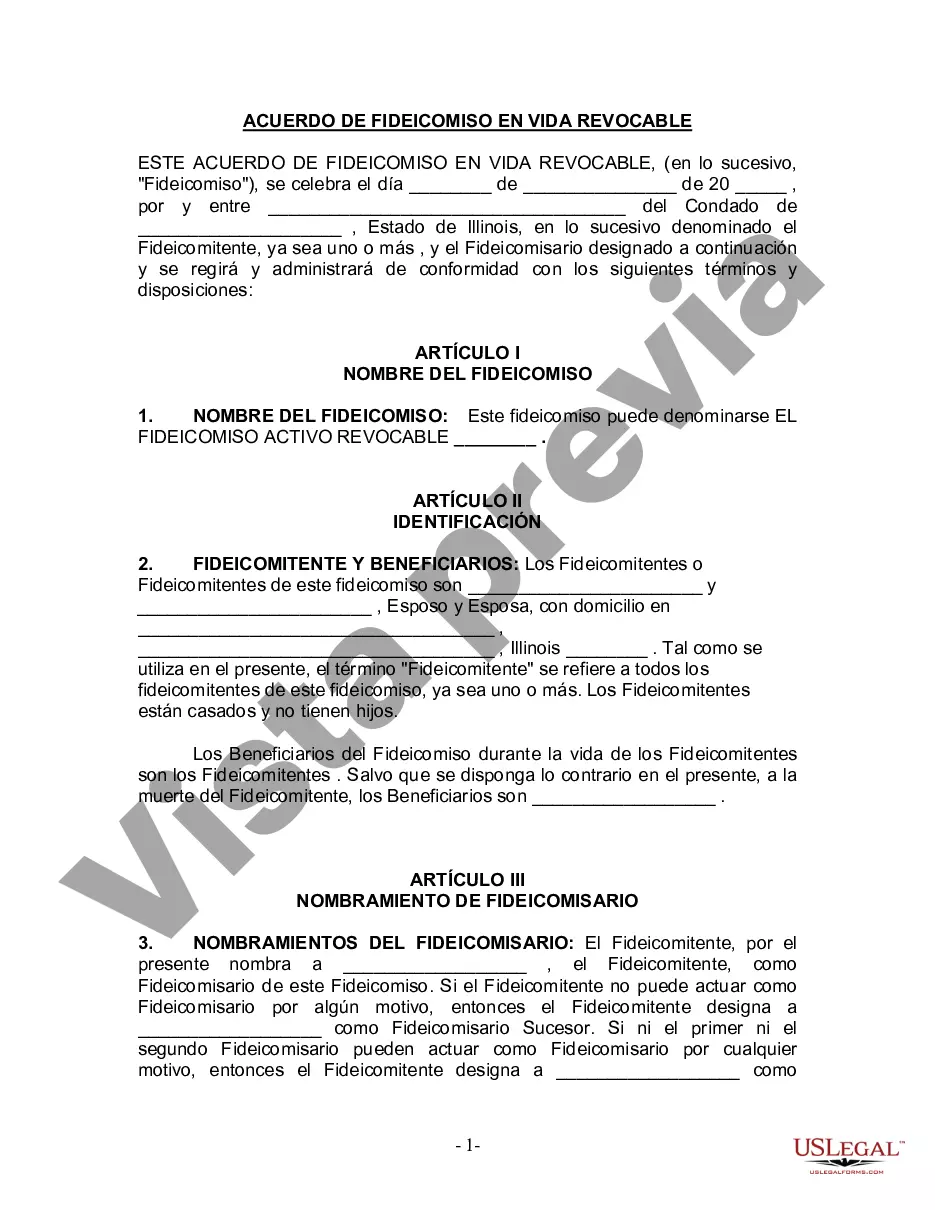

Rockford Illinois Living Trust for Husband and Wife with No Children: A Comprehensive Guide In Rockford, Illinois, a Living Trust for Husband and Wife with No Children is a legal instrument that allows a couple to manage their assets during their lifetime and efficiently transfer them to beneficiaries after their death. A Living Trust, sometimes referred to as a Revocable Trust or Inter Vivos Trust, offers numerous benefits such as avoiding probate, maintaining privacy, and providing flexibility and control over one's assets. In Rockford, there are two primary types of Living Trusts for Husband and Wife with No Children: 1. Joint Living Trust: A Joint Living Trust is a single trust created by both spouses together. In this type, both spouses act as co-trustees and have equal control and management over the trust assets. They can make changes, amend, or revoke the trust as they wish. Upon the death of the first spouse, the surviving spouse retains full control and access to the trust assets. After the death of both spouses, the trust assets are distributed according to the instructions outlined in the trust document. 2. Separate Living Trusts: Alternatively, a couple may decide to create separate living trusts, also known as individual living trusts. Each spouse establishes their own trust, with their respective assets funded into their respective trusts. This type of trust offers more flexibility in terms of estate planning, especially if the spouses have different wishes or concerns regarding asset distribution. Upon the death of one spouse, their trust assets are distributed according to their instructions, while the surviving spouse maintains control over their own trust and assets. Regardless of the type of Living Trust established, the key components and benefits remain the same. Some essential factors to consider when creating a Living Trust for Husband and Wife with No Children in Rockford, Illinois include: 1. Successor Trustees: It is crucial to appoint a successor trustee(s) who will step in to manage the trust assets in the event of the trustees' incapacity or death. 2. Asset Protection: A Living Trust provides protection against potential challenges or disputes from children, relatives, or creditors, ensuring that the couple's assets are distributed according to their wishes. 3. Avoidance of Probate: By placing their assets within a Living Trust, couples can bypass the probate process, saving time, expenses, and maintaining privacy as probate records are public. 4. Incapacity Planning: Living Trusts can include provisions that designate how the couple's affairs should be handled, should they become incapacitated or unable to manage their assets. 5. Charitable Giving: Couples can use Living Trusts to include provisions for charitable donations or establish charitable remainder trusts, allowing them to support causes they care about. In conclusion, a Rockford Illinois Living Trust for Husband and Wife with No Children provides an effective estate planning tool for couples to ensure the seamless transfer of their assets, avoid probate, and maintain control over their financial affairs. Whether opting for a Joint Living Trust or Separate Living Trusts, consulting an experienced attorney is highly recommended tailoring the trust document to the couple's specific needs and goals.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Rockford Illinois Fideicomiso en vida para esposo y esposa sin hijos - Illinois Living Trust for Husband and Wife with No Children

Description

How to fill out Rockford Illinois Fideicomiso En Vida Para Esposo Y Esposa Sin Hijos?

No matter the social or professional status, completing law-related forms is an unfortunate necessity in today’s professional environment. Very often, it’s almost impossible for someone with no law education to draft this sort of papers from scratch, mainly because of the convoluted terminology and legal subtleties they entail. This is where US Legal Forms can save the day. Our platform provides a huge library with over 85,000 ready-to-use state-specific forms that work for pretty much any legal case. US Legal Forms also serves as an excellent resource for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI tpapers.

Whether you need the Rockford Illinois Living Trust for Husband and Wife with No Children or any other document that will be valid in your state or county, with US Legal Forms, everything is on hand. Here’s how you can get the Rockford Illinois Living Trust for Husband and Wife with No Children in minutes using our reliable platform. In case you are presently an existing customer, you can go on and log in to your account to download the appropriate form.

However, in case you are unfamiliar with our library, ensure that you follow these steps prior to downloading the Rockford Illinois Living Trust for Husband and Wife with No Children:

- Ensure the template you have found is suitable for your location because the regulations of one state or county do not work for another state or county.

- Preview the document and go through a short outline (if provided) of scenarios the paper can be used for.

- If the form you picked doesn’t meet your requirements, you can start over and look for the suitable form.

- Click Buy now and choose the subscription plan you prefer the best.

- Access an account {using your credentials or register for one from scratch.

- Pick the payment method and proceed to download the Rockford Illinois Living Trust for Husband and Wife with No Children once the payment is completed.

You’re all set! Now you can go on and print out the document or complete it online. If you have any problems getting your purchased forms, you can easily access them in the My Forms tab.

Regardless of what situation you’re trying to sort out, US Legal Forms has got you covered. Try it out now and see for yourself.