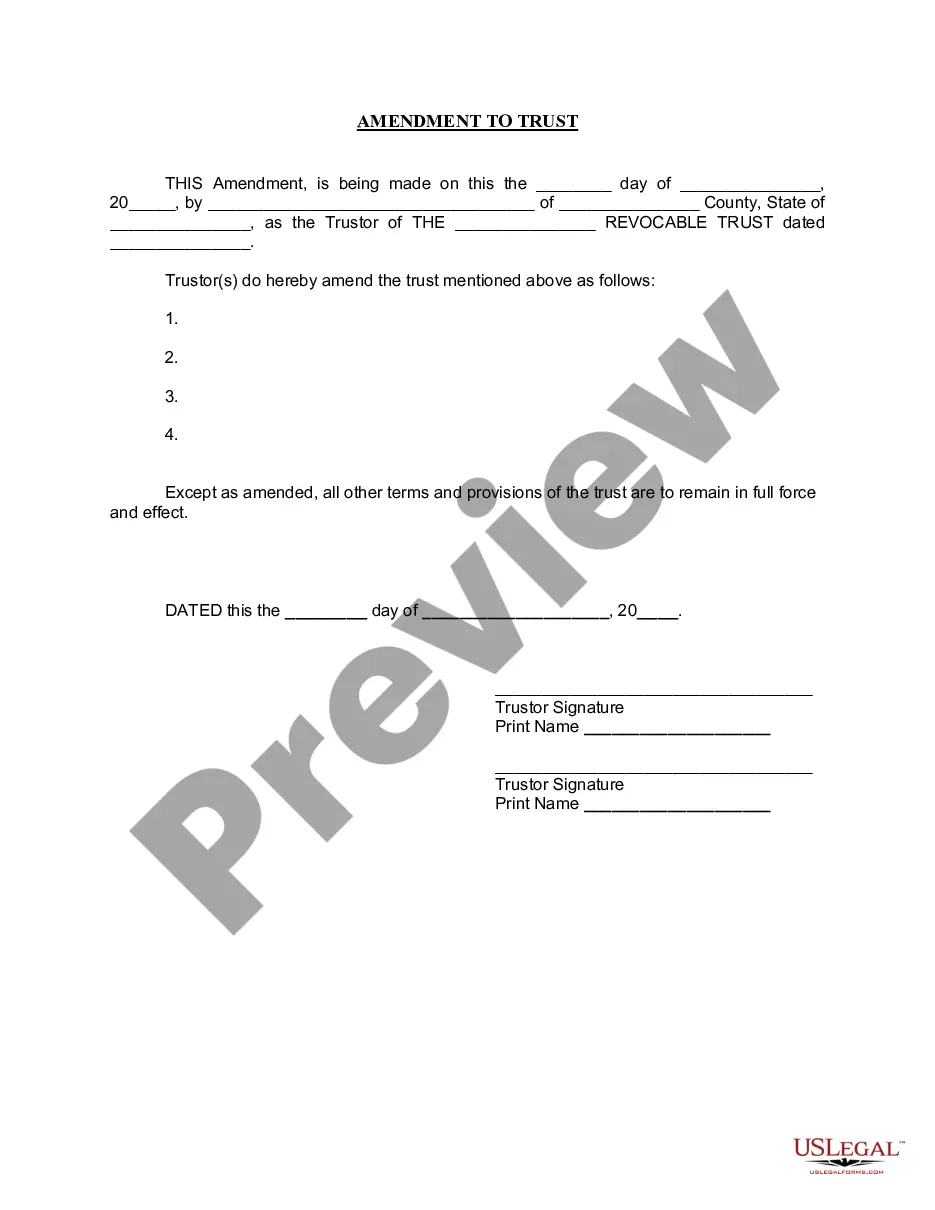

Chicago Illinois Amendment to Living Trust

Description

How to fill out Illinois Amendment To Living Trust?

We consistently endeavor to minimize or evade legal complications when engaging with intricate legal or financial issues.

To achieve this, we seek legal remedies that are typically quite costly.

Nonetheless, not all legal complications possess the same level of intricacy.

Most of them can be managed independently.

Take advantage of US Legal Forms whenever you need to locate and download the Chicago Illinois Amendment to Living Trust or any other form swiftly and securely.

- US Legal Forms is an online repository of current DIY legal paperwork encompassing everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

- Our collection enables you to handle your issues independently without relying on a lawyer's services.

- We provide access to legal form templates that may not always be readily available.

- Our templates are tailored to specific states and regions, which greatly eases the search process.

Form popularity

FAQ

As long as you are the trustee of your own revocable trust, no special tax returns or accountings are required. If anyone else serves as trustee, at the very least they must provide you with an annual accounting of the income and expenses of the trust, if not also file an independent tax return for the trust.

Amending a trust is accomplished by simply writing the desired changes on a separate piece of paper along with references to explain where/how the changes fit into the original agreement. The trust amendment is then attached to the original trust agreement.

Amending a Living Trust in California Nearly all trust documents can be amended. However, some are easier to amend than others. In the case of a revocable living trust, amendments usually take on the form of additional documents written after the original trust document has been signed and notarized.

In order to modify an irrevocable trust, one would typically initiate a court procedure to request approval of the change or modification.

The simplest way to make a change to a living trust is with a trust amendment form. A living trust amendment allows you to make changes to an existing trust while keeping the original document active. If you have a joint trust with your spouse, you both must agree to any changes to the trust.

The short answer is no, it does not. A Revocable Living Trust (also known as a Declaration of Trust or Family Trust) does not require two witnesses. Although, it should be notarized. This is unlike a Last Will and Testament, which has a two witnesses requirement and a notary requirement.

A revocable trust can be modified while the Grantor is alive. Revising the terms of a trust is known as ?amending? the trust. An amendment is generally appropriate when there are only a few minor changes to make, like rewording a certain paragraph, changing the successor trustee, or modifying beneficiaries.