance of the demised premises or the real property containing the demised premises shall be deemed to be void as against public policy and wholly unenforceable. (765 ILCS 705/1) Sec. 1.

Class X felony by lessee or occupant.

(a) If, after the effective date of this amendatory Act of 1995, any lessee or occupant is charged during his or her lease or contract term with having committed an offense on the premises constituting a Class X felony under the laws of this State, upon a judicial finding of probable cause at a preliminary hearing or indictment by a grand jury, the lease or contract for letting the premises shall, at the option of the lessor or the lessor's assignee, become void, and the owner or the owner's ssignee may notify the lessee or occupant by posting a written notice at the premises requiring the lessee or occupant to vacate the leased premises on or before a date 5 days after the giving of the notice. The notice shall state the basis for its issuance on forms provided by the circuit court clerk of the county in which the real property is located. The owner or owner's assignee may have the same remedy to recover possession of the premises as against a tenant holding over after the expiration of his or her term. The owner or lessor may bring a forcible entry and detainer action.

(b) A person does not forfeit his or her security deposit or any part of the security deposit due solely to an eviction under the provisions of this Section.

(c) If a lessor or the lessor's assignee voids a contract under the provisions of this Section, and a tenant or occupant has not vacated the premises within 5 days after receipt of a written notice to vacate the premises, the lessor or the lessor's assignee may seek relief under Article IX of the Code of Civil Procedure. Notwithstanding Sections 9-112, 9-113, and 9-114 of the Code of Civil Procedure, judgment for costs against the plaintiff seeking possession of the premises under this Section shall not be awarded to the defendant unless the action was brought by the plaintiff in bad faith. An action to possess premises under this Section shall not be deemed to be in bad faith if the plaintiff based his or her cause of action on information provided to him or her by a law enforcement agency or the State's Attorney.

(d) The provisions of this Section are enforceable only if the lessee or occupant and the owner or owner's assignee have executed a lease addendum for drug free housing as promulgated by the United States Department of Housing and Urban Development or a substantially similar document. (765 ILCS 705/5) Sec. 5.

Short title. This Act may be cited as the Security Deposit Return Act.

A lessor of residential real property, containing 5 or more units, who has received a security deposit from a lessee to secure the payment of rent or to compensate for damage to the leased property may not withhold any part of that deposit as compensation for property damage unless he has, within 30 days of the date that the lessee vacated the premises, furnished to the lessee, delivered in person or by mail directed to his last known address, an itemized statement of the damage allegedly caused to the premises and the estimated or actual cost for repairing or replacing each item on that statement, attaching the paid receipts, or copies thereof, for the repair or replacement. If the lessor utilizes his or her own labor to repair any damage caused by the lessee, the lessor may include the reasonable cost of his or her labor to repair such damage. If estimated cost is given, the lessor shall furnish the lessee with paid receipts, or copies thereof, within 30 days from the date the statement showing estimated cost was furnished to the lessee, as required by this Section. If no such statement and receipts, or copies thereof, are furnished to the lessee as required by this Section, the lessor shall return the security deposit in full within 45 days of the date that the lessee vacated the premises.

Upon a finding by a circuit court that a lessor has refused to supply the itemized statement required by this Section, or has supplied such statement in bad faith, and has failed or refused to return the amount of the security deposit due within the time limits provided, the lessor shall be liable for an amount equal to twice the amount of the security deposit due, together with court costs and reasonable attorney's fees. (765 ILCS 710/1) Sec. 1.

In the event of a sale, lease, transfer or other direct or indirect disposition of residential real property, other than to the holder of a lien interest in such property, by a lessor who has received a security deposit or prepaid rent from a lessee, the transferee of such property shall be liable to that lessee for any security deposit, including statutory interest, or prepaid rent which the lessee has paid to the transferor. Transferor shall remain jointly and severally liable with the transferee to the lessee for such security deposit or prepaid rent. (765 ILCS 710/1.1)Sec. 1.

This Act takes effect January 1, 1974 and applies to leases executed on or after that date. (765 ILCS 710/2) Sec. 2.

Short title. This Act may be cited as the Security Deposit Interest Act. (765 ILCS 715/0.01) Sec. 0.01.

A lessor of residential real property, containing 25 or more units in either a single building or a complex of buildings located on contiguous parcels of real property, who receives a security deposit from a lessee to secure the payment of rent or compensation for damage to property shall pay interest to the lessee computed from the date of the deposit at a rate equal to the interest paid by the largest commercial bank, as measured by total assets, having its main banking premises in this State on minimum deposit passbook savings accounts as of December 31 of the calendar year immediately preceding the inception of the rental agreement on any deposit held by the lessor for more than 6 months. (765 ILCS 715/1) Sec. 1.

The lessor shall, within 30 days after the end of each 12 month rental period, pay to the lessee any interest, by cash or credit to be applied to rent due, except when the lessee is in default under the terms of the lease. A lessor who willfully fails or refuses to pay the interest required by this Act shall, upon a finding by a circuit court that he has willfully failed or refused to pay, be liable for an amount equal to the amount of the security deposit, together with court costs and reasonable attorneys fees. (765 ILCS 715/2) Sec. 2.

This Act does not apply to any deposit made with respect to public housing. (765 ILCS 715/3) Sec. 3.

Short title. This Act may be cited as the Retaliatory Eviction Act. (765 ILCS 720/0.01) Sec. 0.01.

It is declared to be against the public policy of the State for a landlord to terminate or refuse to renew a lease or tenancy of property used as a residence on the ground that the tenant has complained to any governmental authority of a bona fide violation of any applicable building code, health ordinance, or similar regulation. Any provision in any lease, or any agreement or understanding, purporting to permit the landlord to terminate or refuse to renew a lease or tenancy for such reason is void. (765 ILCS 720/1) Sec. 1.

Short title. This Act may be cited as the Property Taxes Of Alien Landlords Act. (765 ILCS 725/0.01) Sec. 0.01.

No contract, agreement or lease in writing or by parol, by which any lands or tenements therein are demised or leased by any alien or his agents for the purpose of farming, cultivation or the raising of crops thereon, shall contain any provision requiring the tenant or other person for him, to pay taxes on said lands or tenements, or any part thereof, and all such provisions, agreements and leases so made are declared void as to the taxes aforesaid. If any alien landlord or his agents shall receive in advance or at any other time any sum of money or article of value from any tenant in lieu of such taxes, directly or indirectly, the same may be recovered back by such tenant before any court having jurisdiction of the amount thereof, and all provisions or agreements in writing or otherwise to pay such taxes shall be held in all courts of this state to be void. (765 ILCS 725/1) Sec. 1. (Source: P.A. 81-1509.)

Short title. This Act may be cited as the Rent Concession Act. (765 ILCS 730/0.01) Sec. 0.01.

That the purpose of this Act is to regulate the prevalent practice of making or using written leases of real estate, which, because of concessions to the lessees, do not truly state the real net rent being paid, it being recognized that such practice can be, and frequently is, used to mislead prospective purchasers and lessees, and lenders of money on the security of such real estate, into a belief that the rental value or market value thereof is greater than it really is. (765 ILCS 730/1) Sec. 1.

A rent concession is made, within the meaning of this Act, when, in case of a written lease of real estate or a part thereof, the lessor before or at the time the lease or any agreement therefor is entered into, and in consideration of such lease or agreement therefor, directly or indirectly, gives, or agrees or promises to give, to the lessee, without express mention thereof in the lease, any of the following:

(1) any credit upon the rent reserved by the lease between the parties, or rebate of such rent or any part thereof after payment thereof by the lessee, or

(2) the right, privilege or license to occupy the leased premises for a period other than the term created by the lease, rent free or for a rent less than the average rent fixed by the lease for the entire term, or

(3) any other valuable thing, right or privilege. Repairing and decorating the leased premises by the lessor shall not be deemed a rent concession. An agreement by a lessor to waive any of the terms or conditions of the lease other than those relating to the payment of rent shall not be deemed a rent concession. (765 ILCS 730/2) Sec. 2.

When a rent concession shall be made in the case of any lease hereafter entered into, it shall be the duty of the lessor, at the time or immediately after the lease is made, to cause such lease to bear a legend across the face and text thereof plainly legible and in letters not less than one-half inch in height consisting of the words "Concession Granted," and to bear a memorandum on the margin or across the face of such lease stating the amount or extent and nature of each such concession, and any failure on the part of a lessor so to do shall be unlawful and a violation of this Act. (765 ILCS 730/3) Sec. 3.

When a rent concession shall have been made in the case of any lease heretofore or hereafter entered into, it shall be unlawful and a violation of this Act for any person knowing of such concession, to exhibit such lease to any purchaser or lessee or prospective purchaser or lessee of real estate, any part of which is covered by the lease, or to any lender of money, or prospective lender of money on such real estate or any part thereof as security, unless such lease shall bear the legend and memorandum required by section 3 hereof in the case of leases heretofore made. (765 ILCS 730/4) Sec. 4.

The terms "lessor," "lessee" and "person" as used herein shall include the plural thereof and shall include corporations. (765 ILCS 730/5) Sec. 5.

The provisions of this Act shall have no application to farm or agricultural property, or property used as such, nor to any leases or evidences of leasing executed relative thereto. (765 ILCS 730/5a) Sec. 5a.

Any person or corporation violating the provisions of this Act, by using or exhibiting to any person, persons or corporation any written lease or other written evidence of leasing, not having endorsed thereon any and all concessions as herein provided, for the purpose of selling or effecting a sale of the premises in question or a loan thereon, shall be deemed guilty of a Class A misdemeanor. (765 ILCS 730/6) Sec. 6.

Short title. This Act may be cited as the Rental Property Utility Service Act. (765 ILCS 735/0.01)Sec. 0.01.

Utility payments; termination and restoration of service. Whenever, pursuant to any agreement, either written or verbal, a landlord or his or her agent is required to pay for any water, gas or electrical service, and the landlord or his or her agent does not pay for such service, the tenant, or tenants in the event more than one tenant is served by a common system of water, gas or electrical service, including electrical service to common areas, which goes through a common meter in a single building, may pay for such service if the nonpayment jeopardizes the continuation of the service to the tenant or tenants, as the case may be. The utility company shall not terminate service for such nonpayment until the utility company mails, delivers or posts a notice as specified in Section 3 to all tenants of buildings with 3 or more residential apartments. Upon receipt of such payment of the past due cost of such water, gas or electrical service owed by the landlord, the provider of such service shall immediately restore service to such tenant or tenants. In the alternative, the provider of such service shall immediately restore and continue such service to any tenant who

(a) requests that the utility put the bill in his or her name;

(b) establishes satisfactory credit references or provides for and pays a security deposit pursuant to the rules and regulations of the Illinois Commerce Commission applicable to applicants for new utility service; and

(c) agrees to pay future bills. Any sums the tenant or tenants, as the case may be, pay for water, gas or electrical service that the landlord or his or her agent was required to pay may be deducted from the rent due by the tenant or tenants, and the total rent is diminished by the amount the tenant or tenants, as the case may be, have paid for the continuation of the water, gas or electrical service. (765 ILCS 735/1) Sec. 1.

Definitions. As used in this Act:

"Agreement" includes leases, oral agreements, and any other understandings or contracts reached between a landlord and a tenant.

"Individually metered utilities" means that the utility service to one or more rental dwelling units in a building is registered by an individual meter for each dwelling unit.

"Master metered utilities" means that the utility service to a building with one or more rental dwelling units is registered by a single meter for the building.

"Landlord" includes the owner of a building, the owner's agent, and the lessor of a building.

"Tenant" includes occupants of a building or mobile home, whether under a lease or periodic tenancy.

"Utility company" includes all suppliers of utility service, including municipalities.

"Utility service" includes electric, gas, water, or sanitary utility service rendered by a utility company to a tenant at a specific location. (765 ILCS 735/1.1) Sec. 1.1.

Certain tenant-paid utility payment arrangements prohibited; Notice of change in payment arrangements

(a) No landlord shall rent or cause to be rented any unit in which the tenant is responsible by agreement, implication, or otherwise for direct payment for utility service to the utility company and in which the utility company billing for that service includes any service to common areas of the building or other units or areas used or occupied by persons other than the individual tenant and those occupying the unit with the tenant on the utility account, unless, before offering an initial lease or a renewal lease, accepting a security deposit, or otherwise entering into an agreement with the prospective tenant to let the premises:

(1) The landlord provides the prospective tenant with a written statement setting forth the specific areas of the building and any appurtenances that are served by the meter that will be in the tenant's name and the nature of the utility uses of those areas, including any that have not been reflected in past utility company billings but that may arise (such as the rental of a neighboring unit that has been vacant, the installation of washers and driers in the basement, or the use of the garage for mechanics);

(2) The landlord provides the prospective tenant with copies of the utility bills for the unit for the previous 12 months, unless waived by the tenant in writing;

(3) The landlord neither suggests nor requires the tenant to collect any money for utility bills from neighboring tenants whose utility usage will be reflected in the prospective tenant's utility company billings; and

(4) The landlord sets forth in writing the amount of the proposed rent reduction, if any, that is offered to compensate for the tenant's payments for utility usage outside of the tenant's unit.

(b) No landlord shall request or cause to be effected a change

(i) from landlord-paid master metered utilities to tenant-paid individually metered utilities or

(ii) from landlord-paid to tenant-paid utilities, regardless of the metering arrangement, during the term of a lease. The landlord shall provide a minimum of 30 days notice to each affected tenant before effecting such a change in service; for tenants under a lease, the notice shall be provided to the tenants no less than 30 days before the expiration of the lease term. This subsection does not prohibit the landlord and tenant from agreeing to amend the lease to effect such a change; the amendment must be in writing and subscribed by both parties.

(c) Any term or condition in a rental agreement between the landlord and the tenant that is inconsistent with this Section is void and unenforceable.

(d) Nothing in this Section affects the relationship between a utility company and its customers. (765 ILCS 735/1.2) Sec. 1.2.

Tenant remedies and burdens of proof.

(a) A residential tenant shall be entitled to recover damages from the landlord for the utility bills rendered in the tenant's name as a result of the landlord's violation of this Act and which the landlord has not paid to the utility company. The tenant shall have the burden of establishing that the tenant was billed for utility service as a result of the landlord's violation of this Act. Upon proof by the tenant that the tenant was billed an amount for service not attributable to the unit or premises occupied by the tenant, the landlord shall be liable to the tenant for 100% of those utility bills. However, this sum shall be reduced by whatever percentage of use that the court finds that the landlord has established to have been attributable to the unit or premises the tenant occupied during the period that the violation continued. The tenant may recover these damages by an action at law or by a counterclaim in any action brought by the landlord against the tenant. The court may treble the damage award when the court finds that the landlord's violation of this Act was knowing or intentional. The tenant may also recover costs and fees, including attorneys fees, if the amount awarded by the court for utility service is in excess of $3,000. The remedies contained in this Act do not limit or supersede any remedies the tenant may have under a lease, contract, or the laws, including the common law, of this State.

(b) This Section shall be prospective in application; the remedies shall not attach to any violation that occurred before July 1, 1992.

(c) Nothing in this Section affects the relationship between a utility company and its customers. (765 ILCS 735/1.3) Sec. 1.3.

Prohibition on termination of utility service by landlord.

No landlord shall cause or request utility service to tenants to be interrupted, discontinued, or terminated in an occupied building:

(i) by nonpayment of utility bills for which the landlord has assumed responsibility by agreement or by implication (such as where the utilities are master metered) or

(ii) by tampering with equipment or lines. This Section does not prohibit temporary utility shutoffs in cases of emergencies such as gas leaks or fire or, upon 7 days written notice to each affected tenant, temporary shutoffs required for building repairs or rehabilitation. (765 ILCS 735/1.4) Sec. 1.4.

Receivership; utility service termination.

(a) Tenants, upon receiving notice of utility service termination pursuant to Section 1, and utility companies may petition the circuit court, or any court having jurisdiction, for appointment of a receiver of rents due for use and occupancy of the building. No one building may be the subject of more than 2 such petitions in any consecutive 12 month period. The petition shall be served upon the landlord at his or her last known address and upon the utility company which has rendered notice of termination of utility service, except when the utility company is the petitioner. Upon a finding that the tenants' utility service is subject to termination or has been terminated as a result of an amount due and owing by the landlord to the utility company, the court shall appoint a receiver who shall be authorized to collect rents due from the tenants for use and occupancy of the building. The court shall also design a payment plan through which the receiver shall be required to remit to the utility company such portion of the funds as are necessary for payment of current utility bills incurred during the term of the receivership, including any security deposit requested by the utility in accordance with the rules and regulations of the Illinois Commerce Commission. The receiver shall remit the remainder of the collected rents as the court shall direct, taking into consideration the ordinary and necessary expenses of the property including, but not limited to, repair, maintenance, other utility bills, property taxes, arrearages which were the subject of the petition, and any capital expenditures deemed necessary by the court. The landlord or his or her agent shall be liable for arrearages due to the utility company which the court in its payment plan determines cannot feasibly be remitted by the receiver from the collected rents within 12 months.

(b) Within 10 days of the appointment of the receiver, during which time the utility company shall not discontinue service to the building for reason of nonpayment, such receiver shall make a determination as to whether or not the rents due for the use and occupancy of the building can reasonably be expected to be sufficient to pay current bills and to pay any security deposit which may be requested by the utility. Upon a determination by the court that the rents due for the use and occupancy of the building cannot reasonably be expected to be sufficient to pay current bills and to pay any security deposit which may be requested by the utility, such receivership shall be terminated.

(c) In the event that a petition for receivership is filed after utility service has been terminated, service shall be restored as soon as the utility company receives notice that a receiver has been appointed. The receiver shall make all reasonable efforts to provide to the utility access to the building at all times.

(d) Any receivership established pursuant to this Section shall be terminated by the court upon its finding that the arrearage which was the subject of the petition has been satisfied or upon its finding that the income from the building has become insufficient to pay current utility bills and retire the arrearages as ordered by the court and shows no reasonable likelihood of becoming sufficient. (765 ILCS 735/2) Sec. 2.

Tenant damages.

(a) A landlord's violation of Section 1.4 entitles the residential tenant to damages from the landlord in the amount of a 100% abatement of the rental obligation for each month, and prorated for each part of a month, that the utility service was terminated and to consequential damages. The tenant has a duty to mitigate damages.

(b) When utility service is terminated as a result of the landlord's violation of Section 1.4 under circumstances demonstrating the landlord's deliberate or reckless indifference or wilful disregard for the rights of the tenants, or bad faith, the court may additionally award each affected residential tenant in the building statutory damages up to $300 each or the sum of $5,000 divided by the number of affected tenants, whichever is less. (765 ILCS 735/2.1) Sec. 2.1.

Recovery of damages; costs and fees.

In the case of a petition filed on or after July 1, 1992, where termination of utility service is averted as a result of action taken by the utility company or tenant or tenants under Section 2, the petitioner is entitled to recover its costs (including court costs), fees (including attorney's fees), and expenses incurred in connection with bringing the receivership proceeding. The costs, fees, and expenses, and damages recoverable under Section 2.1, may be awarded by the court in the receivership proceeding. The sum awarded by the court to the utility company shall be paid by the receiver to the utility company out of the rents paid to the receiver. (765 ILCS 735/2.2) Sec. 2.2.

Notice of utility service termination.

The utility company shall notify

all tenants of buildings with 3 or

more residential apartments of the proposed termination of utility service.

This notice shall contain the following information:

(1) the specific date, no sooner than 10 days after the notice

is rendered, that utility service is subject to termination;

(2) a statement of the tenants' statutory right either

(A) to pay the utility company the amount due and owing by the landlord and to deduct the amount paid to the utility company from the rent due on the rental agreement or

(B) to petition the court for appointment of a receiver to collect the rents due for use and occupancy of the building and remit a portion to the utility company for payment of utility bills;

(3) the dollar amount of the utility bills due and owing on the date such notice is given and the average monthly utility bill; and

(4) the name and telephone number of any legal services agency within the utility company's service area where the tenants may obtain free legal assistance. Any notice provided to tenants of a building under this Act shall be of a conspicuous size, on red paper, and in at least 14 point bold face type, except that the words "notice of (utility service) termination" shall be in 36 point bold face type if the notice is posted, and shall state:

It is unlawful for the landlord or his or her agent to alter, deface, tamper with, or remove this notice. A landlord or his or her agent who violates this provision is guilty of a Class C misdemeanor. (765 ILCS 735/3) Sec. 3.

The lessor, landlord or his agent shall not increase rent paid by the lessees or tenants of the building in order to collect all or part of the amount lawfully deducted for utility service pursuant to this Act. (765 ILCS 735/4) Sec. 4.

Nothing in this Act shall be construed to prevent a utility company from pursuing any other action or remedy that it may have against the lessor, landlord or his agent for any amounts due and owing to the utility company and nothing in this Act shall be construed to prevent a utility company from acting in the interest of public safety. (765 ILCS 735/5) Sec. 5.

Short title. This Act may be cited as the Tenant

Utility Payment Disclosure Act.

(765 ILCS 740/1) Sec. 1.

Disclosure of utility payments included in rent.

(a) No landlord may demand payment for master metered public utility services pursuant to a lease provision providing for tenant payment of a proportionate share of public utility service without the landlord first providing the tenant with a copy in writing either as part of the lease or another written agreement of the formula used by the landlord for allocating the public utility payments among the tenants. The total of payments under the formula for the building as a whole for a billing period may not exceed the sum demanded by the public utility. The formula shall include all those that use that public utility service and may reflect variations in apartment size or usage. The landlord shall also make available to the tenant upon request a copy of the public utility bill for any billing period for which payment is demanded. Nothing herein shall preclude a landlord from leasing property to a tenant, including the cost of utilities, for a rental which does not segregate or allocate the cost of the utilities.

(b) No condominium or common interest community association may demand payment for master metered public utility services from a unit owner of a proportionate share for public utility service without the condominium or common interest community association first providing the unit owner with a copy in writing of the formula used by the association for allocating the public utility payments among the unit owners. The total of payments under the formula for the association as a whole for the annual budgeted billing period may not exceed the sum demanded by the public utility, provided however, that the board of directors of the association may direct that any payments received by the association in excess of actual utility bills be applied to other budgeted items having a deficit, or be applied to the association's reserve fund, or be credited to the account of the unit owners for the following year's budget. The formula shall include all those that use that public utility service and may reflect, but is not limited to, percent interest, unit size, or usage. The condominium or common interest community association shall also make available to the unit owner upon request a copy of the public utility bill for any billing period for which payment is demanded. A condominium association shall have the right to establish and maintain a system of master metering of public utility services pursuant to Section 18.4 of the Condominium Property Act. A common interest community association shall have the right to establish and maintain a system of master metering of public utility services pursuant to Section 18.5 of the Condominium Property Act. (765 ILCS 740/5) Sec. 5.

Applicability.

This Act shall regulate and determine legal rights, remedies and obligations of the parties to any lease of a mobile home or mobile home lot in a mobile home park containing five or more mobile homes within this State. Any lease, written or oral, shall be unenforceable insofar as any provision thereof conflicts with any provision of this Act. (765 ILCS 745/1) Sec. 1.

Jurisdiction.

Any person whether or not a citizen or resident of this State, who owns, holds an ownership or beneficial interest in, uses, manages or possesses real estate situated in this State, submits himself or his personal representative to the jurisdiction of the courts of this State as to any action proceeding for the enforcement of an obligation arising under this Act. (765 ILCS 745/2) Sec. 2.

Definitions.

Unless otherwise expressly defined, all terms in this Act shall be construed to have their ordinarily accepted meanings or such meaning as the context therein requires.

(a) "Person" means any legal entity, including but not limited to, an individual, firm, partnership, association, trust, joint stock company, corporation or successor of any of the foregoing.

(b) "Mobile Home" means a structure designed for permanent habitation and so constructed as to permit its transport on wheels, temporarily or permanently attached to its frame, from the place of its construction to the location or subsequent locations at which it is intended to be a permanent habitation and designed to permit the occupancy thereof as a dwelling place of one or more persons, provided that any such structure served by individual utilities and resting on a permanent foundation, with wheels, tongue and hitch permanently removed, shall not be construed as a "mobile home".

(c) "Mobile Home Park" or "Park" means an area of land or lands upon which five or more independent mobile homes are harbored for rent.

(d) "Park Owner" means the owner of a mobile home park and any person authorized to exercise any aspect of the management of the premises, including any person who directly or indirectly receives rents and has no obligation to deliver the whole of such receipts to another person.

(e) "Tenant" means any person who occupies a mobile home rental unit for dwelling purposes or a lot on which he parks a mobile home for an agreed upon consideration.

(f) "Rent" means any money or other consideration given for the right of use, possession and occupancy of property, be it a lot or mobile home.

(g) "Master antenna television service" means any and all services provided by or through the facilities of any closed circuit coaxial cable communication system, or any microwave or similar transmission services other than a community antenna television system as defined in Section 11-42-11 of the Illinois Municipal Code. (765 ILCS 745/3) Sec. 3.

Requisites for Rental or Offer of Mobile Home or Lot for Rental. No person shall rent or offer for rent any mobile home which does not conform to the sanitation, housing and health codes of the State or of the county or municipality in which the mobile home is located.

No person shall rent or offer for rent any lot in a mobile home park which does not conform to subdivision ordinances of the county or municipality in which the mobile home park is located. (765 ILCS 745/4) Sec. 4.

No park owner, after the effective date of this amendatory Act of 1987, may require a tenant to remove an outside conventional television antenna, or require that a tenant subscribe to and pay for master antenna television services rather than use an outside conventional television antenna. This Section shall not prohibit an owner from supplying free master antenna television services provided that the price of such services, is not made a part of the rent of the tenant. This Section also shall not prohibit a park owner from requiring a tenant to remove an outside conventional television antenna if such owner makes available master antenna television services at no charge above the rental stated in such tenant's lease. (765 ILCS 745/4a) Sec. 4a.

Exemptions.

No mobile home park operated by the State or the Federal Government, or park land owned by either, and no trailer park operated for the use of recreational campers or travel trailers shall be subject to the provisions of this Act. (765 ILCS 745/5) Sec. 5.

Obligation of Park Owner to Offer Written Lease. No person shall offer a mobile home or lot for rent or sale in a mobile home park without having first exhibited to the prospective tenant or purchaser a copy of the lease applicable to the respective mobile home park.

(a) The park owner shall be required to offer to each present and future tenant a written lease for a term of not less than 12 months, unless the parties agree to a different term subject to existing leases which shall be continued pursuant to their terms.

(b) Tenants in possession on the effective date of this Act shall have 30 days after receipt of the offer for a written lease within which to accept or reject such offer; during which period, the rent may not be increased or any other terms and conditions changed, except as permitted under this Act; providing that if the tenant has not so elected he shall vacate within the 30 day period.

(c) The park owner shall notify his tenants in writing not later than 30 days after the effective date of this Act, that a written lease shall be available to the tenant and that such lease is being offered in compliance with and will conform to the requirements of this Act. (765 ILCS 745/6) Sec. 6.

Effect of Unsigned Lease.

If the tenant shall fail to sign a written lease which has been signed and tendered to him by the owner and shall further provide the owner with a rejection in writing of such offer, the tenant's continuation of possession and payment of rent without reservation shall constitute an acceptance of the lease with the same effect as if it had been signed by the tenant. (765 ILCS 745/7) Sec. 7.

Renewal of Lease.

Every lease of a mobile home or lot in a mobile home park shall contain an option which automatically renews the lease; unless:

(a) the tenant shall notify the owners 30 days prior to the expiration

of the lease that he does not intend to renew the lease;

or

(b) the park owner shall notify the tenant 30 days prior to the expiration of the lease that the lease will not be renewed and specify in writing the reasons, such as violations of park rules, health and safety codes or irregular or non-payment of rent; or

(c) the park owner elects to cease the operation of either all or a portion of the mobile home park. The tenants shall be entitled to at least 12 months notice of such ceasing of operations. If 12 months or more remain on the existing lease at the time of notice, the tenant is entitled to the balance of the term of his lease. If there is less than 12 months remaining in the term of his lease, the tenant is entitled to the balance of his lease plus a written month to month tenancy, at the expiring lease rate to provide him with a full 12 months notice.

All notices required under this Section shall be by certified mail or personal service. Certified mail shall be deemed to be effective upon the date of mailing. (765 ILCS 745/8) Sec. 8.

The Terms of Fees and Rents.

The terms for payment of rent shall be clearly set forth and all charges for services, ground or lot rent, unit rent, or any other charges shall be specifically itemized in the lease and in all billings of the tenant by the park owner.

The owner shall not change the rental terms nor increase the cost of fees, except as provided herein.

The park owner shall not charge a transfer or selling fee as a condition of sale of a mobile home that is going to remain within the park unless a service is rendered.

Rents charged to a tenant by a park owner may be increased upon the renewal of a lease. Notification of an increase shall be delivered 60 days prior to expiration of the lease. (765 ILCS 745/9) Sec. 9.

Waiver of Provisions.

Any provision of a lease whereby any provisions of this Act are waived is declared void. (765 ILCS 745/10) Sec. 10.

Provisions of mobile home park leases. Any lease hereafter executed or currently existing between an owner and tenant in a mobile home park in this State shall also contain, or shall be made to contain, the following covenants binding the owner at all times during the term of the lease to:

(a) identify to each tenant prior to his occupancy the lot area for which he will be responsible;

(b) keep all exterior property areas not in the possession of a tenant, but part of the mobile home park property, free from the species of weeds and plant growth which are generally noxious or detrimental to the health of the tenants;

(c) maintain all electrical, plumbing, gas or other utilities provided by him in good working condition with the exception of emergencies after which repairs must be completed within a reasonable period of time;

(d) maintain all subsurface water and sewage lines and connections in good working order;

(e) respect the privacy of the tenants and if only the lot is rented, agree not to enter the mobile home without the permission of the mobile home owner, and if the mobile home is the property of the park owner, to enter only after due notice to the tenant, provided,the park owner or his representative may enter without notice in emergencies;

(f) maintain all roads within the mobile home park in good condition;

(g) include a statement of all services and facilities which are to be provided by the park owner for the tenant, e.g. lawn maintenance, snow removal, garbage or solid waste disposal, recreation building, community hall, swimming pool, golf course, laundromat, etc.;

(h) disclose the full names and addresses of all individuals in whom all or part of the legal or equitable title to the mobile home park is vested, or the name and address of the owners' designated agent;

(i) provide a custodian's office and furnish each tenant with the name, address and telephone number of the custodian and designated office. (765 ILCS 745/11) Sec. 11.

Lease prohibitions.

No lease hereafter executed or currently existing between a park owner and tenant in a mobile home park in this State shall contain any provision:

(a) Permitting the park owner to charge a penalty fee for late payment of rent without allowing a tenant a minimum of 5 days beyond the date the rent is due in which to remit such payment;

(b) Permitting the park owner to charge an amount in excess of one month's rent as a security deposit;

(c) Requiring the tenant to pay any fees not specified in the lease;

(d) Permitting the park owner to transfer, or move, a mobile home to a different lot, including a different lot in the same mobile home park, during the term of the lease. (765 ILCS 745/12) Sec. 12.

No lease hereafter executed between a mobile home park owner and a tenant in such a park in this State shall contain any provision requiring the tenant to purchase a mobile home from the park owner, or requiring that if the tenant purchases any mobile home during the lease term that such mobile home must be purchased from the park owner, and no such requirement shall be made as a condition precedent to entering into a lease agreement with any such tenant. (765 ILCS 745/12a) Sec. 12a.

Tenant's Duties.

The tenant shall agree at all times during the tenancy to:

(a) Keep the mobile home unit, if he rents such, or the exterior premises if he rents a lot, in a clean and sanitary condition, free of garbage and rubbish;

(b) Refrain from the storage of any inoperable motor vehicle;

(c) Refrain from washing all vehicles except at an area designated by park management;

(d) Refrain from performing any major repairs of motor vehicles at any time;

(e) Refrain from the storage of any icebox, stove, building

material, furniture or similar items on the exterior premises;

(f) Keep the supplied basic facilities, including plumbing fixtures, cooking and refrigeration equipment and electrical fixtures in a leased mobile home unit in a clean and sanitary condition and be responsible for the exercise of reasonable care in their proper use and operation;

(g) Not deliberately or negligently destroy, deface, damage, impair or remove any part of the premises or knowingly permit any person to do so;

(h) Conduct himself and require other persons on the premises with his consent to conduct themselves in a manner that will not effect or disturb his neighbors peaceful enjoyment of the premises;

(i) Abide by all the rules or regulations concerning the use, occupation and maintenance of the premises; and

(j) Abide by any reasonable rules for guest parking which are clearly stated. (765 ILCS 745/13) Sec. 13.

Rules and regulations of park.

Rules and regulations promulgated and adopted by the park owner are enforceable against a tenant only if:

(a) A copy of all rules and regulations was delivered by the park owner to the tenant prior to his signing the lease;

(b) The purpose of such rules and regulations is to promote the convenience, safety and welfare of the tenants, preserve park property from damage or to fairly distribute park services and facilities to the tenants;

(c) They are reasonably related to the purpose for which adopted;

(d) They apply to all tenants in a fair manner;

(e) They are sufficiently explicit in prohibition, direction or limitation of the tenant's conduct to fairly inform him of what he must or must not do to comply; and

(f) They are not for the purpose of evading the obligation of the park owner.

A rule or regulation adopted during the term of a lease is enforceable against the tenant only if 30 days written notice of its adoption is given the tenant and such rule or regulation is not in violation of the terms and conditions of the lease. (765 ILCS 745/14) Sec. 14.

The Department of Public Health shall produce and distribute a pamphlet setting forth clearly, and in detail, the tenant's and park operator's rights and obligations under this Act. The pamphlet shall be produced within 90 days of the effective date of this amendatory Act of 1992.

Each park owner shall make these pamphlets available to all current tenants within 60 days after receiving the pamphlets. This requirement may be satisfied by distributing or mailing the pamphlets to each tenant. All new tenants shall be offered a pamphlet at or before the time at which they are offered a written lease.

A violation of the provisions of this Section shall not render any lease void or voidable nor shall it constitute:

(1) A defense to any action or proceeding to enforce the lease.

(2) A defense to any action or proceeding for breach of the lease. (765 ILCS 745/14-1) Sec. 14-1.

Statutory grounds for eviction.

A park owner may terminate the lease and evict

a tenant for any one or more of

the following acts:

(a) Non-payment of rent due;

(b) Failure to comply with the park rules;

(c) Failure to comply with local ordinances and State laws regulating mobile homes. (765 ILCS 745/15) Sec. 15.

Improper grounds for eviction.

The following conduct by a tenant shall not constitute grounds for eviction or termination of the lease, nor shall a judgment for possession of the premises be entered against a tenant:

(a) As a reprisal for the tenant's effort to secure or enforce any rights under the lease or the laws of the State of Illinois, or its governmental subdivisions of the United States;

(b) As a reprisal for the tenant's good faith complaint to a governmental authority of the park owner's alleged violation of any health or safety law, regulation, code or ordinance, or State law or regulation which has as its objective the regulation of premises used for dwelling purposes;

(c) As a reprisal for the tenant's being an organizer or member of, or involved in any activities relative to a home owners association. (765 ILCS 745/16) Sec. 16.

Notice required by Law.

The following notice shall be printed verbatim in a clear and conspicuous manner in each lease or rental agreement of a mobile home or lot:

"IMPORTANT NOTICE REQUIRED BY LAW:

The rules set forth below govern the terms of your lease of occupancy arrangement with this mobile home park. The law requires all of these rules and regulations to be fair and reasonable, and if not, such rules and regulations cannot be enforced against you.

You may continue to reside in the park as long as you pay your rent and abide by the rules and regulations of the park. You may only be evicted for non-payment of rent, violation of laws, or for violation of the rules and regulations of the park and the terms of the lease.

If this park requires you to deal exclusively with a certain fuel dealer or other merchant for goods or service in connection with the use or occupancy of your mobile home or on your mobile home lot, the price you pay for such goods or services may not be more than the prevailing price in this locality for similar goods and services.

You may not be evicted for reporting any violations of law or health and building codes to boards of health, building commissioners, the department of the Attorney General or any other appropriate government agency." (765 ILCS 745/17) Sec. 17.

Security deposit; Interest.

(a) If the lease requires the tenant to provide any deposit with the park owner for the term of the lease, or any part thereof, said deposit shall be considered a Security Deposit. Security Deposits shall be returned in full to the tenant, provided that the tenant has paid all rent due in full for the term of the lease and has caused no actual damage to the premises. The park owner shall furnish the tenant, within 15 days after termination or expiration of the lease, an itemized list of the damages incurred upon the premises and the estimated cost for the repair of each item. The tenant's failure to object to the itemized list within 15 days shall constitute an agreement upon the amount of damages specified therein. The park owner's failure to furnish such itemized list of damages shall constitute an agreement that no damages have been incurred upon the premises and the entire security deposit shall become immediately due and owing to the tenant. The tenant's failure to furnish the park owner a forwarding address shall excuse the park owner from furnishing the list required by this Section.

(b) A park owner of any park regularly containing 25 or more mobile homes shall pay interest to the tenant, on any deposit held by the park owner, computed from the date of the deposit at a rate equal to the interest paid by the largest commercial bank, as measured by total assets, having its main banking premises in this State on minimum deposit passbook savings accounts as of December 31 of the preceding year on any such deposit held by the park owner for more than 6 months. However, in the event that any portion of the amount deposited is utilized during the period for which it is deposited in order to compensate the owner for non-payment of rent or to make a good faith reimbursement to the owner for damage caused by the tenant, the principal on which the interest accrues may be recomputed to reflect the reduction for the period commencing on the first day of the calendar month following the reduction.

The park owner shall, within 30 days after the end of each 12-month period, pay to the tenant any interest owed under this Section in cash, provided, however, that the amount owed may be applied to rent due if the owner and tenant agree thereto.

A park owner who willfully fails or refuses to pay the interest required by this Act shall, upon a finding by a circuit court that he willfully failed or refused to pay, be liable for an amount equal to the amount of the security deposit, together with court costs and a reasonable attorney's fee. (Source: P.A. 88-643, eff. 1-1-95.)

Property

LANDLORD AND TENANT

Short title. This Act may be cited as the Landlord and Tenant Act. (765 ILCS 705/0.01) Sec. 0.01. (Source: P.A. 89-82, eff. 6-30-95.) Every covenant, agreement or understanding in or in connection with or collateral to any lease of real property, exempting the lessor from liability for damages for injuries to person or property caused by or resulting from the negligence of the lessor, his or her agents, servants or employees, in the operation or maintenance of the demised premises or the real property containing the demised premises shall be deemed to be void as against public policy and wholly unenforceable. (765 ILCS 705/1) Sec. 1.

Class X felony by lessee or occupant.

(a) If, after the effective date of this amendatory Act of 1995, any lessee or occupant is charged during his or her lease or contract term with having committed an offense on the premises constituting a Class X felony under the laws of this State, upon a judicial finding of probable cause at a preliminary hearing or indictment by a grand jury, the lease or contract for letting the premises shall, at the option of the lessor or the lessor's assignee, become void, and the owner or the owner's ssignee may notify the lessee or occupant by posting a written notice at the premises requiring the lessee or occupant to vacate the leased premises on or before a date 5 days after the giving of the notice. The notice shall state the basis for its issuance on forms provided by the circuit court clerk of the county in which the real property is located. The owner or owner's assignee may have the same remedy to recover possession of the premises as against a tenant holding over after the expiration of his or her term. The owner or lessor may bring a forcible entry and detainer action.

(b) A person does not forfeit his or her security deposit or any part of the security deposit due solely to an eviction under the provisions of this Section.

(c) If a lessor or the lessor's assignee voids a contract under the provisions of this Section, and a tenant or occupant has not vacated the premises within 5 days after receipt of a written notice to vacate the premises, the lessor or the lessor's assignee may seek relief under Article IX of the Code of Civil Procedure. Notwithstanding Sections 9-112, 9-113, and 9-114 of the Code of Civil Procedure, judgment for costs against the plaintiff seeking possession of the premises under this Section shall not be awarded to the defendant unless the action was brought by the plaintiff in bad faith. An action to possess premises under this Section shall not be deemed to be in bad faith if the plaintiff based his or her cause of action on information provided to him or her by a law enforcement agency or the State's Attorney.

(d) The provisions of this Section are enforceable only if the lessee or occupant and the owner or owner's assignee have executed a lease addendum for drug free housing as promulgated by the United States Department of Housing and Urban Development or a substantially similar document. (765 ILCS 705/5) Sec. 5.

Short title. This Act may be cited as the Security Deposit Return Act.

A lessor of residential real property, containing 5 or more units, who has received a security deposit from a lessee to secure the payment of rent or to compensate for damage to the leased property may not withhold any part of that deposit as compensation for property damage unless he has, within 30 days of the date that the lessee vacated the premises, furnished to the lessee, delivered in person or by mail directed to his last known address, an itemized statement of the damage allegedly caused to the premises and the estimated or actual cost for repairing or replacing each item on that statement, attaching the paid receipts, or copies thereof, for the repair or replacement. If the lessor utilizes his or her own labor to repair any damage caused by the lessee, the lessor may include the reasonable cost of his or her labor to repair such damage. If estimated cost is given, the lessor shall furnish the lessee with paid receipts, or copies thereof, within 30 days from the date the statement showing estimated cost was furnished to the lessee, as required by this Section. If no such statement and receipts, or copies thereof, are furnished to the lessee as required by this Section, the lessor shall return the security deposit in full within 45 days of the date that the lessee vacated the premises.

Upon a finding by a circuit court that a lessor has refused to supply the itemized statement required by this Section, or has supplied such statement in bad faith, and has failed or refused to return the amount of the security deposit due within the time limits provided, the lessor shall be liable for an amount equal to twice the amount of the security deposit due, together with court costs and reasonable attorney's fees. (765 ILCS 710/1) Sec. 1.

In the event of a sale, lease, transfer or other direct or indirect disposition of residential real property, other than to the holder of a lien interest in such property, by a lessor who has received a security deposit or prepaid rent from a lessee, the transferee of such property shall be liable to that lessee for any security deposit, including statutory interest, or prepaid rent which the lessee has paid to the transferor. Transferor shall remain jointly and severally liable with the transferee to the lessee for such security deposit or prepaid rent. (765 ILCS 710/1.1)Sec. 1.

This Act takes effect January 1, 1974 and applies to leases executed on or after that date. (765 ILCS 710/2) Sec. 2.

Short title. This Act may be cited as the Security Deposit Interest Act. (765 ILCS 715/0.01) Sec. 0.01.

A lessor of residential real property, containing 25 or more units in either a single building or a complex of buildings located on contiguous parcels of real property, who receives a security deposit from a lessee to secure the payment of rent or compensation for damage to property shall pay interest to the lessee computed from the date of the deposit at a rate equal to the interest paid by the largest commercial bank, as measured by total assets, having its main banking premises in this State on minimum deposit passbook savings accounts as of December 31 of the calendar year immediately preceding the inception of the rental agreement on any deposit held by the lessor for more than 6 months. (765 ILCS 715/1) Sec. 1.

The lessor shall, within 30 days after the end of each 12 month rental period, pay to the lessee any interest, by cash or credit to be applied to rent due, except when the lessee is in default under the terms of the lease. A lessor who willfully fails or refuses to pay the interest required by this Act shall, upon a finding by a circuit court that he has willfully failed or refused to pay, be liable for an amount equal to the amount of the security deposit, together with court costs and reasonable attorneys fees. (765 ILCS 715/2) Sec. 2.

This Act does not apply to any deposit made with respect to public housing. (765 ILCS 715/3) Sec. 3.

Short title. This Act may be cited as the Retaliatory Eviction Act. (765 ILCS 720/0.01) Sec. 0.01.